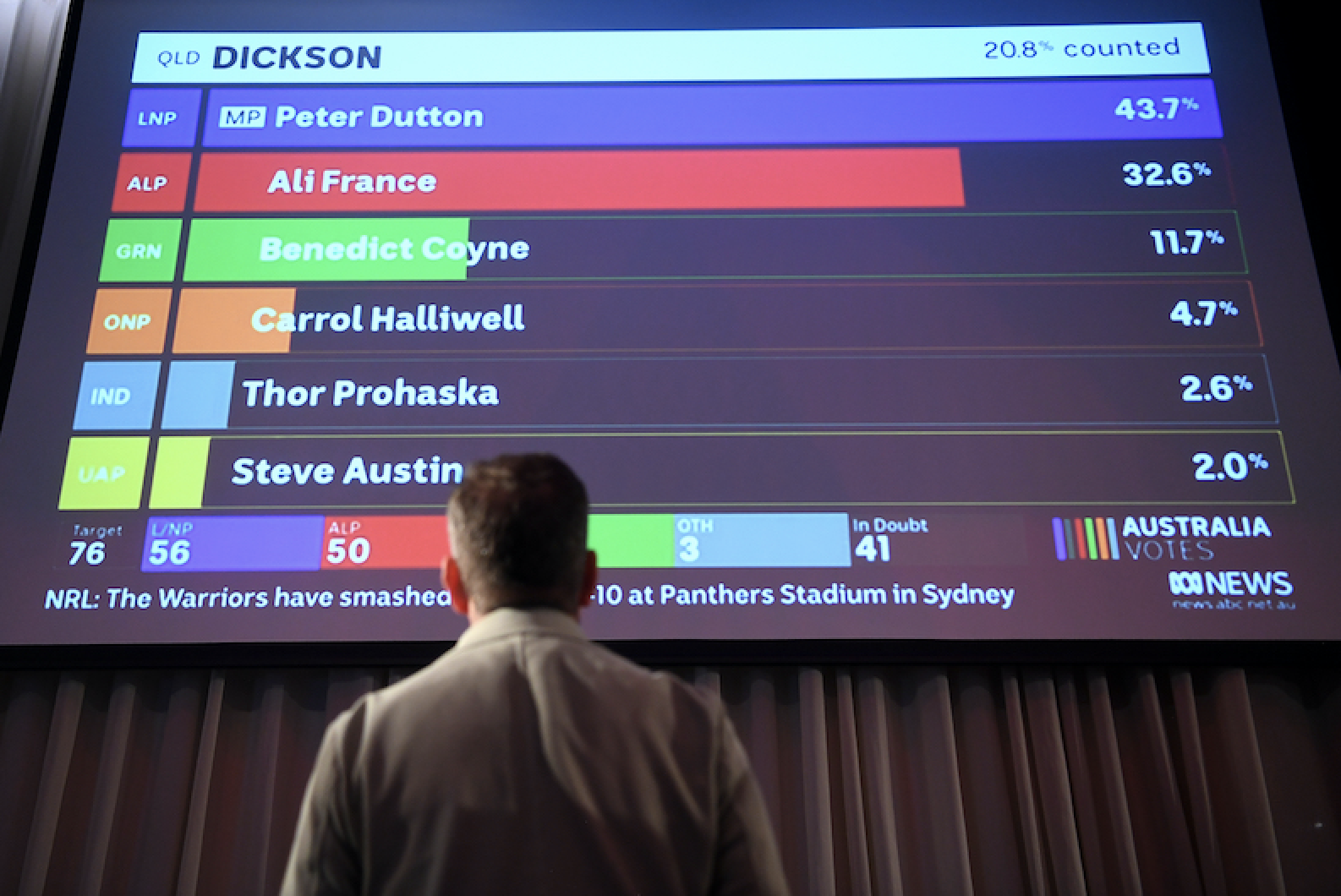

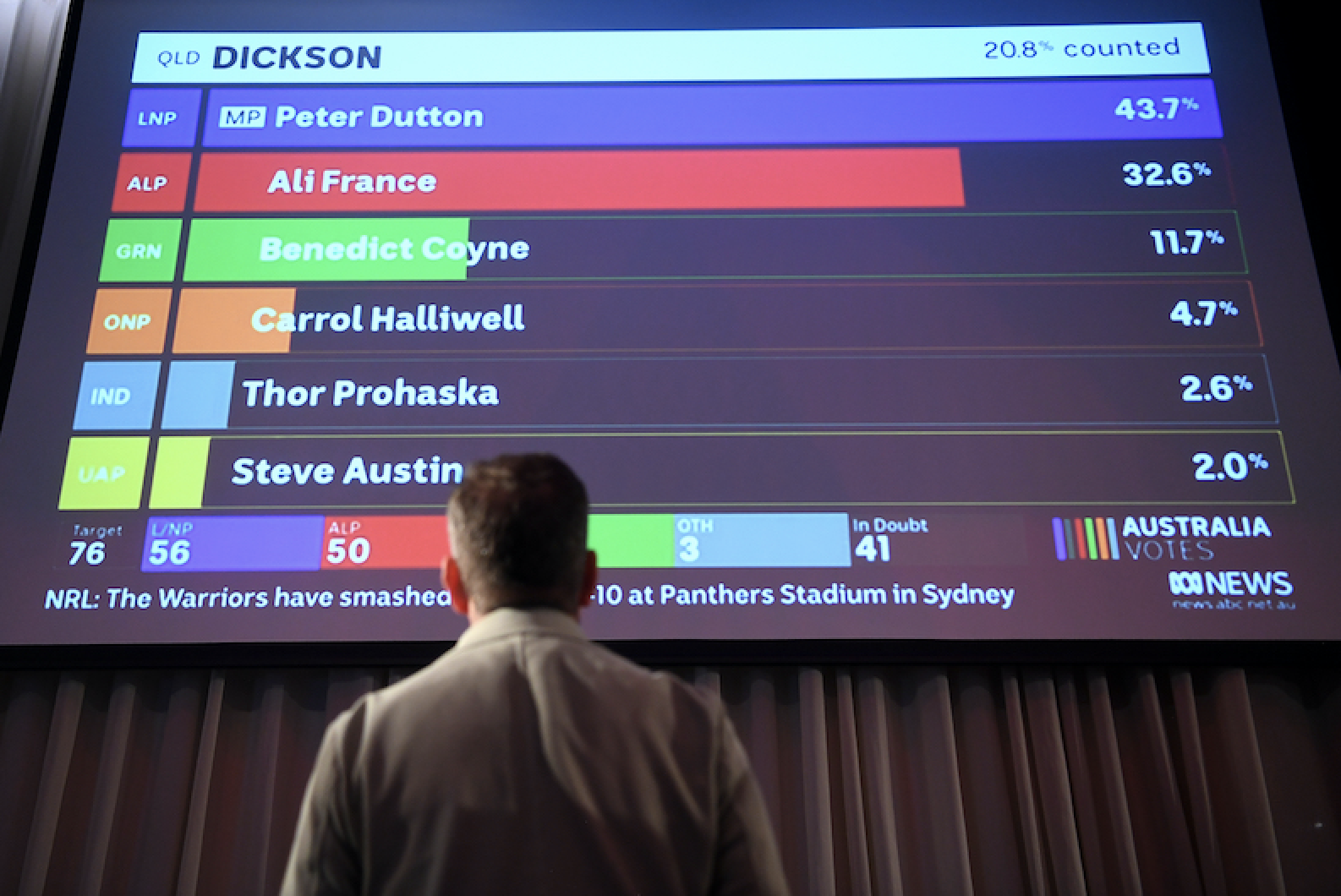

Impact Of Australian Election Results On Asset Performance

Table of Contents

Impact on the Australian Dollar (AUD)

Election periods introduce uncertainty, creating volatility in the Australian dollar (AUD). Understanding this volatility and its drivers is paramount for investors.

Exchange Rate Volatility

- Increased volatility before and after the election: The period surrounding an Australian election often sees increased trading activity and speculation, leading to fluctuations in the AUD's exchange rate. Investors may adopt a wait-and-see approach, increasing market uncertainty.

- Potential for AUD appreciation or depreciation depending on the winning party's economic policies: A party perceived as fiscally responsible might lead to AUD appreciation, while a party with expansionary fiscal policies could cause depreciation. Market reaction depends on investor confidence in the new government's economic plan.

- Influence of global market sentiment: Global economic factors also play a significant role. A strong global economy might offset any negative domestic news, while global economic weakness could exacerbate any downward pressure on the AUD following an election.

Government Debt and Interest Rates

Government spending commitments and fiscal policy directly influence interest rates and the AUD.

- Analysis of potential impacts on government bonds and interest rate sensitive assets: Increased government borrowing can push up interest rates, affecting the yield on government bonds and impacting other interest-rate sensitive assets like term deposits.

- Impact of budget surpluses or deficits: Budget surpluses generally strengthen the AUD, signaling fiscal responsibility, while deficits can weaken it, potentially leading to higher inflation.

- The role of the Reserve Bank of Australia (RBA): The RBA's monetary policy response to government fiscal decisions plays a crucial role in managing inflation and influencing the AUD's value.

Influence on the Stock Market (ASX)

The Australian Securities Exchange (ASX) is highly sensitive to election outcomes. Different sectors experience varied impacts based on the winning party's policy platform.

Sector-Specific Impacts

- Mining and resources sector's sensitivity to resource taxation policies: Changes to mining royalties or resource taxes significantly impact the profitability of mining companies, leading to stock price fluctuations.

- Financial sector's reaction to regulatory changes: Changes in banking regulations or financial market oversight can influence the performance of financial institutions listed on the ASX.

- Impact on renewable energy and infrastructure sectors based on the winning party's environmental policies: Government support for renewable energy initiatives or large-scale infrastructure projects can boost related sectors on the ASX.

Investor Sentiment and Market Volatility

Election results significantly influence investor sentiment and market volatility.

- Short-term market fluctuations leading up to and following the election: Uncertainty before the election often results in short-term market volatility. Post-election, the market reacts to the winning party's policies.

- Long-term implications for market growth based on policy certainty: Policy certainty following an election generally leads to increased investor confidence and long-term market growth.

- The role of market speculation and media influence: Market speculation and media coverage leading up to and following the election can significantly influence investor behaviour and market movements.

Real Estate Market Response

The Australian real estate market, encompassing both housing and commercial properties, is also affected by election outcomes.

Housing Market Sensitivity

Government policies directly influence housing affordability and lending, impacting the property market.

- Changes to negative gearing and capital gains tax: Modifications to these policies can significantly affect investor activity in the housing market.

- Impact on first-home buyer schemes: Government initiatives aimed at assisting first-home buyers can influence demand and property prices.

- Influence of immigration policies on demand: Immigration levels directly impact housing demand, influencing prices and rental yields.

Commercial Real Estate Trends

Election outcomes also have implications for commercial property investments.

- Impact of infrastructure spending plans on commercial property values: Increased government spending on infrastructure projects can boost commercial property values in related areas.

- Changes in taxation policies affecting property investment: Taxation changes related to property investment can influence investment decisions and property values.

- Influence of government regulations on development projects: Changes in building codes or approval processes can impact the development of commercial properties.

Conclusion

The Australian election results have a profound and multifaceted impact on asset performance across various sectors. Understanding the potential influence of different political platforms on the Australian dollar, stock market, and real estate market is essential for investors to make informed decisions. By analyzing the specific policy proposals of competing parties and their historical track records, investors can better anticipate and manage the risks and opportunities presented by each election cycle. To stay informed about the impact of future Australian election results on asset performance, continue to follow credible financial news sources and conduct thorough due diligence before making any investment choices.

Featured Posts

-

Corinthians X Sao Bernardo Horario Do Jogo E Onde Assistir Hoje

May 05, 2025

Corinthians X Sao Bernardo Horario Do Jogo E Onde Assistir Hoje

May 05, 2025 -

Dealers Double Down Fighting Back Against Ev Sales Quotas

May 05, 2025

Dealers Double Down Fighting Back Against Ev Sales Quotas

May 05, 2025 -

How Norways Top Investor Nicolai Tangen Responded To Trumps Tariffs

May 05, 2025

How Norways Top Investor Nicolai Tangen Responded To Trumps Tariffs

May 05, 2025 -

Greg Olsens Third Emmy Nomination Outshining Tom Brady

May 05, 2025

Greg Olsens Third Emmy Nomination Outshining Tom Brady

May 05, 2025 -

Eksklyuziv Dzhidzhi Khadid O Romane S Kuperom

May 05, 2025

Eksklyuziv Dzhidzhi Khadid O Romane S Kuperom

May 05, 2025

Latest Posts

-

Analyzing The Memorable Female Leads In Mindy Kalings Television Shows

May 06, 2025

Analyzing The Memorable Female Leads In Mindy Kalings Television Shows

May 06, 2025 -

Mindy Kalings Transformation Slim Figure Stuns At Premiere

May 06, 2025

Mindy Kalings Transformation Slim Figure Stuns At Premiere

May 06, 2025 -

Powerful Female Characters A Deep Dive Into Mindy Kalings Universe

May 06, 2025

Powerful Female Characters A Deep Dive Into Mindy Kalings Universe

May 06, 2025 -

O Relacionamento Secreto De Mindy Kaling Em The Office Finalmente Revelado

May 06, 2025

O Relacionamento Secreto De Mindy Kaling Em The Office Finalmente Revelado

May 06, 2025 -

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025