How Novo Nordisk Lost Ground In The Weight-Loss Market Despite Ozempic

Table of Contents

Increased Competition in the GLP-1 Receptor Agonist Market

The weight-loss medication market, once largely dominated by Novo Nordisk, has become increasingly competitive. Several factors have contributed to this shift, significantly impacting Novo Nordisk weight loss market share.

Emergence of Biosimilars and Generic Alternatives

The arrival of cheaper alternatives has significantly eroded Novo Nordisk's pricing power and market share. Competitors have launched similar GLP-1 receptor agonists, offering patients and healthcare providers more choices.

- Wegovy (semaglutide): While also manufactured by Novo Nordisk, Wegovy's high price point and initial supply constraints have opened the door for competitors.

- Mounjaro (tirzepatide): Eli Lilly's Mounjaro, a dual GLP-1 and GIP receptor agonist, has proven to be a significant competitor, demonstrating superior weight loss results in clinical trials and gaining substantial market share.

- Other emerging GLP-1 agonists: Several other pharmaceutical companies are developing and launching their own GLP-1 receptor agonists, further intensifying competition.

The speed of biosimilar development, while initially slow due to complex regulatory hurdles, is accelerating, promising further price pressure on Novo Nordisk's flagship products. The accessibility of these alternatives is also a crucial factor impacting Novo Nordisk's position.

Aggressive Marketing Strategies from Competitors

Competitors like Eli Lilly have employed highly effective marketing campaigns targeting both healthcare professionals and consumers. This aggressive marketing has successfully increased brand awareness and patient preference for alternative medications.

- Direct-to-consumer advertising: Competitors have invested heavily in DTC advertising, educating consumers about the benefits of their products and increasing demand.

- Targeted physician outreach: Extensive engagement with healthcare providers through educational materials and clinical trial data has influenced prescribing habits.

- Strategic partnerships: Collaborations with weight-loss clinics and healthcare systems have broadened the reach of competitor products.

Comparing the marketing spend and strategies reveals a clear difference in approach. While Novo Nordisk has traditionally focused on a more measured approach, competitors have adopted bolder, more expansive strategies, directly impacting Novo Nordisk weight loss market share.

Supply Chain Issues and Production Challenges

Meeting the unprecedented demand for Ozempic and Wegovy has presented significant challenges for Novo Nordisk. These supply chain issues have directly affected their ability to maintain their market position.

Manufacturing Bottlenecks and Shortages

The overwhelming demand, coupled with manufacturing limitations, led to recurring shortages of both Ozempic and Wegovy. These shortages frustrated patients and healthcare providers, contributing to lost sales and market share.

- Production capacity constraints: Novo Nordisk's manufacturing facilities struggled to keep pace with the exponential increase in demand.

- Raw material shortages: Difficulties in sourcing necessary raw materials further exacerbated production bottlenecks.

- Regulatory approvals: Navigating the complexities of regulatory approvals for increased production capacity added to the delays.

This lack of supply created opportunities for competitors to gain traction and market share.

Distribution and Logistics Hurdles

The global distribution of these medications is complex, involving intricate logistics across multiple countries and regions. Inefficiencies in this process can lead to delays and impact patient access.

- Transportation challenges: Global supply chain disruptions have further complicated the distribution of these medications.

- Storage and handling requirements: These medications require specific storage and handling conditions, adding to the complexity of their distribution.

- Customs and regulatory clearance: Navigating international customs and regulatory procedures can result in delays.

These logistical hurdles have created openings for competitors with more streamlined distribution networks.

Regulatory Scrutiny and Safety Concerns

The high profile of GLP-1 receptor agonists has brought increased regulatory scrutiny and public attention to their potential side effects and pricing.

Adverse Event Reporting and Public Perception

Reports of adverse events associated with GLP-1 receptor agonists have fueled public concern and led to increased regulatory oversight.

- Pancreatitis: Reports of pancreatitis cases associated with these medications have prompted increased monitoring and safety warnings.

- Gallbladder issues: Increased risk of gallbladder problems has also been reported and investigated.

- Other side effects: Various other side effects, such as nausea, vomiting, and constipation, have been reported, impacting public perception.

Negative media coverage and public perception have influenced patient choices and potentially contributed to a shift in market share.

Pricing Controversies and Reimbursement Challenges

The high cost of these medications has sparked significant debate about affordability and access.

- Patient cost burden: The high price point places a significant financial burden on patients without adequate insurance coverage.

- Reimbursement policies: Insurance companies and government payers are increasingly scrutinizing the cost-effectiveness of these medications, potentially limiting reimbursement.

- Political pressure: Public and political pressure to lower drug prices has impacted the market dynamics.

These pricing controversies and reimbursement challenges directly impact patient access and ultimately affect Novo Nordisk weight loss market share.

Conclusion

Novo Nordisk's reduced market share in the weight-loss sector, despite the initial success of Ozempic, is a result of a confluence of factors. Increased competition from biosimilars and aggressively marketed alternatives, significant supply chain issues, and regulatory scrutiny surrounding safety and pricing have all played crucial roles. Understanding the complexities of the Novo Nordisk weight loss market share decline is crucial for investors and healthcare professionals alike. Further research into market dynamics and competitor strategies is essential to navigate this evolving landscape. Stay informed on the latest developments in the Novo Nordisk weight loss market share and the broader GLP-1 receptor agonist market to make informed decisions.

Featured Posts

-

Ti Na Deite Stin Tileorasi To Savvato 10 5

May 30, 2025

Ti Na Deite Stin Tileorasi To Savvato 10 5

May 30, 2025 -

Nueva Integracion Setlist Fm Y Ticketmaster Optimizan La Experiencia Del Fan

May 30, 2025

Nueva Integracion Setlist Fm Y Ticketmaster Optimizan La Experiencia Del Fan

May 30, 2025 -

Photo Opportunity Joy Smith Foundation Launches New Initiative

May 30, 2025

Photo Opportunity Joy Smith Foundation Launches New Initiative

May 30, 2025 -

Kalyteres Tileoptikes Epiloges Gia To Savvato 15 Martioy

May 30, 2025

Kalyteres Tileoptikes Epiloges Gia To Savvato 15 Martioy

May 30, 2025 -

Caida De Ticketmaster Que Paso Hoy 8 De Abril Grupo Milenio

May 30, 2025

Caida De Ticketmaster Que Paso Hoy 8 De Abril Grupo Milenio

May 30, 2025

Latest Posts

-

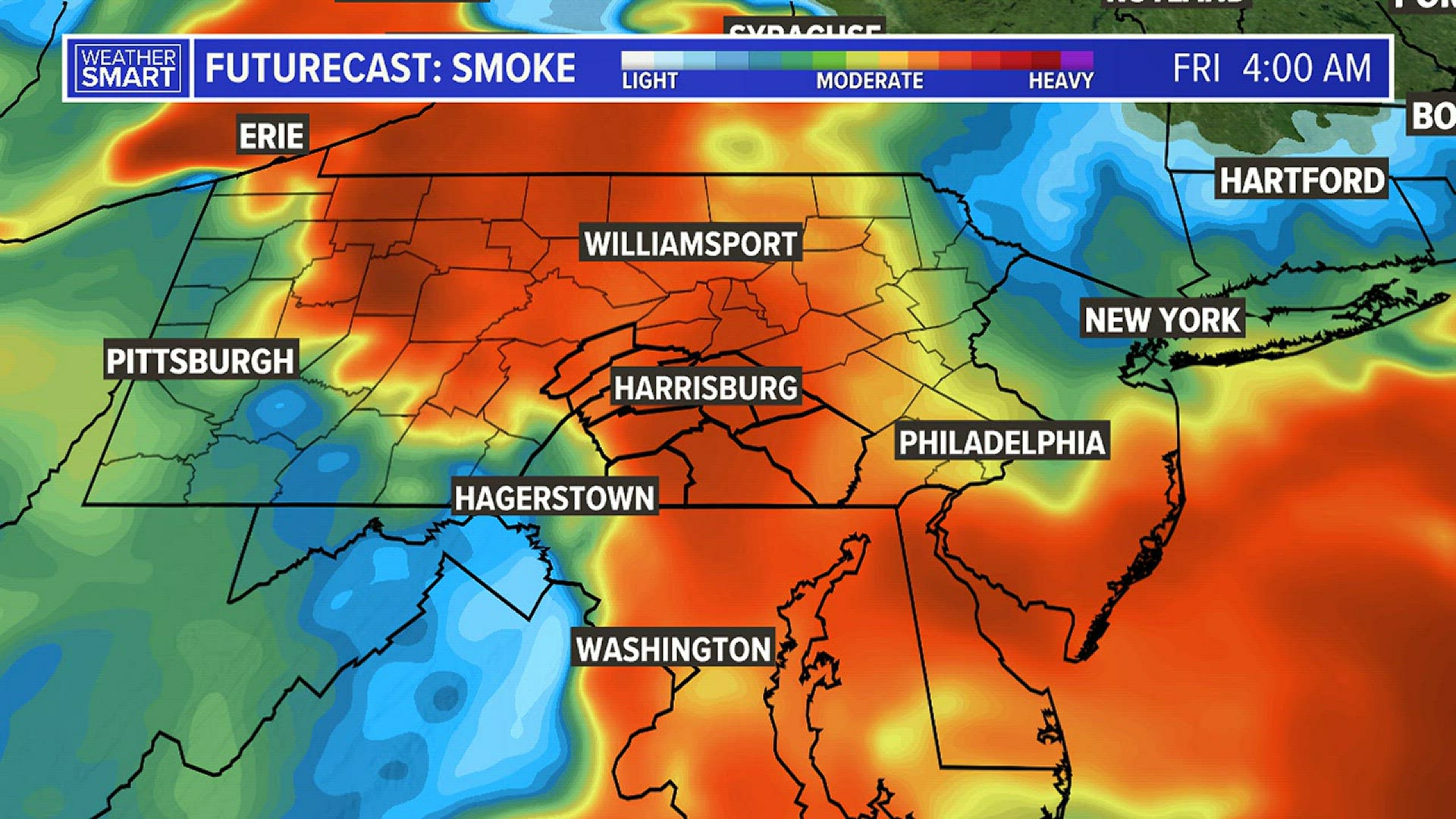

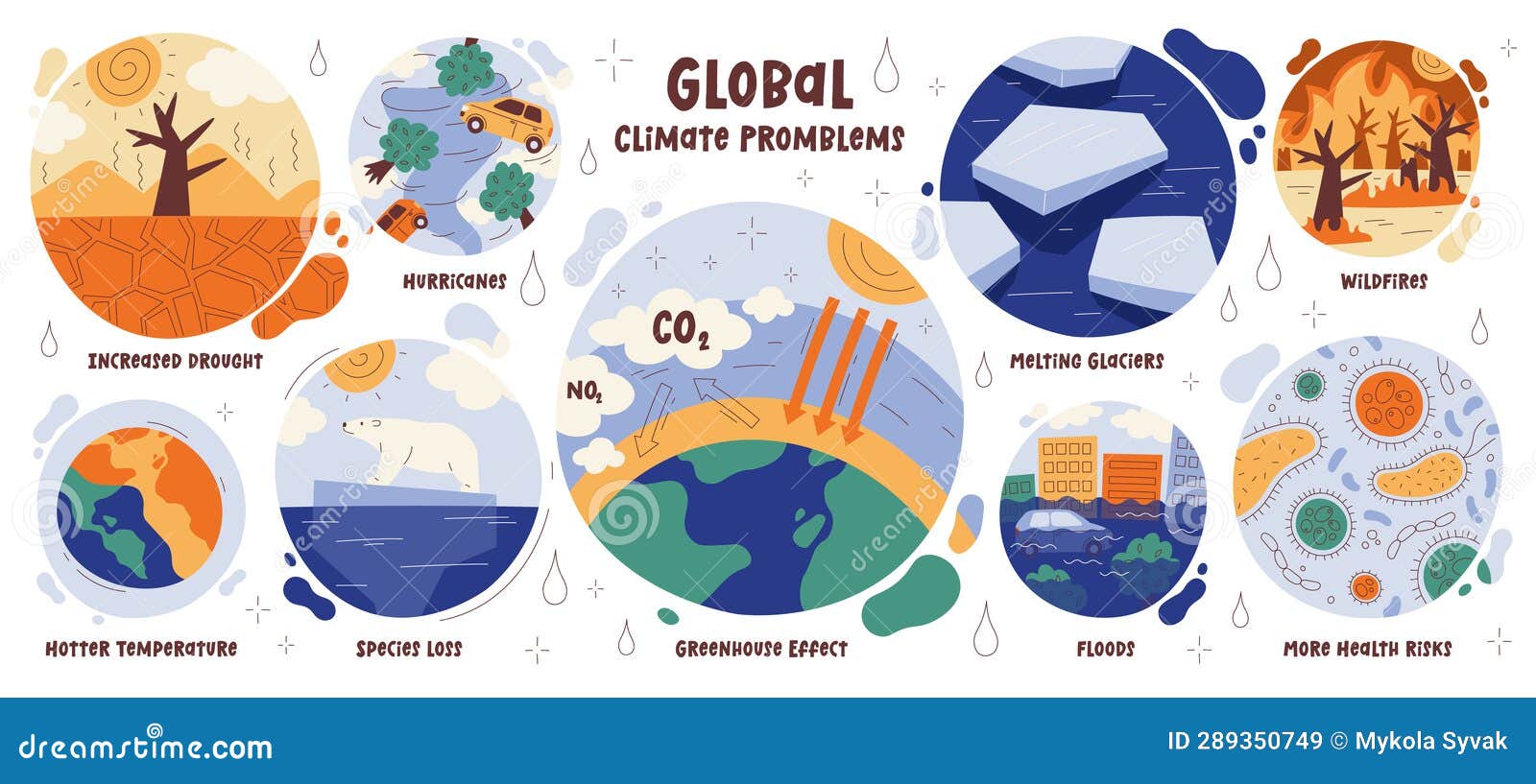

Canada Wildfires Record Evacuations Send Smoke Pouring Into Us

May 31, 2025

Canada Wildfires Record Evacuations Send Smoke Pouring Into Us

May 31, 2025 -

Saskatchewan Wildfires Early Season Activity And Summer Heat Predictions

May 31, 2025

Saskatchewan Wildfires Early Season Activity And Summer Heat Predictions

May 31, 2025 -

Wildfires Rage Extensive Home Damage And Mass Displacement In Eastern Newfoundland

May 31, 2025

Wildfires Rage Extensive Home Damage And Mass Displacement In Eastern Newfoundland

May 31, 2025 -

Officials Warn Of Intensified Wildfire Season In Saskatchewan Due To Heat

May 31, 2025

Officials Warn Of Intensified Wildfire Season In Saskatchewan Due To Heat

May 31, 2025 -

Saskatchewan Faces Increased Wildfire Risk Amidst Hotter Summer Forecast

May 31, 2025

Saskatchewan Faces Increased Wildfire Risk Amidst Hotter Summer Forecast

May 31, 2025