Investigating Thames Water's Executive Bonus Scheme: A Critical Examination

Table of Contents

The Structure of Thames Water's Executive Bonus Scheme

Thames Water's executive bonus scheme, like many others, is designed to incentivize performance through financial rewards. However, the specifics of its design have been heavily criticized. Bonuses are calculated based on a series of key performance indicators (KPIs), but the weighting and selection of these KPIs have raised concerns. Crucially, the balance between financial performance and environmental responsibility within these KPIs remains a point of contention.

- Specific examples of KPIs: Profit margins, customer complaints, regulatory compliance, and operational efficiency are frequently cited as examples of KPIs used in the scheme. However, critics argue that environmental KPIs, such as the reduction of sewage discharges and improvements in water quality, are inadequately weighted.

- Breakdown of bonus structure: The scheme typically offers bonuses as a percentage of base salary, with a potential maximum bonus representing a significant portion of annual earnings. Details about the exact percentages and thresholds are often not publicly disclosed, further fueling concerns about transparency.

- Vesting periods and clawback provisions: While vesting periods exist, ensuring executives remain for a specified time before receiving the full bonus, the effectiveness of clawback provisions—reclaiming bonuses in case of poor performance—is questionable, particularly regarding environmental violations.

The structure, therefore, is arguably incentivizing short-term financial gains over long-term sustainability and customer service improvements, a critical flaw in a sector responsible for essential public services.

Alignment of Bonuses with Company Performance

The relationship between executive bonuses and Thames Water's actual performance is a central point of controversy. Critics point to instances where bonuses were awarded despite significant environmental failures and poor customer service, raising serious questions about the scheme's effectiveness.

- Examples of bonuses awarded despite negative performance: Reports of substantial bonus payouts despite high levels of sewage discharges and widespread criticism of customer service highlight a disconnect between reward and responsibility.

- Comparison to industry benchmarks: A comparative analysis against industry benchmarks reveals that Thames Water's executive compensation often surpasses that of competitors with demonstrably better environmental and customer service records, further fueling the argument for reform.

- Correlation between KPIs and environmental impact: The lack of a strong correlation between the stated KPIs and the company's actual environmental impact suggests a fundamental flaw in the scheme's design, prioritizing financial metrics over environmental responsibility.

In conclusion, the bonus scheme does not fairly reflect Thames Water's overall performance when considering both financial and environmental factors, prompting calls for a fundamental overhaul.

Transparency and Public Accountability

Transparency surrounding the Thames Water executive bonus scheme is severely lacking. Limited information is readily available to the public, hindering effective scrutiny and accountability.

- Public access to information: The lack of detailed public disclosure regarding executive compensation packages prevents proper assessment of the scheme's fairness and alignment with performance.

- Clarity and comprehensibility: Even the information available is often unclear and difficult to interpret, preventing informed public discussion and hindering meaningful engagement.

- Level of public accountability: The overall lack of transparency undermines public accountability, allowing executive compensation decisions to occur largely without public oversight or scrutiny.

This lack of transparency fails to satisfy public expectations and undermines corporate responsibility, demanding immediate improvement.

Comparison with Other Water Companies

Comparing Thames Water's executive bonus scheme with those of other water companies in the UK reveals significant differences. Many companies employ schemes that place greater emphasis on environmental performance and customer satisfaction, illustrating alternative approaches.

- Alternative bonus schemes: Several water companies utilize bonus schemes that incorporate more robust environmental KPIs, weighting sustainability measures more heavily than financial gains.

- Comparison of KPIs and performance metrics: A clear distinction exists in the selection and weighting of KPIs across different water companies, reflecting differing priorities and corporate governance approaches.

- Variation in transparency and accountability: The level of transparency regarding executive compensation also varies significantly across the industry, highlighting best practices that Thames Water could adopt.

Thames Water's scheme lags behind industry best practices, indicating a need for significant reform.

Conclusion

Our critical examination of Thames Water's executive bonus scheme reveals a system that prioritizes short-term financial gains over long-term sustainability and public interest. The lack of transparency, the weak correlation between bonuses and overall performance, and the inadequate weighting of environmental factors all point to significant flaws in the current design. The scheme fails to adequately align incentives with long-term sustainability and public interest. Further investigation into Thames Water's Executive Bonus Scheme is crucial to ensuring responsible corporate governance and environmental protection. Demand greater transparency and accountability from your water company. A revised bonus scheme, prioritizing environmental performance and customer satisfaction alongside financial targets, is urgently needed.

Featured Posts

-

Rezultat Matcha Aleksandrova Samsonova V Shtutgarte

May 24, 2025

Rezultat Matcha Aleksandrova Samsonova V Shtutgarte

May 24, 2025 -

M56 Traffic Updates Motorway Closure Due To Serious Crash

May 24, 2025

M56 Traffic Updates Motorway Closure Due To Serious Crash

May 24, 2025 -

Nimi Muistiin Ferrari Vaervaeae 13 Vuotiaan Lupauksen

May 24, 2025

Nimi Muistiin Ferrari Vaervaeae 13 Vuotiaan Lupauksen

May 24, 2025 -

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 24, 2025

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 24, 2025 -

From Scatological Documents To Podcast Ais Role In Content Transformation

May 24, 2025

From Scatological Documents To Podcast Ais Role In Content Transformation

May 24, 2025

Latest Posts

-

Pobeda Aleksandrovoy Nad Samsonovoy V Shtutgarte

May 24, 2025

Pobeda Aleksandrovoy Nad Samsonovoy V Shtutgarte

May 24, 2025 -

Shtutgart Aleksandrova Obygrala Samsonovu

May 24, 2025

Shtutgart Aleksandrova Obygrala Samsonovu

May 24, 2025 -

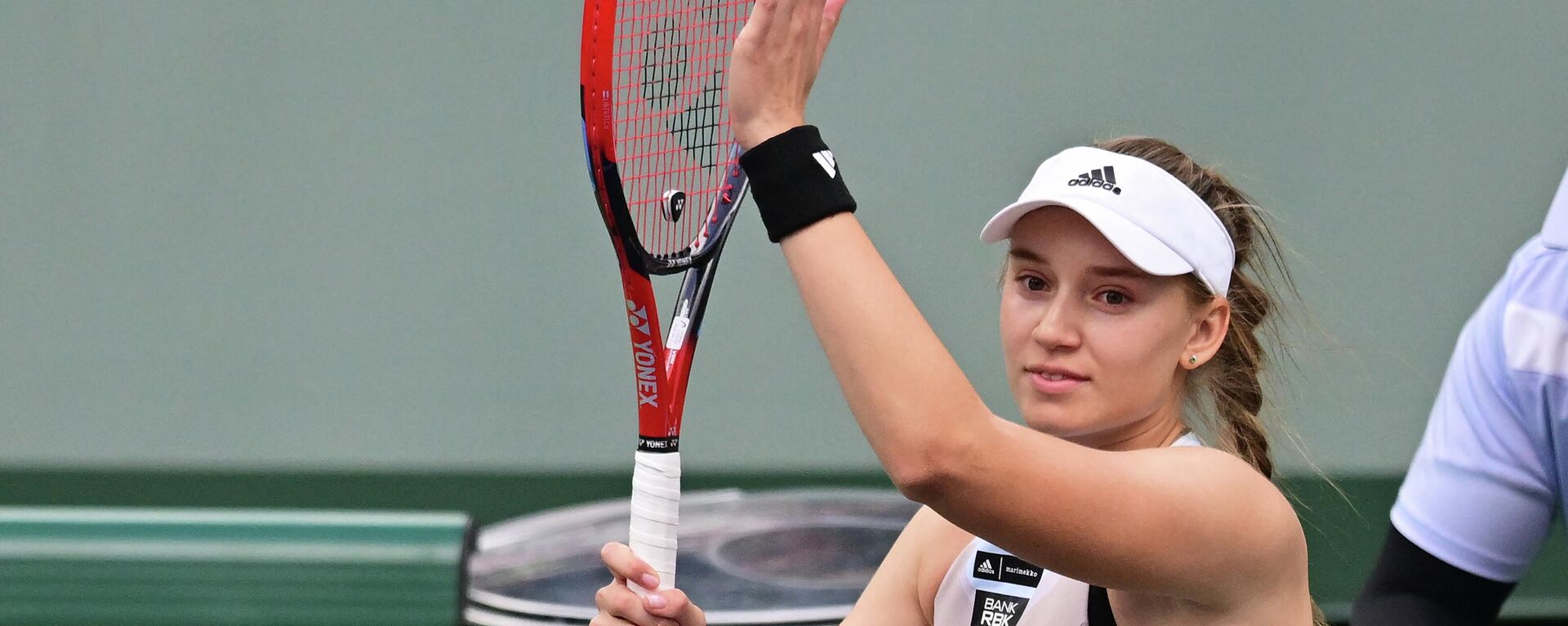

Onlayn Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira 4 Milliarda Prizovykh

May 24, 2025

Onlayn Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira 4 Milliarda Prizovykh

May 24, 2025 -

Match Rybakinoy Na Turnire S Prizovym Fondom 4 Milliarda Smotret Onlayn

May 24, 2025

Match Rybakinoy Na Turnire S Prizovym Fondom 4 Milliarda Smotret Onlayn

May 24, 2025 -

Rezultat Matcha Aleksandrova Samsonova V Shtutgarte

May 24, 2025

Rezultat Matcha Aleksandrova Samsonova V Shtutgarte

May 24, 2025