Hudson's Bay Company's Creditor Protection Extended To July 31st: Court Ruling

Table of Contents

Court Ruling Extends Creditor Protection to July 31st

On [Insert Date of Ruling], the [Insert Court Name] granted HBC an extension to its CCAA protection, pushing the deadline to July 31st. This court order, delivered by [Insert Judge's Name], signifies a crucial step in HBC's financial recovery strategy. The judge's reasoning, as detailed in the court documents, cited [Insert Key Reasons from Court Documents – e.g., the progress made on the restructuring plan, the potential for a successful outcome, etc.]. This extension allows HBC to continue its efforts to reorganize its finances, renegotiate debts, and implement its strategic plan without the immediate pressure of looming deadlines. The conditions attached to this CCAA extension likely include [Insert Specific Conditions – e.g., regular reporting to the court, maintaining certain financial performance metrics, etc.].

Implications for HBC's Restructuring Plan

The extension significantly impacts HBC's restructuring timeline. The company's current plan reportedly involves [Insert Key Elements of Restructuring Plan – e.g., store closures, cost-cutting initiatives, potential asset sales, debt reduction strategies, etc.]. The additional time granted by the court offers HBC the opportunity to refine its restructuring plan and potentially explore new avenues for financial recovery. The likelihood of a successful restructuring hinges on several factors, including:

- The company's ability to secure additional financing.

- The success of negotiations with creditors.

- The effectiveness of implemented operational changes.

- The overall performance of the retail sector.

The extension allows HBC more time to address these challenges and demonstrate progress to its creditors and stakeholders. However, it also increases the financial burden on the company due to ongoing operational costs during the restructuring process.

Impact on Creditors and Stakeholders

The extended creditor protection has significant implications for all stakeholders. HBC's creditors – including banks, suppliers, and other lenders – face continued uncertainty regarding debt repayment. This period offers an opportunity for renegotiation and potential compromises between HBC and its creditors. However, the extended period also means a prolonged delay in receiving payments.

For employees, the extension brings a mix of hope and anxiety. While it buys time to explore solutions, uncertainty about job security remains. Customers may face ongoing changes to store locations and product offerings as the company implements its restructuring plan. The level of uncertainty affecting all stakeholders highlights the high-stakes nature of this period for the company.

Potential Outcomes and Future Scenarios

Several potential outcomes emerge from this extension of Hudson's Bay Company creditor protection. Positive scenarios include a successful restructuring leading to improved financial health and long-term stability. This would involve securing new financing, effectively managing debt, and implementing successful operational changes. Conversely, negative scenarios could involve failure to restructure, potentially resulting in liquidation or the sale of significant assets. The final outcome will depend on the company's ability to execute its plan effectively and negotiate favorable terms with creditors.

Possible Scenarios:

- Successful Restructuring: HBC emerges stronger with a reduced debt burden and a more streamlined business model.

- Partial Sale/Restructuring: HBC sells off non-core assets to reduce debt and focuses on key profitable areas.

- Liquidation: HBC fails to secure necessary financing and is forced to liquidate its assets.

The coming weeks will be critical in determining which path HBC follows.

Conclusion

The court's decision to extend Hudson's Bay Company's creditor protection until July 31st offers a crucial, albeit temporary, reprieve for the iconic retailer. This period represents a pivotal moment in HBC's history. The coming weeks will be critical in determining the ultimate success or failure of HBC's restructuring efforts, with far-reaching implications for its creditors, employees, and the Canadian retail landscape. The path forward remains uncertain, but the extended deadline offers a crucial window of opportunity to create a viable future for the company.

Call to Action: Stay informed about the ongoing developments in the Hudson's Bay Company's creditor protection case by regularly checking back for updates. Understanding the intricacies of this Hudson's Bay Company creditor protection process is vital for all stakeholders.

Featured Posts

-

Padres Aim For Sweep Arraez Heyward Headline Lineup

May 16, 2025

Padres Aim For Sweep Arraez Heyward Headline Lineup

May 16, 2025 -

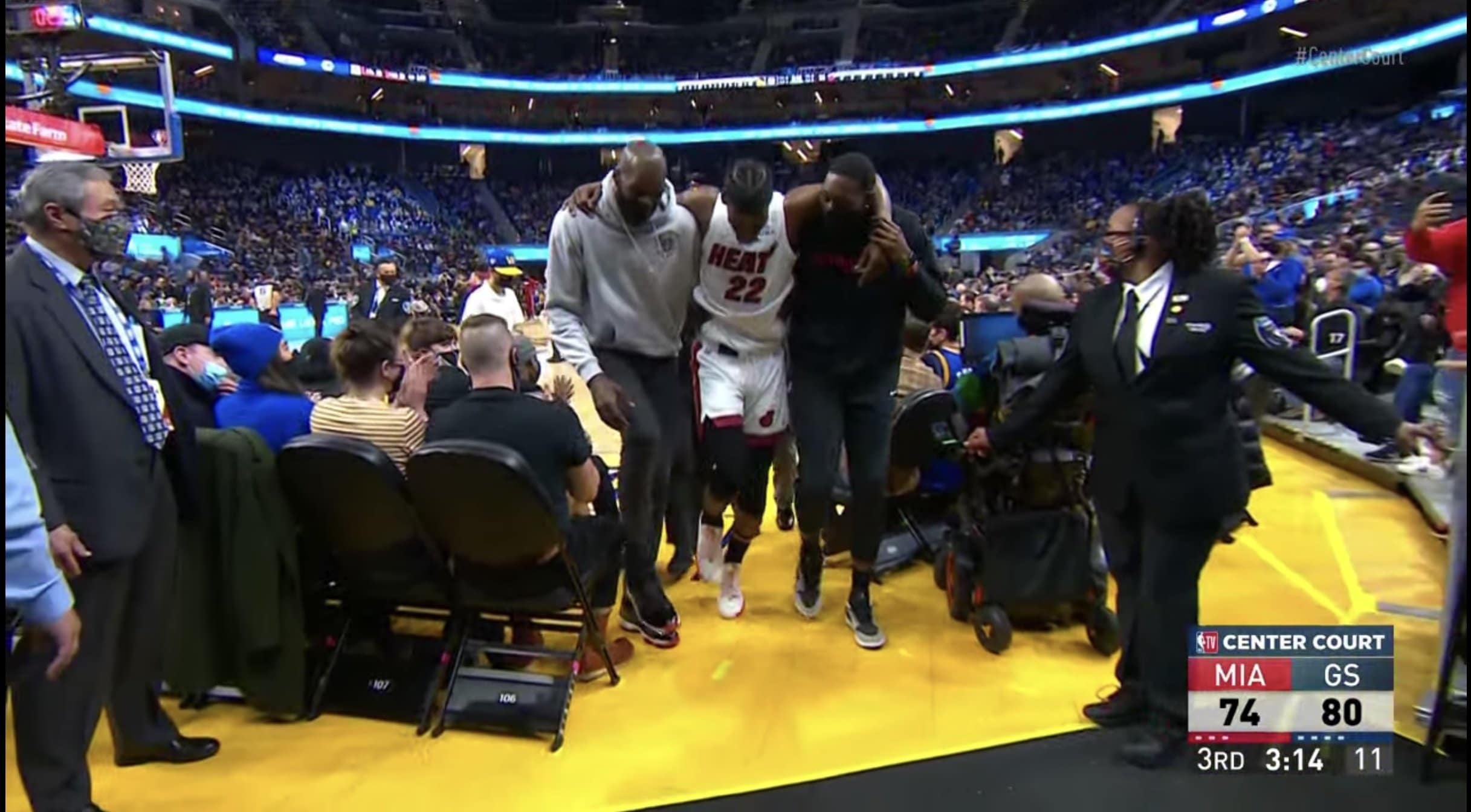

Warriors Loss Highlights Jimmy Butlers Pelvic Contusion Severity

May 16, 2025

Warriors Loss Highlights Jimmy Butlers Pelvic Contusion Severity

May 16, 2025 -

Nhl Stanley Cup Playoffs Ndax Announced As Official Partner Canada

May 16, 2025

Nhl Stanley Cup Playoffs Ndax Announced As Official Partner Canada

May 16, 2025 -

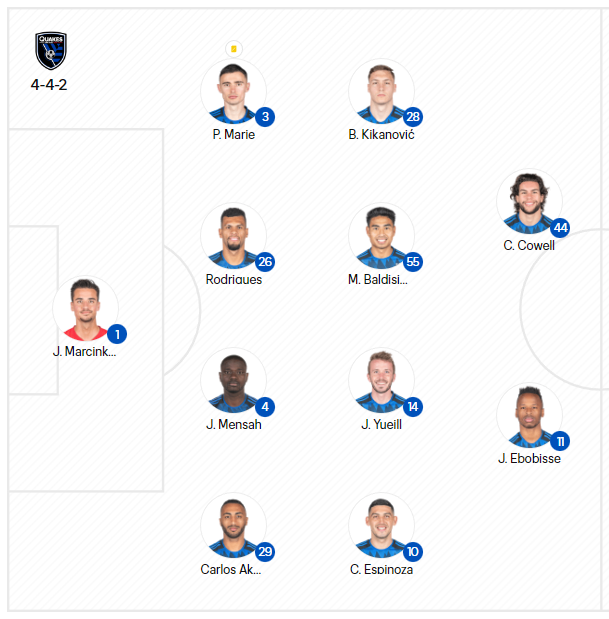

San Jose Earthquakes Scouting Report Tactical Analysis And Player Profiles

May 16, 2025

San Jose Earthquakes Scouting Report Tactical Analysis And Player Profiles

May 16, 2025 -

Understanding Elon Musks Familys Financial Success A Look At Maye Musks Perspective

May 16, 2025

Understanding Elon Musks Familys Financial Success A Look At Maye Musks Perspective

May 16, 2025