InterRent REIT: Executive Chair And Sovereign Wealth Fund Offer

Table of Contents

H2: The Role of the Executive Chair in the InterRent REIT Offer

The involvement of the Executive Chair is a key factor driving confidence in this offer. Their extensive experience in the REIT industry, particularly within the Canadian residential REIT sector, brings a wealth of knowledge and strategic decision-making capabilities. This executive leadership, coupled with proven success in similar ventures, signifies a strong commitment to the offer's success.

- REIT Expertise: The Executive Chair boasts a long and distinguished career in real estate investment, with a proven track record of successful acquisitions, developments, and strategic partnerships within the multifamily REIT market.

- Strategic Decision-Making: Their involvement in the strategic planning of this offer assures investors of a well-thought-out approach, mitigating potential risks and maximizing opportunities.

- Past Successes: Past successful deals and investments spearheaded by the Executive Chair demonstrate their ability to identify and capitalize on profitable opportunities within the competitive landscape of the Canadian REIT market.

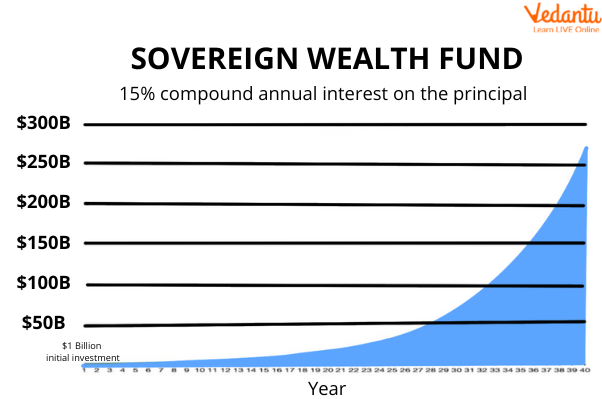

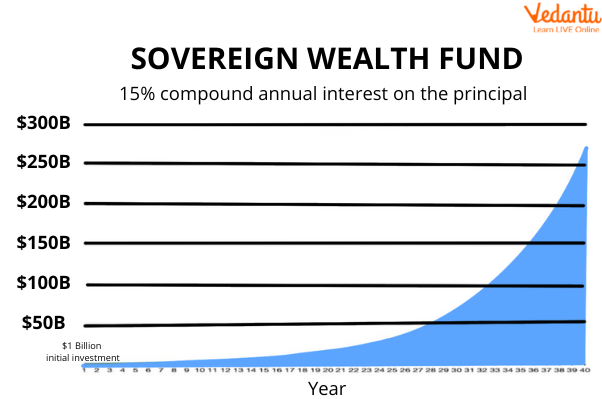

H2: Sovereign Wealth Fund Investment in InterRent REIT

The participation of a major sovereign wealth fund significantly strengthens the InterRent REIT offer. This institutional investor's decision to invest underscores confidence in InterRent REIT's long-term growth potential and stability within the Canadian residential real estate market. This substantial sovereign wealth fund investment signals a vote of confidence in the company’s future.

- Investment Strategy: The Sovereign Wealth Fund's investment criteria emphasize long-term, stable returns, aligning perfectly with InterRent REIT’s focus on the resilient multifamily rental sector.

- Impact on Share Price: The substantial investment is expected to have a positive impact on InterRent REIT’s share price, reflecting the market's confidence in the company's future prospects.

- Long-Term Strategic Benefits: The long-term nature of the Sovereign Wealth Fund's investment provides InterRent REIT with financial stability and the resources to pursue strategic growth initiatives.

H2: Analyzing the Financial Aspects of the InterRent REIT Offer

A thorough understanding of the financial aspects of the InterRent REIT offer is vital for potential investors. This involves carefully scrutinizing the offer price, valuation metrics, and overall investment terms. While specific financial data may require further research, a comparison to existing market prices and projections of future performance should guide investment decisions.

- Valuation Metrics: Key financial indicators like Net Asset Value (NAV) per share, capitalization rates, and projected rental income growth need to be evaluated to determine the fairness of the offer price.

- Offer Price vs. Market Price: A comparison of the offer price to the current market price will help investors determine the potential upside of the offer and inform their investment strategy.

- Potential Risks and Mitigation Strategies: Potential risks, such as interest rate fluctuations or changes in the rental market, need careful consideration. Evaluating the company's mitigation strategies will help assess the offer's overall risk profile.

H2: Implications for InterRent REIT Shareholders and Potential Investors

The InterRent REIT offer presents both opportunities and considerations for existing shareholders and potential investors. Current shareholders can analyze the offer's potential to enhance shareholder value, while potential investors should assess the offer’s potential return on investment and overall risk profile.

- Benefits for Existing Shareholders: The offer could provide existing shareholders with a premium on their investment and a chance to realize gains, contributing to increased shareholder value.

- Potential Risks and Rewards for New Investors: New investors need to evaluate the potential for long-term growth and the risks involved in investing in the Canadian residential REIT market.

- Future Growth Potential: The combination of experienced executive leadership and a significant sovereign wealth fund investment creates a positive outlook for InterRent REIT's future growth potential.

3. Conclusion: Investing in the Future of InterRent REIT

The InterRent REIT offer, supported by its Executive Chair’s expertise and a substantial Sovereign Wealth Fund investment, presents a compelling investment opportunity in the Canadian multifamily REIT sector. The strategic partnership, coupled with the positive outlook for the residential rental market, indicates strong potential for future growth. However, thorough due diligence and a careful evaluation of the financial details are crucial before making an investment decision.

To make an informed investment decision, we urge you to explore further resources and conduct your own research. Consulting a financial advisor is also recommended to assess if InterRent REIT aligns with your personal investment goals and risk tolerance. Don’t miss out on this exciting opportunity in the world of InterRent REIT and REIT investment; seize the chance to secure your future.

Featured Posts

-

Nuevos Artistas Latinos Jacqie Rivera Y Mas Promesas Musicales

May 29, 2025

Nuevos Artistas Latinos Jacqie Rivera Y Mas Promesas Musicales

May 29, 2025 -

Pembeli Nft Nike Gugat Balik Tuntutan Ganti Rugi Rp 84 Miliar

May 29, 2025

Pembeli Nft Nike Gugat Balik Tuntutan Ganti Rugi Rp 84 Miliar

May 29, 2025 -

Analyzing The Content Of Eric Damaseaus Anti Lgbt You Tube Channel

May 29, 2025

Analyzing The Content Of Eric Damaseaus Anti Lgbt You Tube Channel

May 29, 2025 -

Bujdoso Kincsek Hogyan Talalhatsz Szazezreket Ero Targyakat Otthon

May 29, 2025

Bujdoso Kincsek Hogyan Talalhatsz Szazezreket Ero Targyakat Otthon

May 29, 2025 -

Dont Miss Out Nike Dunk Sale At Revolve 52 Off

May 29, 2025

Dont Miss Out Nike Dunk Sale At Revolve 52 Off

May 29, 2025

Latest Posts

-

Assessing The Leadership Of Bernard Kerik In The Wake Of 9 11

May 31, 2025

Assessing The Leadership Of Bernard Kerik In The Wake Of 9 11

May 31, 2025 -

Bernard Keriks Wife Hala Matli And Their Children

May 31, 2025

Bernard Keriks Wife Hala Matli And Their Children

May 31, 2025 -

Hospitalization Of Former Nypd Commissioner Bernard Kerik Full Recovery Anticipated

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik Full Recovery Anticipated

May 31, 2025 -

Bernard Kerik Ex Nypd Commissioner Receives Medical Treatment Expected Recovery

May 31, 2025

Bernard Kerik Ex Nypd Commissioner Receives Medical Treatment Expected Recovery

May 31, 2025 -

Ex Nypd Commissioner Kerik Hospitalized Full Recovery Expected

May 31, 2025

Ex Nypd Commissioner Kerik Hospitalized Full Recovery Expected

May 31, 2025