How Much Do You Need To Earn To Be Middle Class In Your State?

Table of Contents

Understanding the Definition of "Middle Class"

Defining "middle class" is surprisingly challenging. There's no single, universally accepted definition.

The Challenges of Defining Middle Class

Different methodologies exist, often relying on income brackets, percentiles, or a combination of factors. However, these methods have limitations.

- Limitations of Income-Based Definitions: Solely using income to define middle class ignores wealth accumulation, assets, and access to resources. A family with a high income but significant debt may not enjoy the same level of financial security as a family with a lower income but substantial savings.

- Multiple Measures of Middle Class Status: A more holistic approach considers wealth (total assets minus liabilities), net worth (assets minus liabilities), and access to essential resources like healthcare and education. These factors paint a more complete picture of financial well-being.

- The Shifting Sands of Inflation and Economic Change: Inflation and economic downturns significantly impact the purchasing power of income. What constitutes middle class today might not be considered so in a few years due to fluctuating prices and economic cycles.

Cost of Living Variations Across States

Cost of living significantly influences the middle-class threshold. What constitutes a comfortable middle-class income in one state might be considered modest or even below the poverty line in another.

Housing Costs as a Major Factor

Housing represents a substantial portion of most household budgets. Therefore, variations in housing costs dramatically affect the middle-class income level.

- High-Cost Housing States: States like California, New York, and Hawaii are notorious for their high housing costs, requiring significantly higher incomes to maintain a middle-class lifestyle.

- Low-Cost Housing States: Conversely, states like Mississippi, Oklahoma, and West Virginia generally have lower housing costs, enabling a middle-class lifestyle on a lower income.

- Property Taxes and Rent: Property taxes and rent significantly contribute to housing expenses and vary greatly across states, further impacting the middle-class threshold. These costs are often directly correlated with other living expenses.

Transportation Costs and Their Impact

Transportation is another significant factor.

- Public Transportation vs. Car Ownership: States with robust public transportation systems may have lower transportation costs than those where car ownership is a necessity.

- Fuel Prices and Car Insurance: Fluctuations in fuel prices and variations in car insurance costs add to the overall transportation burden.

- Commute Times and Earning Potential: Long commutes often reduce available time for other activities and can impact earning potential.

Healthcare Expenses and Their Variability

Healthcare costs significantly affect household budgets, and variations between states are substantial.

- Healthcare Access and Insurance Costs: Access to affordable healthcare and the cost of insurance policies vary dramatically. Some states have more competitive insurance markets than others, leading to higher or lower premiums.

- Deductibles, Copays, and Out-of-Pocket Expenses: High deductibles, copays, and out-of-pocket expenses can severely strain household budgets, even with insurance.

- Medical Debt and Middle-Class Families: The rising trend of medical debt is a serious concern for many middle-class families, impacting their financial stability.

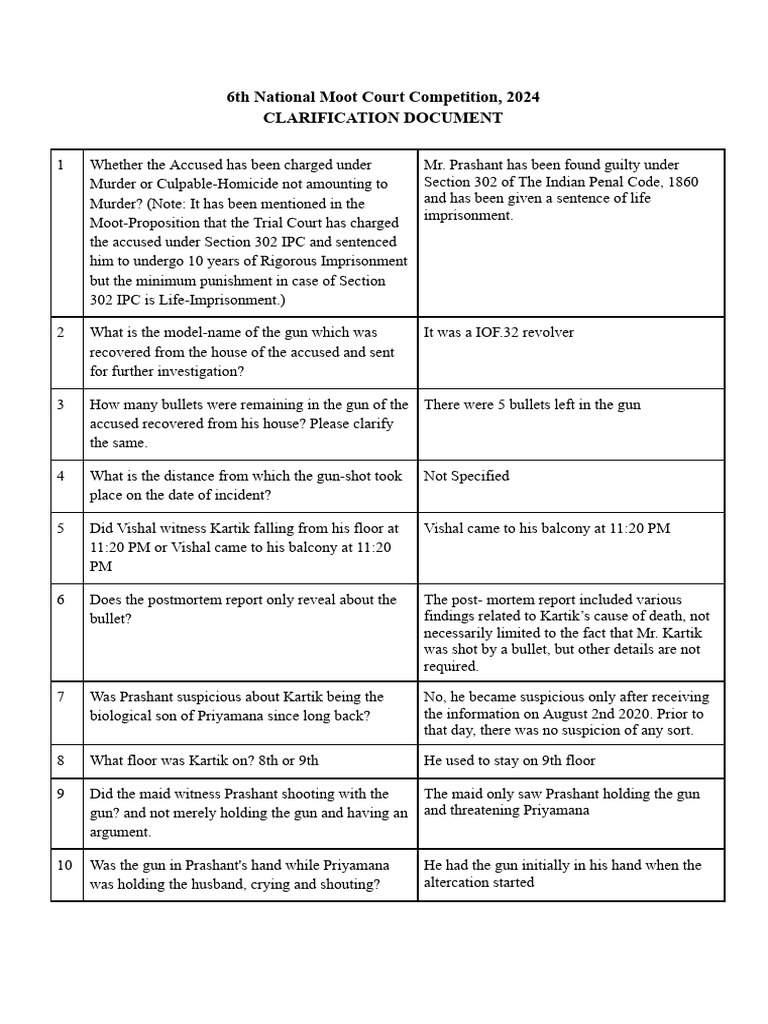

Regional Differences and State-Specific Data

Determining your state's middle-class income requires research.

Using Online Resources to Find Your State's Data

Several reputable sources provide data on income and cost of living by state:

-

U.S. Census Bureau: Offers extensive data on income, poverty, and household characteristics.

-

Bureau of Labor Statistics (BLS): Provides data on wages, employment, and consumer price indexes.

-

Council for Community and Economic Research (C2ER): Provides cost-of-living indices for various locations.

-

Interpreting the Data: Remember to consider your family size when interpreting the data; a household of four requires a higher income than a single person to maintain a middle-class lifestyle.

Factors Beyond Income: Defining Middle-Class Security

While income is a crucial factor, true middle-class security encompasses more than just earnings.

Financial Security Beyond Income

Beyond your income, several other factors contribute to financial security and a comfortable middle-class life.

- Emergency Funds and Financial Planning: Having sufficient emergency savings is crucial to weather unexpected financial challenges. Proactive financial planning is essential for long-term stability.

- Retirement Savings and Long-Term Financial Stability: Adequate retirement savings are essential to ensure a secure financial future.

- Debt Levels and Their Impact: High levels of student loan debt, credit card debt, or other forms of debt can significantly reduce financial security, even with a seemingly comfortable income.

Conclusion

Determining how much you need to earn to be middle class in your state depends on several interconnected factors. Cost of living variations across states, particularly housing costs and healthcare expenses, play a significant role. However, a truly secure middle-class lifestyle requires considering factors beyond just income, including savings, investments, and debt levels. Use the resources listed above to discover how much you need to earn to be middle class in your state and start planning for a secure financial future! Understanding your state's middle-class income, your specific cost of living, and your personal financial picture is crucial for achieving long-term financial security. Conduct a thorough cost of living analysis to gain a clear picture of your financial situation.

Featured Posts

-

Russias Spring Offensive A Weather Dependent Campaign

Apr 30, 2025

Russias Spring Offensive A Weather Dependent Campaign

Apr 30, 2025 -

Faltan 3 Dias Inscribete A Clases De Boxeo En Edomex

Apr 30, 2025

Faltan 3 Dias Inscribete A Clases De Boxeo En Edomex

Apr 30, 2025 -

Ramaphosa To Establish Commission Investigating Apartheid Era Crimes

Apr 30, 2025

Ramaphosa To Establish Commission Investigating Apartheid Era Crimes

Apr 30, 2025 -

Watch Ru Pauls Drag Race Season 17 Episode 9 Free And Legal Methods

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 9 Free And Legal Methods

Apr 30, 2025 -

Understanding And Implementing Corrections And Clarifications

Apr 30, 2025

Understanding And Implementing Corrections And Clarifications

Apr 30, 2025