Impact Of A Minority Government On The Canadian Dollar Exchange Rate

Table of Contents

Increased Political Uncertainty and its Effect on the CAD

The inherent instability of minority governments significantly influences the Canadian dollar exchange rate. Their survival hinges on maintaining the confidence of the House, making them susceptible to sudden collapses and potential snap elections. This inherent instability creates a climate of heightened political risk.

The Nature of Minority Governments and Instability

Minority governments are characterized by a governing party lacking a majority of seats in the legislature. This necessitates reliance on the support of other parties to pass legislation, creating inherent fragility.

- Examples: Canada has a history of minority governments, including those led by Prime Ministers such as Paul Martin and Stephen Harper. These governments often had shorter lifespans than majority governments. Coalition governments, while rare in Canada, represent an even more complex scenario with potential for internal conflict further impacting investor confidence.

- Coalition Governments: The potential for coalition governments, while less frequent than simple minority governments, presents an even more intricate and potentially volatile political environment. The inherent compromises and potential for internal disagreements within a coalition can drastically increase uncertainty.

Impact on Investor Confidence

Political instability directly undermines investor confidence. Uncertainty surrounding policy direction discourages both foreign and domestic investment.

- Foreign Direct Investment (FDI): Companies are less likely to invest in a country with a volatile political environment due to the increased risk. This reduced FDI flow can negatively impact economic growth and put downward pressure on the CAD.

- Portfolio Investment: Similarly, investors are less inclined to hold CAD-denominated assets when political instability is high. They might shift their investments to currencies perceived as safer havens, such as the US dollar (USD) or the Euro (EUR). This capital flight weakens the CAD.

- Risk Premiums: Investors demand higher risk premiums for investing in assets associated with higher political risk, effectively increasing the cost of borrowing and dampening investment.

Weakening of the Canadian Dollar

The confluence of reduced investor confidence and capital flight directly translates to a weaker Canadian dollar.

- Flight to Safety: Investors often flee to "safe haven" currencies like the USD or EUR during periods of political instability, increasing demand for these currencies and reducing demand for the CAD. This leads to a depreciation of the CAD against these major currencies.

Fiscal Policy Challenges under Minority Governments

The passage of budgets and the implementation of economic policies become significantly more challenging under minority governments. This inherent difficulty can have profound consequences for the CAD.

Difficulties in Passing Budgets and Legislation

Minority governments must constantly negotiate and compromise with opposition parties to pass essential legislation, including budgets.

- Compromise and Negotiation: The need for consensus often leads to delays in the implementation of critical fiscal policies, potentially impacting economic stability and investor sentiment. Policies might also be diluted through compromise, making them less effective.

Impact on Government Spending and Debt

The struggle to pass budgets can impact government spending and debt levels.

- Increased Debt: Difficulty implementing fiscal austerity measures can lead to increased government deficits and debt. Higher debt levels generally signal a weaker economy, potentially further depressing the CAD. This increased debt can trigger negative sentiment from international credit rating agencies, leading to further depreciation.

Uncertainty Regarding Fiscal Policy and its Effect on the CAD

Unpredictable fiscal policy makes it difficult for investors to forecast future economic conditions.

- Investment Decisions: This uncertainty increases the risk associated with investing in Canada, deterring both domestic and foreign investment and further weakening the CAD.

Monetary Policy Considerations under a Minority Government

While the Bank of Canada operates independently, a minority government's actions can still indirectly influence monetary policy and exchange rate fluctuations.

Independence of the Bank of Canada

It's crucial to emphasize that the Bank of Canada maintains its independence in setting monetary policy, aiming to control inflation and maintain price stability.

Potential for Political Interference

Although direct political interference in the Bank of Canada's decisions is unlikely, there's potential for indirect pressure.

- Political Pressure: A minority government might face pressure to influence monetary policy for short-term political gains (e.g., lowering interest rates to stimulate the economy before an election). However, such actions could negatively impact long-term economic stability and ultimately hurt the CAD.

Monetary Policy Response to Exchange Rate Fluctuations

The Bank of Canada responds to exchange rate fluctuations arising from political uncertainty by adjusting monetary policy instruments.

- Interest Rate Adjustments: To counter a weakening CAD, the Bank might raise interest rates, attracting foreign investment and strengthening the currency. Conversely, lower interest rates might be used to stimulate economic growth if the CAD is perceived as too strong.

Conclusion

Minority governments in Canada introduce a significant degree of political uncertainty, impacting investor confidence and consequently influencing the Canadian dollar exchange rate. The difficulties in passing budgets and implementing consistent fiscal policies, coupled with the potential for indirect pressure on monetary policy, contribute to a weaker CAD during periods of minority government. Understanding the impact of a minority government on the Canadian dollar exchange rate is crucial for investors and businesses alike. Stay informed about the latest developments in Canadian politics and their impact on the Canadian dollar exchange rate to effectively navigate this complex relationship.

Featured Posts

-

Il Processo Becciu Data Appello E Dichiarazione Di Innocenza

May 01, 2025

Il Processo Becciu Data Appello E Dichiarazione Di Innocenza

May 01, 2025 -

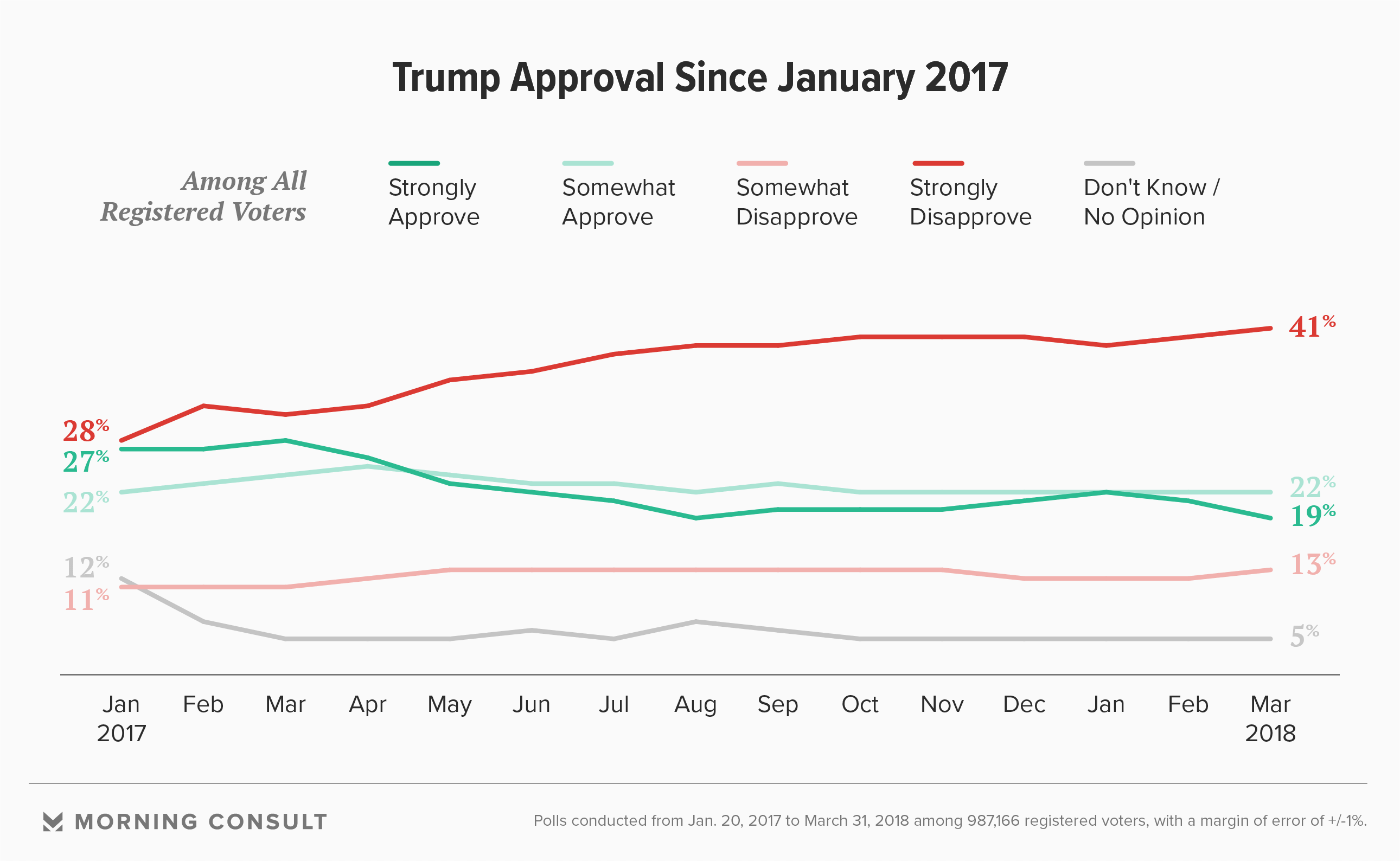

Trumps Approval Rating Plunges A Look At The First 100 Days

May 01, 2025

Trumps Approval Rating Plunges A Look At The First 100 Days

May 01, 2025 -

Ultima Oportunidad Clases De Boxeo Edomex 3 Dias

May 01, 2025

Ultima Oportunidad Clases De Boxeo Edomex 3 Dias

May 01, 2025 -

Inscripciones De Boxeo Edomex Solo 3 Dias

May 01, 2025

Inscripciones De Boxeo Edomex Solo 3 Dias

May 01, 2025 -

Submit Your Debris Removal Request Louisvilles Post Storm Cleanup

May 01, 2025

Submit Your Debris Removal Request Louisvilles Post Storm Cleanup

May 01, 2025

Latest Posts

-

The X Files Director Ryan Coogler On A Potential Reboot

May 01, 2025

The X Files Director Ryan Coogler On A Potential Reboot

May 01, 2025 -

X Files Reboot Cooglers Conversation With Anderson

May 01, 2025

X Files Reboot Cooglers Conversation With Anderson

May 01, 2025 -

Gillian Anderson And Ryan Coogler Discuss Future Of X Files

May 01, 2025

Gillian Anderson And Ryan Coogler Discuss Future Of X Files

May 01, 2025 -

Revenirea Dosarelor X Ce Spune Viata Libera Galati

May 01, 2025

Revenirea Dosarelor X Ce Spune Viata Libera Galati

May 01, 2025 -

Ryan Coogler Talks Potential X Files Reboot With Gillian Anderson

May 01, 2025

Ryan Coogler Talks Potential X Files Reboot With Gillian Anderson

May 01, 2025