IMF Review Of Pakistan's $1.3 Billion Bailout Package: Key Factors And Implications

Table of Contents

Key Conditions Imposed by the IMF for the Bailout Package

The IMF's bailout package is contingent upon Pakistan's commitment to a series of stringent conditions designed to address the root causes of its economic instability. These conditions broadly fall under fiscal consolidation, structural reforms, and exchange rate policy.

Fiscal Consolidation and Revenue Generation

To achieve fiscal sustainability, the IMF demands significant improvements in revenue generation and expenditure control. This involves:

- Enhanced Tax Collection: Improving tax administration, broadening the tax base to include previously untaxed sectors, and cracking down on tax evasion are crucial. This might involve implementing stricter penalties for non-compliance and modernizing tax collection systems.

- Reduced Government Spending: The government must drastically reduce non-essential expenditures. This will likely involve cuts to subsidies, reducing the size of the bureaucracy and prioritizing spending on essential services.

- Curbing Tax Evasion: Strengthening institutions to combat tax evasion and improve tax compliance is vital. This includes improving transparency and accountability within the tax system.

- Impact on Social Programs: The fiscal consolidation measures may necessitate cuts to social programs and public services, potentially leading to social unrest and impacting the most vulnerable segments of the population. Balancing fiscal responsibility with social welfare is a major challenge.

Structural Reforms

The IMF bailout also necessitates wide-ranging structural reforms to improve the efficiency and competitiveness of the Pakistani economy. Key areas include:

- Privatization of SOEs: Selling off loss-making state-owned enterprises (SOEs) is aimed at reducing the government's financial burden and improving efficiency. However, this process is often politically challenging and may face resistance from various stakeholders.

- Energy Sector Reforms: Addressing inefficiencies and losses within the energy sector is critical. This may involve investing in renewable energy sources, improving energy distribution networks, and reforming pricing mechanisms.

- Governance and Transparency: Improving governance and transparency within public institutions is crucial for attracting foreign investment and fostering economic growth. This includes strengthening anti-corruption measures and promoting accountability.

- Challenges in Implementation: Implementing these reforms will likely face significant challenges, including resistance from powerful vested interests and bureaucratic inertia.

Exchange Rate Policy

Maintaining a market-determined exchange rate is a key condition, aiming to reflect the true value of the Pakistani Rupee. This requires:

- Market-Based Exchange Rate: Allowing the exchange rate to fluctuate freely based on market forces, rather than artificially maintaining it at a specific level.

- Managing Volatility: Implementing measures to manage exchange rate volatility and mitigate inflationary pressures. This could involve interventions from the central bank to smooth out extreme fluctuations.

- Impact on Trade: A realistic exchange rate will impact imports and exports, potentially improving the trade balance in the long run. However, in the short term, it may lead to increased import costs and potentially higher inflation.

- Foreign Investment: A stable and market-determined exchange rate is crucial for attracting foreign investment and encouraging capital inflows.

Factors Influencing the IMF's Decision

The IMF's decision to release the bailout funds is influenced by a multitude of factors, assessing Pakistan's economic performance, political stability, and debt sustainability.

Pakistan's Economic Performance

The IMF closely monitors key economic indicators, including:

- GDP Growth: The rate of economic growth is a crucial factor, reflecting the overall health of the economy.

- Inflation: High inflation erodes purchasing power and can destabilize the economy, impacting the IMF's assessment.

- Current Account Deficit: A large current account deficit indicates that the country is importing more than it is exporting, putting pressure on foreign exchange reserves.

- Effectiveness of Past Reforms: The IMF evaluates the success of previously implemented reforms and policy adjustments.

Political Stability and Governance

Political stability and strong governance are crucial for successful economic reforms.

- Government Commitment: The IMF assesses the government's commitment to implementing the agreed-upon conditions and its ability to maintain political stability.

- Investor Confidence: Political uncertainty can negatively impact investor confidence and hinder economic growth.

Debt Sustainability

Pakistan's high level of debt poses a significant challenge. The IMF evaluates:

- Debt Burden: The overall level of debt and the country's ability to service its debt obligations.

- Debt Restructuring: Exploring potential debt restructuring options with international creditors.

- International Creditor Support: The level of support received from international creditors for debt relief measures.

Implications of the IMF Review for Pakistan

The IMF review's outcome will have significant short-term and long-term implications for Pakistan.

Short-term Implications

- Inflation and Exchange Rate: Austerity measures can lead to increased inflation and exchange rate volatility in the short term.

- Social Unrest: Cuts in government spending and rising prices may trigger social unrest.

- Poverty and Inequality: The impact on poverty and inequality is a key concern, requiring mitigating measures.

Long-term Implications

- Sustainable Growth: Successful implementation of the reforms could lead to sustainable economic growth and stability.

- Improved Governance: Successful reforms can strengthen governance and institutional frameworks.

- Foreign Investment: Improved economic conditions and greater transparency could attract increased foreign investment.

- International Cooperation: Successful implementation could enhance international cooperation and access to debt relief.

Conclusion

The IMF review of Pakistan's $1.3 billion bailout package is a critical moment for the nation's economic future. The success hinges on Pakistan's commitment to implementing tough but necessary reforms, covering fiscal consolidation, structural adjustments, and a realistic exchange rate policy. The implications, short-term and long-term, are profound and will determine whether Pakistan achieves sustainable economic growth and stability. Understanding the factors influencing this IMF Pakistan Bailout is crucial. Further research into the program's specifics and Pakistan's progress is essential for a clearer picture of the country’s economic trajectory. Stay informed about the evolving situation surrounding the IMF Pakistan Bailout for the latest updates and analysis.

Featured Posts

-

Sinoptiki Oshibayutsya Pochemu Mayskie Snegopady Tak Trudno Predskazat

May 09, 2025

Sinoptiki Oshibayutsya Pochemu Mayskie Snegopady Tak Trudno Predskazat

May 09, 2025 -

Nepobedliv Bekam Analiza Na Negovata Dominatsi A Vo Fudbalot

May 09, 2025

Nepobedliv Bekam Analiza Na Negovata Dominatsi A Vo Fudbalot

May 09, 2025 -

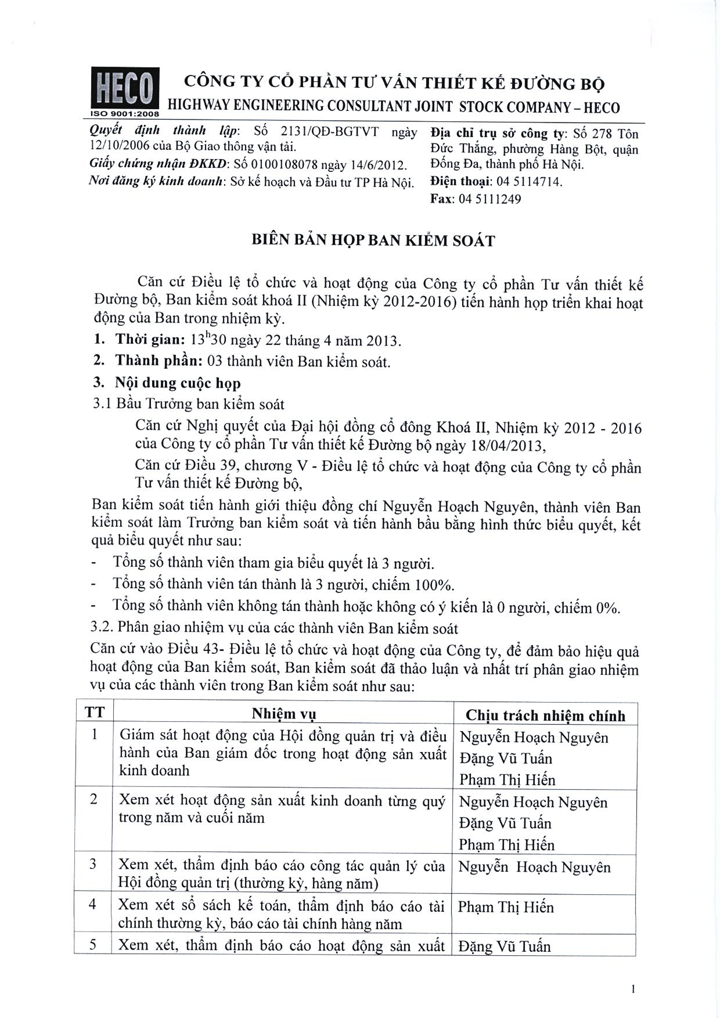

Dam Bao An Toan Cho Tre Co Che Ra Soat Co So Giu Tre Va Xu Ly Bao Hanh

May 09, 2025

Dam Bao An Toan Cho Tre Co Che Ra Soat Co So Giu Tre Va Xu Ly Bao Hanh

May 09, 2025 -

Young Thugs Vow Of Faithfulness To Mariah The Scientist A Song Snippet Analysis

May 09, 2025

Young Thugs Vow Of Faithfulness To Mariah The Scientist A Song Snippet Analysis

May 09, 2025 -

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025