Impact Of Trump's 30% China Tariffs: Extended Timeline To Late 2025

Table of Contents

This article analyzes the prolonged impact of former President Trump's 30% tariffs on Chinese goods. These tariffs, initially implemented as part of a broader trade war, continue to cast a long shadow, with their effects potentially extending to late 2025 and beyond. We will explore the multifaceted consequences, from inflation and widespread supply chain disruptions to the shifting geopolitical landscape and the enduring strain on the US-China relationship. The ripple effects of these trade policies are far-reaching and demand a comprehensive understanding.

Inflationary Pressures and Consumer Costs

Increased Prices for Consumers

The Trump tariffs directly increased the cost of imported goods from China, leading to significantly higher prices for American consumers. This impact wasn't limited to a few niche products; it rippled across various sectors:

- Electronics: Tariffs on components and finished products led to increased prices for smartphones, laptops, and televisions.

- Furniture: The cost of furniture, much of which is sourced from China, rose sharply, impacting household budgets.

- Clothing and Apparel: Consumers faced higher prices for clothing and footwear, particularly impacting lower-income households disproportionately.

Statistics from the Bureau of Labor Statistics show a clear correlation between the imposition of tariffs and the rise in consumer prices across numerous categories. The impact on lower-income households was particularly severe, as a larger percentage of their disposable income is allocated to essential goods affected by these price increases. This further exacerbated existing economic inequalities.

Impact on Businesses and Manufacturing

Businesses faced a double whammy: higher input costs and reduced consumer demand due to increased prices. This led to:

- Reduced Profits: Many businesses, particularly in manufacturing and retail, saw their profit margins squeezed due to increased costs.

- Job Losses: Some companies responded to the increased costs by laying off workers or slowing expansion.

- Price Increases: Businesses often passed on the increased costs to consumers, further fueling inflationary pressures.

Industries heavily affected included manufacturing, retail, and agriculture. Many companies responded by relocating production to other countries, a process known as offshoring, to mitigate the impact of the tariffs. Data on business closures and job losses directly attributable to the tariffs are complex to isolate, but industry reports and economic analyses suggest a significant negative effect.

Disruptions to Global Supply Chains

Complexities of Global Trade

The 30% China tariffs significantly complicated already intricate global supply chains. This resulted in:

- Delays: The increased bureaucratic hurdles and uncertainty surrounding tariffs led to significant delays in shipments.

- Increased Transportation Costs: Businesses faced higher freight and logistics costs due to trade disruptions and the need to find alternative suppliers.

- Shortages: Disruptions in the supply chain led to shortages of various goods, affecting production and consumer access.

The "just-in-time" manufacturing model, which relies on efficient and timely delivery of components, proved particularly vulnerable to the disruptions caused by the tariffs. Companies were forced to hold larger inventories, increasing costs and storage needs.

The Search for Alternative Suppliers

In response to the tariffs, many companies actively sought alternative suppliers outside of China. This led to:

- Shift in Sourcing: Countries like Vietnam, Mexico, and India benefited from the shift in global sourcing, experiencing increased investment and job creation.

- Challenges in Finding Alternatives: Finding suitable alternatives wasn't always easy, as factors like infrastructure, labor costs, and regulatory environments varied significantly.

- Long-Term Implications for Global Trade Patterns: The long-term effects on global trade patterns are still unfolding, but it's clear that the tariffs have spurred a significant reshaping of supply chains.

The search for alternative suppliers has had profound consequences, reshaping global trade relationships and potentially leading to a more fragmented and less efficient global economy in the long run.

Geopolitical Ramifications and the US-China Relationship

Escalation of Trade Tensions

The Trump tariffs dramatically escalated trade tensions between the US and China. This led to:

- Retaliatory Tariffs: China retaliated by imposing its own tariffs on American goods, leading to a tit-for-tat trade war.

- Impact on International Trade Agreements: The trade war raised concerns about the stability of the global trading system and the future of international trade agreements.

- Broader Strategic Competition: The tariffs became intertwined with the broader US-China strategic competition, impacting other areas of bilateral relations.

Long-Term Impact on Global Trade

The lasting effects of these tariffs on the global trading system are still being assessed, but the potential for future trade conflicts remains a significant concern. This includes:

- Potential for Future Trade Conflicts: The experience of the Trump tariffs has demonstrated the potential for protectionist policies to destabilize global trade.

- Impact on Multilateral Trade Organizations: The trade war has raised questions about the effectiveness of multilateral trade organizations in managing trade disputes.

- Implications for Globalization: The long-term impact of these tariffs on the process of globalization is still uncertain, with some suggesting a move towards a more fragmented global economy.

Conclusion

Trump's 30% China tariffs have had a profound and lasting impact on the US and global economies. The effects, far from being short-lived, continue to resonate, impacting inflation, supply chains, and the delicate balance of the US-China relationship, extending potentially well into late 2025. The increased consumer costs, disruptions to global trade, and the escalation of geopolitical tensions are just some of the long-term consequences we continue to grapple with.

To further understand the intricacies of this complex issue, we encourage readers to delve deeper into the long-term effects on specific industries or geographical areas. Search for "[Specific Industry] and impact of Trump's China tariffs" or "Supply chain disruption and the legacy of Trump's 30% tariffs" to explore this further. Understanding the lingering effects of these tariffs is crucial for navigating the complexities of the current global economic landscape.

Featured Posts

-

Fastest To 100 Haalands Epl Goal Involvement Record

May 19, 2025

Fastest To 100 Haalands Epl Goal Involvement Record

May 19, 2025 -

Switzerland And Eurovision 2025 Jamalas Possible Role

May 19, 2025

Switzerland And Eurovision 2025 Jamalas Possible Role

May 19, 2025 -

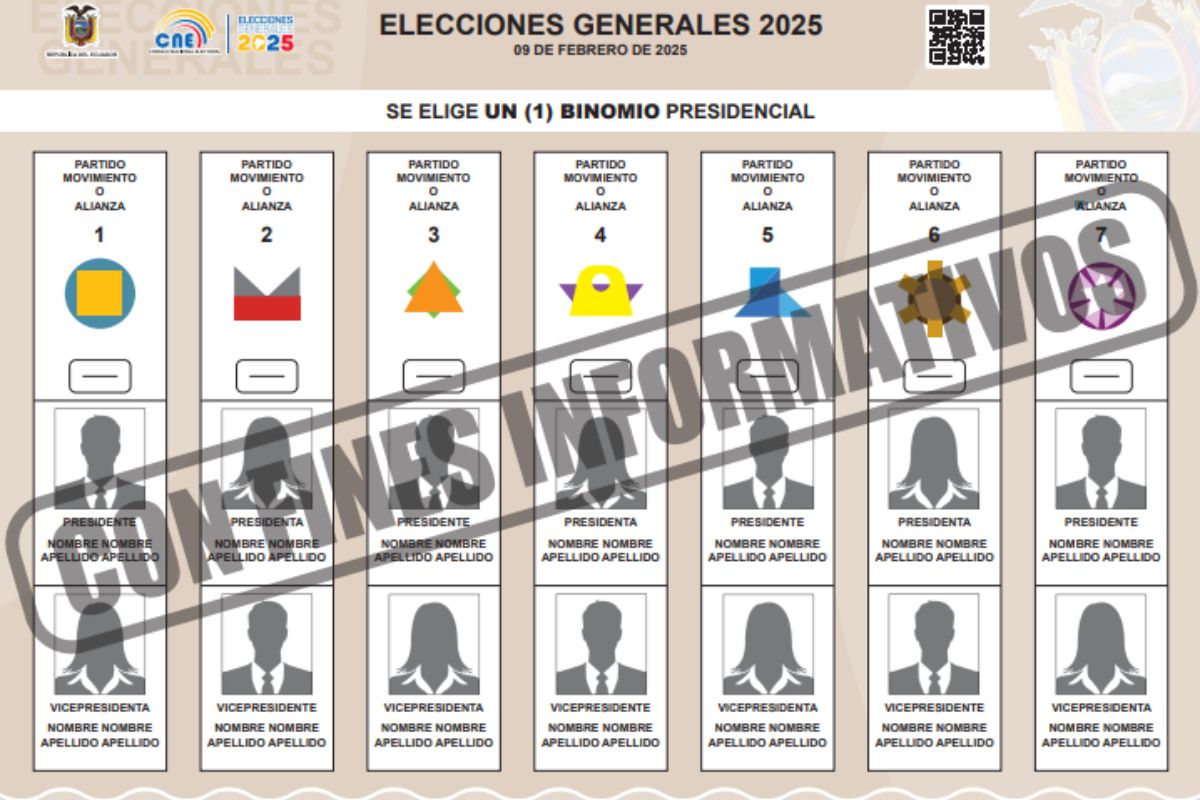

Primarias 2025 El Cne Anuncia Nuevas Elecciones

May 19, 2025

Primarias 2025 El Cne Anuncia Nuevas Elecciones

May 19, 2025 -

Starving Artist Husband Addressing The Income Gap In Relationships

May 19, 2025

Starving Artist Husband Addressing The Income Gap In Relationships

May 19, 2025 -

Unlocking The Mystery Of Eurovisions Voting System

May 19, 2025

Unlocking The Mystery Of Eurovisions Voting System

May 19, 2025