India's Greenko: Founders In Talks To Buy Out Orix's Investment

Table of Contents

Understanding Greenko Group's Current Position and Orix's Stake

Greenko Group is a leading integrated renewable energy company in India, boasting a diverse portfolio encompassing solar, wind, and hydro power generation. The company has ambitious expansion plans, aiming to further consolidate its position as a major player in the rapidly growing Indian renewable energy market. Orix Corporation's investment in Greenko represents a substantial stake in the company, reflecting the international interest in India's renewable energy potential. The exact percentage of Orix's ownership and the total investment amount haven't been publicly disclosed, however, market analysts estimate a significant holding.

- Greenko's operational capacity: Over X MW (Insert actual figure if available) across various renewable energy sources.

- Orix's percentage ownership in Greenko: Estimated at Y% (Insert estimated figure if available; otherwise, remove this bullet point).

- Key projects undertaken by Greenko: Several large-scale solar and wind farms across multiple Indian states. (Mention specific examples if available, including location and capacity).

- Greenko's geographical presence in India: Greenko operates across multiple states, strategically positioned to leverage diverse renewable energy resources. (List key states if available).

The Rationale Behind the Founders' Buyout Attempt

The founders' pursuit of a complete buyout suggests a strategic move to regain full control and operational autonomy. Several factors likely motivate this decision. A complete buyout could allow for greater flexibility in strategic decision-making, enabling the founders to pursue aggressive expansion plans without external constraints. This enhanced independence could also facilitate future acquisitions or partnerships aligning with their long-term vision for Greenko. The potential for increased operational efficiency and a stronger focus on core competencies are further driving factors.

- Enhanced operational flexibility: Reduced reliance on external stakeholders for crucial decisions.

- Increased decision-making power: Faster implementation of strategic initiatives without lengthy approval processes.

- Potential for future acquisitions or expansions: Greater freedom to pursue strategic mergers and acquisitions.

- Strategic alignment with long-term vision: Unfettered pursuit of Greenko's long-term growth goals.

Market Implications and Future Outlook for Greenko

The successful completion of the Greenko Founders Buyout will likely have significant market implications. While the precise impact on Greenko's stock price (if publicly traded) remains uncertain, a buyout could lead to increased investor confidence and potentially boost its valuation. This move could also intensify competition within the Indian renewable energy sector, prompting other players to accelerate their own expansion strategies. The Indian government's supportive policies for renewable energy will continue to play a crucial role in shaping the sector's future.

- Potential impact on Greenko's share price: Potential for increased share price due to enhanced investor confidence.

- Increased competition among renewable energy companies: A potential trigger for increased investment and innovation in the sector.

- Government policies and their influence on the sector: Continued government support crucial for the growth of renewable energy in India.

- Opportunities for future investments in renewable energy: The buyout could attract further investments in the Indian renewable energy sector.

Challenges and Potential Hurdles in the Buyout Process

Securing the buyout will not be without challenges. The founders will need to secure substantial funding to finance the acquisition, requiring careful planning and potentially involving debt financing or equity partnerships. Negotiations with Orix Corporation may prove complex, requiring a delicate balance of interests. Regulatory approvals and potential legal complexities are further hurdles that need to be addressed.

- Funding requirements for the buyout: Securing the necessary capital will be a major challenge.

- Negotiation complexities with Orix: Reaching a mutually agreeable deal will necessitate skillful negotiation.

- Regulatory approvals needed: Navigating the regulatory landscape will require careful planning and legal expertise.

- Potential legal challenges: Addressing potential legal obstacles will be essential for a successful buyout.

Conclusion: The Greenko Founders' Buyout – A Pivotal Moment for India's Green Energy Future

The potential Greenko Founders Buyout represents a pivotal moment for Greenko and the broader Indian renewable energy landscape. The outcome will significantly influence Greenko's future trajectory and the competitive dynamics within the sector. The challenges ahead are substantial, but a successful buyout could solidify Greenko's position as a leader in India's green energy transition. Stay tuned for updates on this landmark deal that could reshape the landscape of India's renewable energy sector. Follow us for the latest news on the Greenko founders' buyout and its impact on the future of sustainable energy in India.

Featured Posts

-

Srochno Rossiya Atakovala Ukrainu Bolee Chem 200 Raketami I Dronami

May 17, 2025

Srochno Rossiya Atakovala Ukrainu Bolee Chem 200 Raketami I Dronami

May 17, 2025 -

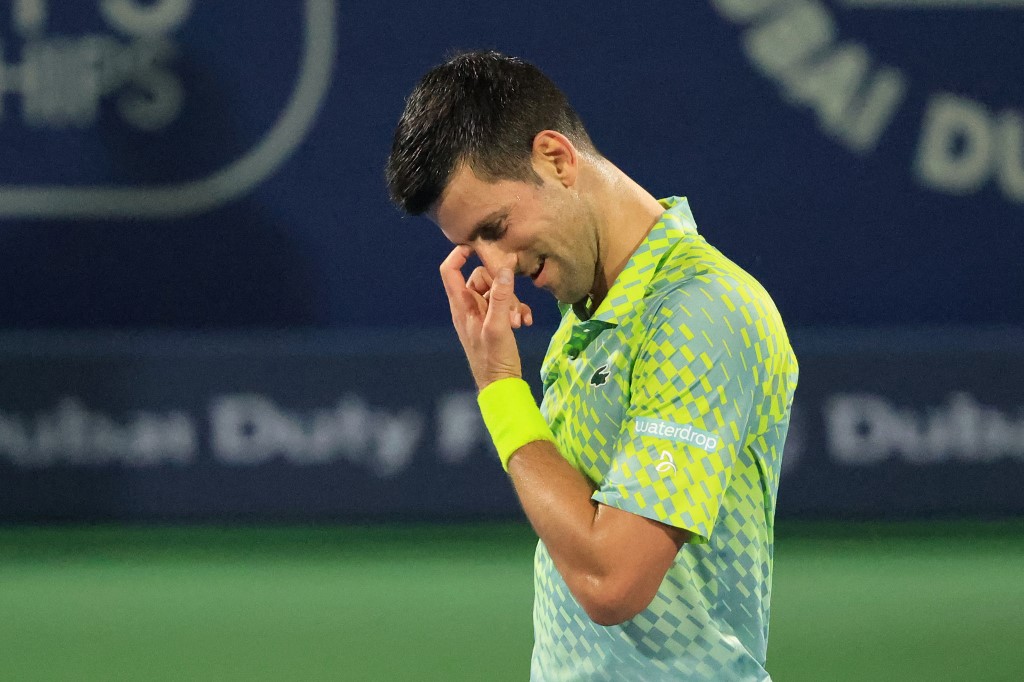

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025 -

Toronto Tempo A Wnba Franchise On The Rise Analyzing Recent Updates

May 17, 2025

Toronto Tempo A Wnba Franchise On The Rise Analyzing Recent Updates

May 17, 2025 -

Increased Earnings For Uber Kenya Drivers And Couriers Customers Enjoy Cashback

May 17, 2025

Increased Earnings For Uber Kenya Drivers And Couriers Customers Enjoy Cashback

May 17, 2025 -

Top 3 Investorov Uzbekistana Rossiya Ukreplyaet Pozitsii

May 17, 2025

Top 3 Investorov Uzbekistana Rossiya Ukreplyaet Pozitsii

May 17, 2025