Indian Insurers Seek Regulatory Relief On Bond Forwards

Table of Contents

The Current Regulatory Landscape for Bond Forwards in India

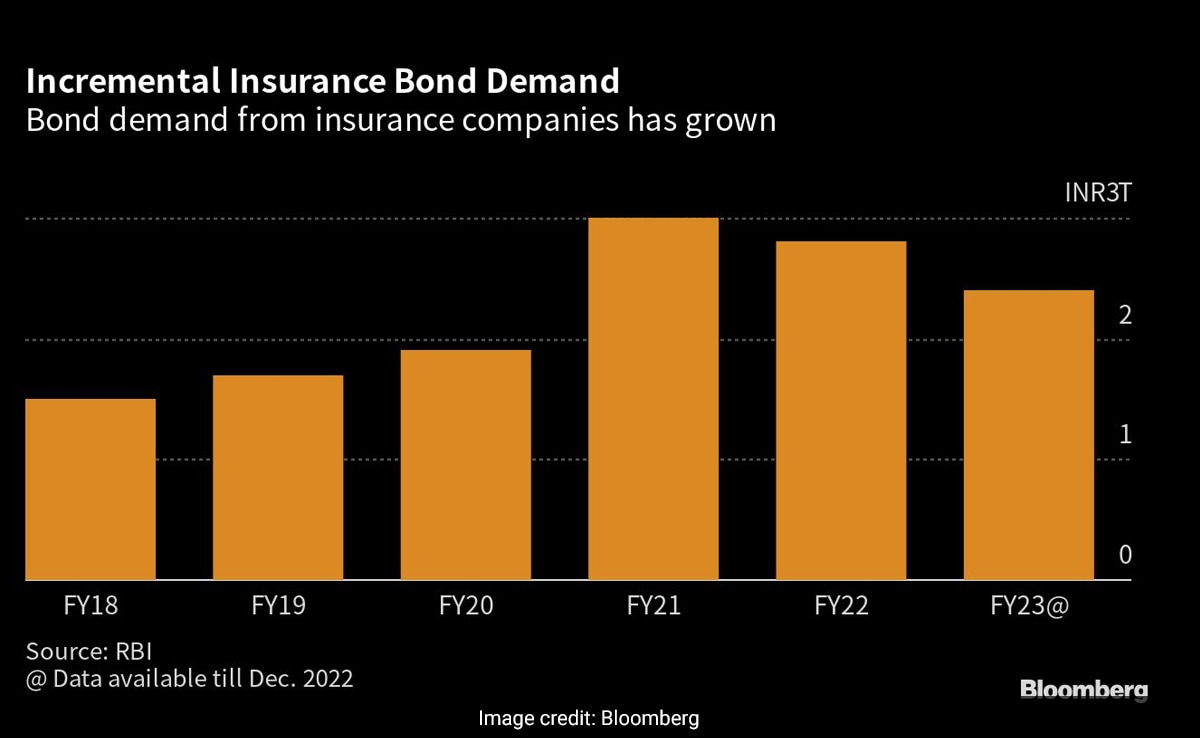

The existing regulatory framework governing bond forward investments for Indian insurers presents significant limitations. These restrictions, designed to mitigate risk, have inadvertently stifled innovation and reduced the sector's overall potential. The current rules impose several key constraints on insurance companies' investment choices:

- Limited Investment Options: Indian insurers are restricted in the types of bond forwards they can access, narrowing their investment universe and hindering diversification efforts. This often leads to lower investment returns compared to their global counterparts.

- Higher Capital Requirements: The capital adequacy ratios (CAR) for bond forward investments are significantly higher than for other asset classes, tying up valuable capital that could be deployed more effectively elsewhere. This increases compliance costs and reduces profitability.

- Complexity of Compliance: Navigating the complex regulatory maze surrounding bond forwards is a substantial undertaking, demanding significant resources and expertise. This places a considerable burden on smaller insurance companies.

- Reduced Investment Returns Compared to Global Peers: The restrictive regulations prevent Indian insurers from achieving the same level of investment returns enjoyed by their international competitors who have access to a broader range of investment opportunities. This impacts their competitiveness and long-term sustainability.

These challenges highlight the urgent need for a review of the current bond forward regulations in India to foster a more dynamic and competitive insurance sector.

Arguments for Regulatory Relief on Bond Forwards

Indian insurers argue that easing regulations on bond forwards would significantly enhance their investment strategies and contribute positively to the national economy. Their arguments center on several key benefits:

- Increased Investment Opportunities for Better Returns: Relaxed regulations would allow insurers to access a wider range of bond forwards, leading to potentially higher returns and improved portfolio performance. This would directly translate into stronger financial positions and increased capacity for risk management.

- Enhanced Risk Management Capabilities: Greater investment flexibility allows for sophisticated hedging strategies and better risk diversification. Access to a wider range of instruments provides insurers with tools to better manage their liabilities and protect policyholders' interests.

- Improved Portfolio Diversification: A wider array of bond forward investment options allows for better portfolio diversification, reducing overall risk and enhancing stability. This would create a more resilient and robust insurance sector.

- Potential for Higher Profits and Increased Competitiveness: Improved investment returns and enhanced efficiency would lead to higher profitability, enabling Indian insurers to compete more effectively in both the domestic and global insurance markets.

This increased competitiveness could attract foreign investment and boost the country's overall economic growth.

Potential Impact of Regulatory Changes on the Indian Insurance Sector

Regulatory changes could have a profound impact on the Indian insurance sector and the broader economy. The potential positive effects include:

- Increased Investment in Infrastructure Projects: With more capital available and higher returns on investments, insurers could channel significant funds into infrastructure development, acting as a major catalyst for economic growth.

- Stimulus to Economic Growth: Increased investment activity by insurers would stimulate economic growth across various sectors, creating jobs and fostering innovation.

- Improved Financial Stability of Insurance Companies: Higher returns and better risk management capabilities would contribute to the overall financial stability of insurance companies, minimizing the risk of systemic failures.

- Attracting Foreign Investment into the Insurance Sector: A more attractive regulatory environment would attract significant foreign investment, bringing in much-needed capital and expertise to the Indian insurance market.

These combined effects could propel India’s financial and economic development.

Concerns and Potential Risks Associated with Regulatory Relaxation

While regulatory relief offers numerous potential benefits, it's crucial to acknowledge potential drawbacks. Easing regulations without appropriate safeguards could expose the sector to various risks:

- Increased Systemic Risk: A sudden and uncontrolled expansion of bond forward investments could increase systemic risk within the financial system.

- Need for Robust Risk Management Frameworks: The introduction of more complex investment instruments requires equally robust risk management frameworks to effectively manage and monitor potential risks.

- Potential for Market Manipulation: Greater flexibility in the market could increase the potential for market manipulation and unethical practices, necessitating stronger regulatory oversight.

- Importance of Stringent Oversight and Monitoring: Any regulatory changes must be accompanied by stringent oversight and continuous monitoring to ensure the stability and integrity of the market.

Carefully designed regulations are necessary to mitigate these risks and create a sustainable and healthy market.

Conclusion: The Future of Bond Forwards and Regulatory Relief for Indian Insurers

The debate surrounding regulatory relief on bond forwards for Indian insurers highlights a complex interplay between the need for growth and the imperative for stability. While easing regulations presents significant opportunities to enhance investment returns, improve risk management, and contribute to economic growth, it's equally crucial to address the potential risks through robust risk management frameworks and stringent regulatory oversight. The future of bond forward investments in India depends on a balanced approach that fosters innovation while safeguarding the financial stability of the insurance sector. We urge stakeholders – insurers, regulators, and policymakers – to engage in constructive dialogue, ensuring a regulatory environment that promotes sustainable growth and strengthens the Indian insurance industry. The need for a balanced approach to ensure both growth and stability within the Indian insurance sector through careful consideration of regulatory relief on bond forwards is paramount.

Featured Posts

-

Dijon La Contribution Meconnue De Melanie Eiffel A La Tour Eiffel

May 09, 2025

Dijon La Contribution Meconnue De Melanie Eiffel A La Tour Eiffel

May 09, 2025 -

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 09, 2025

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 09, 2025 -

The High Price Of Childcare A Mans Experience With Babysitting And Daycare Costs

May 09, 2025

The High Price Of Childcare A Mans Experience With Babysitting And Daycare Costs

May 09, 2025 -

Nyt Crossword Solutions April 6 2025 Strands Puzzle

May 09, 2025

Nyt Crossword Solutions April 6 2025 Strands Puzzle

May 09, 2025 -

Joanna Page Calls Out Wynne Evans On Bbc Show You Re So Trying

May 09, 2025

Joanna Page Calls Out Wynne Evans On Bbc Show You Re So Trying

May 09, 2025