How Strategy's $555.8 Million Bitcoin Purchase Could Shape The Market

Table of Contents

MicroStrategy's Bitcoin Strategy: A Deep Dive

MicroStrategy's Rationale Behind the Investment

MicroStrategy's CEO, Michael Saylor, is a staunch Bitcoin advocate. His rationale for the massive investment rests on several pillars:

- Inflation Hedge: Saylor views Bitcoin as a hedge against inflation, believing its limited supply protects it from the devaluation often associated with fiat currencies. This perspective positions Bitcoin as a superior store of value compared to traditional assets.

- Superior Asset Class: MicroStrategy sees Bitcoin as a superior asset class compared to traditional investments like bonds and gold, offering higher potential returns in the long term.

- Treasury Reserve Asset: The company shifted its treasury management strategy, allocating a significant portion of its reserves to Bitcoin, signaling a long-term commitment to the cryptocurrency. This strategy highlights Bitcoin's potential as a stable, albeit volatile, long-term investment for large corporations.

This strategy demonstrates a shift away from traditional financial instruments and towards a more forward-thinking, decentralized approach to treasury management.

The Impact on Bitcoin's Price

MicroStrategy's massive Bitcoin purchase undoubtedly had an impact on its price.

- Short-Term Volatility: While large institutional purchases can cause short-term price increases due to increased demand, it's difficult to isolate the exact impact of MicroStrategy's purchase from other market factors.

- Long-Term Price Support: The long-term effect, however, suggests price support, as MicroStrategy's holdings are unlikely to be sold off quickly. This represents a substantial amount of "locked-in" Bitcoin, reducing the circulating supply and potentially pushing prices higher over time.

- Institutional Influence: This investment is part of a broader trend of institutional adoption influencing the cryptocurrency market's volatility. Tesla's similar investment, for instance, significantly impacted Bitcoin's price.

Increased Institutional Adoption of Bitcoin

MicroStrategy's decision acted as a catalyst, encouraging other large corporations to consider Bitcoin as a treasury asset.

- Snowball Effect: The move signals a growing acceptance of Bitcoin's legitimacy and its potential as a viable investment for mainstream institutions.

- Regulatory Implications: This increase in institutional adoption also leads to increased regulatory scrutiny and the need for clear guidelines for Bitcoin investment within corporate structures.

- Investment Vehicles: The growing institutional interest is driving the development of new financial instruments and investment vehicles specifically designed for Bitcoin exposure.

Market Implications and Future Predictions

The Ripple Effect on the Cryptocurrency Market

MicroStrategy's purchase had a ripple effect across the cryptocurrency market.

- Altcoin Impact: Some investors may reallocate capital from altcoins (alternative cryptocurrencies) into Bitcoin, potentially impacting the prices of other cryptocurrencies.

- Bitcoin Dominance: This increased demand strengthens Bitcoin's market dominance as the leading cryptocurrency.

- Overall Market Capitalization: The sustained institutional investment in Bitcoin has the potential to boost the overall cryptocurrency market capitalization.

Long-Term Implications and Future Outlook for Bitcoin

The long-term implications of MicroStrategy's bold move are significant.

- Price Predictions: Although precise price predictions are impossible, the continued institutional interest points towards a bullish long-term outlook for Bitcoin's price.

- Mainstream Adoption: MicroStrategy's move significantly accelerates Bitcoin's path towards becoming a widely accepted store of value.

- Challenges and Risks: Despite the potential, Bitcoin investments still carry inherent risks, including volatility, regulatory uncertainty, and potential security vulnerabilities.

Conclusion: Analyzing the Lasting Effects of MicroStrategy's Bitcoin Purchase

MicroStrategy's $555.8 million Bitcoin purchase represents a pivotal moment in the cryptocurrency market. The company's decision, driven by a long-term bullish outlook and a strategic shift in treasury management, has significant implications for Bitcoin's price, adoption, and the overall crypto landscape. The increased institutional interest sparked by MicroStrategy's move is likely to shape the future of Bitcoin and its place in the global financial system. Stay updated on the latest developments in MicroStrategy's Bitcoin holdings and its influence on the market. Learn more about the potential of Bitcoin as a long-term investment following MicroStrategy's bold move.

Featured Posts

-

Document Amf Seb Sa 2025 E1021792 Du 24 Fevrier 2025 Decryptage Complet

Apr 30, 2025

Document Amf Seb Sa 2025 E1021792 Du 24 Fevrier 2025 Decryptage Complet

Apr 30, 2025 -

Early Morning West Bank Arrest Prominent Palestinian Journalist Detained By Israeli Forces

Apr 30, 2025

Early Morning West Bank Arrest Prominent Palestinian Journalist Detained By Israeli Forces

Apr 30, 2025 -

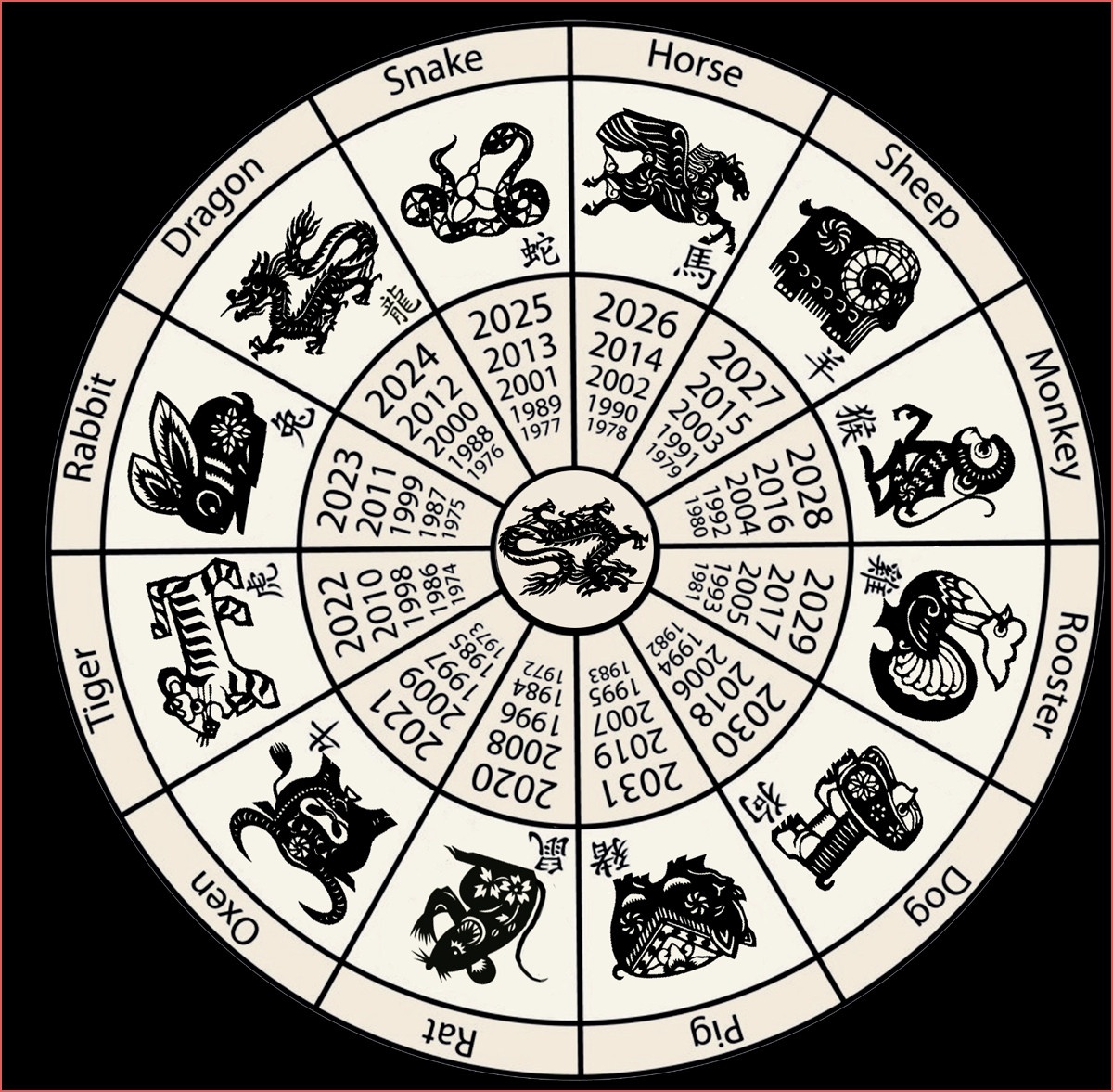

Your Daily Horoscope April 17 2025 Astrological Forecast

Apr 30, 2025

Your Daily Horoscope April 17 2025 Astrological Forecast

Apr 30, 2025 -

Beyonce Jay Z E Donald Trump As Estrelas Nas Festas Privadas De P Diddy Documentario

Apr 30, 2025

Beyonce Jay Z E Donald Trump As Estrelas Nas Festas Privadas De P Diddy Documentario

Apr 30, 2025 -

Channing Tatum And Inka Williams A Couples Appearance At The Australian Grand Prix

Apr 30, 2025

Channing Tatum And Inka Williams A Couples Appearance At The Australian Grand Prix

Apr 30, 2025