How Much Wealth Did Musk, Bezos, And Zuckerberg Lose After Trump's Inauguration?

Table of Contents

Elon Musk and SpaceX/Tesla Stock Performance Post-Inauguration

Elon Musk's net worth is intrinsically linked to the performance of Tesla and SpaceX. Following Trump's inauguration, Tesla stock experienced a period of volatility. To understand the "Trump's impact on Tesla," we must examine several key factors. One significant influence was the production challenges Tesla faced in ramping up Model 3 production. This impacted investor confidence, creating downward pressure on the stock price.

-

Regulatory Changes: Trump's administration's approach to environmental regulations, while initially perceived as potentially favorable to Tesla due to a reduced focus on strict emission standards, didn't consistently translate into significant positive market reactions for Tesla.

-

Electric Vehicle Policies: Although Trump expressed support for American manufacturing, his policies on electric vehicles were inconsistent, causing uncertainty among investors. This uncertainty, coupled with production bottlenecks, affected Tesla's stock valuation in the months following the inauguration.

Analyzing the Impact of Trump's Policies on Tesla's Growth:

- Mixed signals on EV subsidies: While not directly detrimental, the lack of strong federal support for electric vehicles created ambiguity.

- Focus on traditional auto industry: Trump's emphasis on the traditional auto industry could have been perceived as potentially diverting resources from the emerging EV sector.

- Tariff implications: International trade policies, including tariffs, impacted the cost of raw materials and potentially affected Tesla's supply chain and overall profitability.

Analyzing Tesla's stock charts from late 2016 to mid-2017 reveals considerable fluctuations, making precise quantification of immediate post-inauguration losses challenging. While exact figures are hard to isolate from other market forces, Tesla stock experienced notable volatility during this time. This volatility had a corresponding effect on Elon Musk's "Elon Musk net worth."

Jeff Bezos and Amazon's Response to the Post-Inauguration Economic Climate

Jeff Bezos, the founder of Amazon, saw his net worth significantly tied to Amazon's stock performance. Post-inauguration, Amazon’s stock, while generally resilient, faced new challenges. The "Trump's impact on Amazon" was primarily felt through several avenues.

-

Trade Wars: Trump's initiation of trade wars significantly impacted global supply chains. Amazon, with its vast global network, faced increased costs and logistical complexities due to tariffs on imported goods.

-

Antitrust Scrutiny: The Trump administration, while not initiating major new antitrust actions against Amazon immediately, set a tone of increased regulatory scrutiny over large tech companies, creating uncertainty in the market.

-

Consumer Spending: While consumer spending remained relatively strong in the initial period, concerns over trade wars and economic uncertainty could have affected consumer confidence, impacting Amazon's overall revenue and stock price.

Trade Wars and Amazon's Global Supply Chain:

- Increased costs of imported goods: Tariffs led to higher prices for many products sold on Amazon.

- Supply chain disruptions: Trade disputes created delays and logistical challenges in sourcing and shipping products.

- Strategic responses: Amazon implemented strategies to mitigate the impact, including diversifying suppliers and exploring alternative shipping routes.

The effect of the inauguration on Amazon's stock price and thus Jeff Bezos's "Jeff Bezos net worth" was less dramatic than what some analysts predicted, but the increased uncertainties negatively affected investor sentiment and long-term growth projections.

Mark Zuckerberg and Facebook's Navigating the Post-Inauguration Political Landscape

Mark Zuckerberg and Facebook entered the post-inauguration period facing a different set of challenges than Musk and Bezos. While Facebook's stock saw fluctuations, analyzing the "Trump's impact on Facebook" requires looking at a complex interplay of factors.

-

Regulatory Changes: The issue of data privacy gained momentum globally, leading to increased regulatory pressure on Facebook. Concerns about the misuse of user data, already present before the inauguration, were heightened during this period, influencing investor sentiment.

-

Political Polarization: The highly polarized political environment intensified discussions about the role of social media in spreading misinformation and its impact on democratic processes.

The Rise of Fake News and its Effect on Facebook Valuation:

- Increased scrutiny on misinformation: The spread of fake news and foreign interference in elections became major focal points, leading to public criticism and regulatory pressure on Facebook.

- Impact on advertising revenue: Concerns about the quality of Facebook's advertising ecosystem, related to fake news and data privacy issues, raised questions among advertisers.

- Facebook's responses: Facebook implemented measures to combat fake news and improve data privacy, but the damage to its reputation affected its valuation.

The impact on Facebook’s stock and, consequently, Mark Zuckerberg's "Mark Zuckerberg net worth" was felt primarily through a shift in investor sentiment related to regulatory risk and reputational damage, particularly related to social media regulation and the "Facebook stock" price.

Conclusion: Quantifying the Wealth Shift: A Summary of the Impact of Trump's Inauguration on Tech Giants' Fortunes

Precisely quantifying the immediate wealth changes experienced by Musk, Bezos, and Zuckerberg after Trump's inauguration is complex due to the volatility of the market and the many interconnected factors at play. While pinpointing exact dollar figures attributable solely to the inauguration's immediate impact is difficult, it is clear that all three experienced significant market-driven fluctuations in their net worths in the months following the event. The impact stemmed primarily from market uncertainty driven by changes in policy, regulatory concerns, and shifts in consumer and investor sentiment. These factors ultimately affected their companies' stock prices, impacting their overall wealth.

Learn more about the impact of political events on the wealth of tech giants by exploring our other articles on market volatility and the influence of presidential administrations on major company valuations.

Featured Posts

-

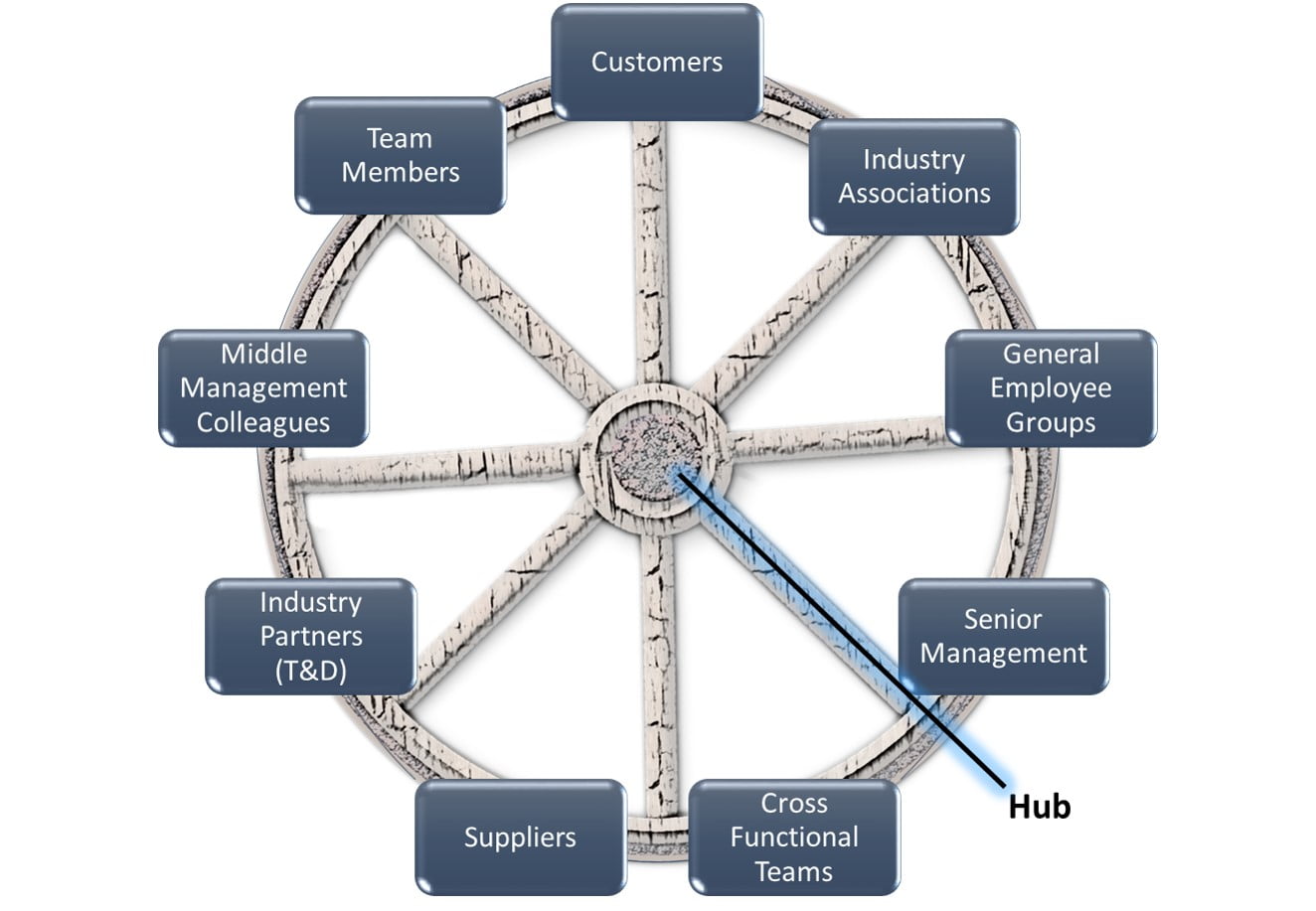

How Middle Management Drives Organizational Effectiveness And Employee Engagement

May 10, 2025

How Middle Management Drives Organizational Effectiveness And Employee Engagement

May 10, 2025 -

Discover Elizabeth Arden Skincare At Walmarts Prices

May 10, 2025

Discover Elizabeth Arden Skincare At Walmarts Prices

May 10, 2025 -

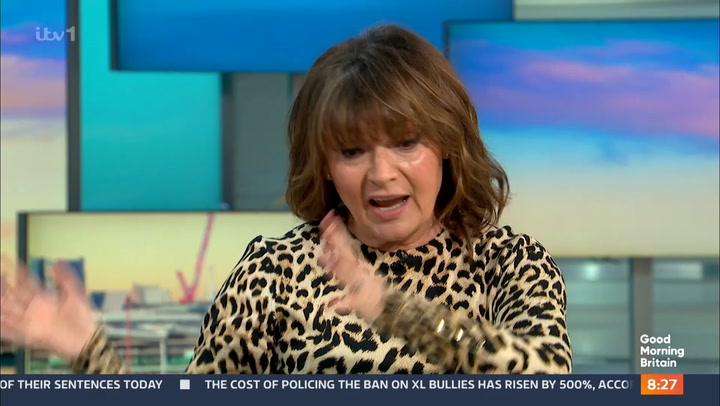

Joanna Pages Candid Assessment Of Wynne Evans Bbc Appearance

May 10, 2025

Joanna Pages Candid Assessment Of Wynne Evans Bbc Appearance

May 10, 2025 -

Putin Announces Victory Day Ceasefire What To Expect

May 10, 2025

Putin Announces Victory Day Ceasefire What To Expect

May 10, 2025 -

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025