India's Real Estate Market: A 47% Investment Surge In The First Quarter

Table of Contents

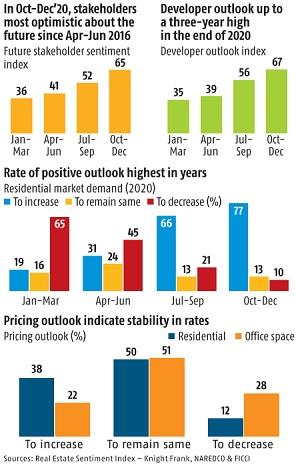

The Indian real estate market has experienced a phenomenal surge in the first quarter of the year, witnessing a staggering 47% increase in investments. This remarkable growth signifies a resurgence in investor confidence and a robust recovery from the pandemic's impact. This article delves into the key factors driving this impressive surge, explores regional variations, and offers insights into the future outlook of the Indian real estate market, providing valuable information for both seasoned investors and newcomers considering entering this dynamic sector.

Key Drivers Behind the 47% Investment Surge

Several intertwined factors have contributed to the significant rise in real estate investment in India during Q1. Understanding these drivers is crucial for navigating the market effectively.

Economic Recovery and Increased Disposable Incomes

India's post-pandemic economic recovery has played a pivotal role. Improved economic indicators have led to increased disposable incomes, boosting consumer spending and investment capacity.

- Rising Salaries: Across various sectors, salaries have seen a steady rise, particularly in technology and finance, leading to greater purchasing power among potential homeowners and investors.

- Improved Employment Rates: The job market has shown signs of recovery, with decreased unemployment rates and increased employment opportunities, contributing to heightened consumer confidence.

- Increased Consumer Confidence: Positive economic sentiment and improved financial stability have fostered greater confidence among consumers, encouraging them to invest in assets like real estate. Data from the Reserve Bank of India (RBI) shows a steady increase in consumer spending in recent quarters, directly impacting real estate demand.

Government Initiatives and Policy Changes

Government initiatives and favorable policy changes have also played a significant role in bolstering investor confidence. These measures have streamlined processes and created a more attractive investment environment.

- PMAY (Pradhan Mantri Awas Yojana): This flagship affordable housing scheme continues to stimulate demand and increase access to homeownership for a large segment of the population. The scheme's impact is evident in the increased activity in the affordable housing segment.

- Reduced Stamp Duty in Certain States: Several states have implemented reductions in stamp duty, making property purchases more affordable and attractive to potential buyers. This initiative has significantly boosted sales and investment in those specific regions. [Link to relevant government website detailing stamp duty reductions].

- Infrastructure Development Projects: Massive infrastructure projects undertaken by the government, including road expansions, metro rail projects, and airport upgrades, are enhancing connectivity and increasing property values in the surrounding areas.

Shifting Investment Preferences

The appeal of real estate as a stable and reliable investment has drawn investors away from other, potentially riskier asset classes.

- Lower Returns in Other Markets: Compared to fluctuating returns in the stock market or other investment avenues, real estate offers a perceived sense of stability and security.

- Perceived Safety and Stability of Real Estate: Real estate is often viewed as a tangible asset, providing a sense of security and long-term value appreciation.

- Increased Demand for Residential Properties: The robust demand for residential properties, fuelled by factors like urbanization and nuclear family structures, has created a strong incentive for investment in this segment. Data suggests a significant shift of investment from other sectors towards residential real estate.

Regional Variations in Real Estate Investment

While the overall growth is impressive, the Indian real estate market exhibits significant regional variations in investment activity.

Growth in Tier 1 Cities

Major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai continue to be hotspots for real estate investment.

- High-Growth Areas: Specific localities within these cities, particularly those with excellent infrastructure, connectivity, and proximity to employment hubs, experience exceptionally high growth.

- IT Sector Boom: The thriving IT sector in many Tier 1 cities fuels the demand for residential and commercial properties, further driving investment. [Include a chart visualizing regional investment distribution across major cities].

Emerging Opportunities in Tier 2 and Tier 3 Cities

Increasingly, investors are recognizing the lucrative potential in smaller cities and towns.

- Improved Infrastructure: Government initiatives focused on infrastructure development are improving connectivity and amenities in Tier 2 and Tier 3 cities, making them more attractive.

- Affordability: Compared to Tier 1 cities, properties in these areas offer greater affordability, attracting budget-conscious buyers and investors.

- High-Growth Tier 2/3 Cities: Cities like Coimbatore, Jaipur, and Indore are witnessing substantial growth in real estate investment, indicating a wider geographical spread of opportunities. [Include data points supporting the growth in Tier 2 and Tier 3 cities].

Future Outlook for the Indian Real Estate Market

The future of the Indian real estate market presents both exciting opportunities and potential challenges.

Sustained Growth or Potential Correction?

While the current growth is encouraging, several factors could influence future trends.

- Interest Rate Hikes: Potential interest rate hikes by the RBI could impact borrowing costs, potentially slowing down the market.

- Inflation: Rising inflation could dampen consumer demand and affect investment decisions.

- Geopolitical Factors: Global geopolitical events can have indirect effects on the Indian economy and real estate market.

- Potential Supply-Demand Imbalances: A significant mismatch between supply and demand could lead to market corrections in certain segments. [Include expert opinions and market forecasts from reputable sources].

Investment Opportunities and Strategies

For those considering investing in the Indian real estate market, careful planning and due diligence are essential.

- Due Diligence: Thorough research on property titles, legal compliance, and market trends is crucial before making any investment decisions.

- Choosing the Right Property Type and Location: Understanding market dynamics and identifying high-growth areas is paramount.

- Understanding Market Risks: Being aware of potential risks, including interest rate fluctuations and market corrections, is vital for informed decision-making.

Conclusion

The 47% surge in Q1 real estate investment in India showcases the remarkable resilience and growth potential of this dynamic market. Factors such as economic recovery, government initiatives, and shifting investor preferences have fueled this impressive growth. While potential challenges exist, the long-term prospects remain promising. Invest wisely in India's booming real estate market and capitalize on the numerous opportunities it presents. Explore investment opportunities in Tier 2 and 3 cities, where growth is substantial and prices are relatively more affordable. Conduct thorough research, and consider consulting with real estate professionals to navigate the market effectively and make informed investment decisions. Further research into specific areas like commercial real estate or luxury housing segments can provide even more focused insights.

Featured Posts

-

Knicks News Brunsons Return Koleks Impact And Key Games Ahead

May 17, 2025

Knicks News Brunsons Return Koleks Impact And Key Games Ahead

May 17, 2025 -

Refinancing Your Federal Student Loans Private Lender Options Explained

May 17, 2025

Refinancing Your Federal Student Loans Private Lender Options Explained

May 17, 2025 -

Djokovic Miami Acik Finalinde

May 17, 2025

Djokovic Miami Acik Finalinde

May 17, 2025 -

Knicks Playoff Hopes Rise Brunsons Imminent Return For Pistons Matchup

May 17, 2025

Knicks Playoff Hopes Rise Brunsons Imminent Return For Pistons Matchup

May 17, 2025 -

Tkrym Astthnayy Llmkhrj Allyby Sbry Abwshealt Mn Aljzayr

May 17, 2025

Tkrym Astthnayy Llmkhrj Allyby Sbry Abwshealt Mn Aljzayr

May 17, 2025