How Trump Tariffs Shut Down The IPO Market For Fintech Companies Like Affirm (AFRM)

Table of Contents

The Direct Impact of Tariffs on Fintech Supply Chains

Tariffs imposed during the Trump administration had a tangible and detrimental impact on fintech companies' operational capabilities and financial health, directly affecting their readiness for an IPO.

Increased Input Costs

Tariffs on imported components, software, and hardware directly increased the operational costs for fintech companies. This squeezed profit margins, making them less attractive to investors eyeing an IPO. The increased expenses reduced the overall profitability and attractiveness of these firms for potential investors.

- Example: Higher costs for server infrastructure, a critical component of any fintech operation, significantly impacted bottom lines. Data centers, crucial for processing and storing financial data, rely heavily on imported components.

- Example: Tariffs on imported components for mobile payment devices, a cornerstone of many fintech business models, added to the cost of development and deployment. This particularly affected companies specializing in mobile payment solutions.

Disruption of Global Partnerships

Tariffs complicated international collaborations and partnerships, essential for fintech expansion and scaling. This uncertainty significantly impacted investor confidence. The added complexity and risks associated with international collaborations made investors hesitant.

- Example: Delays or cancellations of collaborations with international payment processors due to tariff-related uncertainties hindered growth and market penetration. This disruption impacted crucial elements like transaction processing and cross-border payments.

- Example: Difficulty in securing funding from foreign investors due to trade uncertainties and the increased risk associated with global partnerships. This created a funding gap, particularly for startups relying on international investment.

Reduced Consumer Spending

Tariffs contributed to higher prices for consumers, potentially impacting the demand for fintech services and affecting the overall market valuation of companies like Affirm (AFRM). Reduced consumer purchasing power directly translated into lower demand for fintech products.

- Example: Reduced consumer spending on discretionary items directly impacted the Buy Now, Pay Later (BNPL) market, a sector where Affirm operates. Consumers tightened their budgets, leading to a decrease in BNPL transactions.

- Example: Lower transaction volumes due to decreased consumer confidence and reduced disposable income. The overall economic climate impacted transaction frequencies and the overall health of the fintech sector.

The Indirect Impact of Tariffs on Investor Sentiment

Beyond the direct costs, the Trump tariffs created a broader economic climate of uncertainty that significantly affected investor sentiment towards fintech IPOs.

Increased Market Volatility

The overall economic uncertainty created by the tariffs fostered a climate of fear and uncertainty in the stock market, making investors more risk-averse. This risk aversion pushed investors toward more established companies and away from fintech startups.

- Example: Investors prioritized established, less risky companies over fintech startups, which were perceived as more vulnerable to economic downturns. This preference shift created a funding gap for many fintech companies seeking IPOs.

- Example: Reduced IPO valuations due to investor hesitancy and a lack of confidence in the long-term stability of the market. This resulted in lower valuations and less attractive investment opportunities for fintech companies.

Difficulty in Securing Funding

The challenging market conditions made it harder for fintech companies to secure the necessary funding for growth and expansion before their IPOs. The overall economic slowdown and investor risk aversion made securing capital more difficult.

- Example: Venture capitalists and private equity firms were less inclined to invest in high-risk ventures, preferring safer investment options during uncertain times. This reluctance to invest hampered the growth plans of many fintech firms.

- Example: Higher interest rates on loans made it more expensive to finance growth, further constricting the financial resources available to fintech companies preparing for IPOs. This increased the cost of borrowing and reduced the viability of growth-oriented strategies.

Negative Media Coverage

The negative press surrounding the trade war created a general sense of pessimism impacting investor confidence in all sectors, including fintech. The negative news cycle exacerbated the prevailing economic uncertainty.

- Example: Negative media coverage created uncertainty and risk aversion among potential investors, leading to decreased investor confidence in the sector as a whole. This negative press contributed to lower investor interest in fintech IPOs.

- Example: Lower media attention for IPOs due to dominant news coverage of the trade war. The trade war dominated news cycles, shifting attention away from other business news, including fintech IPOs.

Case Study: Affirm (AFRM) and the Tariffs

Affirm's business model, heavily reliant on consumer spending and technology infrastructure, was directly impacted by the tariffs. Increased costs for server infrastructure and potential disruptions to international partnerships could have affected its operational efficiency and profitability. Reduced consumer spending, a direct consequence of tariffs, likely influenced the timing and valuation of Affirm's IPO. Compared to other fintech companies that went public or delayed their IPOs during the same period, Affirm's journey might serve as a telling case study on how trade policy affected fintech's entrance into the public market. A detailed analysis comparing Affirm’s performance with that of its peers during this period would reveal the exact extent to which the tariffs impacted its IPO trajectory.

Conclusion

Trump-era tariffs cast a long shadow over the fintech IPO market, directly and indirectly impacting companies like Affirm (AFRM). The increased costs, market volatility, and decreased investor confidence created a challenging environment for startups seeking funding and public listing. Understanding this historical context is crucial for navigating future economic uncertainties and their ripple effects on the fintech sector. By carefully studying the impact of these tariffs, investors and entrepreneurs can better prepare for similar challenges and successfully navigate the complexities of the global economy while pursuing fintech IPOs and other fintech investment opportunities. Understanding the impact of trade policy on fintech is paramount for future success in this dynamic sector.

Featured Posts

-

Chinas Lithium Export Restrictions A Potential Boost For Eramet

May 14, 2025

Chinas Lithium Export Restrictions A Potential Boost For Eramet

May 14, 2025 -

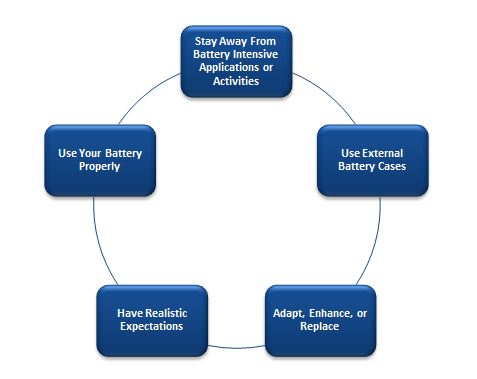

Apples I Os 19 To Feature Ai Driven Battery Optimization

May 14, 2025

Apples I Os 19 To Feature Ai Driven Battery Optimization

May 14, 2025 -

Fallecimiento De Jose Mujica Expresidente De Uruguay Muere A Los 89 Anos

May 14, 2025

Fallecimiento De Jose Mujica Expresidente De Uruguay Muere A Los 89 Anos

May 14, 2025 -

Raccolta Fondi Di Successo A Sanremo Musica E Pace Per Al Fa Pp

May 14, 2025

Raccolta Fondi Di Successo A Sanremo Musica E Pace Per Al Fa Pp

May 14, 2025 -

Captain America Brave New World Box Office Underwhelms Lowest Mcu Earnings

May 14, 2025

Captain America Brave New World Box Office Underwhelms Lowest Mcu Earnings

May 14, 2025