Indonesia's Falling Reserves: Analyzing The Impact Of Rupiah Weakness

Table of Contents

Factors Contributing to Indonesia's Falling Reserves

Several interconnected factors contribute to Indonesia's dwindling foreign exchange reserves. Understanding these factors is crucial for formulating effective countermeasures.

Increased Imports and Current Account Deficit

Indonesia's rising import bill significantly depletes its reserves. This is fueled by:

- Rising global commodity prices: Increased prices for essential imports, particularly energy and raw materials, increase the cost of imports, putting pressure on reserves.

- Increased demand for imported goods: Growing domestic consumption and industrial activity lead to higher import volumes, further straining foreign exchange reserves.

- Widening trade deficit: The imbalance between imports and exports, with imports exceeding exports, directly draws down on foreign exchange reserves.

Higher import costs directly strain foreign exchange reserves and exert downward pressure on the Rupiah, creating a vicious cycle. The Indonesian government needs to carefully monitor import dependency and encourage domestic production to mitigate this effect.

Capital Outflows and Foreign Investment

Capital flight and reduced foreign direct investment (FDI) also contribute to the decline in Indonesia's reserves. This is influenced by:

- Global economic uncertainty: Geopolitical instability and global economic slowdowns often lead investors to seek safer havens, resulting in capital outflows from emerging markets like Indonesia.

- Rising interest rates in developed countries: Higher interest rates in developed nations make investments in those countries more attractive, drawing capital away from Indonesia.

- Reduced investor confidence: Negative perceptions about Indonesia's economic outlook or political stability can deter foreign investment, further impacting reserves.

These factors combined create significant capital outflows, directly impacting the level of foreign exchange reserves available to the Indonesian government.

Government Spending and Debt Management

Government fiscal policies significantly influence foreign exchange reserves. This includes:

- Government borrowing costs: Higher borrowing costs for government debt, both domestically and internationally, can strain reserves as the government uses foreign exchange to service its debt.

- Repayments on foreign debt: Repaying foreign-denominated debt requires using foreign exchange reserves, further contributing to the decline.

Effective debt management and responsible government spending are vital for preserving foreign exchange reserves and maintaining macroeconomic stability.

The Impact of Rupiah Weakness on the Indonesian Economy

The weakening Rupiah has far-reaching consequences for the Indonesian economy.

Inflationary Pressures

A weaker Rupiah fuels inflation primarily through:

- Higher prices for imported goods: As the Rupiah depreciates, the cost of imported goods rises, leading to increased consumer prices.

- Potential for wage increases: To maintain purchasing power, workers may demand higher wages, further contributing to inflationary pressures.

This inflation erodes consumer purchasing power and can stifle economic growth, impacting the overall well-being of the Indonesian population.

Impact on Businesses and Exports

Rupiah devaluation presents a double-edged sword for Indonesian businesses:

- Increased competitiveness of exports: A weaker Rupiah makes Indonesian exports cheaper for foreign buyers, potentially boosting export volumes.

- Higher input costs for businesses reliant on imports: Businesses that rely heavily on imported raw materials or machinery face higher input costs, squeezing profit margins.

This situation requires businesses to adapt their strategies, focusing on efficiency and exploring opportunities in export markets while mitigating the impact of higher import costs.

Debt Servicing Challenges

A weaker Rupiah significantly increases the burden of servicing foreign-denominated debt:

- Increased cost of servicing foreign-denominated debt: As the Rupiah depreciates, the cost of repaying foreign debt in Rupiah terms increases, putting additional strain on the government's finances.

This can create a cycle of further weakening the Rupiah and increasing the pressure on foreign exchange reserves.

Potential Mitigation Strategies

Addressing Indonesia's falling reserves and Rupiah weakness requires a comprehensive strategy:

Diversifying Export Markets

Reducing reliance on specific export markets is crucial for resilience:

- Exploring new export destinations: Actively seeking new export markets reduces vulnerability to shocks in any single market.

- Promoting non-commodity exports: Diversifying exports beyond commodities reduces dependence on volatile global commodity prices.

This diversification strengthens Indonesia's export base and makes it less susceptible to global economic fluctuations.

Attracting Foreign Direct Investment (FDI)

Boosting FDI inflows is vital for strengthening the Rupiah and bolstering reserves:

- Improving investment climate: Creating a more predictable and transparent investment environment attracts foreign investors.

- Streamlining regulations: Simplifying regulations and reducing bureaucratic hurdles makes it easier for foreign companies to invest in Indonesia.

- Offering tax incentives: Attractive tax incentives can encourage foreign investment and stimulate economic activity.

FDI inflows directly contribute to foreign exchange reserves and stimulate economic growth.

Prudent Fiscal Management

Responsible government spending and debt management are critical for long-term stability:

- Controlling government expenditure: Efficient and effective use of public funds reduces the need for excessive borrowing.

- Improving tax collection efficiency: Increasing tax revenue reduces the reliance on borrowing and strengthens the government's financial position.

Prudent fiscal policies are essential for maintaining macroeconomic stability and accumulating foreign exchange reserves.

Conclusion

Indonesia's falling reserves and Rupiah weakness present significant challenges. Addressing these issues necessitates a multi-pronged approach: diversifying export markets, attracting FDI, and practicing prudent fiscal management. Understanding the interplay between these factors is crucial for navigating the current economic climate and ensuring long-term economic stability. Continuous monitoring of Indonesia's falling reserves and the Rupiah's weakness is essential for informed policymaking and investment decisions. Proactive steps to strengthen the Rupiah and rebuild reserves are vital for safeguarding Indonesia's economic future.

Featured Posts

-

Wynne Evans Seeks To Clear His Name With Fresh Evidence Following Strictly Controversy

May 10, 2025

Wynne Evans Seeks To Clear His Name With Fresh Evidence Following Strictly Controversy

May 10, 2025 -

Post Tour Boost Beyonces Cowboy Carter Streams Double

May 10, 2025

Post Tour Boost Beyonces Cowboy Carter Streams Double

May 10, 2025 -

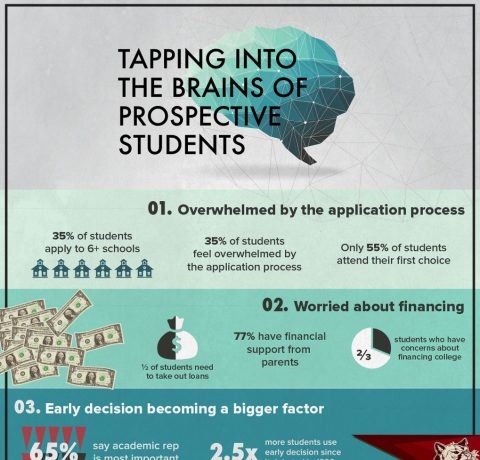

City Name Michigan A Comprehensive Guide For Prospective College Students

May 10, 2025

City Name Michigan A Comprehensive Guide For Prospective College Students

May 10, 2025 -

Young Thugs Loyalty To Mariah The Scientist A Song Snippet Analysis

May 10, 2025

Young Thugs Loyalty To Mariah The Scientist A Song Snippet Analysis

May 10, 2025 -

2025 Nhl Trade Deadline Predicting The Post Deadline Playoff Picture

May 10, 2025

2025 Nhl Trade Deadline Predicting The Post Deadline Playoff Picture

May 10, 2025