Ignoring High Stock Market Valuations: A BofA Investment Strategy

Table of Contents

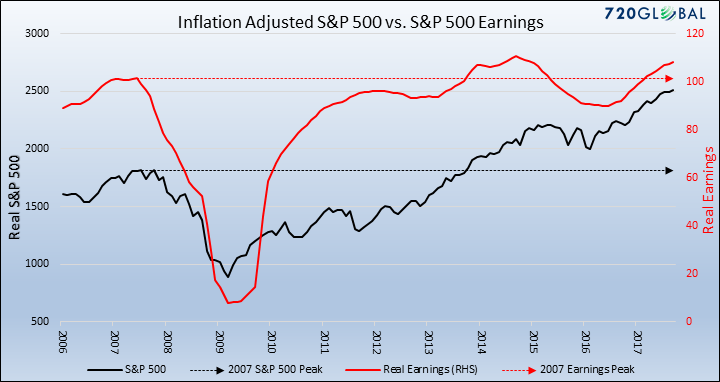

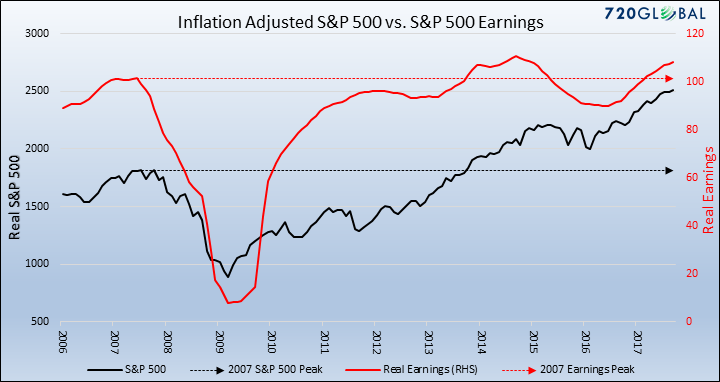

Understanding BofA's Perspective on High Stock Market Valuations

Bank of America, a leading global financial institution, regularly publishes market analyses and investment strategies. While specific recommendations change based on market conditions, BofA generally acknowledges the risks associated with high stock market valuations. Their analyses often consider factors like price-to-earnings ratios (P/E ratios), cyclically adjusted price-to-earnings ratios (CAPE ratios), and other valuation metrics to gauge the overall market health. (Note: Specific reports and their dates should be inserted here if available, citing them appropriately. For example: "In their Q3 2024 report, BofA analysts highlighted...").

- Summary of BofA's Reasoning: BofA's strategy often emphasizes a cautious yet opportunistic approach during periods of high valuations. They tend to advocate for a diversified portfolio to mitigate risk and are less likely to recommend aggressive, fully invested strategies. The reasoning often centers on the potential for market corrections or slower growth.

- Key Economic Indicators: BofA's analysts carefully consider several key economic indicators. These include inflation rates (CPI, PPI), interest rate movements (Federal Funds Rate, bond yields), Gross Domestic Product (GDP) growth, and unemployment figures. These indicators help them assess the underlying health of the economy and its potential impact on stock prices.

- BofA Reports and Publications: To gain a deeper understanding of BofA's current stance, refer to their regularly published investment outlook reports and research papers available on their website (link to BofA website here). These documents often contain detailed analysis and specific recommendations.

Key Elements of BofA's Investment Strategy During High Valuations

BofA's investment strategy during periods of high valuations typically revolves around several key tenets: diversification, risk management, and a selective approach to investment opportunities.

- Diversification Strategies: BofA often suggests diversifying across various asset classes. This includes a mix of equities (stocks), fixed-income securities (bonds), and potentially alternative investments like real estate or commodities. Within equities, they may advocate for diversification across sectors, market capitalizations (large-cap, mid-cap, small-cap), and geographical regions.

- Risk Management Techniques: Effective risk management is crucial. BofA may suggest techniques such as hedging strategies (using derivatives to protect against losses), stop-loss orders (automatic sell orders to limit potential losses), and position sizing (controlling the amount invested in any single asset).

- Value vs. Growth: BofA's approach may lean towards a blend of value and growth investing. While growth stocks may be appealing, high valuations can increase their risk. Value investing, focusing on undervalued companies, can provide a more defensive approach during periods of uncertainty. (Again, specific recommendations from BofA reports should be included here if available.)

- Specific Sectors/Companies: (Disclaimer: This section must include a strong disclaimer that mentioning specific sectors or companies is not a recommendation, and individual investors should conduct their own research.) BofA may highlight specific sectors or companies that they believe are relatively undervalued or possess strong fundamentals, even within a high-valuation market. However, this is subject to constant change and should not be interpreted as financial advice.

Practical Application: Adapting BofA's Strategy to Your Portfolio

Applying BofA's insights to your individual portfolio requires a thoughtful and personalized approach.

- Rebalancing Your Portfolio: Review your current asset allocation and compare it to BofA's suggested diversification. Rebalance your portfolio to align more closely with their recommendations, adjusting the proportion of equities, bonds, and other asset classes.

- Understanding Your Risk Tolerance: BofA's strategy should be adapted to your individual risk tolerance. If you are risk-averse, you may want a more conservative approach with a higher allocation to fixed income.

- Further Research and Due Diligence: Don't solely rely on BofA's analysis. Conduct your own independent research to validate their findings and assess the suitability of their recommendations for your personal circumstances.

- Consulting a Financial Advisor: Working with a qualified financial advisor is highly recommended. They can help you tailor a BofA-inspired investment strategy to your specific financial goals, risk tolerance, and time horizon.

Potential Drawbacks and Considerations

While BofA's investment strategy offers valuable insights, it's essential to acknowledge potential drawbacks.

- Risks Associated with the Strategy: Even a diversified portfolio can experience losses during market downturns. No investment strategy guarantees profits.

- Alternative Investment Strategies: Other investment strategies may be more suitable for your specific circumstances. Consider exploring different approaches and comparing their risk-reward profiles.

- Factors that Could Invalidate Assumptions: Economic conditions, geopolitical events, and unexpected market shifts can all affect the accuracy of BofA's assumptions.

Conclusion

BofA's investment strategy for navigating high stock market valuations emphasizes diversification, risk management, and a selective approach. Key takeaways include carefully assessing your own risk tolerance, conducting thorough due diligence, and potentially seeking professional financial advice. Remember, while BofA's analysis provides valuable insights, it's crucial to adapt it to your personal financial goals and situation. Don't ignore the signals; learn more about adapting a BofA investment strategy to your portfolio and navigate high stock market valuations effectively. Create a robust plan today.

Featured Posts

-

February 20 2025 A Happy Day

Apr 27, 2025

February 20 2025 A Happy Day

Apr 27, 2025 -

Blue Origin Rocket Launch Abruptly Halted Technical Glitch Reported

Apr 27, 2025

Blue Origin Rocket Launch Abruptly Halted Technical Glitch Reported

Apr 27, 2025 -

Posthaste How A Canadian Travel Boycott Affects The Us Economy

Apr 27, 2025

Posthaste How A Canadian Travel Boycott Affects The Us Economy

Apr 27, 2025 -

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Latest Posts

-

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025 -

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025