Indian Stock Market Update: Sensex, Nifty Record Significant Gains; Sector-Specific Analysis

Table of Contents

Sensex and Nifty Performance Analysis

Sensex Gains

The Sensex witnessed a remarkable [Percentage]% increase during this period, closing at [Closing Value] on [Date]. This represents a significant jump from its previous closing value of [Previous Closing Value] and even surpasses previous record highs achieved on [Date of previous high]. Key contributing factors include [briefly mention 2-3 factors, e.g., positive global cues, strong corporate earnings, increased FII investments].

- Specific Closing Values: [Include a table or graph visually representing the Sensex's gains over the specified period]

- Record Highs: The Sensex reached a new all-time high of [Value] on [Date].

- Contributing Factors: Positive global economic indicators, robust domestic consumption, and government policy reforms played a pivotal role in driving the Sensex's upward trajectory.

Nifty Performance

Similarly, the Nifty 50 index experienced a robust [Percentage]% surge, concluding at [Closing Value] on [Date]. This represents a substantial increase from [Previous Closing Value] and also marks a new high for the index. The Nifty's performance mirrors the Sensex's upward trend, indicating broad-based market optimism.

- Specific Closing Values: [Include a table or graph visually representing the Nifty's gains over the specified period]

- Record Highs: The Nifty 50 index reached its peak at [Value] on [Date].

- Contributing Factors: Strong corporate earnings across various sectors, coupled with positive investor sentiment, fueled the Nifty's impressive gains.

Correlation Analysis

The Sensex and Nifty movements exhibited a strong positive correlation during this period, indicating a synchronized upward trend across large-cap stocks. However, minor divergences were observed in specific sectors, reflecting varied responses to market drivers. Further analysis is required to pinpoint these sector-specific nuances.

Sector-Specific Analysis: Identifying Top Performers

IT Sector

The IT sector emerged as a standout performer, driven by strong demand for technology services globally and sustained growth in outsourcing. Key players like [mention 2-3 major companies] witnessed significant stock price appreciation.

- Key Players: TCS, Infosys, and HCL Technologies reported impressive revenue and profit growth.

- Impact of Global Events: The global recovery from the pandemic and increased digital transformation across various industries significantly boosted demand.

- Future Outlook: The IT sector is projected to maintain its growth trajectory, driven by long-term trends such as cloud computing and artificial intelligence.

Financials Sector

The financial sector also displayed strong performance, with banking and insurance stocks leading the charge. Increased lending activity and improved asset quality contributed significantly to the sector’s growth.

- Key Players: Leading public and private sector banks and insurance companies experienced substantial stock price appreciation.

- Impact of Interest Rate Changes: The impact of recent interest rate changes on the sector needs further analysis.

- Future Outlook: The financial sector’s growth will likely depend on economic growth, credit quality, and regulatory changes.

FMCG Sector

The Fast-Moving Consumer Goods (FMCG) sector showed steady growth, driven by rising consumer spending and strong brand performance.

- Key Players: Major FMCG companies witnessed positive stock performance, reflecting consistent consumer demand.

- Impact of Consumer Spending: Increased consumer confidence and disposable income contributed to higher FMCG sales.

- Future Outlook: The FMCG sector’s outlook depends heavily on macroeconomic factors like inflation and consumer sentiment.

Other Key Performing Sectors

Other sectors demonstrating significant gains include [mention 2-3 other sectors with brief explanations of their performance].

Factors Contributing to Market Growth

Global Economic Factors

Positive global economic indicators and easing geopolitical tensions played a significant role in bolstering investor confidence. The recovery in major global economies provided a tailwind for the Indian stock market.

- Specific Global Events: Positive growth forecasts from international organizations and easing inflation in some key markets.

- Impact on Investor Sentiment: Improved global economic outlook boosted investor sentiment, encouraging increased investment in the Indian market.

Government Policies

Supportive government policies and reforms also contributed to the positive market sentiment. Initiatives focused on infrastructure development and ease of doing business fostered investor confidence.

- Specific Policy Changes: Mention specific policy changes or announcements that positively impacted the market.

- Their Effects on Different Sectors: Highlight how these policies impacted different sectors.

Investor Sentiment

A strong surge in both Foreign Institutional Investor (FII) and Domestic Institutional Investor (DII) flows fueled the market's upward trend. Retail investor participation also contributed significantly to the market’s buoyancy.

- FII Flows: Positive FII flows indicated increased confidence in the Indian economy.

- DII Flows: Strong DII participation signaled strong domestic investor sentiment.

- Retail Investor Participation: Increased retail investor participation further propelled the market's upward trajectory.

Future Outlook and Investment Strategies

The Indian stock market's future trajectory will depend on various factors, including global economic conditions, domestic policy developments, and corporate earnings. While the current outlook appears positive, investors should exercise caution and diversify their portfolios.

- Potential Future Trends: Factors such as inflation, interest rates, and geopolitical events will influence the market's performance.

- Investment Strategies: A balanced investment strategy, considering risk tolerance and investment goals, is recommended. Consult with financial advisors for personalized guidance.

Conclusion: Navigating the Indian Stock Market's Rise

The Indian stock market’s recent surge, reflected in the impressive gains of the Sensex and Nifty, signifies a period of robust growth and optimism. The IT, financial, and FMCG sectors emerged as top performers, driven by a combination of global factors, supportive government policies, and strong investor sentiment. While the outlook appears favorable, navigating the Indian stock market requires careful analysis and a well-informed approach. Staying informed about the Indian stock market update is crucial for making sound investment decisions. We encourage you to continue following the Indian stock market closely and to consult with financial advisors for personalized guidance before making any investment decisions. Conduct thorough Indian stock market analysis before investing, considering factors like the Sensex and Nifty outlook alongside your individual risk tolerance.

Featured Posts

-

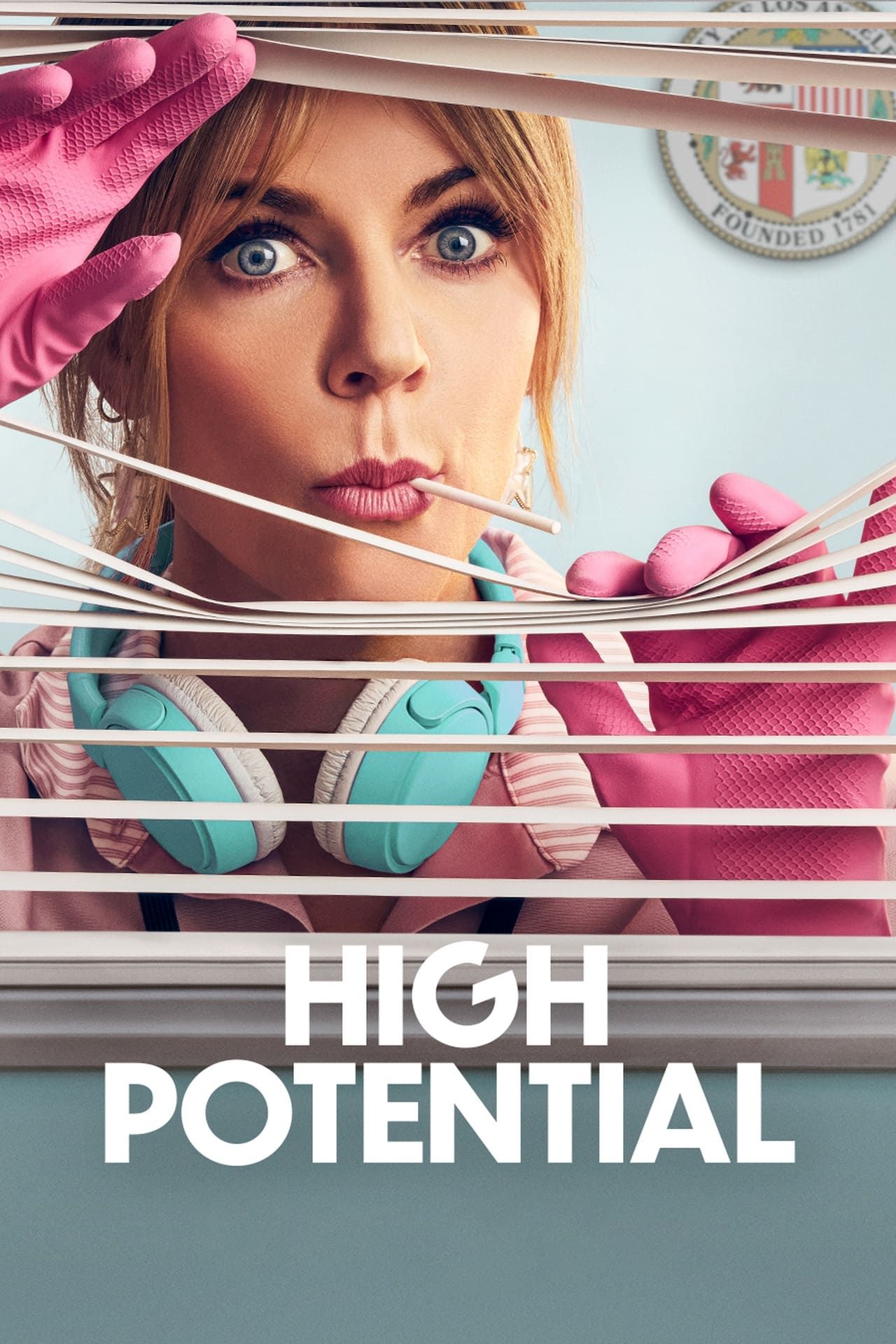

The Unexpected Hero Of High Potential Season 1 A Prime Candidate For Season 2

May 10, 2025

The Unexpected Hero Of High Potential Season 1 A Prime Candidate For Season 2

May 10, 2025 -

Extension Viticole A Dijon 2 500 M Aux Valendons

May 10, 2025

Extension Viticole A Dijon 2 500 M Aux Valendons

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

Draisaitls 100 Point Milestone Leads Oilers To Overtime Victory Against Islanders

May 10, 2025

Draisaitls 100 Point Milestone Leads Oilers To Overtime Victory Against Islanders

May 10, 2025 -

Will Hertls Injury Sideline The Golden Knights

May 10, 2025

Will Hertls Injury Sideline The Golden Knights

May 10, 2025