Impact Of Trump's Decision On The Nippon-U.S. Steel Deal

Table of Contents

The Proposed Nippon-U.S. Steel Merger: A Pre-Tariff Overview

Before the imposition of tariffs, the proposed merger between Nippon Steel and U.S. Steel promised significant benefits for both companies. This potential union aimed to create a global steel giant, combining the strengths of a leading Japanese producer with a major American player. The intended benefits were substantial:

- Increased market share in North America and Asia: The combined entity would have commanded a dominant market share in key regions, improving pricing power and competitiveness.

- Synergies in production and distribution: Combining operations would have streamlined processes, reduced redundancies, and improved efficiency across the supply chain.

- Enhanced technological innovation and R&D: The merger would have facilitated the sharing of technological expertise, accelerating innovation and development of new steel products.

- Potential for cost reduction and efficiency gains: Economies of scale would have led to significant cost savings in production, logistics, and administration.

This ambitious merger, however, was significantly impacted by unforeseen external factors – namely, the Trump administration's trade policies.

Trump's Steel Tariffs and Their Immediate Impact

Trump's rationale for imposing tariffs on imported steel centered on national security concerns and the need to protect the American steel industry from what he perceived as unfair competition. These tariffs, averaging 25%, had an immediate and negative impact on the proposed Nippon-U.S. Steel merger.

- Increased costs for U.S. Steel, impacting merger viability: The tariffs dramatically increased the cost of imported raw materials and components for U.S. Steel, significantly reducing the potential profitability of the merged entity.

- Potential for reduced competitiveness against other global steel producers: The tariffs made American steel more expensive, reducing its competitiveness in both domestic and international markets against steel producers outside the scope of the tariffs.

- Uncertainty in the market impacting investment decisions: The abrupt policy shift created significant market uncertainty, making it harder for both companies to secure financing and proceed with the merger.

- Negative reactions from Japanese government and businesses: The tariffs were met with strong criticism from the Japanese government and businesses, straining already delicate trade relations between the two countries.

The immediate impact of the tariffs was a significant blow to the viability of the merger.

Economic Consequences of the Tariffs on the Deal

The economic consequences of Trump's steel tariffs on the Nippon-U.S. Steel deal were far-reaching and significant.

- Increased production costs for U.S. Steel: The tariffs directly increased U.S. Steel's input costs, squeezing profit margins and making the merger less attractive.

- Reduced profitability for both companies: The uncertainty and reduced competitiveness significantly affected the projected profitability of the combined entity, potentially jeopardizing the deal's financial feasibility.

- Potential job losses in both the U.S. and Japan (if merger failed): The failure of the merger could have led to job losses in both countries, due to plant closures, restructuring, and reduced investment.

- Impact on downstream industries using steel: The increased cost of steel due to tariffs had a ripple effect on industries reliant on steel, like construction and automotive, affecting their competitiveness and potentially leading to job losses.

Geopolitical Implications of Trump's Decision

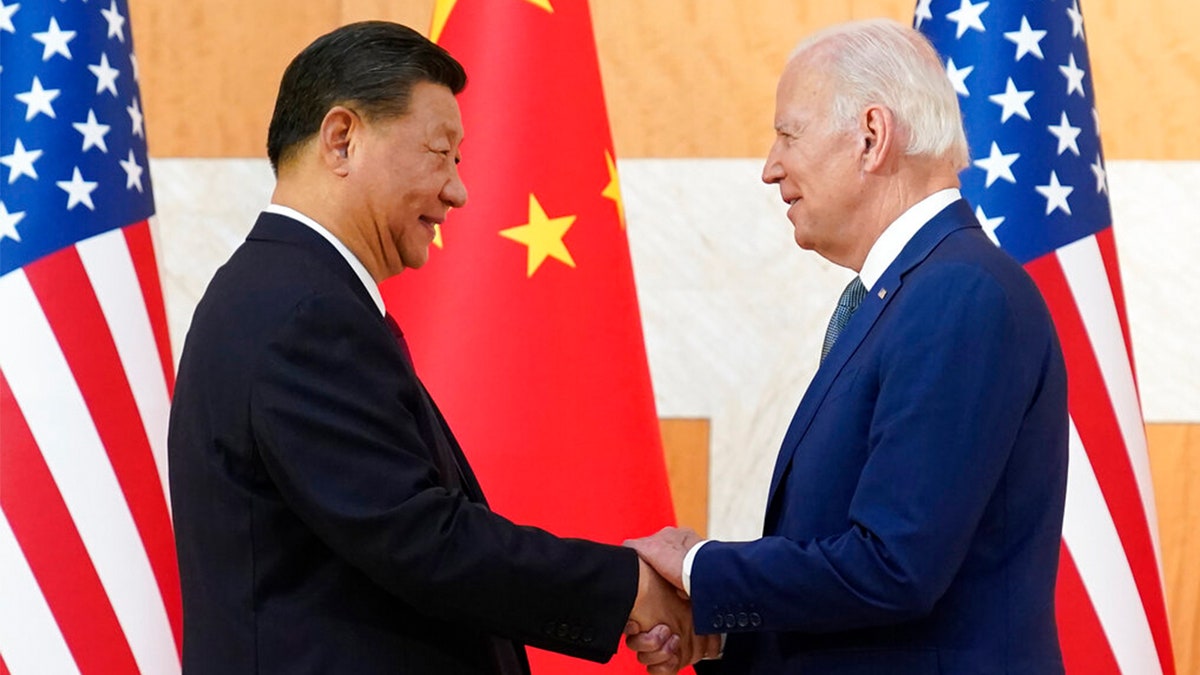

Trump's decision had far-reaching geopolitical implications, primarily impacting U.S.-Japan trade relations.

- Strained trade relations between the U.S. and Japan: The tariffs created significant friction between the two nations, raising concerns about the reliability of U.S. trade commitments and potentially undermining broader geopolitical alliances.

- Potential for trade wars and further economic instability: The tariffs could have triggered retaliatory measures from Japan, escalating trade tensions and leading to further economic instability.

- Impact on broader geopolitical alliances: The strained relationship could have undermined broader trust and cooperation between the U.S. and Japan on other geopolitical issues.

- Negative sentiment towards U.S. trade policy: The unilateral nature of the tariffs fostered negative sentiment toward U.S. trade policy globally, damaging America's reputation as a reliable and predictable trading partner.

Long-Term Effects on the Steel Industry

The long-term effects of Trump's decision continue to shape the global steel landscape.

- Restructuring of the steel industry in both countries: The tariffs forced both American and Japanese steel industries to restructure, adapting to a more protectionist global environment.

- Increased focus on domestic production and self-sufficiency: The uncertainty created by the tariffs encouraged a greater emphasis on domestic steel production in both countries, potentially leading to reduced reliance on international trade.

- Changes in global supply chains and trade patterns: The tariffs disrupted established global steel supply chains, causing companies to seek alternative suppliers and leading to shifts in global trade patterns.

- Long-term economic impact on affected regions: The consequences of the tariffs continue to impact the steel-producing regions in the U.S. and Japan, creating long-term economic challenges.

Conclusion: Understanding Trump's Decision on the Nippon-U.S. Steel Deal

Trump's decision to impose steel tariffs had a profound and multifaceted impact on the proposed Nippon-U.S. Steel merger. This analysis has shown how the tariffs significantly increased production costs, strained U.S.-Japan relations, and created considerable uncertainty in the global steel market. The long-term consequences continue to unfold, influencing the structure and competitiveness of the steel industry worldwide. Understanding the intricacies of Trump's Decision on the Nippon-U.S. Steel Deal remains crucial for navigating the complexities of international trade and economic policy. Further research into the ongoing effects of this decision is essential for informing future trade negotiations and strategic business planning. A comprehensive understanding of the ripple effects stemming from Trump's decision on the Nippon-U.S. Steel deal is vital for policymakers and business leaders alike.

Featured Posts

-

Delaware Governor Calls Out Fascism In Post Biden World Trump Administrations Role

May 26, 2025

Delaware Governor Calls Out Fascism In Post Biden World Trump Administrations Role

May 26, 2025 -

Los Gemelos De Alberto De Monaco Hacen Su Primera Comunion

May 26, 2025

Los Gemelos De Alberto De Monaco Hacen Su Primera Comunion

May 26, 2025 -

Alex Ealas French Open Prospects A Realistic Assessment

May 26, 2025

Alex Ealas French Open Prospects A Realistic Assessment

May 26, 2025 -

Rtbf Lance Un Jeu De Management Vivez Le Tour De France Autrement

May 26, 2025

Rtbf Lance Un Jeu De Management Vivez Le Tour De France Autrement

May 26, 2025 -

I Alitheia Gia Tin Mercedes Kai Ton Verstappen

May 26, 2025

I Alitheia Gia Tin Mercedes Kai Ton Verstappen

May 26, 2025

Latest Posts

-

The Killer Seaweed Exterminating Australias Marine Fauna

May 30, 2025

The Killer Seaweed Exterminating Australias Marine Fauna

May 30, 2025 -

Manila Bay Assessing The Longevity Of Its Recent Improvements

May 30, 2025

Manila Bay Assessing The Longevity Of Its Recent Improvements

May 30, 2025 -

Spring And Fall Bioluminescent Waves At Southern California Beaches

May 30, 2025

Spring And Fall Bioluminescent Waves At Southern California Beaches

May 30, 2025 -

The Future Of Manila Bay A Look At Its Continued Vitality

May 30, 2025

The Future Of Manila Bay A Look At Its Continued Vitality

May 30, 2025 -

Toxic Algae Blooms Off California Extent And Effects On Marine Life

May 30, 2025

Toxic Algae Blooms Off California Extent And Effects On Marine Life

May 30, 2025