Increased Demand For Gold: Trump's Trade Policies Fuel Uncertainty

Table of Contents

Trump's Trade Wars and Their Economic Impact

Trump's administration implemented a series of protectionist trade policies, characterized by escalating tariffs and trade disputes with major global economies. These actions significantly impacted global trade relationships, creating uncertainty and volatility in the markets.

Escalating Tariffs and Global Trade Tensions

The imposition of tariffs on goods from China, the European Union, and other countries disrupted established supply chains and led to increased costs for businesses and consumers.

- Example 1: The 25% tariff on steel imports from China increased the cost of production for numerous industries reliant on steel, impacting profitability and potentially hindering economic growth.

- Example 2: Tariffs on goods from the EU led to retaliatory measures, further escalating tensions and creating a climate of uncertainty that investors found unsettling.

- Statistics from the World Trade Organization show a noticeable decrease in global trade volume during this period, reflecting the negative impact of these trade disputes.

- Many economists voiced concerns about the negative consequences of these trade wars, predicting a slowdown in global economic growth and increased market volatility.

Impact on the US Dollar and its Effect on Gold Prices

Gold and the US dollar traditionally exhibit an inverse relationship. A weakening US dollar typically strengthens the price of gold, as it becomes cheaper for holders of other currencies to buy. Trump's trade policies, and the uncertainty they generated, contributed to a period of dollar weakness, ultimately boosting demand for gold.

- Charts clearly illustrate the negative correlation between the US dollar index and the gold price during this period. As the dollar weakened, gold prices rose.

- The "flight-to-safety" phenomenon is a key driver of this relationship. During times of economic uncertainty, investors often move their assets into safer havens like gold, reducing their exposure to riskier assets.

- Currency devaluation, a potential outcome of trade wars, also makes gold a more attractive investment for those seeking to preserve their purchasing power.

Gold as a Safe-Haven Asset During Times of Uncertainty

Gold has historically served as a safe-haven asset, providing investors with a store of value during times of economic and political instability. Trump's trade policies amplified this role.

Investor Sentiment and the Search for Stability

When economic or political uncertainty rises, investors seek stability. Gold, with its inherent value and historical resilience, becomes a preferred choice.

- Throughout history, gold has consistently acted as a safe haven during periods of turmoil, such as wars and financial crises.

- The uncertainty created by Trump's trade policies triggered a similar response, with investors increasing their gold holdings to hedge against potential losses in other asset classes.

- Diversification is a crucial aspect of investment strategy, and gold plays a vital role in mitigating risk within a well-diversified portfolio.

Inflationary Pressures and Gold's Hedge Against Inflation

Trade wars can create inflationary pressures by increasing the cost of goods and services. Gold is often seen as a hedge against inflation because its price tends to rise along with inflation.

- The relationship between inflation and gold prices is complex but generally positive. When inflation rises, the purchasing power of fiat currencies decreases, making gold a relatively more attractive asset.

- Economists presented various scenarios outlining how increased inflation, potentially resulting from trade disputes, could further drive up the price of gold.

- While other assets can act as inflation hedges, gold's long history and proven resilience continue to make it a popular choice.

Other Factors Contributing to Increased Demand for Gold

Beyond Trump's trade policies, other factors also contributed to the increased demand for gold.

Geopolitical Instability and Global Conflicts

Global conflicts and geopolitical tensions often lead to increased uncertainty and a surge in demand for safe-haven assets like gold.

- Various geopolitical events, such as rising tensions in the Middle East or other regions of conflict, have historically influenced gold prices.

- Comparing the performance of gold to other precious metals during similar periods of geopolitical instability shows gold's consistent strength as a safe haven.

- The role of central banks in holding gold reserves also influences the market sentiment and price levels.

Central Bank Gold Purchases and their Market Influence

Central banks worldwide have been increasing their gold reserves in recent years, impacting market sentiment and supporting price increases.

- Statistics show a clear increase in central bank gold purchases during the period of increased uncertainty.

- These purchases are often driven by a desire to diversify reserves and maintain financial stability in the face of geopolitical and economic risks.

- The long-term implications of these increased central bank holdings on gold prices remain a subject of ongoing analysis and discussion.

Conclusion

In summary, the increased demand for gold in recent years is a complex phenomenon, with former President Trump's trade policies playing a significant role. These policies created significant economic uncertainty, boosting gold's appeal as a safe-haven asset. Coupled with inflationary pressures and ongoing geopolitical instability, the demand for gold experienced substantial growth. Investing in gold remains an important consideration for those seeking to diversify their portfolios and mitigate risk in uncertain economic times. The increased demand for gold continues to be influenced by numerous factors, and staying informed about market trends is crucial for making well-informed investment decisions. To learn more about investing in gold and understanding its role in a diversified portfolio, explore resources and analysis from reputable financial institutions and market experts. Consider gold as a safe haven in your investment strategy.

Featured Posts

-

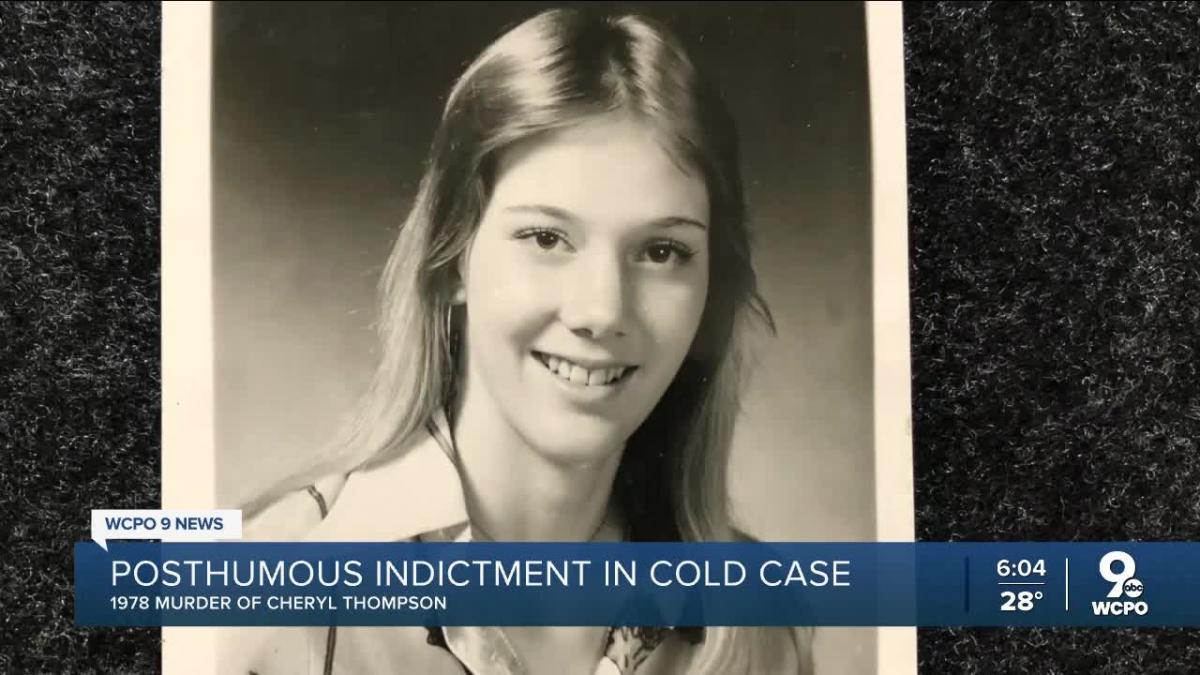

Cold Case Solved Georgia Husband Charged In Wifes Murder After 19 Years On The Run With Nanny

May 26, 2025

Cold Case Solved Georgia Husband Charged In Wifes Murder After 19 Years On The Run With Nanny

May 26, 2025 -

Rewatching Pride And Prejudice Donald Sutherlands Unexpected Brilliance

May 26, 2025

Rewatching Pride And Prejudice Donald Sutherlands Unexpected Brilliance

May 26, 2025 -

Jacques Y Gabriella Asi Fue Su Primera Comunion

May 26, 2025

Jacques Y Gabriella Asi Fue Su Primera Comunion

May 26, 2025 -

Ovde Penzioneri Uzivaju Luksuz Skupe Vile I Bogatstvo

May 26, 2025

Ovde Penzioneri Uzivaju Luksuz Skupe Vile I Bogatstvo

May 26, 2025 -

Jadwal Moto Gp Argentina 2025 Catat Waktu Sprint Race

May 26, 2025

Jadwal Moto Gp Argentina 2025 Catat Waktu Sprint Race

May 26, 2025

Latest Posts

-

Ntayj Msabqt Altwzyf Bbryd Aljzayr Byan Rsmy Llmqbwlyn

May 27, 2025

Ntayj Msabqt Altwzyf Bbryd Aljzayr Byan Rsmy Llmqbwlyn

May 27, 2025 -

Bryd Aljzayr Byan Ham Llmtrshhyn Almqbwlyn Fy Msabqt Altwzyf

May 27, 2025

Bryd Aljzayr Byan Ham Llmtrshhyn Almqbwlyn Fy Msabqt Altwzyf

May 27, 2025 -

Can Chock And Bates Secure A Third Consecutive World Title

May 27, 2025

Can Chock And Bates Secure A Third Consecutive World Title

May 27, 2025 -

Port Of Spain Traffic Congestion Persists State Of Emergency Assessment

May 27, 2025

Port Of Spain Traffic Congestion Persists State Of Emergency Assessment

May 27, 2025 -

Chock And Bates Bid For A Third Consecutive World Title

May 27, 2025

Chock And Bates Bid For A Third Consecutive World Title

May 27, 2025