Ignoring HMRC Child Benefit Messages? Here's Why You Shouldn't

Table of Contents

Understanding Your HMRC Child Benefit Correspondence

Understanding the different ways HMRC communicates about your Child Benefit is crucial. Ignoring any form of contact could have serious implications for your payments.

Types of HMRC Child Benefit Communication:

HMRC uses several methods to contact you regarding your Child Benefit:

- Letters: Traditional letters remain a primary method for important updates and requests. These might include notifications of changes to your payments, requests for further information to verify your claim, or details of potential overpayments or underpayments.

- Emails: HMRC may use email to contact you, especially if you've registered your email address with them. Emails often contain less sensitive information than letters but are still vital to check.

- Online Portal Messages: The HMRC online portal is the most efficient way to manage your Child Benefit and other tax affairs. Check your messages regularly for updates, requests for information, or changes to your claim.

It's vital to be able to identify legitimate HMRC communication. Scammers often attempt to mimic official HMRC correspondence. Never click on links or provide personal information in emails or messages that you're unsure about. Always verify the sender's authenticity independently through official HMRC channels.

Penalties for Ignoring HMRC Child Benefit Messages

Ignoring HMRC Child Benefit messages isn't a trivial matter. Failing to respond promptly or provide requested information can result in significant financial penalties.

Financial Penalties:

The penalties for ignoring HMRC correspondence can be substantial and are usually calculated as a percentage of the amount owed.

- Percentage-based penalties: These penalties increase the longer you delay responding and resolving the issue. The percentage can vary depending on the nature of the issue and your history with HMRC.

- Interest charges: Interest will accrue on any outstanding amounts, adding to the overall debt.

- Debt collection agencies: In cases of persistent non-response, HMRC might refer your case to a debt collection agency, which will add further fees and potentially damage your credit rating.

- Legal proceedings: In extreme cases of non-compliance, HMRC can take legal action to recover the debt, which could include court fees and potential further penalties.

For example, failing to inform HMRC about a change in circumstances that affects your Child Benefit entitlement could result in overpayments. These overpayments will need to be repaid with interest and potential penalties added if you fail to respond to their communication.

What to Do If You Receive an HMRC Child Benefit Message

Prompt action is key when dealing with HMRC Child Benefit communication. The quicker you address any requests or concerns, the less likely you are to face penalties.

Responding Promptly:

- Verify authenticity: Ensure the communication is genuinely from HMRC by checking the sender's details and referring to the official HMRC website.

- Act within the timeframe: HMRC usually provides a deadline for your response. Meeting this deadline is crucial in avoiding penalties.

- Gather necessary documents: Depending on the request, you might need documents like payslips, bank statements, or proof of address.

- Contact HMRC directly: If you have any questions or concerns, don't hesitate to contact HMRC directly through their official channels—phone, online portal, or letter.

Use the HMRC online portal to manage your Child Benefit; it's the most efficient way to communicate and avoid delays. Links to helpful HMRC resources and contact information can be found on the official government website.

Avoiding Future HMRC Child Benefit Issues

Proactive engagement with HMRC is the best way to avoid future problems with your Child Benefit payments.

Keeping Your Details Up-to-Date:

- Regularly check your online account: Log in to your HMRC online account regularly to check for messages and ensure your details are up-to-date.

- Update your information promptly: Immediately update your address, contact details, and bank account information if any changes occur.

- Ensure correct bank details: Incorrect bank details can cause payment delays or failures.

- Understand your entitlement: Stay informed about your eligibility for Child Benefit and any changes to the rules and regulations.

By taking these preventative measures, you significantly reduce the risk of encountering problems with your Child Benefit payments and avoid potentially costly penalties.

Conclusion

Responding promptly to all HMRC Child Benefit communications is crucial to avoid penalties and potential legal action. Ignoring these messages can lead to significant financial repercussions. Managing your Child Benefit online through the HMRC portal is the easiest and most effective way to stay informed and up-to-date. Don't delay, check your HMRC Child Benefit messages today! Avoid HMRC Child Benefit penalties – act now!

Featured Posts

-

Aldhkae Alastnaey Ykhlq Rwayat Jdydt Baslwb Aghatha Krysty

May 20, 2025

Aldhkae Alastnaey Ykhlq Rwayat Jdydt Baslwb Aghatha Krysty

May 20, 2025 -

Lewis Hamilton And Ferraris Heated Miami Gp Tea Break Dispute

May 20, 2025

Lewis Hamilton And Ferraris Heated Miami Gp Tea Break Dispute

May 20, 2025 -

Radostna Novina Dzhenifr Lorns Otnovo Stana Mayka

May 20, 2025

Radostna Novina Dzhenifr Lorns Otnovo Stana Mayka

May 20, 2025 -

The Us Typhon Missile System A Comprehensive Overview Of Its Presence In The Philippines

May 20, 2025

The Us Typhon Missile System A Comprehensive Overview Of Its Presence In The Philippines

May 20, 2025 -

Mangas Disaster Forecast Leads To Japanese Tourism Dip

May 20, 2025

Mangas Disaster Forecast Leads To Japanese Tourism Dip

May 20, 2025

Latest Posts

-

Cobollis Triumph Winning The Bucharest Atp Tournament

May 20, 2025

Cobollis Triumph Winning The Bucharest Atp Tournament

May 20, 2025 -

Flavio Cobolli Wins Bucharest Tiriac Open

May 20, 2025

Flavio Cobolli Wins Bucharest Tiriac Open

May 20, 2025 -

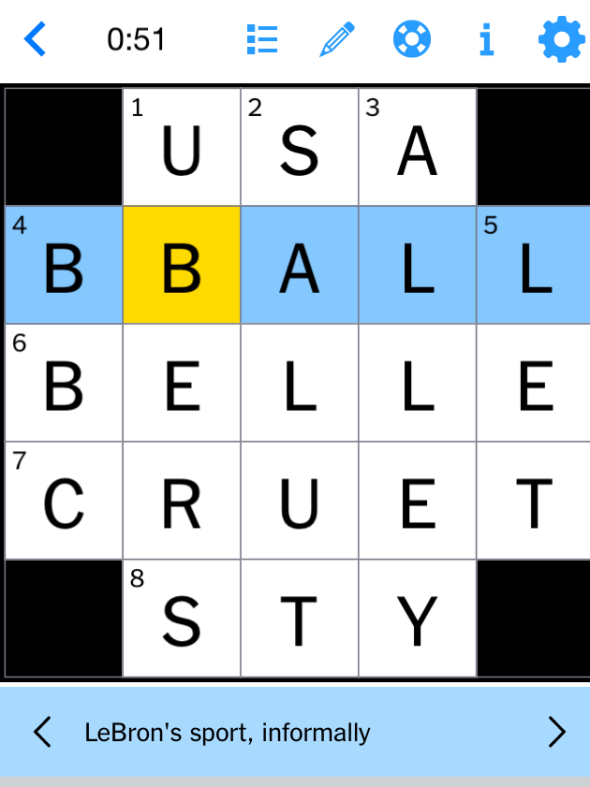

Nyt Mini Crossword Answers And Hints March 26 2025

May 20, 2025

Nyt Mini Crossword Answers And Hints March 26 2025

May 20, 2025 -

Flavio Cobolli First Atp Title In Bucharest

May 20, 2025

Flavio Cobolli First Atp Title In Bucharest

May 20, 2025 -

Nyt Mini Crossword Solutions And Hints April 26 2025

May 20, 2025

Nyt Mini Crossword Solutions And Hints April 26 2025

May 20, 2025