How To Interpret The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is the Net Asset Value (NAV) and why is it important?

The Net Asset Value (NAV) represents the market value of all the assets held within an ETF, minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, this means the total value of its diverse global equity holdings, reflecting exposure to a wide range of international companies.

-

Why is NAV important for investors? The NAV offers a true picture of the ETF's intrinsic worth, independent of the daily market trading price. Tracking NAV fluctuations allows you to objectively assess the ETF's performance over time and compare it against relevant benchmarks. This provides a clearer understanding of the underlying value growth irrespective of short-term market volatility.

-

Daily NAV Calculation: The Amundi MSCI World II UCITS ETF Dist's NAV is meticulously calculated each day, reflecting the closing prices of all its constituent securities. This daily calculation is essential for understanding short-term price movements and for making informed decisions based on current market conditions. Regular access to this data, often available on the ETF provider's website and financial data platforms, is key to effective monitoring.

-

NAV vs. Market Price: While the NAV and the market price of the Amundi MSCI World II UCITS ETF Dist should ideally be very close, minor discrepancies can emerge. These discrepancies typically arise from factors such as trading volume, market liquidity, and the time lag between the market closing and NAV calculation. Understanding this distinction is vital for avoiding misinterpretations of the ETF's true value.

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF Dist

Several key factors can influence the NAV of the Amundi MSCI World II UCITS ETF Dist, impacting the value of your investment. Understanding these factors is crucial for long-term investment success.

-

Market Performance: The most significant driver of NAV changes is the overall performance of the global equity markets represented by the MSCI World Index, the benchmark for this ETF. Positive market trends usually translate to a higher NAV, while negative trends have the opposite effect. This underscores the importance of keeping abreast of global economic news and trends.

-

Currency Fluctuations: As a global ETF, the Amundi MSCI World II UCITS ETF Dist is exposed to currency exchange rate fluctuations. Changes in exchange rates between the Euro (the ETF's base currency) and the currencies of the companies held within the ETF can significantly impact the NAV. This is particularly pertinent given the ETF's global diversification.

-

Dividend Distributions: Dividend payments from the underlying companies within the ETF's holdings will reduce the NAV, as these assets are distributed to shareholders. While this reduces the NAV on the ex-dividend date, it represents a return on your investment. Understanding the timing and impact of dividend distributions is essential for long-term investors.

-

Management Fees and Expenses: The ETF's management fees and other operational expenses will slightly reduce the NAV over time. These costs are inherent in all ETFs and are factored into the NAV calculation. It’s important to be aware of these fees when comparing investment options.

Analyzing NAV Trends for Investment Decisions

Analyzing NAV trends, both short-term and long-term, is crucial for making sound investment decisions regarding the Amundi MSCI World II UCITS ETF Dist.

-

Long-Term Growth: Studying long-term NAV trends provides a clear perspective on the ETF's historical growth trajectory, indicating its long-term investment potential. This long-term view helps to mitigate the impact of short-term market volatility.

-

Comparison with Benchmarks: Comparing the Amundi MSCI World II UCITS ETF Dist's NAV performance against its benchmark index (MSCI World Index) is essential for evaluating its tracking efficiency. This comparison shows how well the ETF mirrors the performance of its underlying index.

-

Short-Term Volatility: While short-term NAV fluctuations can be informative, they should be viewed with caution. Short-term changes are often driven by market sentiment and temporary events rather than fundamental changes in the underlying asset values. Avoid making impulsive decisions based solely on short-term fluctuations.

Conclusion:

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is paramount for investors seeking to effectively monitor performance and manage their investment in this global equity ETF. By carefully analyzing NAV trends, understanding the influencing factors, and comparing its performance against benchmarks, you can make more informed decisions to optimize your investment strategy. Regularly monitor the NAV of your Amundi MSCI World II UCITS ETF Dist holdings and use this key indicator to make informed decisions. Remember to seek professional financial advice tailored to your specific situation and risk tolerance. Mastering the interpretation of the NAV is key to unlocking the full potential of this diversified global equity investment.

Featured Posts

-

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje Vieta Ir Galimybes

May 25, 2025

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje Vieta Ir Galimybes

May 25, 2025 -

Sejarah Porsche 356 Zuffenhausen Dari Garasi Hingga Legenda

May 25, 2025

Sejarah Porsche 356 Zuffenhausen Dari Garasi Hingga Legenda

May 25, 2025 -

Annie Kilners Day Out After Kyle Walkers Evening With Mystery Women

May 25, 2025

Annie Kilners Day Out After Kyle Walkers Evening With Mystery Women

May 25, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 25, 2025 -

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Tjawz 24 Alf Nqtt

May 25, 2025

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Tjawz 24 Alf Nqtt

May 25, 2025

Latest Posts

-

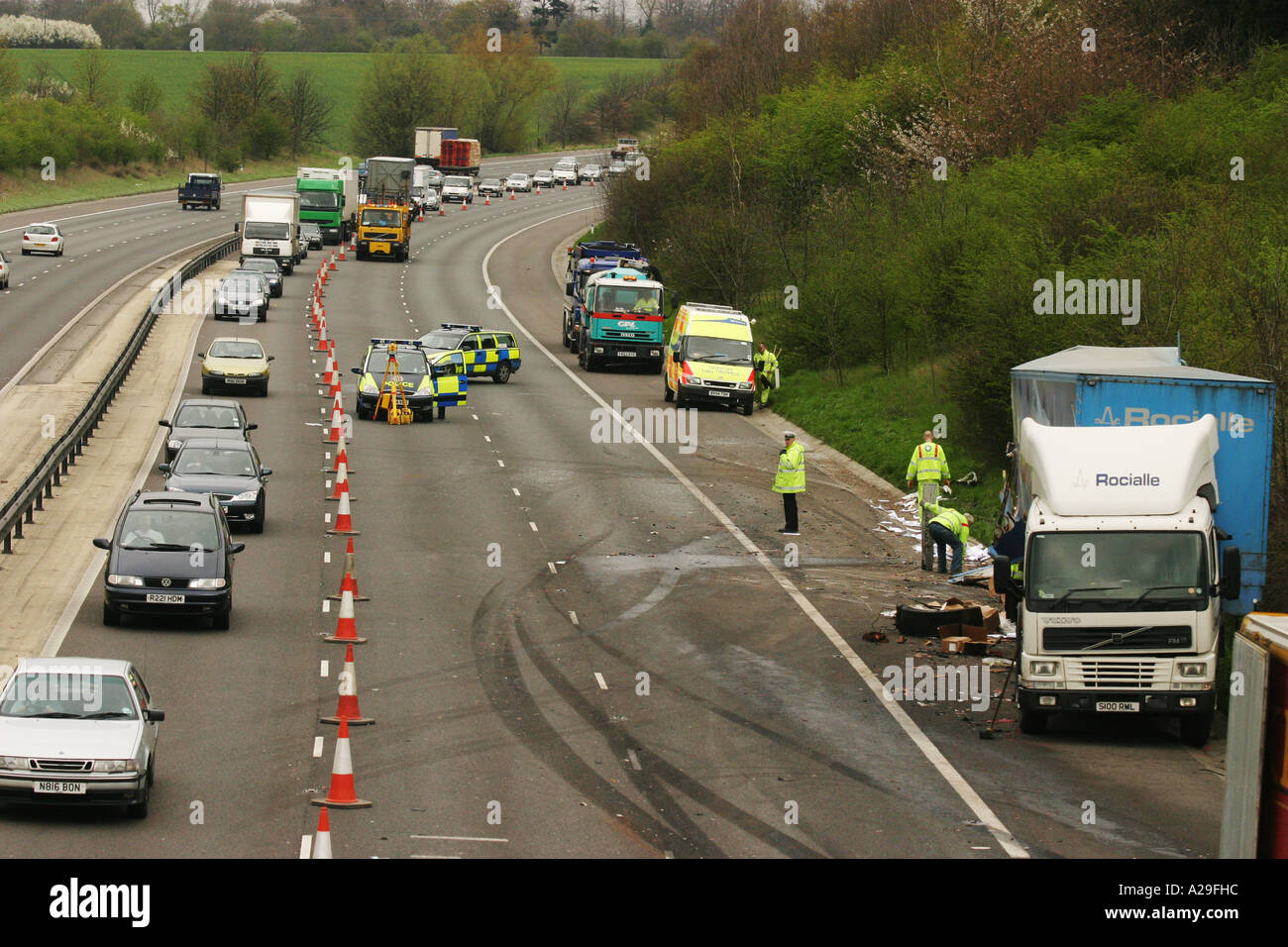

Princess Road Accident Emergency Response Underway Live Updates

May 25, 2025

Princess Road Accident Emergency Response Underway Live Updates

May 25, 2025 -

M62 Westbound Road Closure Resurfacing Between Manchester And Warrington

May 25, 2025

M62 Westbound Road Closure Resurfacing Between Manchester And Warrington

May 25, 2025 -

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025 -

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025 -

M56 Motorway Accident Real Time Traffic Information And Route Alternatives

May 25, 2025

M56 Motorway Accident Real Time Traffic Information And Route Alternatives

May 25, 2025