Internal Investigation Leads To PwC US Partners Cutting Brokerage Ties

Table of Contents

The Internal Investigation: Unveiling Potential Conflicts of Interest

PwC's internal investigation, launched earlier this year, focused on potential ethical violations and conflicts of interest related to the personal brokerage accounts of some of its partners. While the exact triggers remain undisclosed, sources suggest the probe was initiated after whistleblowers raised concerns about potentially inappropriate trading activities. The investigation involved a thorough review of trading records, communication logs, and financial transactions across various departments and geographical locations within PwC US. The scope of the audit was extensive, encompassing not only individual partners but also examining potential systemic issues within the firm's internal control frameworks. This extensive internal audit signifies the seriousness with which PwC is taking this matter.

- Timeline of the investigation: While the exact start date remains confidential, the investigation spanned several months, involving extensive data analysis and interviews.

- Key findings of the preliminary investigation: Preliminary findings reportedly uncovered instances where partners potentially used non-public information or engaged in transactions that created a conflict of interest with their professional duties.

- Types of alleged conflicts of interest discovered: The alleged conflicts ranged from potential insider trading based on client information to investments in firms audited by PwC, raising serious ethical and regulatory concerns.

- Potential regulatory ramifications: The Securities and Exchange Commission (SEC) and other regulatory bodies are reportedly monitoring the situation closely, potentially opening their own investigations based on PwC's findings. The potential penalties for any violations could be substantial, including significant fines and reputational damage.

Severing Brokerage Ties: PwC's Response to the Findings

In response to the findings of the internal investigation, PwC US partners have taken the decisive step of severing ties with several unnamed brokerage firms. This action demonstrates a commitment to addressing the identified conflicts and mitigating future risks. The decision reflects PwC's proactive approach to reinforcing its dedication to ethical conduct and regulatory compliance, crucial elements for maintaining its reputation and client trust. The firm's actions underscore the increasing pressure on financial institutions to maintain the highest standards of corporate governance.

- Specific brokerage firms affected: While the names of the brokerage firms involved haven't been publicly disclosed, the number of affected firms suggests a significant effort to rectify the situation.

- The nature of the severed relationships: The severed relationships involved both personal trading accounts held by partners and any existing consulting agreements or partnerships between PwC and the brokerage firms.

- The steps PwC is taking to prevent future conflicts: PwC has implemented stricter guidelines on personal investments, enhanced its compliance training programs, and strengthened its internal controls to prevent similar incidents from occurring in the future. This includes more robust monitoring of employee trading activities.

- Impact on PwC's investment strategies and client services: While the impact on client services is expected to be minimal, the changes in internal policies may influence future investment strategies for the firm's own funds.

Implications for PwC's Reputation and Future Practices

The internal investigation and subsequent actions will undoubtedly have significant ramifications for PwC's reputation and future practices. The scandal has the potential to erode client trust, impacting the firm's ability to attract and retain both clients and high-quality employees. The increased regulatory scrutiny resulting from this investigation could lead to further changes in the firm's internal policies and procedures. The incident serves as a stark reminder of the importance of robust ethical guidelines and stringent internal controls within large financial institutions.

- Potential loss of clients due to the scandal: While the full extent of the impact on client relationships remains to be seen, the negative publicity surrounding the investigation poses a significant risk.

- Impact on PwC's recruitment and retention efforts: The scandal may affect PwC's ability to attract and retain top talent, as potential employees may be hesitant to join a firm embroiled in controversy.

- Changes in PwC's internal policies and procedures: Expect to see more rigorous oversight of partner investments and transactions, alongside enhanced compliance training and stricter ethical guidelines.

- Increased scrutiny from regulatory bodies: The SEC and other regulatory bodies will likely increase their scrutiny of PwC's operations to ensure that adequate measures are in place to prevent future conflicts of interest.

Conclusion:

The PwC internal investigation and the subsequent decision to sever brokerage ties represent a significant development in the financial services industry. The potential conflicts of interest uncovered highlight the crucial need for robust internal controls, transparent reporting, and a strong commitment to ethical conduct. The long-term implications for PwC's reputation and future practices remain to be seen, but the firm's proactive response signals its commitment to regaining trust and preventing future occurrences. Follow this story to stay updated on the continuing developments related to the PwC internal investigation and the evolving standards of ethical conduct in the industry.

Featured Posts

-

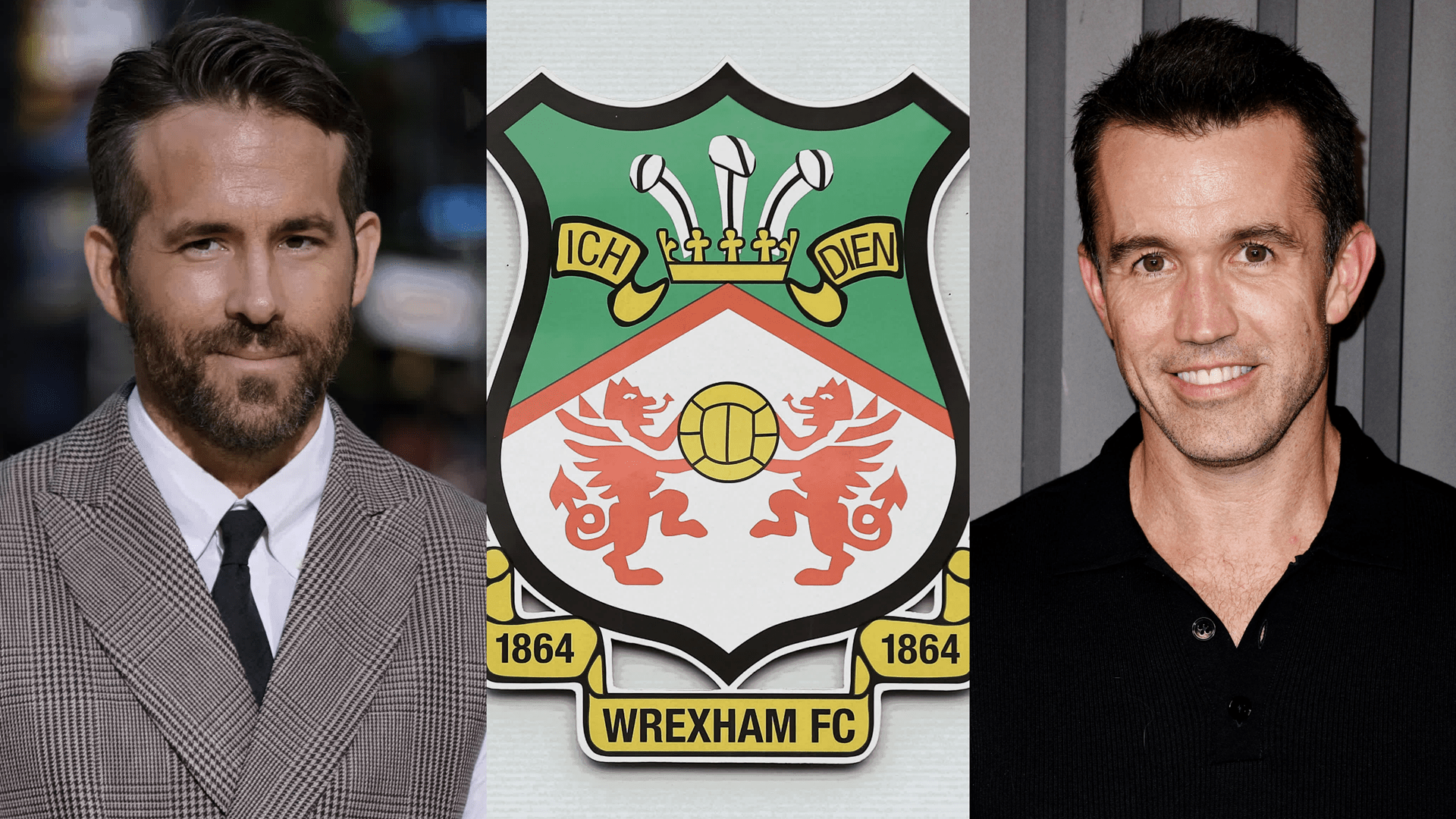

Ryan Reynolds Joins Wrexhams Promotion Party A Historic Moment For The Club

Apr 29, 2025

Ryan Reynolds Joins Wrexhams Promotion Party A Historic Moment For The Club

Apr 29, 2025 -

Pw Cs Strategic Retreat The Impact Of Exiting Nine African Markets

Apr 29, 2025

Pw Cs Strategic Retreat The Impact Of Exiting Nine African Markets

Apr 29, 2025 -

The Unexpected Journey Of Macario Martinez Street Sweeper To National Icon

Apr 29, 2025

The Unexpected Journey Of Macario Martinez Street Sweeper To National Icon

Apr 29, 2025 -

Alberto Ardila Olivares Garantia De Gol En El Futbol

Apr 29, 2025

Alberto Ardila Olivares Garantia De Gol En El Futbol

Apr 29, 2025 -

Ai Browser War Perplexitys Ceo On Challenging Googles Reign

Apr 29, 2025

Ai Browser War Perplexitys Ceo On Challenging Googles Reign

Apr 29, 2025