Impact Of Alberta's Indefinite Carbon Price Freeze On Industry

Table of Contents

Impact on the Oil and Gas Sector

The oil and gas sector is the most directly affected by Alberta's carbon price freeze. The implications are complex, presenting both short-term gains and long-term risks.

Reduced Operational Costs

- Lower carbon levy translates to direct cost savings for oil and gas producers. The immediate impact is a reduction in operational costs. This translates into higher profit margins and increased competitiveness in the global market. Estimates suggest savings in the millions of dollars for larger producers.

- Increased competitiveness compared to other jurisdictions with carbon pricing. By eliminating the carbon levy, Alberta's oil and gas producers gain a significant cost advantage over competitors in provinces like British Columbia and Ontario, where carbon pricing mechanisms remain in place.

- Potential for increased production and investment in the short term. The reduced cost burden may incentivize increased oil and gas production and attract new investment into the sector. This could lead to a short-term boost in economic activity and job creation within the province.

The specific cost savings vary depending on production levels and the type of operation. For instance, larger producers with high emission levels experience more substantial savings than smaller operators. This cost advantage, however, may be temporary.

Environmental Concerns

- Potential increase in greenhouse gas emissions. The absence of a carbon price removes a key incentive for oil and gas companies to invest in emissions reduction technologies and adopt cleaner production practices. This could lead to a significant increase in greenhouse gas emissions from the sector. Studies project an increase in Alberta's carbon footprint in the absence of a pricing mechanism.

- Reduced incentive for investment in cleaner energy technologies. With the carbon price frozen, there's less financial motivation to pursue innovations in carbon capture, utilization, and storage (CCUS) or transition to renewable energy sources.

- Negative impact on Alberta’s climate goals. Alberta's commitment to reducing greenhouse gas emissions is directly challenged by the carbon price freeze. Achieving the province's climate targets will become significantly more difficult without a robust carbon pricing mechanism.

- Possible damage to Alberta's reputation on the global stage. The decision to indefinitely freeze the carbon price could negatively impact Alberta's reputation as a responsible player in the global effort to combat climate change, potentially affecting foreign investment and trade relationships. International investors are increasingly seeking environmentally responsible jurisdictions.

Long-Term Competitiveness

- Uncertainty surrounding future carbon pricing. The indefinite nature of the freeze creates uncertainty for investors and businesses. The possibility of future carbon price increases, or the introduction of other environmental regulations, casts a shadow over long-term investment decisions.

- Risk of stranded assets if global carbon pricing mechanisms gain traction. If global carbon pricing becomes more widespread, Alberta's oil and gas sector could face a competitive disadvantage, potentially leading to stranded assets – resources that become uneconomical to extract or process due to changing regulatory environments.

- Potential for a less sustainable and less innovative energy sector. The lack of a carbon price could stifle innovation and investment in cleaner energy technologies, potentially leaving Alberta’s energy sector less competitive and sustainable in the long run.

- Impact on attracting foreign investment. International investors are increasingly wary of jurisdictions without robust climate policies. The carbon price freeze could deter foreign investment into Alberta's energy sector.

Impact on Other Industries

While the oil and gas sector bears the brunt of the impact, the carbon price freeze ripples through other industries as well.

Manufacturing and Agriculture

- Indirect benefits from reduced energy costs. Lower energy prices, resulting from reduced carbon taxes on energy production, can benefit manufacturing and agricultural businesses. This can lead to lower production costs and increased competitiveness.

- Potential for increased production. Lower energy costs can translate into increased production volumes for manufacturing and agricultural industries.

- Limited direct impact compared to the energy sector. The impact on manufacturing and agriculture is largely indirect and less significant than the direct impact on the oil and gas sector.

The savings for these sectors are likely to be smaller compared to the oil and gas industry because their energy consumption is usually a smaller fraction of their total costs.

The Service Sector

- Indirect impact through supply chains and consumer spending. The service sector's performance is intertwined with the overall economic activity in the province. A stimulated oil and gas sector positively impacts the service sector through increased demand for goods and services. Conversely, slower growth in the energy sector negatively affects the service sector.

- Economic growth stimulation dependent on overall economic activity. The success of the economic stimulus strategy associated with the carbon price freeze heavily depends on the overall success of the oil and gas sector and its related industries.

- Potential job creation offset by potential loss of jobs in the green economy. The carbon price freeze could lead to job creation in the oil and gas sector and its related industries, but it may also hinder job creation in the burgeoning green economy sector.

The service sector's response is therefore complex and highly dependent on the overall economic performance of the province.

Political and Economic Implications

The decision to freeze the carbon price has profound political and economic ramifications.

Economic Growth vs. Environmental Sustainability

- Trade-off between short-term economic gains and long-term environmental sustainability. The policy represents a clear trade-off between short-term economic gains for certain industries and long-term environmental sustainability for the province as a whole.

- Potential for economic volatility if global climate policy changes. Alberta’s economy remains highly dependent on the oil and gas sector. If global climate policy changes and demand for fossil fuels declines significantly, the province could face economic instability.

- Reputational risks for Alberta’s investment climate. The freeze could damage Alberta’s reputation among investors concerned about environmental, social, and governance (ESG) factors.

The government's justification rests on the argument that stimulating the economy in the short-term is crucial, however, the long-term consequences of ignoring climate change must also be considered.

Federal-Provincial Relations

- Potential conflicts with federal carbon pricing policies. The Alberta government’s decision is in direct conflict with the federal government’s carbon pricing framework, creating tension between the two levels of government.

- Impact on interprovincial trade and cooperation. The differing approaches to carbon pricing could create challenges for interprovincial trade and cooperation on environmental issues.

- Legal challenges and potential constitutional disputes. The clash between provincial and federal policies has the potential to lead to legal challenges and constitutional disputes.

This conflict underscores the challenges of harmonizing provincial and federal environmental policies in a federal system.

Conclusion

Alberta's indefinite carbon price freeze presents a complex scenario with both short-term economic benefits and potentially significant long-term consequences. While it may provide short-term relief to some industries, particularly the oil and gas sector, the long-term implications for environmental sustainability, economic competitiveness, and Alberta's international reputation remain uncertain. The freeze's impact extends beyond the energy sector, affecting various industries and influencing the province's relationship with the federal government. Understanding the multifaceted effects of this policy decision is crucial for businesses and policymakers alike. Further research and analysis are needed to assess the full impact of Alberta's carbon price freeze and to develop effective strategies for mitigating potential negative consequences. To stay informed about the ongoing impacts of Alberta's carbon policy, continue to follow updates on the subject and engage in informed discussions on sustainable economic development in the province.

Featured Posts

-

Jobe Bellingham To Borussia Dortmund A Likely Transfer

May 14, 2025

Jobe Bellingham To Borussia Dortmund A Likely Transfer

May 14, 2025 -

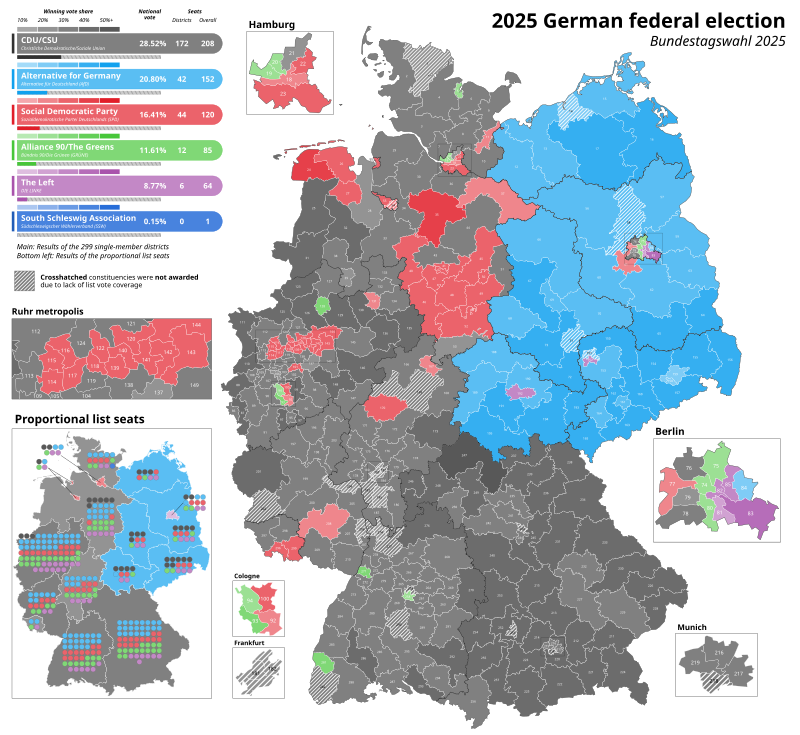

German Election Is This The Tide Turning Vote

May 14, 2025

German Election Is This The Tide Turning Vote

May 14, 2025 -

Product Recall Walmart Removes Electric Ride Ons And Phone Chargers From Sale

May 14, 2025

Product Recall Walmart Removes Electric Ride Ons And Phone Chargers From Sale

May 14, 2025 -

Meet Bianca Censoris Sister Angelina Exploring Her Instagram Photos

May 14, 2025

Meet Bianca Censoris Sister Angelina Exploring Her Instagram Photos

May 14, 2025 -

Maya Jama And The Manchester City Star Relationship Confirmed

May 14, 2025

Maya Jama And The Manchester City Star Relationship Confirmed

May 14, 2025