India Market Update: Tailwinds Driving Nifty Gains

Table of Contents

Robust Economic Growth as a Primary Driver

India's strong GDP growth is a primary driver of the Nifty's ascent. The nation's economic engine is humming, contributing significantly to the positive market sentiment. This growth isn't spread thinly; key sectors are experiencing substantial expansion, fueling investor optimism.

- Impressive GDP Growth: India's GDP consistently exceeded expectations in recent quarters, registering growth rates of [Insert specific GDP growth percentage figures for the relevant period]. This robust expansion is a testament to the nation's economic resilience.

- High-Growth Sectors: The IT sector continues to be a powerhouse, driven by global demand for technology services. Manufacturing, boosted by the "Make in India" initiative, is also experiencing significant expansion. The services sector, a cornerstone of the Indian economy, continues to display strong performance. Examples of thriving companies in these sectors include [Insert examples of successful companies in high-growth sectors].

- Government Support: Government policies like "Make in India" and various infrastructure development projects are actively supporting economic growth, attracting both domestic and foreign investment. These initiatives aim to create a more favorable business environment and stimulate job creation.

- Foreign Investment Inflows: Robust economic growth has attracted significant foreign investment inflows, further bolstering the Indian stock market and contributing to the Nifty's upward trajectory. These inflows indicate a strong vote of confidence in the Indian economy.

Positive Global Sentiment and Foreign Portfolio Investment (FPI) Flows

The Indian market is benefiting from a positive global sentiment, further amplified by substantial Foreign Portfolio Investment (FPI) inflows. Easing inflation in developed markets has freed up capital for investment, and India is perceived as an attractive destination for this capital.

- FPI Inflows: Recent months have witnessed significant FPI inflows into the Indian market, totaling [Insert statistics on FPI inflows in recent months]. This influx of foreign capital has directly impacted the Nifty's performance, pushing the index higher.

- Global Sentiment: The easing of inflationary pressures in major economies has created a more favorable global investment climate. India's relatively strong economic fundamentals compared to other nations make it an attractive investment haven.

- Geopolitical Factors: While geopolitical uncertainties exist globally, India's strategic position and economic stability have mitigated some of the negative impacts of these factors, attracting investors seeking relative safety and growth.

Improved Corporate Earnings and Strong Company Fundamentals

Strong corporate earnings are a key indicator of a healthy market, and the Indian market is currently benefiting from this trend. Many Indian companies are reporting improved profitability and stronger fundamentals, boosting investor confidence.

- Strong Earnings Reports: Several leading Indian companies have reported exceptionally strong earnings in recent quarters. Examples include [Insert examples of companies with strong earnings reports]. These positive results demonstrate the underlying strength of the corporate sector.

- Improved Fundamentals: Many Indian companies are showcasing improved fundamentals, such as increased profitability, reduced debt levels, and enhanced operational efficiency. These positive metrics instill confidence among investors.

- Sector-Specific Growth: Specific sectors, such as [mention specific high-performing sectors], are exhibiting particularly robust earnings growth, driving overall market performance.

Government Policies and Regulatory Reforms

The Indian government's proactive approach to policymaking and regulatory reforms is creating a more conducive environment for businesses to thrive and investors to feel confident. These reforms are long-term investments in the Indian economy and contribute significantly to the Nifty's upward trend.

- Positive Regulatory Changes: The government's focus on infrastructure development, easing the "ease of doing business" regulations, and streamlining various processes has had a significant positive impact. Specific examples include [Insert examples of positive regulatory changes].

- Sector-Specific Initiatives: Government initiatives targeting specific sectors are providing further impetus to growth. For instance, [mention specific government initiatives boosting particular sectors].

- Long-Term Implications: These reforms have profound long-term implications, paving the way for sustainable economic growth and positioning the Indian market for further expansion, positively impacting the Nifty 50's future prospects.

Conclusion: Navigating the Nifty's Rise – Future Outlook and Investment Strategies

The Nifty 50's recent ascent is driven by a combination of robust economic growth, positive global sentiment, strong corporate earnings, and supportive government policies. These tailwinds create a compelling investment environment. However, it's crucial to maintain a balanced perspective, acknowledging potential risks and challenges. Geopolitical uncertainties and global economic fluctuations could impact market performance.

While the outlook for the Nifty 50 remains positive, investors should conduct thorough research, consult with qualified financial advisors, and carefully consider their risk tolerance before making any investment decisions. The positive tailwinds driving the Nifty present significant opportunities, but informed decision-making is crucial for navigating the Indian market effectively. Explore the potential of Nifty investment and discover the numerous Indian market opportunities. Stay informed on the Nifty 50 forecast and India stock market outlook to make informed decisions about your portfolio.

Featured Posts

-

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 24, 2025

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 24, 2025 -

Hopes Devastating News Liams Pledge To Steffy And Lunas Bold Move On The Bold And The Beautiful

Apr 24, 2025

Hopes Devastating News Liams Pledge To Steffy And Lunas Bold Move On The Bold And The Beautiful

Apr 24, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025 -

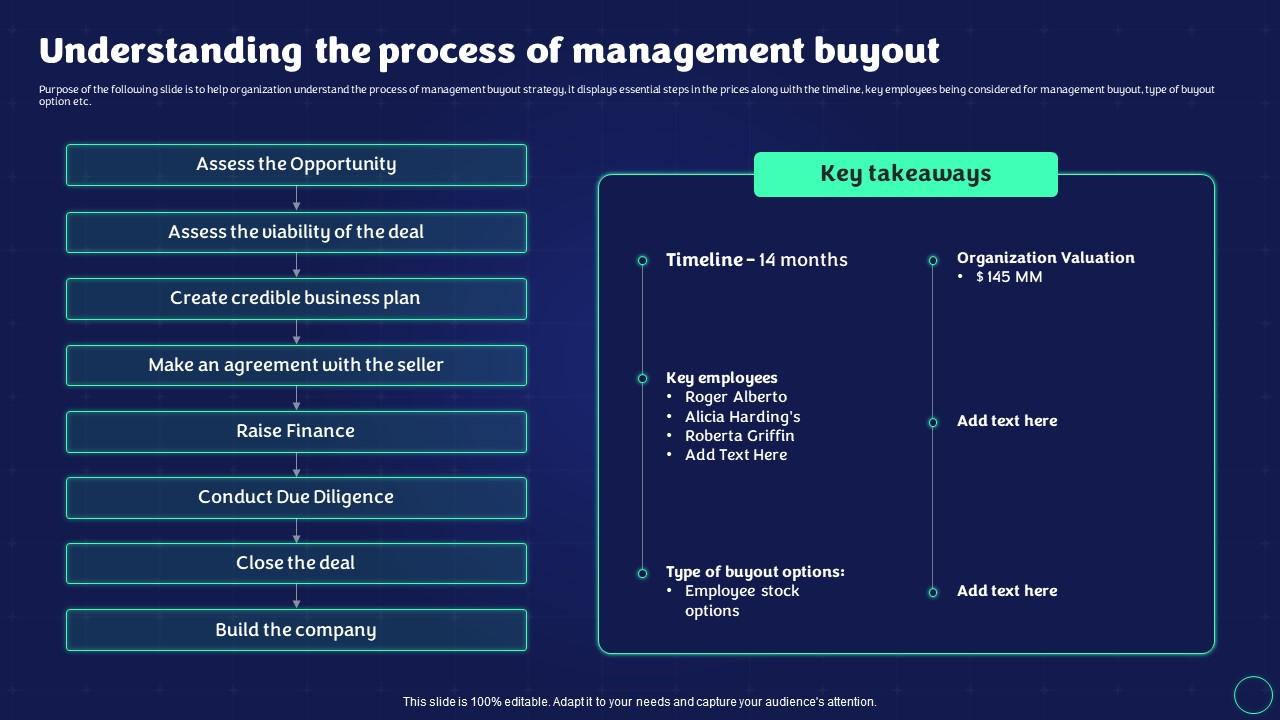

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025 -

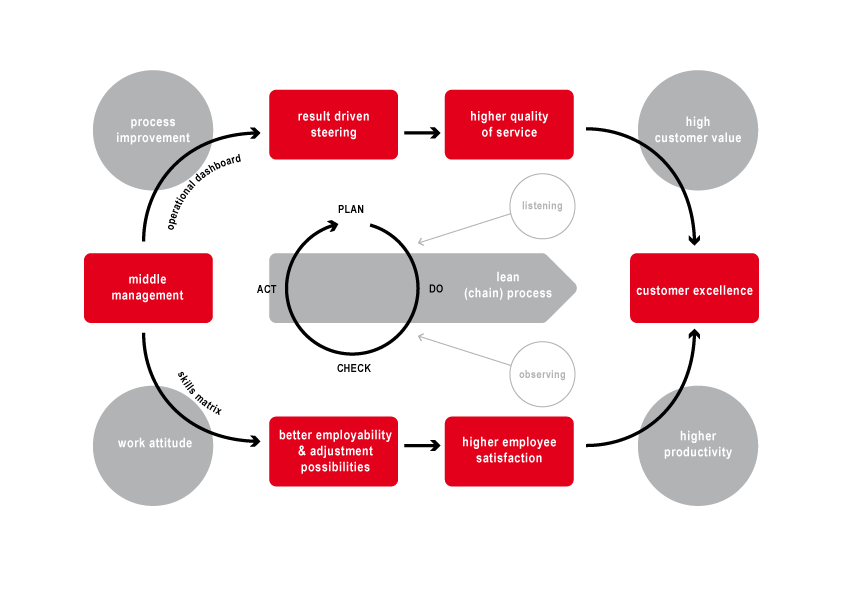

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025