How To Interpret The Net Asset Value Of The Amundi DJIA UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

In the context of ETFs, the Net Asset Value (NAV) represents the total value of the ETF's underlying assets minus any liabilities. Essentially, it's the per-share value of the ETF's holdings. The NAV is calculated daily and provides a benchmark for the ETF's fair market price. Understanding the NAV is crucial, as it directly impacts the ETF's pricing and helps investors assess its performance and potential value.

The Amundi DJIA UCITS ETF (let's assume its ticker is 'AMDJIA' for this article – please replace with the actual ticker if different) tracks the Dow Jones Industrial Average, a leading index of 30 large, publicly-owned companies in the United States. This ETF aims to replicate the performance of the DJIA, offering investors broad exposure to the US blue-chip market.

This article aims to demystify the NAV of the Amundi DJIA UCITS ETF, enabling you to utilize this key metric for effective investment strategies.

How the NAV of the Amundi DJIA UCITS ETF is Calculated

The NAV of the Amundi DJIA UCITS ETF is calculated daily, typically at the close of the market. The process involves several key steps:

- Determining the Market Values: The market value of each of the 30 constituent stocks in the DJIA is obtained at the end of the trading day.

- Weighting the Stocks: Each stock's market value is weighted according to its representation in the DJIA index. Stocks with higher market capitalizations will have a larger weighting.

- Deduction of Fees and Expenses: The management fees and other operating expenses associated with the ETF are deducted from the total value of the underlying assets.

- Currency Conversion (if applicable): If the ETF holds assets denominated in currencies other than the base currency of the ETF, currency conversions are performed at prevailing exchange rates.

The final NAV is then calculated by dividing the total net asset value by the number of outstanding shares. This calculation provides a precise measure of the ETF’s underlying worth.

Factors Affecting the NAV of the Amundi DJIA UCITS ETF

Several factors influence the NAV of the Amundi DJIA UCITS ETF:

- Market Fluctuations: Changes in the prices of the individual DJIA stocks directly impact the overall value of the ETF. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

- Currency Exchange Rates: If the ETF holds assets in multiple currencies, fluctuations in exchange rates can affect the NAV. A stronger US dollar, for instance, could negatively impact the NAV if a significant portion of the holdings are in other currencies.

- Dividend Distributions: When the underlying DJIA companies pay dividends, the ETF receives these payments, which generally increase the NAV. However, the impact is usually temporary, as the dividends are subsequently distributed to ETF shareholders.

- Expense Ratio: The expense ratio, representing the annual cost of managing the ETF, gradually impacts the NAV over time. The expense ratio is deducted from the total asset value, reducing the overall NAV.

Other influential factors include:

- Market volatility

- Economic events (e.g., interest rate changes, recessions)

- Geopolitical factors (e.g., international conflicts, trade wars)

- Company-specific news (e.g., earnings reports, mergers and acquisitions)

Where to Find the NAV of the Amundi DJIA UCITS ETF

You can find the daily NAV of the Amundi DJIA UCITS ETF from various sources:

- Official Sources: The Amundi website is the primary source for official NAV data.

- Financial News Websites: Reputable financial news websites (e.g., Bloomberg, Yahoo Finance, Google Finance) typically publish ETF NAV data.

- Brokerage Platforms: If you hold the Amundi DJIA UCITS ETF in your brokerage account, the NAV will usually be displayed alongside other relevant information.

- Data Providers: Professional financial data providers (e.g., Refinitiv, FactSet) offer real-time or delayed NAV data.

Using the NAV to Make Informed Investment Decisions

The NAV is a critical tool for making informed investment decisions:

- Comparing NAV to Market Price: The ETF's market price may trade at a premium or discount to its NAV. Understanding this difference can help you identify potential buying or selling opportunities.

- Tracking Performance: By monitoring the NAV over time, you can track the ETF's performance and assess its growth.

- Evaluating Investment Strategies: The NAV helps you evaluate the success of your investment strategy in relation to the performance of the DJIA.

Utilizing NAV data for strategic decision-making:

- Premium/Discount Analysis: Analyze the relationship between the market price and the NAV to make informed buy/sell decisions.

- Long-Term Performance Tracking: Regularly check the NAV to monitor the ETF's long-term growth and compare it to its benchmark, the DJIA.

- Comparison with Benchmarks: Compare the Amundi DJIA UCITS ETF’s NAV performance against other similar ETFs or the DJIA itself.

Mastering the Net Asset Value of the Amundi DJIA UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is crucial for successful investment. This article has outlined how the NAV is calculated, the factors that affect it, where to find it, and how to use it for informed decision-making. Remember that the NAV is a key indicator of the ETF's intrinsic value and should be considered alongside other market factors. By actively monitoring the Amundi DJIA UCITS ETF's NAV and understanding its implications, you can enhance your investment strategy and optimize your returns. For a deeper understanding of ETFs and NAV calculations, further research into financial literature and online resources is recommended. Mastering the NAV is key to mastering your investments!

Featured Posts

-

Frances National Rally Evaluating The Strength Of Le Pens Support Following Sundays Demonstration

May 24, 2025

Frances National Rally Evaluating The Strength Of Le Pens Support Following Sundays Demonstration

May 24, 2025 -

Avrupa Piyasalari Buguenkue Karisik Seyir Ve Gelecek Tahminleri

May 24, 2025

Avrupa Piyasalari Buguenkue Karisik Seyir Ve Gelecek Tahminleri

May 24, 2025 -

Bangkok Post Ferrari Day Unveils New Flagship Facility

May 24, 2025

Bangkok Post Ferrari Day Unveils New Flagship Facility

May 24, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

Astonishing 90mph Refueling Police Chase Ends In Dramatic Text And Refuel

May 24, 2025

Astonishing 90mph Refueling Police Chase Ends In Dramatic Text And Refuel

May 24, 2025

Latest Posts

-

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025 -

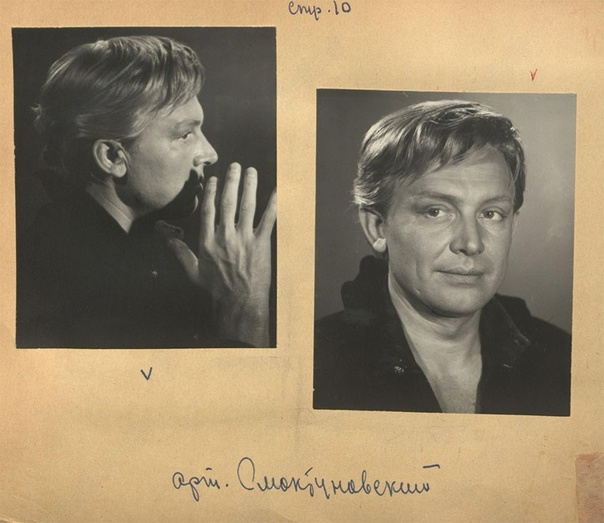

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025 -

Schekotat Nervy Interpretatsiya Fedora Lavrova Pavel I I Trillery

May 24, 2025

Schekotat Nervy Interpretatsiya Fedora Lavrova Pavel I I Trillery

May 24, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025