How Tariff Shocks Impact The Bond Market

Table of Contents

The Mechanism of Tariff Shock Transmission to Bond Markets

Tariffs, essentially taxes on imported goods, directly impact inflation. Increased tariffs raise the cost of imported goods, leading to higher consumer prices. This inflationary pressure influences inflation expectations, a key driver of interest rates. The relationship between inflation, interest rates, and bond yields is inversely proportional: higher inflation generally leads central banks to increase interest rates to curb price increases. This, in turn, affects bond yields, as yields on existing bonds move in the opposite direction of interest rates. This dynamic is reflected in the yield curve, which illustrates the relationship between bond yields and their maturities.

Tariff uncertainty further complicates matters. The unpredictable nature of tariff policies creates significant uncertainty for businesses and investors. This uncertainty fuels risk aversion:

- Increased uncertainty leads to a flight to safety: Investors often seek refuge in government bonds, considered less risky, driving up demand and potentially lowering yields.

- Reduced investment in corporate bonds: Perceived higher risk associated with corporate bonds, particularly those of companies heavily reliant on international trade, leads to decreased investment.

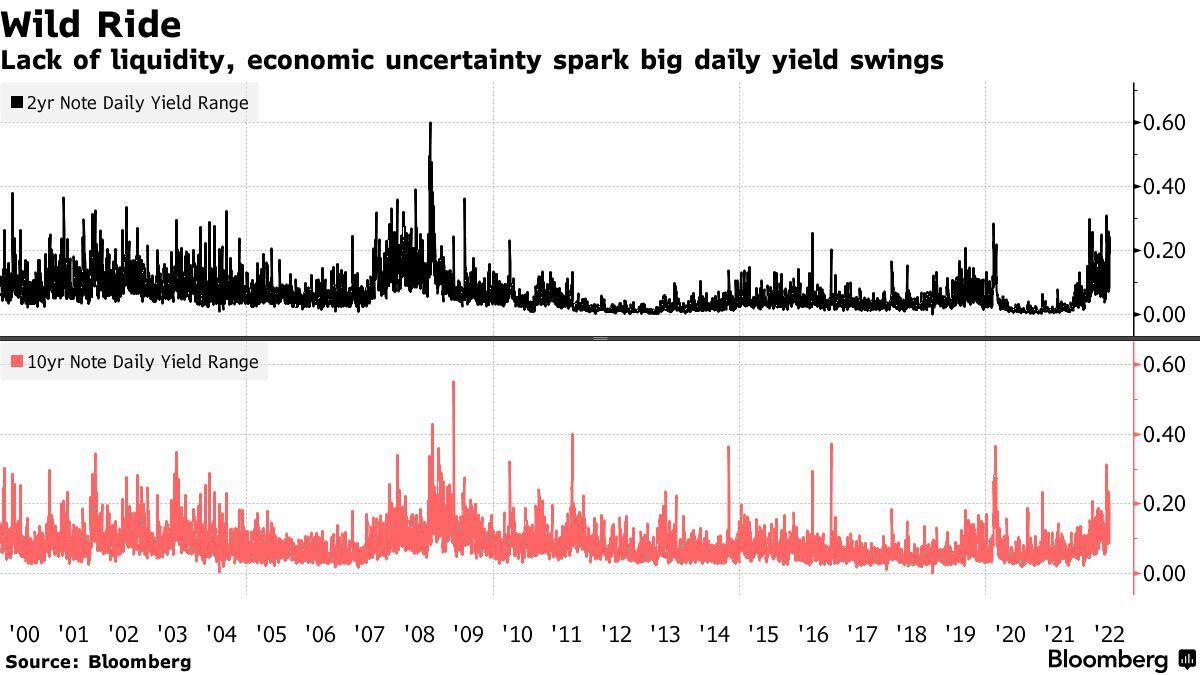

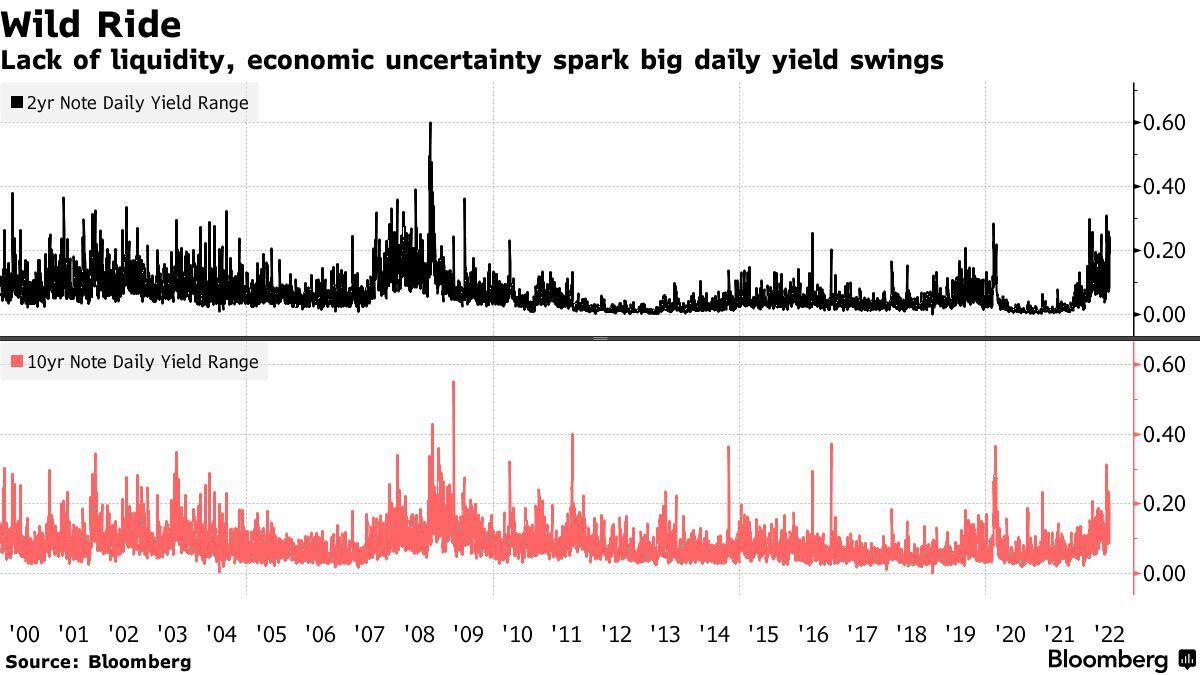

- Potential for increased volatility in bond prices: The fluctuating nature of investor sentiment in response to tariff announcements can cause significant price swings in the bond market.

Currency fluctuations, often a byproduct of tariff disputes, can also impact bond markets, particularly those involving international bonds. A weakening domestic currency can make foreign bonds more expensive for domestic investors and vice versa.

Sector-Specific Impacts of Tariff Shocks on Bonds

Tariffs don't impact all bond sectors uniformly. Their effects vary depending on the type of bond and the underlying industry.

- Government bonds: Generally considered safe haven assets, government bonds might see increased demand during periods of tariff uncertainty.

- Corporate bonds: Companies in import-dependent sectors (e.g., manufacturing, retail) face higher input costs due to tariffs, potentially impacting their profitability and creditworthiness. This can lead to lower credit ratings and higher yields on their bonds.

- Municipal bonds: While less directly affected by international trade, municipal bonds can still experience indirect impacts, such as reduced economic activity in regions heavily reliant on industries affected by tariffs.

Let's examine this further:

- Analysis of bonds issued by companies in import-dependent sectors: These bonds may see higher yields to compensate for increased risk.

- Examination of how tariffs affect credit ratings and corporate bond yields: A downgrade in credit rating will invariably result in higher yields to reflect the increased default risk.

- Discussion of the resilience of different bond sectors to tariff shocks: Government bonds typically exhibit greater resilience compared to corporate bonds.

Geographical differences also play a critical role. Economies heavily reliant on international trade are more susceptible to tariff shocks than those with more diversified economies.

Analyzing the Impact of Specific Tariff Policies

Examining historical instances provides valuable insights. For example, the impact of the Smoot-Hawley Tariff Act of 1930, although occurring in a different economic climate, offers a cautionary tale of how protectionist trade policies can negatively affect global economic growth and consequently, bond markets. Analyzing the effects of different tariff types – import tariffs versus export tariffs – reveals their distinct impacts on various sectors and consequently, on related bond yields. Central bank responses to tariff shocks, such as interest rate adjustments or quantitative easing, significantly influence bond market dynamics.

Investing in Bonds During Times of Tariff Uncertainty

Navigating the bond market during periods of tariff uncertainty requires careful planning and strategic portfolio management.

- Diversification: Diversifying across different bond sectors (government, corporate, municipal), maturities, and geographical regions can help mitigate risk.

- Inflation-protected securities (TIPS): Consider investing in TIPS as a hedge against inflation, which can be exacerbated by tariffs.

- Creditworthiness assessment: Thoroughly assess the creditworthiness of corporate bond issuers, paying particular attention to their dependence on international trade and their ability to withstand increased input costs.

- Monitoring economic indicators: Closely monitor key economic indicators, such as inflation rates, trade balances, and consumer confidence, to gauge the overall economic impact of tariffs.

Professional investment advice is invaluable in these complex circumstances. A financial advisor can help you tailor a bond portfolio strategy suitable for your risk tolerance and financial goals.

Understanding the Interplay of Tariff Shocks and Bond Market Dynamics

Tariff shocks significantly influence bond markets through their impact on inflation, investor sentiment, and sector-specific vulnerabilities. Understanding this intricate relationship between tariffs and bond yields is paramount for making informed investment decisions. The effects of "Tariff Shocks and Bond Market" fluctuations require careful consideration and proactive risk management strategies. Continue learning about this dynamic interplay, and seek professional financial advice to navigate the complexities of the bond market during periods of trade uncertainty. Further resources, including economic reports and financial analysis from reputable sources, can provide deeper insights into this critical area of finance.

Featured Posts

-

Your Guide To Montego Bay Jamaica Things To Do And See

May 12, 2025

Your Guide To Montego Bay Jamaica Things To Do And See

May 12, 2025 -

A Crazy Rich Asians Tv Series Is Officially Happening

May 12, 2025

A Crazy Rich Asians Tv Series Is Officially Happening

May 12, 2025 -

Cody Bellingers Role In Protecting Aaron Judge In The Yankees Lineup

May 12, 2025

Cody Bellingers Role In Protecting Aaron Judge In The Yankees Lineup

May 12, 2025 -

Stellantis Ceo Decision Imminent Us Head In The Running

May 12, 2025

Stellantis Ceo Decision Imminent Us Head In The Running

May 12, 2025 -

Crazy Rich Asians Tv Adaptation Cast Plot And Release Date Speculation

May 12, 2025

Crazy Rich Asians Tv Adaptation Cast Plot And Release Date Speculation

May 12, 2025