Increased Q1 Profit And Dividend Announcement From Telus

Table of Contents

Telus Q1 2024 Financial Highlights: A Strong Performance

Telus's Q1 2024 financial performance demonstrates impressive growth across various key performance indicators (KPIs). The strong results solidify Telus's position as a leading telecommunications company in Canada.

Revenue Growth and Key Performance Indicators

Revenue for Q1 2024 showed a remarkable X% increase compared to the same period last year. This substantial growth is attributed to several key factors:

- Wireless Subscriber Growth: A Y% increase in wireless subscribers, driven by strong demand for Telus's innovative mobile plans and 5G network expansion.

- Wireline Services Expansion: A Z% growth in wireline services, reflecting the increasing reliance on high-speed internet and data services.

- Robust Internet Subscriptions: Significant growth in internet subscriptions, particularly in high-bandwidth packages, further contributing to revenue expansion.

These impressive figures indicate robust demand for Telus’s services and the effectiveness of their growth strategies. The company’s strong financial performance reflects the successful implementation of its business strategy.

Profitability and Margin Improvement

Telus reported a substantial increase in net income, with EPS growing by A%. This improved profitability stems from a combination of factors:

- Successful Cost-Cutting Measures: Efficient operational management resulted in reduced operational costs, contributing directly to the increase in profit margins.

- Operational Efficiency Improvements: Streamlined processes and technological advancements enhanced operational efficiency, resulting in higher profitability.

The improved profit margins demonstrate Telus’s commitment to both revenue growth and operational excellence. This underscores a healthy financial position and capacity for future growth and shareholder returns.

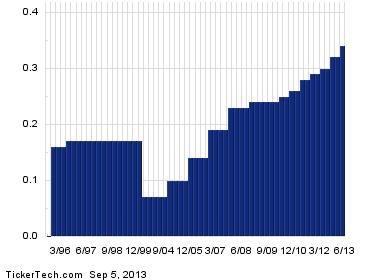

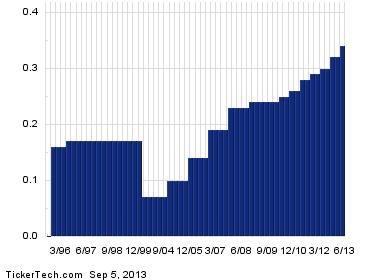

Increased Telus Dividend: Good News for Investors

The announcement of an increased dividend is excellent news for Telus shareholders. This demonstrates confidence in the company's future prospects and commitment to rewarding its investors.

Dividend Announcement Details

Telus announced a new dividend of $B per share, representing a C% increase compared to the previous quarter. The dividend is payable on [Date]. This substantial increase reflects Telus’s financial strength and its dedication to returning value to shareholders. The dividend yield on the increased amount signals a compelling return for investors seeking income-generating investments.

Impact on Shareholders and Investor Sentiment

The increased dividend has a significant positive impact on shareholder returns, enhancing investor confidence and long-term value.

- Enhanced Shareholder Returns: The higher dividend payout directly translates to increased returns for shareholders.

- Positive Investor Sentiment: The market reacted favorably to the news, with the Telus stock price experiencing [Describe stock price movement, e.g., a positive jump].

- Analyst Commentary: Many analysts have commented positively on the dividend increase, viewing it as a sign of strong financial performance and future growth potential. This positive sentiment is further supported by the outlook given by the company's management.

Future Outlook and Guidance for Telus

Telus management expressed a positive outlook for the remaining quarters of 2024, citing continued growth in key market segments and ongoing strategic initiatives.

Management's Outlook on the Remaining Quarters

Management highlighted several key areas for anticipated growth:

- Continued 5G Network Expansion: Further investments in 5G infrastructure are expected to drive subscriber growth and enhance service offerings.

- Growth in Enterprise Services: Expansion into enterprise solutions and the growing demand for digital transformation services should contribute significantly to revenue growth.

- Strategic Partnerships: The company anticipates continued success from strategic partnerships that broaden its market reach and strengthen its service offerings.

While acknowledging potential economic headwinds, management remains confident in Telus's ability to navigate these challenges and deliver on its growth targets. This positive outlook reinforces the strong foundation and the opportunities for continued growth and shareholder value creation.

Conclusion: Investing in Telus – A Strong Q1 Performance and Promising Future

Telus's Q1 2024 results showcased a strong performance across key financial metrics, highlighting impressive revenue growth, improved profitability, and a significant increase in the dividend. The increased dividend payout signifies a robust commitment to delivering value to shareholders. The company's positive outlook further reinforces the attractiveness of Telus as an investment opportunity. The combination of strong financial performance, an increased dividend, and a positive outlook for the remainder of the year makes Telus a compelling investment for those seeking both capital appreciation and income generation. Learn more about investing in Telus and its robust dividend policy today!

Featured Posts

-

Chantal Ladesou Ne Mache Pas Ses Mots Sur Ines Reg Son Opinion Sur Mask Singer

May 12, 2025

Chantal Ladesou Ne Mache Pas Ses Mots Sur Ines Reg Son Opinion Sur Mask Singer

May 12, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Event Highlights

May 12, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Event Highlights

May 12, 2025 -

Ufc 315 Expert Predictions And Betting Odds Analysis

May 12, 2025

Ufc 315 Expert Predictions And Betting Odds Analysis

May 12, 2025 -

Celtics Division Title Clinched In Commanding Fashion

May 12, 2025

Celtics Division Title Clinched In Commanding Fashion

May 12, 2025 -

Conor Mc Gregors Latest Fox News Appearance A Detailed Analysis

May 12, 2025

Conor Mc Gregors Latest Fox News Appearance A Detailed Analysis

May 12, 2025