Impact Of Tariffs On Brookfield's Manufacturing Investment In The US

Table of Contents

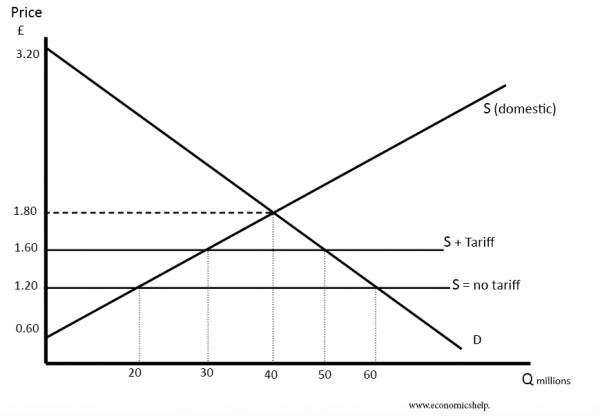

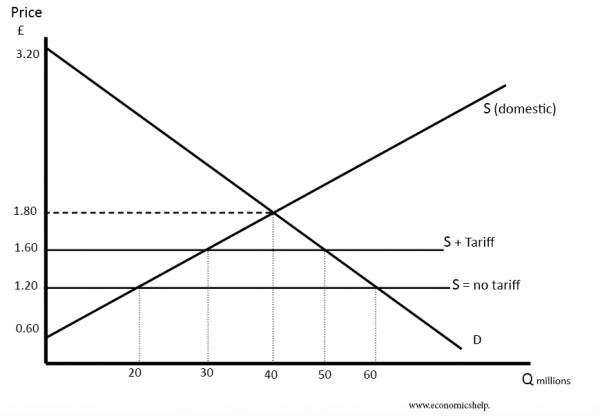

Increased Input Costs due to Tariffs

Tariffs on imported raw materials and components directly translate to increased production costs for Brookfield's US manufacturing operations. This is a fundamental challenge affecting profitability and competitiveness.

- Higher Raw Material Prices: Tariffs increase the cost of importing essential raw materials, such as steel, aluminum, or specific chemicals, depending on Brookfield's specific manufacturing processes. For example, a tariff on imported steel could significantly impact the cost of producing goods requiring steel components.

- Component Cost Inflation: Similarly, tariffs on imported components, whether electronic parts or specialized machinery, directly inflate the cost of production. This is especially crucial in industries with complex supply chains relying heavily on global sourcing.

- Price Adjustments: To offset these increased input costs, Brookfield may be forced to raise prices of its finished goods. This can reduce demand and impact market share if competitors are not similarly affected.

- Reduced Profit Margins: Without price adjustments, increased input costs directly eat into Brookfield's profit margins, potentially reducing returns on investment and hindering future expansion plans.

Impact on Brookfield's Global Supply Chain Strategy

Tariffs force a critical reassessment of Brookfield's global supply chain strategy. The reliance on imported goods becomes a significant vulnerability, leading to explorations of alternative sourcing options.

- Reshoring and Nearshoring: Brookfield may consider reshoring (bringing manufacturing back to the US) or nearshoring (moving production to nearby countries) to mitigate tariff impacts. However, this involves significant challenges such as higher labor costs and logistical complexities.

- Supply Chain Diversification: To reduce reliance on single suppliers affected by tariffs, Brookfield may need to diversify its supplier base, exploring both domestic and international alternatives. This requires careful evaluation of supplier capabilities, reliability, and cost-effectiveness.

- Supplier Relationships: Existing supplier relationships may be strained by renegotiations needed to accommodate new pricing structures or sourcing adjustments. Building and maintaining strong relationships with both domestic and international suppliers is crucial.

- Increased Logistics Costs: Shifting sourcing to domestic or nearshore suppliers often entails increased transportation and logistics costs, adding another layer of complexity to the supply chain.

Changes in Investment Decisions and Future Plans

Tariffs significantly impact Brookfield's future investment decisions regarding expansion, modernization, or new plant construction in the US.

- Reduced FDI (Foreign Direct Investment): High or increasing tariffs could discourage Brookfield from making further foreign direct investment in the US, potentially diverting funds to countries with more favorable trade environments.

- Delayed Expansion Plans: The uncertainty created by fluctuating tariffs may lead Brookfield to delay or postpone expansion projects, opting for a wait-and-see approach to assess the long-term impact of trade policies.

- Investment Shifting: Brookfield may shift its investment focus to regions with more predictable and favorable trade policies, potentially impacting job creation and economic growth in the US.

- Modernization Challenges: Modernizing existing facilities becomes more expensive under a tariff regime, as imported equipment and technology might become significantly more costly.

Competitive Landscape and Market Share

Tariffs dramatically reshape the competitive landscape, affecting Brookfield's position relative to both domestic and foreign competitors.

- Level Playing Field (or not): Tariffs, in theory, could create a level playing field for US manufacturers by increasing the cost of imports. However, in practice, the impact varies greatly across industries and products.

- Market Share Fluctuations: Brookfield's market share could be impacted by its ability to absorb increased costs, adjust pricing strategies effectively, and maintain a competitive edge in the face of tariff-induced changes in the global market.

- Pricing Power: The ability of Brookfield to maintain pricing power depends heavily on consumer demand and the pricing strategies of its competitors, making market analysis crucial for effective responses to tariffs.

- Competitive Disadvantage: If competitors in countries with more favorable trade policies can offer lower prices, Brookfield may face a competitive disadvantage.

Government Policies and Lobbying Efforts

Brookfield, like other affected businesses, may engage in lobbying efforts to influence trade policy and mitigate the negative effects of tariffs.

- Industry Associations: Participation in industry associations allows Brookfield to collectively advocate for changes in trade policy and provide a unified voice for manufacturers facing similar challenges.

- Government Relations: Maintaining strong relationships with government officials at various levels is vital for influencing trade policy and advocating for favorable regulatory changes.

- Strategic Partnerships: Brookfield might form strategic partnerships with other businesses to collectively lobby for policy changes and share the costs of influencing trade decisions.

- Policy Impact Assessment: A thorough assessment of the potential impact of specific tariff policies on Brookfield's operations is needed to effectively advocate for changes that would minimize adverse effects on the business.

Conclusion: Navigating the Tariff Landscape for Future Brookfield Investments in the US

The impact of tariffs on Brookfield's US manufacturing investments is multifaceted and significant. Increased input costs, supply chain disruptions, and shifts in the competitive landscape present considerable challenges. However, opportunities exist for adapting to the new environment through reshoring, nearshoring, supply chain diversification, and strategic lobbying. Brookfield's future strategies will likely involve a combination of these approaches to navigate the complex tariff landscape and continue to maintain its competitiveness in the US manufacturing market. Understanding the impact of tariffs on Brookfield's US manufacturing investments is crucial for future strategic planning. Further research into the evolving trade landscape is essential to effectively navigate this complex issue and make informed decisions regarding future investments and operational strategies in the US.

Featured Posts

-

Is Fortnite Down Server Status Downtime Schedule And Update 34 20 Details

May 03, 2025

Is Fortnite Down Server Status Downtime Schedule And Update 34 20 Details

May 03, 2025 -

Sonys Play Station Beta Program Your Chance To Test The Latest Features

May 03, 2025

Sonys Play Station Beta Program Your Chance To Test The Latest Features

May 03, 2025 -

Utahs Clayton Keller 500 Nhl Points Missouris Second

May 03, 2025

Utahs Clayton Keller 500 Nhl Points Missouris Second

May 03, 2025 -

Voter Turnout In Florida And Wisconsin What It Means For The Future Of Politics

May 03, 2025

Voter Turnout In Florida And Wisconsin What It Means For The Future Of Politics

May 03, 2025 -

Tuerkiye Ve Avrupa Artan Is Birligi Ve Ortaklik

May 03, 2025

Tuerkiye Ve Avrupa Artan Is Birligi Ve Ortaklik

May 03, 2025

Latest Posts

-

Freedom Flotilla Claims Drone Attack Near Maltese Territorial Waters

May 03, 2025

Freedom Flotilla Claims Drone Attack Near Maltese Territorial Waters

May 03, 2025 -

Sfynt Astwl Alhryt Hjwm Israyyly Wkshf Alhqayq Hwl Alhsar Ela Ghzt

May 03, 2025

Sfynt Astwl Alhryt Hjwm Israyyly Wkshf Alhqayq Hwl Alhsar Ela Ghzt

May 03, 2025 -

Maltese Waters Incident Freedom Flotilla Ship Reports Drone Attack

May 03, 2025

Maltese Waters Incident Freedom Flotilla Ship Reports Drone Attack

May 03, 2025 -

Asthdaf Sfynt Astwl Alhryt Wqaye Hjwm Israyyly Ela Ghzt

May 03, 2025

Asthdaf Sfynt Astwl Alhryt Wqaye Hjwm Israyyly Ela Ghzt

May 03, 2025 -

Hjwm Israyyly Ela Sfynt Astwl Alhryt Tfasyl Jdydt En Asthdaf Sfynt Ghzt

May 03, 2025

Hjwm Israyyly Ela Sfynt Astwl Alhryt Tfasyl Jdydt En Asthdaf Sfynt Ghzt

May 03, 2025