Indonesia's Foreign Reserves Plunge: Rupiah Weakness Takes A Toll

Table of Contents

Factors Contributing to Indonesia's Falling Foreign Reserves

Several interconnected factors have contributed to the depletion of Indonesia's foreign reserves. Understanding these factors is crucial to addressing the current economic challenges.

Increased Imports and Widening Trade Deficit

Rising global commodity prices have significantly increased Indonesia's import bill. This, combined with relatively slower export growth, has resulted in a widening trade deficit. The current account deficit, a key indicator of a country's international transactions, has been consistently negative, further straining Indonesia's foreign reserves.

- Impact of Rising Global Commodity Prices: The surge in global energy and food prices has placed immense pressure on Indonesia's import costs. Indonesia relies heavily on imported energy and raw materials, making it particularly vulnerable to price fluctuations in the global market.

- Role of the Current Account Deficit: A persistent current account deficit indicates that Indonesia's imports consistently exceed its exports. This necessitates drawing down on foreign reserves to finance the gap.

- Statistics: (Insert relevant statistics on import growth, export growth, and the trade deficit for the relevant period. Source the statistics from reputable sources like the Bank Indonesia or the World Bank.) For example: "Indonesia's trade deficit widened by X% in Q[Quarter] [Year], reaching a total of Y billion USD." This illustrates the direct impact on Indonesia forex reserves.

Capital Outflows and Investor Sentiment

Global economic uncertainty, coupled with rising US interest rates, has led to significant capital outflows from Indonesia. Investors, seeking higher returns in more stable markets, have withdrawn their investments, putting further pressure on the Rupiah exchange rate and depleting the country's forex reserves.

- Impact of Global Economic Uncertainty: The global economic slowdown and geopolitical instability have dampened investor confidence, leading to a reduction in foreign direct investment (FDI) inflows into Indonesia.

- Effect of Rising US Interest Rates: Higher US interest rates make US dollar-denominated assets more attractive, encouraging capital flight from emerging markets like Indonesia.

- Specific Events: (Mention any specific events, such as a global financial crisis or a major political development, that might have triggered significant capital flight from Indonesia. Provide context and link to reliable sources.)

Government Spending and Interventions

Government spending and interventions in the foreign exchange market also play a role in managing Indonesia's forex reserves. While necessary to stabilize the Rupiah, such interventions can deplete reserves if not carefully managed.

- Government Spending: Government spending policies can impact the current account deficit and foreign exchange reserves. High levels of government spending may lead to higher imports and increased pressure on reserves.

- Monetary Policy Interventions: Bank Indonesia (BI), the central bank of Indonesia, often intervenes in the forex market to manage the Rupiah's exchange rate. These interventions can involve buying or selling foreign currency, which directly impacts the level of foreign reserves.

- Trade-offs: The government faces a trade-off between maintaining stable Rupiah exchange rate and preserving foreign reserves. Aggressive intervention to support the Rupiah may deplete reserves more rapidly.

Impact of the Rupiah's Weakness on the Indonesian Economy

The weakening Rupiah has several significant implications for the Indonesian economy.

Inflationary Pressures

A weaker Rupiah increases the cost of imported goods, leading to import price inflation and potentially higher consumer prices.

- Increased Import Costs: As the Rupiah depreciates, the cost of importing goods increases, pushing up prices for consumers.

- Impact on Consumer Spending: Higher prices can reduce consumer spending and negatively impact economic growth.

- Central Bank's Role: BI has a critical role in managing inflation through monetary policy tools.

Debt Servicing Costs

A weaker Rupiah significantly increases the cost of servicing Indonesia's foreign-currency denominated debt, placing a strain on government finances.

- Increased Debt Burden: As the Rupiah weakens, the value of foreign currency debt rises in Rupiah terms, increasing the cost of repayments.

- Implications for Government Finances: Higher debt servicing costs can limit the government's ability to fund other essential programs and services.

Impact on Businesses and Consumers

Businesses that rely on imported raw materials or export goods are directly affected by Rupiah fluctuations. Consumers face higher prices for imported goods, impacting their purchasing power and overall standard of living.

- Businesses: Businesses relying on imported raw materials see increased production costs, potentially impacting profitability and competitiveness. Exporters, on the other hand, might benefit from increased global demand.

- Consumers: Consumers face higher prices for imported goods, diminishing purchasing power and potentially leading to reduced consumption.

Potential Solutions and Outlook

Addressing the challenges requires a multi-pronged approach focusing on long-term solutions.

Diversifying Exports

Reducing reliance on commodity exports is crucial. Promoting value-added manufacturing and developing other export sectors can enhance Indonesia's resilience to global price fluctuations.

- Strategies: Investing in technology and innovation to move beyond primary commodity exports. Developing export-oriented industries with high value-added potential.

Attracting Foreign Direct Investment (FDI)

Attracting long-term FDI is vital for bolstering Indonesia's economy and enhancing investor confidence.

- Policies: Implementing policies that create a stable and predictable investment climate, including reducing bureaucratic hurdles and improving infrastructure.

Strengthening Fiscal Management

Improving fiscal discipline and reducing government debt are crucial for sustainable economic growth.

- Measures: Implementing sound fiscal policies to reduce government borrowing and ensure sustainable public finances.

Conclusion

The decline in Indonesia's foreign reserves and the weakening Rupiah are interconnected challenges stemming from a combination of factors, including increased imports, capital outflows, and government interventions. These factors have created inflationary pressures, increased debt servicing costs, and impacted businesses and consumers. Addressing these challenges requires a concerted effort to diversify exports, attract FDI, and strengthen fiscal management. Indonesia's economic stability depends on proactive measures to improve its foreign exchange reserves and strengthen the Rupiah. Stay updated on the latest developments regarding Indonesia's foreign reserves and the evolving situation of the Rupiah by following reputable financial news sources and Bank Indonesia's official statements. Understanding the dynamics of Indonesia forex reserves is vital for navigating the current economic landscape.

Featured Posts

-

From 3 K Babysitter To 3 6 K Daycare Avoiding Costly Childcare Mistakes

May 09, 2025

From 3 K Babysitter To 3 6 K Daycare Avoiding Costly Childcare Mistakes

May 09, 2025 -

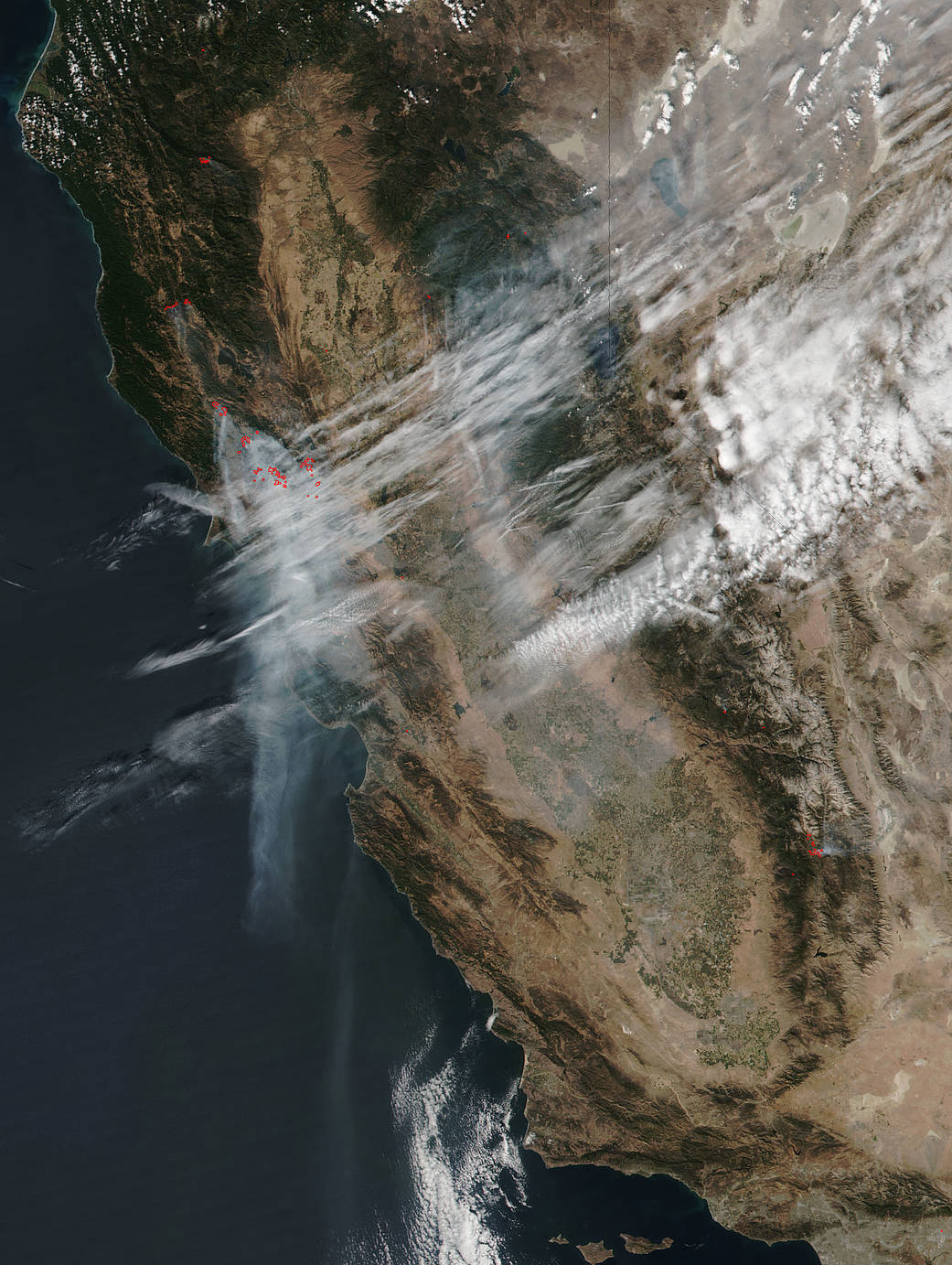

The Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Gambling

May 09, 2025

The Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Gambling

May 09, 2025 -

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025 -

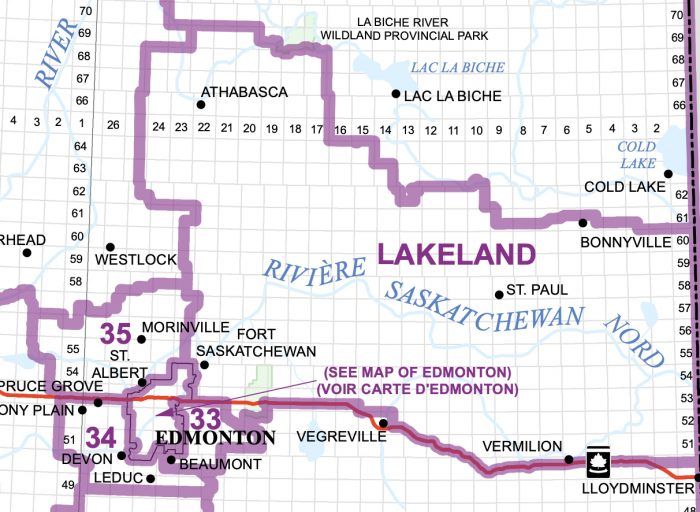

Impact Of Federal Riding Redistribution On Greater Edmonton Voters

May 09, 2025

Impact Of Federal Riding Redistribution On Greater Edmonton Voters

May 09, 2025 -

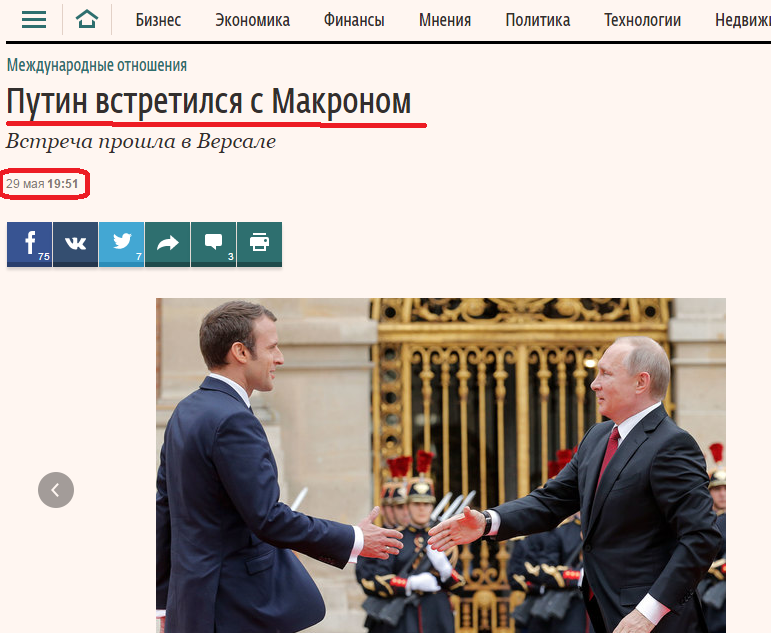

Zayavlenie Makrona O Rezultatakh Vstrechi Zelenskogo I Trampa V Vatikane

May 09, 2025

Zayavlenie Makrona O Rezultatakh Vstrechi Zelenskogo I Trampa V Vatikane

May 09, 2025