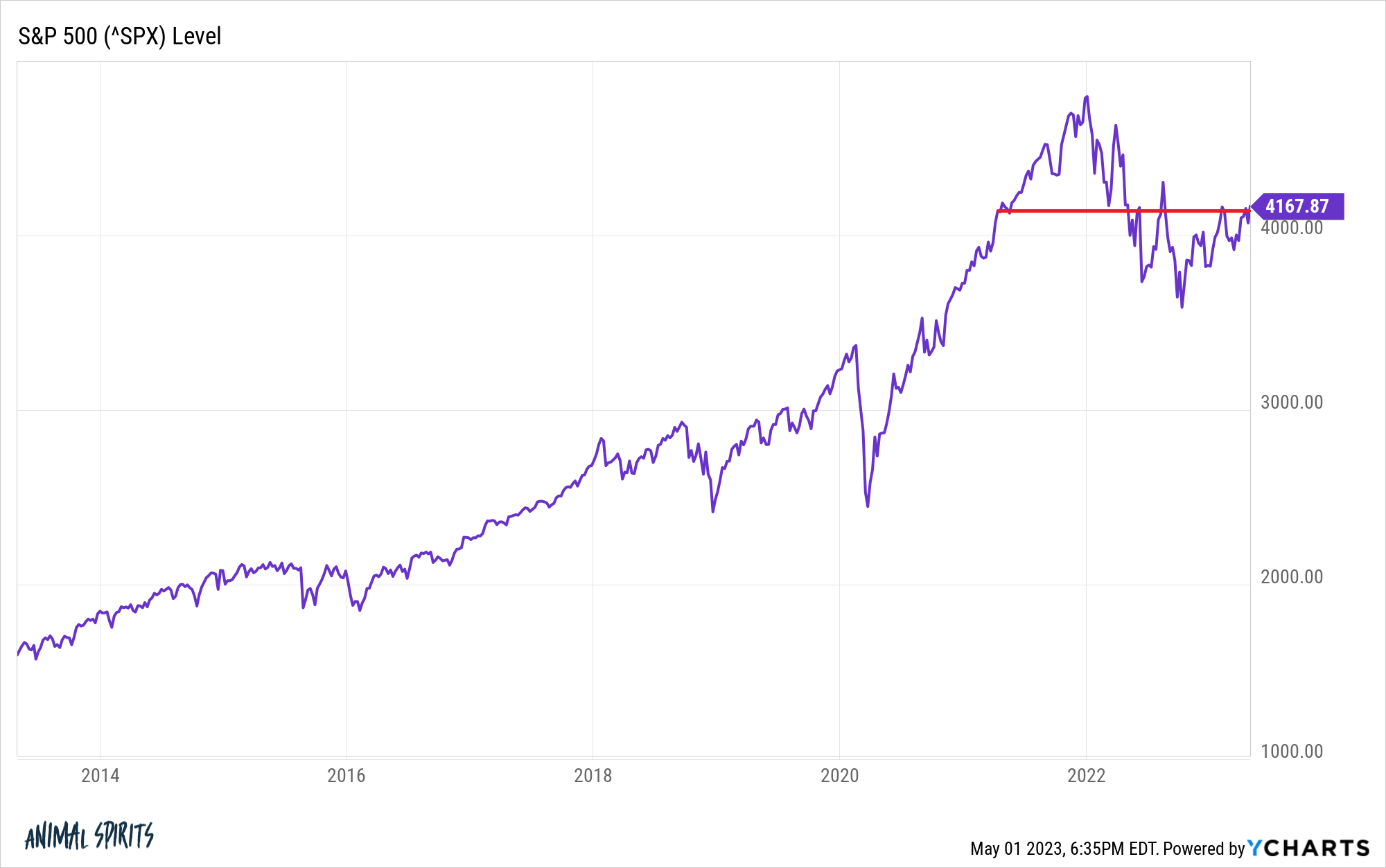

Ignoring High Stock Market Valuations: BofA's Rationale

Table of Contents

BofA's Justification for Overlooking High Valuations

BofA's contrarian stance on high valuations isn't based on blind optimism. Instead, their rationale rests on several key pillars that warrant a closer examination. Understanding these arguments is crucial for any investor navigating the current market landscape.

Low Interest Rates as a Supporting Factor

Historically low interest rates play a significant role in justifying higher valuations. The inverse relationship between interest rates and present value is fundamental.

- Lower discount rates: Low interest rates mean lower discount rates used in discounted cash flow (DCF) models, a common valuation technique. This results in higher present values for future earnings, making high current valuations seem less extreme.

- Impact on valuation metrics: Metrics like the price-to-earnings ratio (P/E) are directly affected. A lower discount rate increases the perceived value of future earnings, leading to a higher acceptable P/E ratio.

- Example: If the discount rate is 5%, the present value of $100 received in a year is approximately $95. However, if the discount rate falls to 2%, the present value rises to approximately $98, significantly impacting valuation calculations.

Strong Corporate Earnings and Profitability

BofA points to robust corporate earnings and profitability as a key justification for higher valuations. Many sectors are exhibiting exceptional financial performance, supporting higher price-to-earnings ratios.

- Strong performing sectors: Technology, healthcare, and consumer staples have shown remarkable resilience and growth, driving overall market performance.

- Supporting data: Numerous financial reports and earnings releases corroborate this trend, demonstrating strong revenue growth and increased profitability across various sectors.

- Future growth implications: These robust earnings suggest potential for continued growth, justifying the higher valuations in the eyes of BofA.

Long-Term Growth Potential and Technological Innovation

BofA's perspective also emphasizes the long-term growth prospects fueled by technological innovation. Disruptive technologies are reshaping industries, creating new opportunities and justifying higher valuations for companies positioned to benefit.

- Technological trends: Artificial intelligence, cloud computing, and biotechnology are just a few examples of trends driving significant growth and transformation.

- Disruption and valuation: Technological disruption can lead to significant increases in market share and profitability, potentially justifying higher valuations despite current market concerns.

- Benefiting companies: Companies at the forefront of these technological advancements are expected to reap substantial long-term benefits, justifying premium valuations.

Risks Associated with BofA's Approach

While BofA's arguments are compelling, it's crucial to acknowledge the inherent risks associated with ignoring high valuations. A balanced perspective is essential for responsible investing.

Potential for a Market Correction

Despite positive indicators, the potential for a market correction remains a significant risk. Several factors could trigger such a correction.

- Potential triggers: Rising interest rates, geopolitical instability, or a sudden economic downturn could all lead to a market correction.

- Implications for high valuation stocks: High valuation stocks are particularly vulnerable during market corrections, potentially experiencing steeper declines than their lower-valued counterparts.

- Potential outcomes: A correction could range from a mild downturn to a more significant bear market, impacting investor portfolios considerably.

Overvaluation Risk and its Long-Term Consequences

The danger of prolonged overvaluation and its impact on long-term investor returns is undeniable. History is replete with examples of market bubbles eventually bursting.

- Historical precedent: The dot-com bubble and the housing market crash serve as stark reminders of the consequences of ignoring overvaluation risks.

- Importance of diversification and risk management: Diversification across different asset classes and robust risk management strategies are crucial to mitigate potential losses.

- Cautionary notes: Investors should proceed with caution, recognizing that high valuations do not guarantee future returns.

Alternative Investment Strategies to Consider

For investors uncomfortable with high valuations, alternative strategies exist. These approaches offer different risk profiles and potential returns.

Focus on Value Investing

Value investing emphasizes identifying undervalued companies with strong fundamentals. This approach offers a contrarian perspective to the current market exuberance.

- Value investing strategies: Analyzing financial statements, identifying undervalued assets, and focusing on long-term growth potential are key elements of value investing.

- Advantages and disadvantages: Value investing can offer protection during market corrections but may require a longer-term horizon to realize returns.

Diversification across Asset Classes

Diversification beyond equities is a crucial risk management strategy. Spreading investments across different asset classes can reduce overall portfolio volatility.

- Alternative asset classes: Bonds, real estate, commodities, and alternative investments can offer diversification benefits and potentially smoother returns.

- Mitigating risk: Diversification reduces the impact of any single asset class underperforming, thus protecting the overall portfolio.

Conclusion: Navigating High Stock Market Valuations: A Balanced Approach

BofA's rationale for potentially ignoring high stock market valuations rests on low interest rates, strong corporate earnings, and long-term growth potential driven by technological innovation. However, investors must acknowledge the potential for market corrections and the inherent risks associated with high valuations. A balanced approach is crucial. Consider alternative strategies like value investing and diversification to mitigate risk. Conduct thorough research, carefully assess your risk tolerance, and make informed investment decisions. Don't hesitate to consult with a qualified financial advisor for personalized guidance on navigating the complexities of ignoring high stock market valuations or finding the right strategy for your circumstances.

Featured Posts

-

Zheng Qinwens Path To The Italian Open Semifinals A Winning Strategy

May 25, 2025

Zheng Qinwens Path To The Italian Open Semifinals A Winning Strategy

May 25, 2025 -

The Saint On Itv 4 Where To Watch Air Times And Schedule

May 25, 2025

The Saint On Itv 4 Where To Watch Air Times And Schedule

May 25, 2025 -

A Fungi That Could Spread As The World Heats Up A Growing Threat

May 25, 2025

A Fungi That Could Spread As The World Heats Up A Growing Threat

May 25, 2025 -

Le Temoignage De Laurent Baffie Nouvelles Revelations Sur Thierry Ardisson

May 25, 2025

Le Temoignage De Laurent Baffie Nouvelles Revelations Sur Thierry Ardisson

May 25, 2025 -

Lino En Otono Inspiracion De Charlene De Monaco

May 25, 2025

Lino En Otono Inspiracion De Charlene De Monaco

May 25, 2025

Latest Posts

-

Lock Up Season 5 A Breakdown Of The 5 Best Action Episodes

May 25, 2025

Lock Up Season 5 A Breakdown Of The 5 Best Action Episodes

May 25, 2025 -

5 Must See Action Episodes From Lock Up Season 5

May 25, 2025

5 Must See Action Episodes From Lock Up Season 5

May 25, 2025 -

Lock Up Your Guide To The Top 5 Action Episodes In Season 5

May 25, 2025

Lock Up Your Guide To The Top 5 Action Episodes In Season 5

May 25, 2025 -

Lock Up Season 5 Action Highlights And Episode Guide

May 25, 2025

Lock Up Season 5 Action Highlights And Episode Guide

May 25, 2025 -

The Ultimate Guide To Dr Terrors House Of Horrors

May 25, 2025

The Ultimate Guide To Dr Terrors House Of Horrors

May 25, 2025