How The Stealthy Wealthy Achieve Financial Success: Practical Strategies And Habits

Table of Contents

Strategic Long-Term Investing

The stealthy wealthy prioritize long-term growth over short-term gains. They focus on building a diversified portfolio and avoid impulsive financial decisions driven by market hype or fear. Their approach to investing is defined by patience, discipline, and a clear understanding of their financial goals. This contrasts sharply with those who chase get-rich-quick schemes, often leading to significant losses.

Diversification and Asset Allocation

This involves spreading investments across different asset classes (stocks, bonds, real estate, precious metals, etc.) to minimize risk. A well-diversified portfolio protects against the volatility inherent in any single asset class.

- Regularly rebalance their portfolio: This ensures their asset allocation remains consistent with their risk tolerance and long-term goals. Rebalancing involves selling some assets that have performed well and buying others that have underperformed, bringing the portfolio back to its target allocation.

- Utilize index funds and ETFs: These offer broad market exposure at lower costs than actively managed funds, aligning with the stealthy wealthy's focus on efficiency and long-term growth. Index funds passively track a specific market index, offering diversification without the need for extensive research.

- Invest in assets that appreciate over time: Rather than chasing quick returns, they favor assets with a proven track record of long-term growth, such as blue-chip stocks and real estate in stable markets. This patient approach is a hallmark of the stealthy wealthy investor.

Long-Term Vision and Patience

They understand that wealth building is a marathon, not a sprint. Their financial decisions are guided by a long-term perspective, enabling them to weather market fluctuations without panic.

- They are comfortable with volatility: Market downturns are viewed as opportunities to buy undervalued assets, rather than reasons to sell in a panic.

- They have a clear financial plan with long-term goals: This plan outlines their investment strategy, risk tolerance, and desired retirement lifestyle. It provides a roadmap for their financial journey.

- They are disciplined in their investment strategy and stick to their plan: They avoid emotional decision-making and remain committed to their long-term strategy, even during periods of market uncertainty.

Mindful Spending and Debt Management

The stealthy wealthy are not necessarily frugal, but they are mindful spenders. They prioritize needs over wants and strategically manage debt to minimize interest payments and maximize their investment returns. Their spending habits support their long-term financial goals rather than hindering them.

Budgeting and Financial Planning

Creating and sticking to a detailed budget is paramount. This allows them to track their income and expenses, identify areas for savings, and ensure their spending aligns with their financial goals.

- Track expenses diligently: This helps to pinpoint areas where spending can be reduced without sacrificing quality of life.

- Prioritize paying down high-interest debt aggressively: High-interest debt, such as credit card debt, can significantly hinder wealth accumulation. The stealthy wealthy tackle this debt swiftly.

- Automate savings and investments: Setting up automatic transfers to savings and investment accounts ensures consistent contributions, even when life gets busy. This consistent saving is crucial for long-term growth.

Avoiding Lifestyle Inflation

They don't significantly increase their spending as their income grows. This allows them to allocate a larger portion of their income towards investments and wealth building.

- They resist the temptation to buy luxury items just because they can afford them: They focus on value and long-term investment rather than immediate gratification.

- They focus on experiences and relationships rather than material possessions: This shift in priorities enhances their quality of life without excessive spending.

- They invest their surplus income rather than spending it: This disciplined approach accelerates wealth accumulation.

Continuous Learning and Professional Development

The stealthy wealthy are lifelong learners who continuously improve their financial literacy and professional skills. They recognize that financial knowledge and professional expertise are essential for long-term success.

Financial Education

They actively seek knowledge about investing, personal finance, and tax optimization to make informed financial decisions.

- Read books and articles on finance and investing: They stay abreast of current market trends and investment strategies.

- Attend workshops and seminars on wealth management: This provides access to expert insights and networking opportunities.

- Seek advice from qualified financial advisors: A financial advisor provides personalized guidance and support in managing their finances.

Professional Growth

They strive to increase their earning potential through promotions, career changes, or entrepreneurial ventures.

- Invest in their education and skills: This enhances their career prospects and earning potential.

- Network and build relationships with other successful professionals: This expands their opportunities and provides valuable insights.

- Embrace continuous learning and adaptation: The stealthy wealthy understand that adapting to change is vital in today's dynamic environment.

Conclusion

The path to becoming stealthily wealthy is not about flashy displays of wealth, but rather about strategic planning, mindful spending, and a commitment to long-term growth. By adopting the strategies and habits discussed – strategic investing, mindful spending, and continuous learning – you can pave your way towards achieving your own financial success. Start building your own stealthy wealth today by focusing on long-term strategies and smart financial decisions. Remember, the journey to becoming "stealthy wealthy" requires dedication, discipline, and a clear understanding of your financial goals. Begin your journey towards stealthy wealth now!

Featured Posts

-

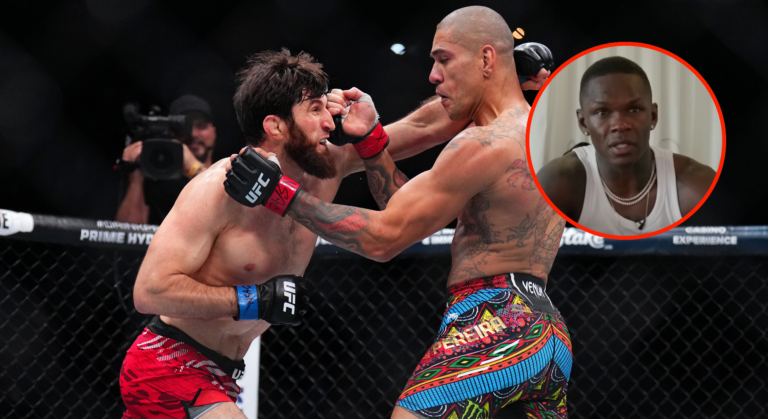

Ufc 313 Alex Pereira Breaks Silence On Loss And Future

May 19, 2025

Ufc 313 Alex Pereira Breaks Silence On Loss And Future

May 19, 2025 -

Anazitontas Ta Istorika Xnaria Tis Anastasis Toy Lazaroy Sta Ierosolyma

May 19, 2025

Anazitontas Ta Istorika Xnaria Tis Anastasis Toy Lazaroy Sta Ierosolyma

May 19, 2025 -

Balmains Fall Winter 2025 2026 Collection Trends Pieces And Runway Highlights

May 19, 2025

Balmains Fall Winter 2025 2026 Collection Trends Pieces And Runway Highlights

May 19, 2025 -

Azzi Fudd And Paige Bueckers A Look At Their Styles U Conn Vs Wnba

May 19, 2025

Azzi Fudd And Paige Bueckers A Look At Their Styles U Conn Vs Wnba

May 19, 2025 -

Parg To Represent Armenia At Eurovision In Concert 2025

May 19, 2025

Parg To Represent Armenia At Eurovision In Concert 2025

May 19, 2025