Impact Of Musk's Debt Sale: A Financial Analysis Of X Corp.

Table of Contents

The Scale and Structure of Musk's Debt

The acquisition of Twitter involved a staggering amount of debt, fundamentally reshaping X Corp.'s financial landscape. The exact figures are complex, involving a mix of loans and high-yield bonds, but the overall debt burden is substantial, placing immense pressure on the company's cash flow. Securing this financing involved multiple lenders and investors, each with their own risk assessment and associated interest rates.

- Specific debt figures and sources: While precise figures vary depending on the source and the reporting period, estimates suggest billions of dollars in debt were incurred, a significant portion leveraged against X Corp.'s own assets and future earnings. Detailed breakdowns are often found in SEC filings and financial news reports.

- Interest rates and repayment schedules: The interest rates on these loans and bonds are likely high, reflecting the perceived risk involved in lending to a highly leveraged company undergoing significant operational changes. The repayment schedules, often spread over several years, represent a considerable ongoing financial obligation for X Corp.

- Potential risks associated with each debt instrument: Each debt instrument carries inherent risks. For example, high-yield bonds are often considered riskier than traditional bank loans and carry a higher interest rate to compensate lenders for the increased risk of default.

Immediate Impact on X Corp.'s Financial Statements

Musk's debt sale has had an immediate and measurable impact on X Corp.'s financial statements. The increased debt significantly impacts key financial ratios, potentially jeopardizing the company's creditworthiness.

- Changes in balance sheet items (assets, liabilities, equity): The acquisition significantly boosted X Corp.'s liabilities, primarily due to the added debt. This increase in debt negatively affects the equity, potentially reducing the company's net worth.

- Impact on profitability metrics (net income, operating margin): The interest expense associated with the significant debt burden directly reduces X Corp.'s net income and operating margin, making the company less profitable.

- Analysis of cash flow statements, focusing on debt servicing: A crucial aspect is the cash flow statement, which shows how X Corp. generates and utilizes cash. A large portion of the cash flow is now dedicated to servicing the debt, leaving less for investments in growth and operations. This significantly impacts the company's ability to adapt and respond to market challenges. The debt-to-equity ratio, a key indicator of financial leverage, has drastically increased, highlighting the considerable financial risk X Corp. now faces. The impact on X Corp.'s credit rating is likely to be negative, potentially making it more expensive or even impossible to obtain future financing.

Long-Term Financial Sustainability and X Corp.'s Growth Strategy

The long-term financial sustainability of X Corp. hinges on its ability to generate sufficient revenue to service its massive debt load and fund its growth initiatives. Musk's plans for the future, including a subscription model and diversified advertising revenue, are crucial to achieving this goal.

- Projected revenue streams and their reliability: The success of X Corp.’s long-term strategy rests on the reliability of its projected revenue streams. The subscription model, while promising, faces intense competition, and advertising revenue may be vulnerable to economic downturns.

- Cost-cutting measures and their effectiveness: To enhance profitability, X Corp. has likely implemented various cost-cutting measures. The effectiveness of these measures will be critical in reducing expenses and freeing up cash flow for debt repayment.

- Evaluation of Musk's long-term vision for X Corp.'s profitability: Musk’s vision for X Corp.’s future profitability is ambitious. Its success depends on various factors, including technological innovation, regulatory changes, and market acceptance. Achieving sustainable profitability within the given timeframe will be crucial for the company's survival.

Market Reaction and Investor Sentiment

The market's reaction to Musk's debt-fueled acquisition has been mixed. Investor sentiment reflects a complex picture, influenced by the scale of the debt, the company's uncertain future, and Musk's track record.

- Stock price fluctuations before and after the debt sale: The stock price (if applicable) has likely experienced fluctuations influenced by the news of the debt sale, investor confidence, and X Corp's performance.

- Changes in analyst ratings and forecasts: Financial analysts have likely adjusted their ratings and forecasts for X Corp. in light of the increased debt burden.

- Investor confidence levels based on available data: Investor confidence has been significantly impacted by the uncertainty surrounding X Corp.'s financial stability.

Conclusion: Analyzing the Long-Term Effects of Musk's Debt Sale on X Corp.

Musk's debt sale to acquire X Corp. represents a significant financial gamble. The massive debt burden immediately impacts the company's financial statements, affecting key ratios and potentially jeopardizing its creditworthiness. Long-term sustainability depends entirely on X Corp.'s ability to generate sufficient revenue to service the debt and invest in future growth. The market's reaction and investor sentiment reflect the inherent risks and uncertainties surrounding this bold acquisition. The coming years will be critical in determining whether Musk's vision for X Corp. can overcome the considerable financial challenges presented by this massive debt acquisition. To stay informed about the ongoing effects of Musk's debt sale and the evolving financial health of X Corp., it's crucial to follow reputable financial news outlets and the analysis of experts tracking X Corp. finances. Continued monitoring of Musk's debt and its impact on X Corp. is essential for understanding the long-term implications of this transformative event.

Featured Posts

-

Asatyr Almwsyqa Alealmyt Thyy Hflat Dkhmt Fy Mhrjan Abwzby

Apr 28, 2025

Asatyr Almwsyqa Alealmyt Thyy Hflat Dkhmt Fy Mhrjan Abwzby

Apr 28, 2025 -

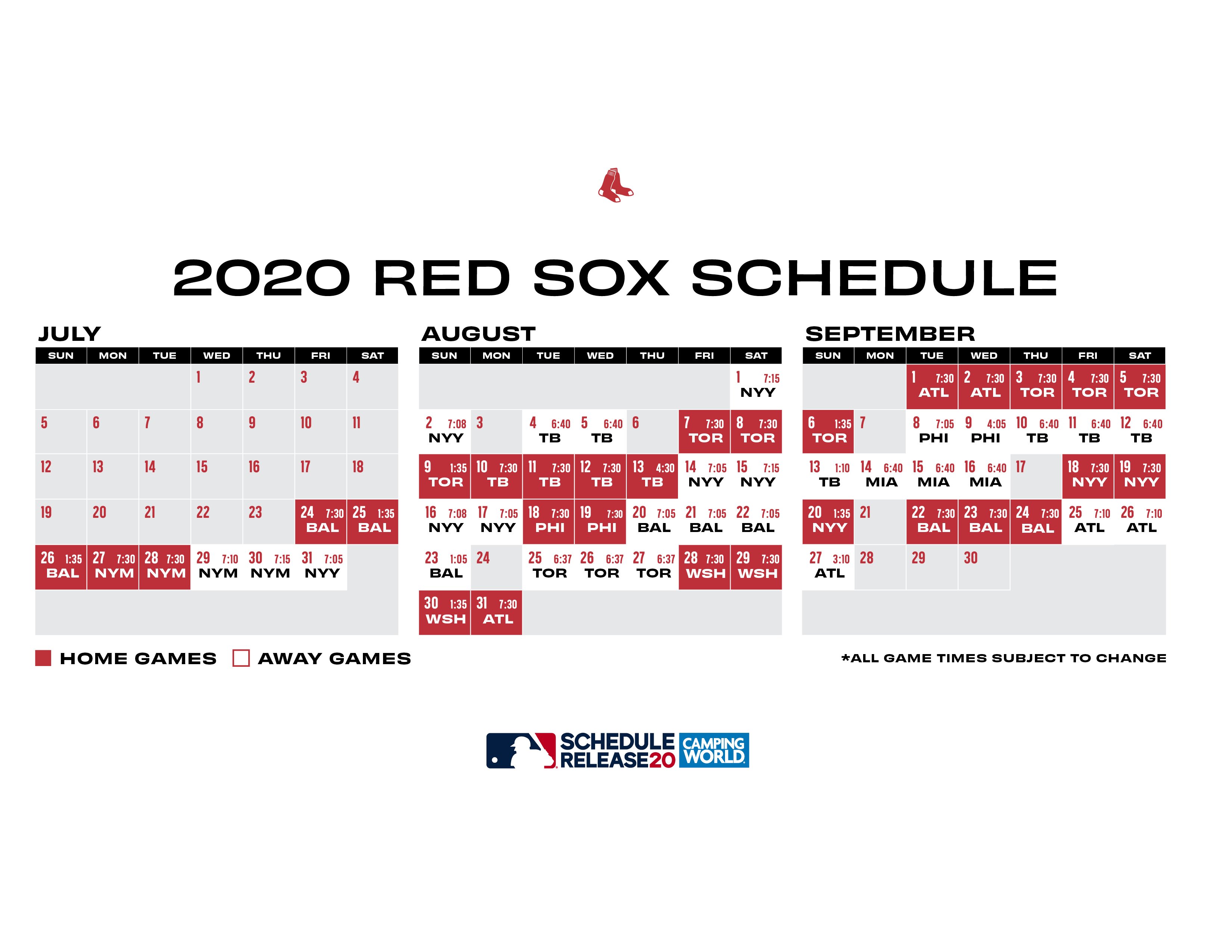

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025 -

The Countrys Top New Business Locations A Geographic Analysis

Apr 28, 2025

The Countrys Top New Business Locations A Geographic Analysis

Apr 28, 2025 -

Final Restart How Bubba Wallace Lost Second Place At Martinsville

Apr 28, 2025

Final Restart How Bubba Wallace Lost Second Place At Martinsville

Apr 28, 2025 -

Astedadat Fn Abwzby Lantlaq Fealyath Fy 19 Nwfmbr

Apr 28, 2025

Astedadat Fn Abwzby Lantlaq Fealyath Fy 19 Nwfmbr

Apr 28, 2025