How To Decide If Refinancing Federal Student Loans Is Best For You

Table of Contents

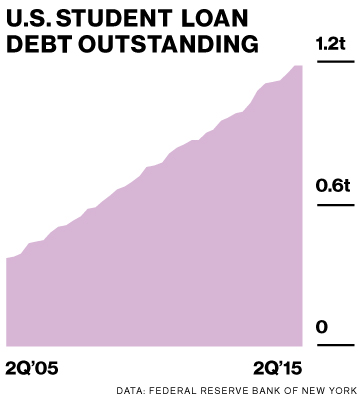

Understanding Federal Student Loan Refinancing

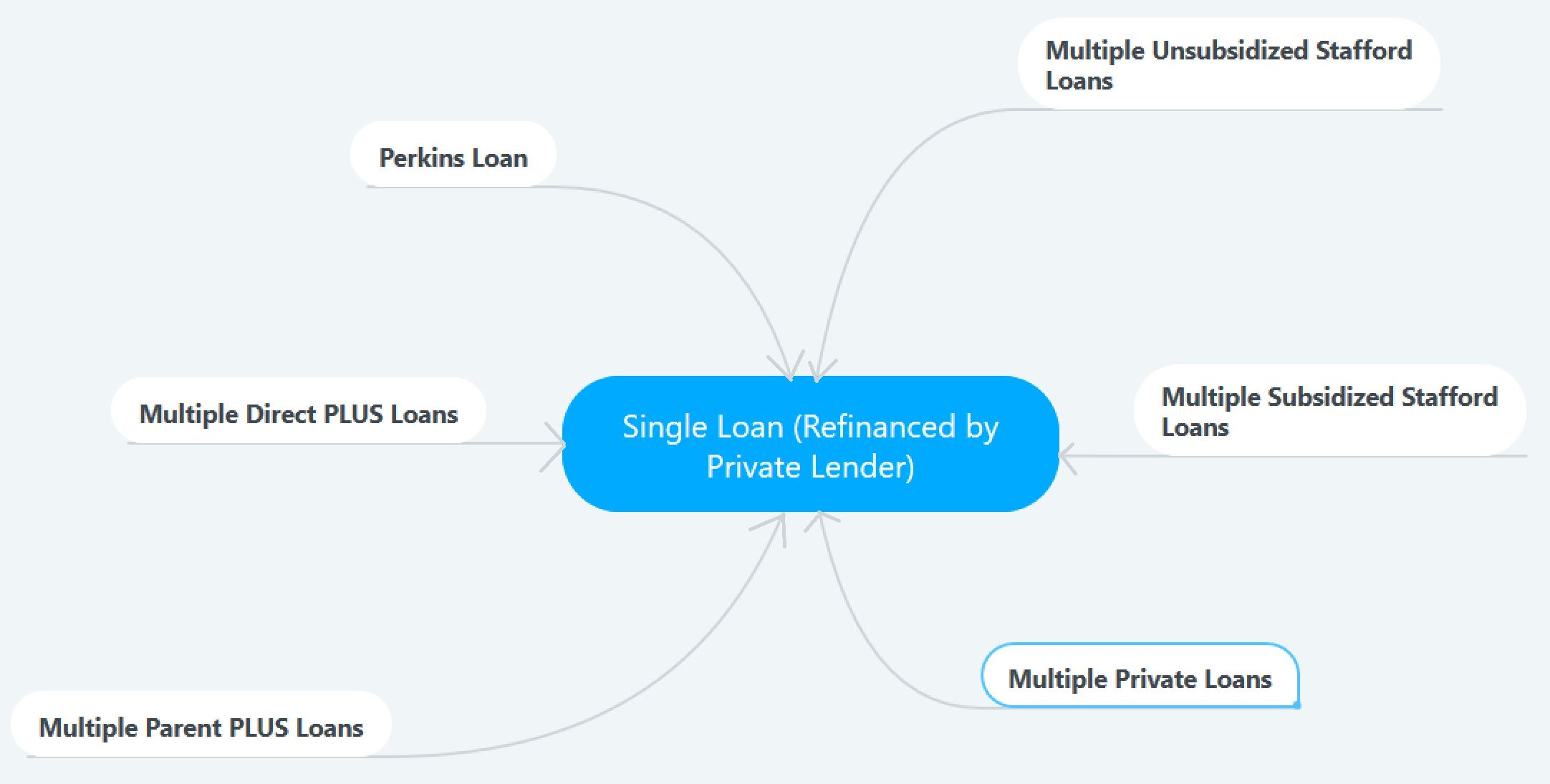

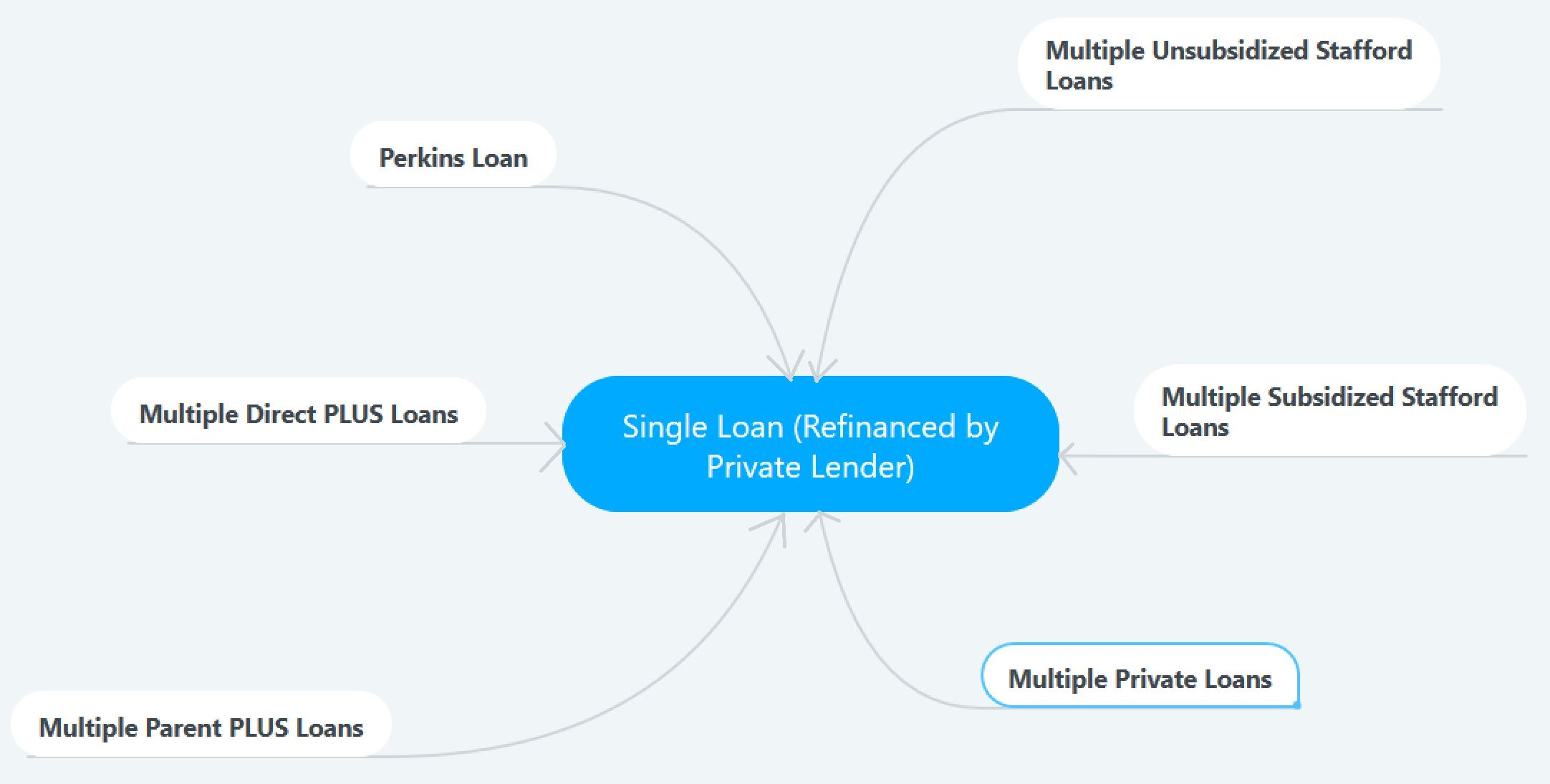

Federal student loan refinancing is the process of replacing your existing federal student loans with a new private loan. This is different from consolidation, which combines your federal loans into a single federal loan. The key difference lies in the lender: consolidation keeps your loans under the federal government, while refinancing transfers them to a private lender. This means you'll lose the protections and benefits associated with federal loans. Private student loan lenders offer refinancing options based on your creditworthiness.

Key Differences Between Private and Federal Loans:

- Lower interest rates: A primary benefit of refinancing is the potential for securing a lower interest rate than your current federal loan rates, leading to significant savings over the life of the loan.

- Potential for a shorter repayment term: Refinancing can allow you to shorten your repayment period, enabling you to pay off your debt faster.

- Simplified payment process: Managing a single loan payment with one lender is simpler than juggling multiple federal loan payments.

- Loss of federal student loan benefits: This is a critical drawback. Refinancing means losing access to federal benefits such as income-driven repayment plans (IDR), deferment, forbearance, and potential loan forgiveness programs.

Assessing Your Current Financial Situation

Before considering refinancing federal student loans, thoroughly assess your financial health. This involves evaluating several key factors:

- Review your current loan balances and interest rates: Make a detailed list of all your federal student loans, including their balances and interest rates.

- Check your credit report for errors and assess your credit score: Your credit score significantly impacts the interest rate you'll qualify for. A higher credit score typically means lower interest rates. Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for accuracy.

- Calculate your debt-to-income ratio (DTI): Your DTI is the percentage of your gross monthly income that goes toward debt payments. A lower DTI improves your chances of securing favorable refinancing terms.

- Consider your current income and expenses: Ensure you can comfortably afford higher monthly payments, should your new loan require them.

Weighing the Pros and Cons of Refinancing Federal Student Loans

Carefully consider the advantages and disadvantages before making a decision.

Pros of Refinancing:

- Lower monthly payments: A lower interest rate could result in significantly lower monthly payments, making your debt more manageable.

- Lower overall interest paid: Over the life of the loan, lower interest rates translate to substantial savings on the total amount paid.

- Shorter repayment term: Paying off your debt faster can save you money on interest and provide a sense of accomplishment.

- Simplified repayment process: One monthly payment to one lender streamlines your finances.

Cons of Refinancing:

- Loss of federal student loan benefits: This is the biggest risk. You lose access to income-driven repayment plans, deferment, forbearance, and government forgiveness programs like Public Service Loan Forgiveness (PSLF).

- Potential for higher interest rates: If your credit score is low, you might end up with a higher interest rate than your current federal loan rates, negating the benefits of refinancing.

- Increased risk if you lose your job or experience financial hardship: Private lenders offer fewer protections during financial difficulties compared to federal loans.

- No forgiveness programs: You'll forfeit eligibility for any federal loan forgiveness programs.

Exploring Alternative Options to Refinancing

Before jumping into refinancing, explore alternatives that preserve your federal loan benefits:

- Income-driven repayment (IDR) plans: These plans base your monthly payment on your income and family size.

- Deferment and forbearance options: These can temporarily postpone or reduce your payments during times of financial hardship.

- Public Service Loan Forgiveness (PSLF): This program can forgive the remaining balance of your federal student loans after 10 years of qualifying payments in public service.

- Teacher Loan Forgiveness: This program can forgive a portion of your federal student loans if you work as a full-time teacher in a low-income school.

Steps to Take Before Refinancing

If, after careful consideration, you decide refinancing is right for you, follow these steps:

- Shop around and compare interest rates from different lenders: Don't settle for the first offer you receive. Compare rates, terms, and fees from multiple private lenders.

- Carefully review the terms and conditions of each loan offer: Pay close attention to the interest rate, fees, repayment terms, and any prepayment penalties.

- Understand any prepayment penalties: Some lenders charge fees if you pay off your loan early.

- Consider the lender’s reputation and customer service: Choose a reputable lender with a history of providing excellent customer service.

Conclusion

Refinancing federal student loans can be a beneficial strategy for some borrowers, potentially leading to lower monthly payments and faster debt repayment. However, it's crucial to carefully weigh the pros and cons, assess your financial situation, and explore alternative options before making a decision. Losing valuable federal loan benefits is a significant consideration. By following the steps outlined above and considering all factors, you can make an informed decision about whether refinancing your federal student loans is the best choice for your unique financial circumstances. Start exploring your options and decide if refinancing your federal student loans is right for you today!

Featured Posts

-

Resultado Final Bahia Vence A Paysandu 1 0 Resumen Y Goles

May 17, 2025

Resultado Final Bahia Vence A Paysandu 1 0 Resumen Y Goles

May 17, 2025 -

Government Crackdown On Delinquent Student Loans What Borrowers Need To Know

May 17, 2025

Government Crackdown On Delinquent Student Loans What Borrowers Need To Know

May 17, 2025 -

Updated Jalen Brunson Injury Report Return Date And Knicks Next Steps

May 17, 2025

Updated Jalen Brunson Injury Report Return Date And Knicks Next Steps

May 17, 2025 -

Celtics Vs Magic Nba Playoffs Game 1 Live Stream Tv Channel And Game Time

May 17, 2025

Celtics Vs Magic Nba Playoffs Game 1 Live Stream Tv Channel And Game Time

May 17, 2025 -

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025