Interest Rate Cuts: Why The Fed Is Different

Table of Contents

The Mandate and Structure of the Federal Reserve

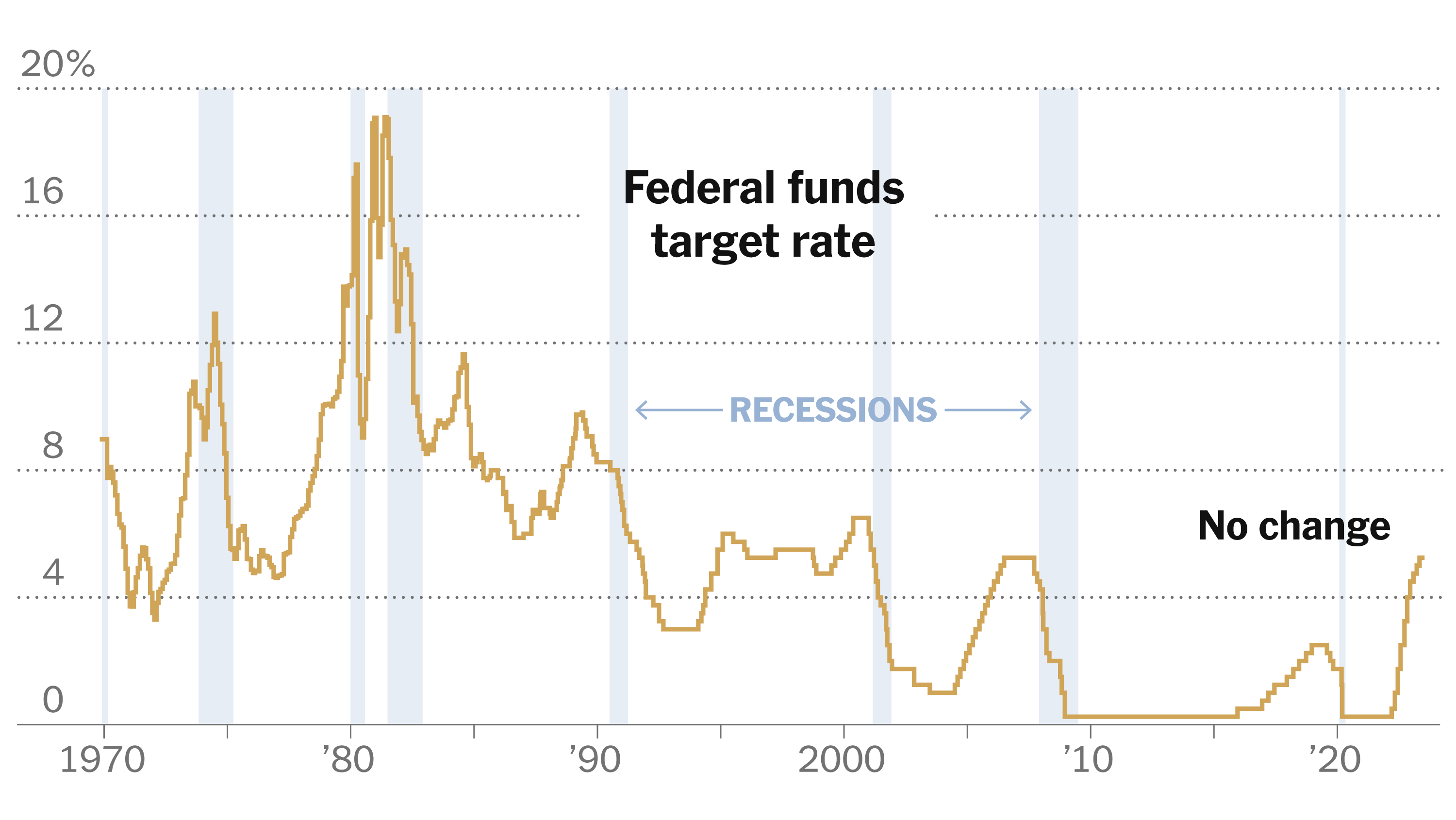

The Federal Reserve's unique structure and dual mandate significantly influence its decisions regarding interest rate cuts. Unlike some central banks that primarily focus on exchange rate stability or inflation control, the Fed operates under a dual mandate: maximizing employment and maintaining price stability. This necessitates a more nuanced approach to interest rate adjustments.

- The Fed's independence from political pressure: This independence allows the Fed to make long-term decisions based on economic data rather than short-term political considerations. This contrasts with some central banks that are more susceptible to government influence.

- The structure of the Federal Open Market Committee (FOMC): The FOMC, comprised of Federal Reserve governors and reserve bank presidents, deliberates and decides on monetary policy, including interest rate cuts. This collaborative process considers diverse perspectives and economic data before arriving at a decision.

- The Fed's long-term perspective: The Fed's focus extends beyond immediate economic cycles. Its long-term outlook allows for a more strategic approach to interest rate cuts, aiming for sustainable economic growth rather than solely reacting to short-term fluctuations.

- Balancing the dual mandate: Achieving both maximum employment and price stability requires careful calibration of monetary policy. Interest rate cuts, while potentially boosting employment, could also fuel inflation if not managed carefully. This balancing act shapes the Fed's approach to interest rate adjustments.

The Fed's Tools Beyond Interest Rate Cuts

The Fed's toolkit extends far beyond traditional interest rate cuts. It utilizes unconventional monetary policies to influence the economy, offering additional levers for managing economic conditions.

- Quantitative easing (QE): QE involves the Fed purchasing government bonds and other securities to increase the money supply and lower long-term interest rates. This is a powerful tool used during periods of economic stress, such as the 2008 financial crisis.

- Bond purchases: By purchasing government bonds, the Fed injects liquidity into the market, lowering borrowing costs and encouraging investment. The scale and type of bond purchases are carefully considered to achieve specific economic outcomes.

- Forward guidance: The Fed often communicates its intentions regarding future monetary policy through forward guidance. This helps shape market expectations and influence investor behavior, potentially reducing uncertainty and supporting economic stability.

- Balance sheet management: The Fed actively manages its balance sheet, adjusting the size and composition of its assets to influence market conditions. This includes expanding or contracting its holdings of securities to impact liquidity and interest rates.

Global Economic Considerations and the Fed's Response

The Fed's decisions on interest rate cuts are not made in isolation. Global economic conditions and interconnected markets significantly impact its actions.

- Impact of global economic shocks: Global events like financial crises or trade wars can profoundly impact the US economy, requiring the Fed to adjust its monetary policy, including potential interest rate cuts, to mitigate negative effects.

- The Fed's role as a global lender of last resort: The Fed's actions can have significant global implications. Its role as a lender of last resort during times of international financial distress underscores its influence on the global financial system.

- Balancing domestic and international considerations: The Fed must consider the impact of its actions on both the domestic and international economies. Striking a balance between these competing interests requires careful consideration and analysis.

- Reactions of other central banks: Other central banks often react to the Fed's actions, creating a ripple effect throughout the global financial system. Understanding these interdependencies is crucial for anticipating the broader consequences of the Fed's decisions.

Case Study: Comparing Fed Actions to Other Central Banks

During the 2008 financial crisis, the Fed's response differed significantly from that of other major central banks. While the European Central Bank (ECB), the Bank of Japan (BOJ), and the Bank of England (BOE) also implemented interest rate cuts, the Fed’s utilization of quantitative easing on an unprecedented scale was a key differentiator. This aggressive approach, coupled with other unconventional monetary policies, helped stabilize the US financial system and prevent a deeper economic collapse. A comparison of these responses highlights the unique approaches to monetary policy and the different priorities of central banks worldwide.

Conclusion

The Federal Reserve's approach to interest rate cuts is distinct due to its dual mandate, unique tools, and global influence. Understanding the nuances of its decision-making process is crucial for interpreting economic developments and forecasting future monetary policy. Unlike central banks focused solely on inflation or exchange rates, the Fed's multifaceted approach requires a holistic understanding of the interplay between employment, price stability, and global economic conditions.

Learn more about the intricacies of Federal Reserve policy and how interest rate cuts impact the US and global economies. Stay informed on future Federal Reserve decisions and their implications. Subscribe to our newsletter for regular updates on monetary policy and interest rate changes.

Featured Posts

-

Nhl Playoffs Golden Knights Secure Postseason Spot After 3 2 Loss To Oilers

May 10, 2025

Nhl Playoffs Golden Knights Secure Postseason Spot After 3 2 Loss To Oilers

May 10, 2025 -

Pochemu Makron Starmer Merts I Tusk Ne Poekhali V Kiev Na 9 Maya

May 10, 2025

Pochemu Makron Starmer Merts I Tusk Ne Poekhali V Kiev Na 9 Maya

May 10, 2025 -

Update Arrest Made Following Elizabeth City Weekend Shooting

May 10, 2025

Update Arrest Made Following Elizabeth City Weekend Shooting

May 10, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

May 10, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

May 10, 2025 -

Declaration Du Ministre Francais De L Europe Sur Le Partage Du Bouclier Nucleaire

May 10, 2025

Declaration Du Ministre Francais De L Europe Sur Le Partage Du Bouclier Nucleaire

May 10, 2025