ING's 2024 Form 20-F: A Comprehensive Analysis Of Financial Performance

Table of Contents

Revenue and Net Income Analysis

Analyzing ING's revenue and net income is essential to understanding its overall financial performance. The ING 2024 Form 20-F provides a detailed breakdown of these key metrics.

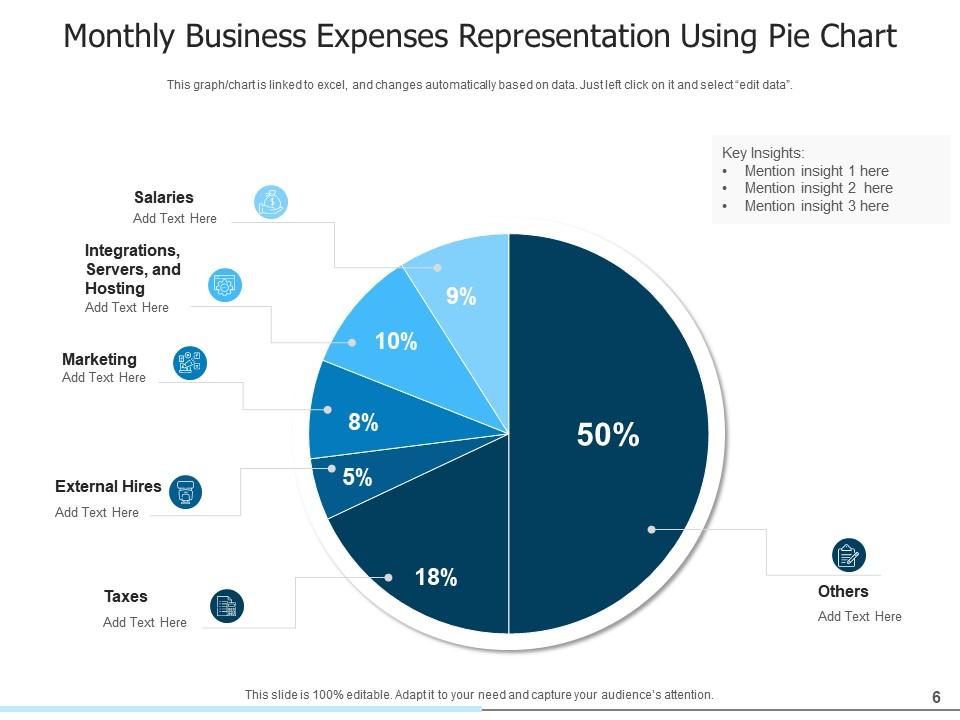

Revenue Breakdown

ING's revenue is generated from diverse sources, including retail banking, wholesale banking, and investment banking. Examining the contribution of each segment offers crucial insights into the bank's business model and resilience.

- Retail Banking: This segment likely saw growth in areas like mortgage lending and personal banking, driven by [insert specific data from 20-F, e.g., increased loan volume or market share gains]. The percentage change year-over-year will be a critical indicator of the success of its retail banking strategies.

- Wholesale Banking: This area, encompassing corporate and institutional banking, is likely influenced by global economic conditions and interest rate movements. The ING 20-F should detail the impact of these factors on revenue generation. Look for details on performance in areas like trade finance and syndicated loans.

- Investment Banking: This segment's performance is often more volatile and depends on market conditions. Analyzing the contribution of this segment to overall revenue in the ING 2024 report helps gauge the bank's ability to navigate market fluctuations.

Net Income Performance

ING's net income, the bottom line, reflects its profitability after all expenses are accounted for. Examining the net income figures in the context of previous years and industry benchmarks reveals important trends.

- Year-over-Year Comparison: A comparison of net income figures year-over-year provides an immediate insight into the direction of ING’s profitability.

- Interest Rate Impact: Changes in interest rates significantly impact a bank's profitability. The ING 20-F report will likely detail the effect of interest rate fluctuations on net income.

- Credit Losses: Provisions for credit losses are a crucial indicator of asset quality and risk management. Analyzing these provisions in the ING 2024 report is vital for assessing the bank's resilience.

- Benchmarking: Comparing ING’s net income to competitors helps determine its relative performance within the financial industry.

Asset Quality and Risk Management

Assessing ING's asset quality and risk management practices is crucial for evaluating its long-term stability. The ING 2024 Form 20-F provides vital information in this regard.

Non-Performing Loans (NPLs)

The Non-Performing Loan (NPL) ratio is a key indicator of a bank's asset quality. A rising NPL ratio signifies increased credit risk.

- NPL Ratio Trend: Examining the trend of the NPL ratio over time, as detailed in the ING 20-F, highlights the effectiveness of the bank’s credit risk management.

- Loan Loss Provisions: Adequate loan loss provisions demonstrate a proactive approach to managing potential losses from non-performing loans. The ING 2024 report will likely show the bank’s approach to loan loss provisioning.

- Macroeconomic Factors: Economic downturns often lead to an increase in NPLs. The ING 20-F should discuss the potential impact of macroeconomic factors on asset quality.

Capital Ratios and Liquidity

Maintaining adequate capital ratios and liquidity is critical for the stability of any financial institution.

- CET1 Ratio: The Common Equity Tier 1 (CET1) ratio is a crucial measure of a bank's capital adequacy. A strong CET1 ratio indicates a higher capacity to absorb losses.

- Liquidity Position: The ING 20-F should provide details on the bank’s liquidity position, ensuring it can meet its short-term obligations.

- Stress Testing: The results of stress tests, often included in the 20-F, demonstrate the bank's resilience to potential financial shocks.

Key Financial Ratios and Metrics

Analyzing key financial ratios provides a concise overview of ING's financial health. The ING 2024 Form 20-F allows for a detailed examination of these vital metrics.

- Return on Equity (ROE): This ratio measures the profitability of the bank relative to shareholders' equity. A higher ROE generally indicates better efficiency and profitability.

- Return on Assets (ROA): This ratio assesses the bank's efficiency in generating profits from its assets.

- Efficiency Ratios: These ratios measure the bank's operational efficiency in managing its expenses. The ING 20-F will provide data on key efficiency metrics.

The following table summarizes key financial ratios and their trends (Data to be filled from ING 2024 20-F):

| Ratio | 2023 | 2024 | Trend |

|---|---|---|---|

| ROE | |||

| ROA | |||

| Efficiency Ratio |

Financial Projections and Outlook

ING's financial projections and outlook, as presented in the 2024 Form 20-F, provide valuable insights into the bank's future performance expectations.

- Guidance: The report should contain management's guidance on future performance, indicating expected growth or challenges.

- Underlying Assumptions: Understanding the assumptions underlying these projections is vital for a realistic assessment of their reliability.

- Potential Risks: The ING 20-F will likely identify potential risks that could impact future performance, such as macroeconomic conditions or regulatory changes.

Conclusion

Analyzing ING's 2024 Form 20-F reveals a complex picture of its financial performance. While [mention positive aspects found in the analysis, e.g., strong capital ratios], [mention areas needing attention, e.g., potential challenges related to NPLs or macroeconomic headwinds] also warrant careful consideration. Understanding these strengths and weaknesses is vital for investors and stakeholders.

Key Takeaways: This comprehensive analysis of the ING 20-F highlights the importance of regularly reviewing a company’s financial statements for a complete understanding of its financial health and future prospects. The ING 2024 report showcases both positive aspects and potential challenges.

Call to Action: For a thorough understanding of ING's financial position and future prospects, we strongly encourage a detailed review of the complete ING 2024 Form 20-F filing. Analyzing ING's 20-F, coupled with further independent research and consultation with financial professionals, will enable you to make well-informed decisions regarding investments and business strategies related to ING's future. Remember to always conduct thorough due diligence before making any investment decisions based on ING's 2024 financial statements or any financial reports.

Featured Posts

-

Is De Nederlandse Huizenmarkt Echt Betaalbaar Het Standpunt Van Abn Amro En Geen Stijl

May 22, 2025

Is De Nederlandse Huizenmarkt Echt Betaalbaar Het Standpunt Van Abn Amro En Geen Stijl

May 22, 2025 -

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025 -

Huizenprijzen Nederland Klopt De Abn Amro Analyse Volgens Geen Stijl

May 22, 2025

Huizenprijzen Nederland Klopt De Abn Amro Analyse Volgens Geen Stijl

May 22, 2025 -

Tory Councillors Spouse Imprisoned Following Hotel Fire Tweet Appeal To Follow

May 22, 2025

Tory Councillors Spouse Imprisoned Following Hotel Fire Tweet Appeal To Follow

May 22, 2025 -

Dexter Resurrection The Return Of Arthur Mitchell And Miguel Prado

May 22, 2025

Dexter Resurrection The Return Of Arthur Mitchell And Miguel Prado

May 22, 2025

Latest Posts

-

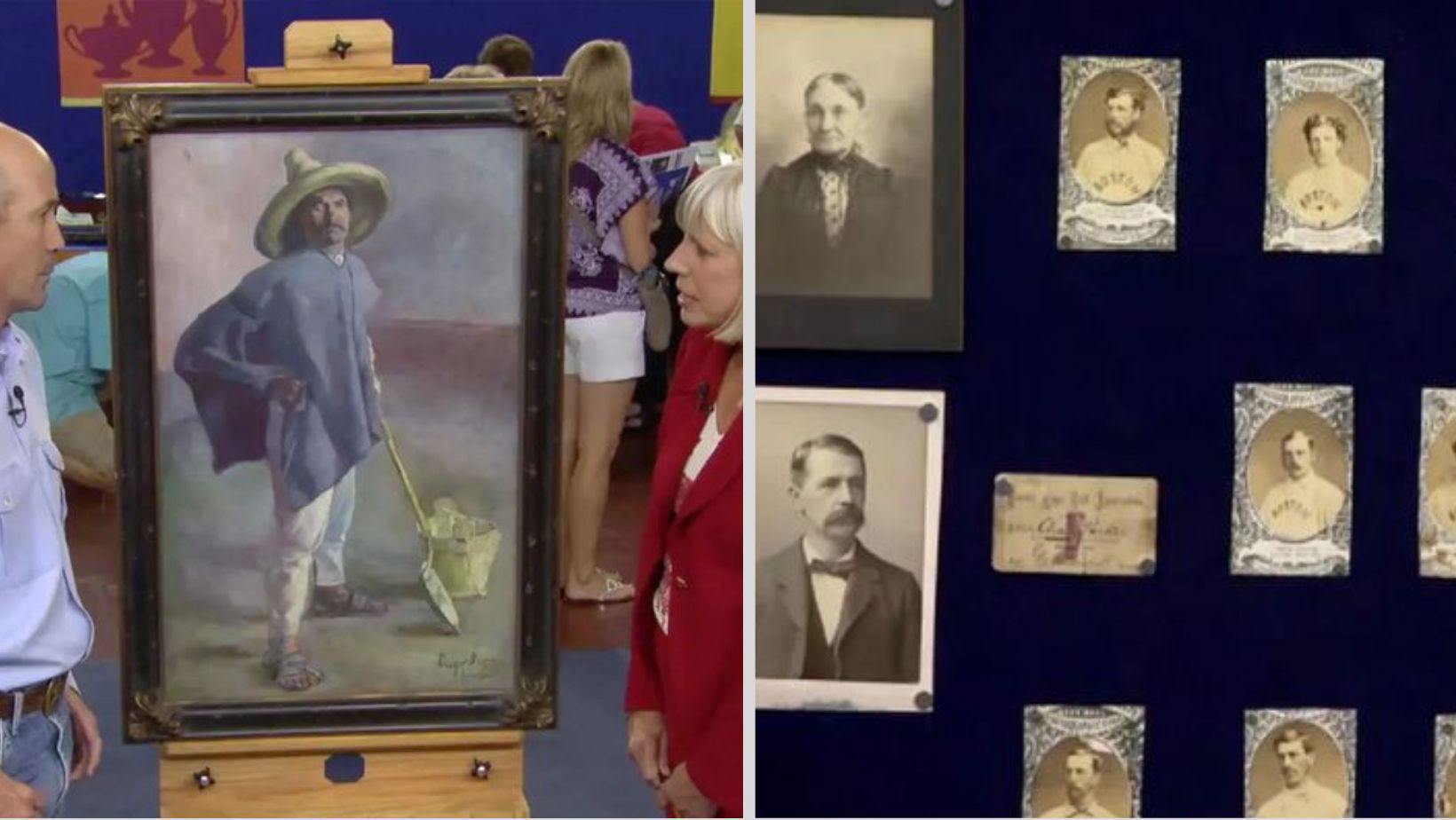

Antiques Roadshow Arrest National Treasure Trafficking Case Unfolds

May 22, 2025

Antiques Roadshow Arrest National Treasure Trafficking Case Unfolds

May 22, 2025 -

Jaw Dropping Antiques Roadshow Couple Arrested For Smuggling National Treasure

May 22, 2025

Jaw Dropping Antiques Roadshow Couple Arrested For Smuggling National Treasure

May 22, 2025 -

Antiques Roadshow Stolen Goods Discovery Leads To Criminal Charges

May 22, 2025

Antiques Roadshow Stolen Goods Discovery Leads To Criminal Charges

May 22, 2025 -

Couples Antiques Roadshow Appearance Results In Prison Sentence

May 22, 2025

Couples Antiques Roadshow Appearance Results In Prison Sentence

May 22, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025