Infineon (IFX) Stock Slumps: Sales Forecast Misses Target Due To Tariff Uncertainty

Table of Contents

Infineon's Disappointing Sales Forecast

Lower-than-expected revenue projections:

Infineon's recent earnings report revealed a substantial shortfall in its sales projections, significantly lower than analyst predictions and the company's previous forecasts. The revenue miss represents a considerable setback, impacting investor confidence and highlighting the vulnerabilities of the semiconductor sector to global economic uncertainty.

- Specific shortfall: The company reported a [Insert Percentage]% decrease in revenue compared to the previous quarter and a [Insert Percentage]% miss compared to analyst consensus estimates. (Source: [Link to Official Press Release or Financial Report]).

- Sectors affected: The automotive and industrial sectors were particularly hard hit, indicating the significant reliance of these industries on Infineon's semiconductor solutions.

- Quantifiable impact: The revenue shortfall translated to a loss of approximately [Insert Dollar Amount] in projected revenue for the [Specify Time Period].

Impact on Key Market Segments:

The disappointing sales forecast underscores the vulnerability of Infineon's key market segments to the ongoing global trade tensions.

- Automotive: Reduced car production due to global economic slowdown and the impact of tariffs on automotive components directly impacted the demand for Infineon's automotive chips.

- Industrial: The industrial sector, also a significant customer for Infineon, experienced reduced demand due to supply chain disruptions and decreased capital expenditure.

- Other sectors: [Mention other impacted sectors and specific product lines affected, if applicable].

Analysis of Underlying Causes Beyond Tariffs:

While tariff uncertainty played a significant role, other factors contributed to Infineon's sales forecast miss.

- Supply chain disruptions: Global supply chain bottlenecks and shortages of key materials impacted production capacity and delivery timelines.

- Increased competition: Intense competition within the semiconductor industry put pressure on pricing and profit margins.

- Macroeconomic factors: The global economic slowdown and uncertainty further dampened demand for semiconductors across various sectors.

- Seasonal variations: Seasonal fluctuations in demand could also have played a role in the lower-than-expected sales figures.

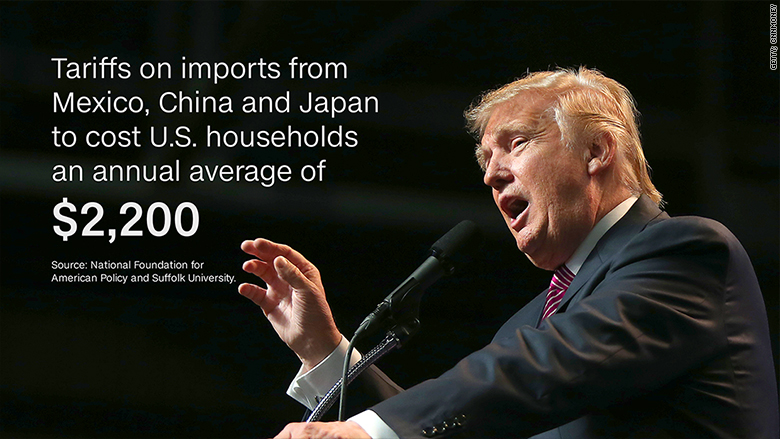

Tariff Uncertainty as a Major Contributing Factor

The Role of US-China Trade Tensions:

The escalating trade war between the US and China has created a climate of uncertainty that significantly impacts Infineon's operations and supply chains.

- Increased import costs: Tariffs on imported components and materials have increased Infineon's production costs, making its products less competitive in the global market.

- Retaliatory tariffs: The risk of retaliatory tariffs from China further complicates Infineon's international trade operations and introduces additional uncertainty.

- Supply chain disruptions: Trade tensions disrupt supply chains, leading to delays and increased costs, impacting Infineon's ability to meet customer demand. For example, tariffs on certain raw materials used in the production of Infineon’s [Specific Product] chips have increased costs by [Percentage]%.

Impact on Investor Confidence:

The tariff uncertainty significantly impacted investor confidence in Infineon's future prospects.

- Stock price fluctuations: Infineon's stock price experienced a sharp decline following the announcement of the disappointing sales forecast, reflecting investors' concerns.

- Analyst downgrades: Several financial analysts downgraded their ratings for Infineon's stock, citing tariff uncertainty and the impact on future earnings.

- Investor sentiment: Overall investor sentiment towards Infineon has turned negative, reflected in decreased trading volume and a negative outlook on the short-term prospects of the company.

Infineon's Response and Future Outlook

Company Statements and Mitigation Strategies:

Infineon has acknowledged the challenges posed by tariff uncertainty and outlined several mitigation strategies.

- Cost-cutting measures: The company has implemented cost-cutting measures to improve profitability and offset the impact of increased input costs.

- Diversification strategies: Infineon is pursuing diversification strategies to reduce its reliance on specific market segments and geographical regions.

- Mitigation of tariff impact: Infineon is actively working to minimize the negative impact of tariffs through lobbying efforts and adjustments to its supply chain. [Include any specific initiatives mentioned by the company].

Analyst Predictions and Long-Term Prospects:

While the short-term outlook remains uncertain, analysts offer varying predictions for Infineon's long-term prospects.

- Mixed forecasts: Analysts hold differing views on the company's ability to overcome the current challenges and return to growth. Some remain positive about Infineon’s long-term potential due to its strong technological capabilities and presence in key markets, while others remain cautious.

- Potential recovery: Despite the current headwinds, many believe that Infineon's long-term growth prospects remain strong, particularly given the ongoing demand for semiconductors in various sectors.

- Long-term growth potential: The long-term growth potential of the semiconductor industry remains positive, and Infineon is well-positioned to benefit from this growth once the current uncertainties subside.

Conclusion

Infineon's (IFX) recent sales forecast miss highlights the significant impact of tariff uncertainty on the company's performance and its stock price. The shortfall is attributable to a combination of factors, including trade tensions, supply chain disruptions, and broader macroeconomic conditions. While the short-term outlook presents challenges, Infineon's response strategies and the long-term growth potential of the semiconductor industry offer some grounds for optimism. Stay updated on the latest developments in the Infineon (IFX) stock and the impact of evolving trade policies by regularly checking financial news sources and analyzing the company’s financial reports. Understanding these factors is crucial for informed investment decisions in the semiconductor sector.

Featured Posts

-

Council Approves Rezoning Edmontons Nordic Spa Closer To Opening

May 10, 2025

Council Approves Rezoning Edmontons Nordic Spa Closer To Opening

May 10, 2025 -

Pentagon Proposal Sparks Debate Shifting Greenlands Control To Us Northern Command

May 10, 2025

Pentagon Proposal Sparks Debate Shifting Greenlands Control To Us Northern Command

May 10, 2025 -

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 10, 2025

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 10, 2025 -

Trumps Trade Policy The Impact Of Potential Tariffs On The Aviation Industry

May 10, 2025

Trumps Trade Policy The Impact Of Potential Tariffs On The Aviation Industry

May 10, 2025 -

Dispute On Bbc Show Joanna Pages Critique Of Wynne Evans Performance

May 10, 2025

Dispute On Bbc Show Joanna Pages Critique Of Wynne Evans Performance

May 10, 2025