Investigating The Cause Of D-Wave Quantum (QBTS) Stock's Monday Decline

Table of Contents

Market-Wide Influences on QBTS Stock Performance

Several macroeconomic and industry-wide factors could have contributed to the QBTS stock decline on Monday.

Broader Market Sentiment and Downturn

The overall market climate plays a significant role in individual stock performance. A general downturn can negatively impact even strong companies. On Monday, several key market indices experienced declines.

- The Nasdaq Composite, a technology-heavy index, saw a [insert percentage]% drop.

- The S&P 500, a broader market indicator, also experienced a [insert percentage]% decrease.

- Negative news regarding inflation, interest rate hikes, or geopolitical instability could have fueled a general sell-off in the tech sector, dragging down QBTS along with other growth stocks. Keywords: Market volatility, tech stock downturn, economic indicators.

Sector-Specific Trends in Quantum Computing Stocks

It's crucial to consider the performance of other quantum computing stocks on Monday. Was QBTS's decline an isolated event, or did the entire sector experience a downturn?

- A comparison of QBTS's performance against competitors like [mention competitor names] is necessary to determine if sector-specific factors contributed to the drop.

- Any negative news or announcements related to the quantum computing sector as a whole – such as setbacks in research, regulatory hurdles, or reduced investment – could have influenced investor sentiment and led to widespread selling pressure. Keywords: Quantum computing investment, competitor analysis, industry trends.

Company-Specific Factors Affecting D-Wave Quantum (QBTS)

Beyond market-wide forces, several company-specific factors may have played a role in QBTS's Monday decline.

Absence of Positive News or Announcements

The absence of positive news or announcements can create selling pressure. Investors often react negatively to periods of inactivity, especially in a rapidly evolving sector like quantum computing.

- Were there any anticipated earnings reports, product launches, partnerships, or other significant events that failed to materialize? The lack of such positive catalysts could have disappointed investors and triggered selling.

- Effective investor relations and a steady stream of positive communications are crucial for maintaining investor confidence and preventing sharp stock price drops. Keywords: Earnings reports, product launches, partnerships, investor relations.

Analyst Ratings and Reports

Analyst ratings and reports hold considerable sway over investor sentiment. Negative revisions or downgrades can trigger significant selling pressure.

- Did any prominent financial analysts issue negative reports or change their rating on QBTS stock before or on Monday?

- The influence of analyst opinions on investment decisions cannot be underestimated. Negative recommendations can create a domino effect, leading to further selling. Keywords: Analyst ratings, stock recommendations, sell-side research.

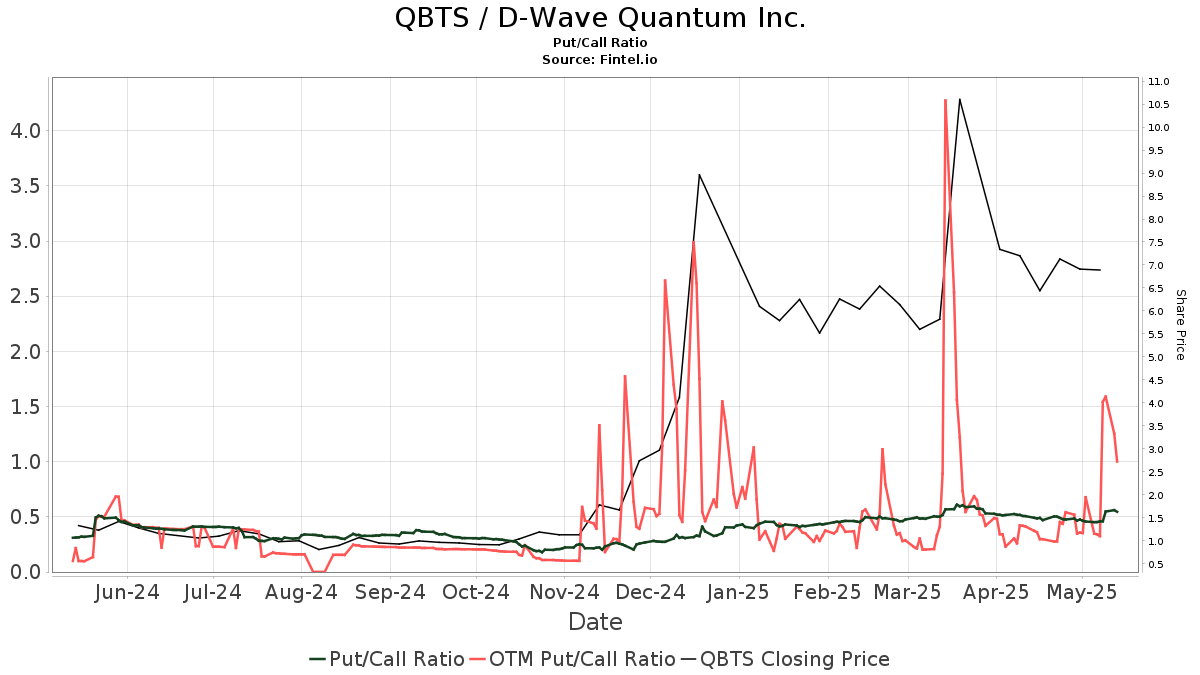

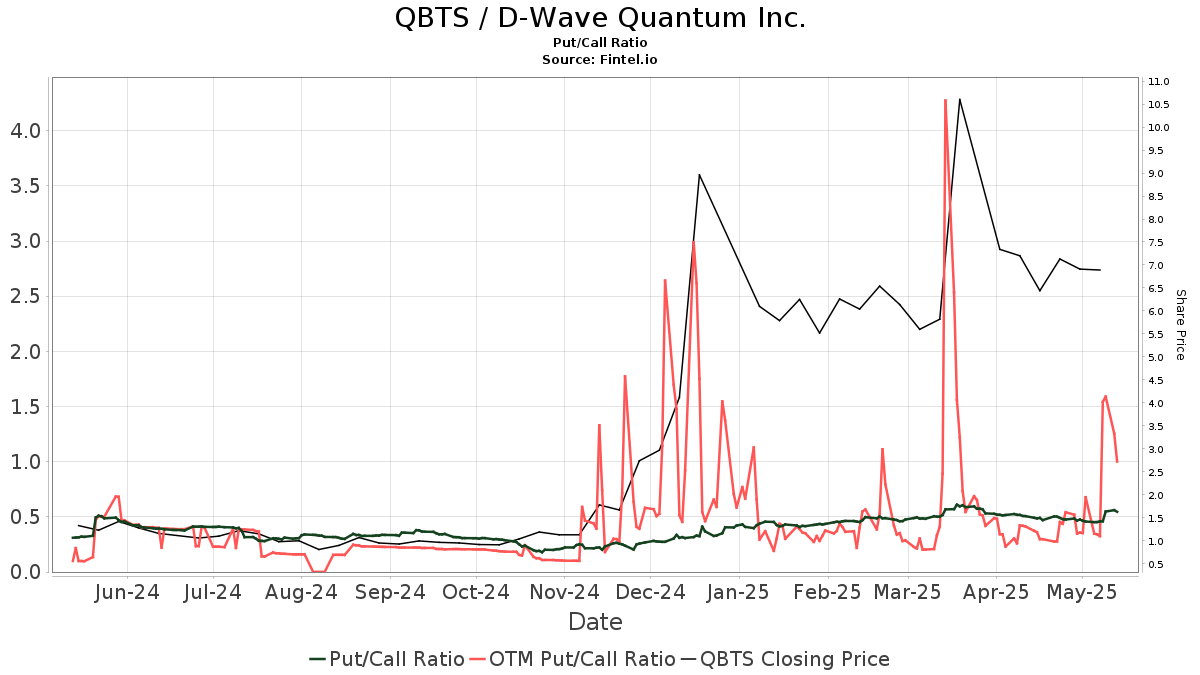

Potential Impact of Short Selling or Institutional Selling

Significant short selling or institutional selling can drastically influence a stock's price.

- High short interest indicates a substantial number of investors betting against the stock. A sudden increase in short selling could amplify downward pressure.

- Large institutional investors, such as mutual funds or hedge funds, can significantly impact trading volume and stock price through their buying and selling activities. Unusual trading volume on Monday might point to significant institutional selling. Keywords: Short interest, institutional ownership, trading volume.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Decline

The Monday decline in D-Wave Quantum (QBTS) stock price appears to be a complex issue stemming from a combination of market-wide factors and company-specific events. The broader tech sector downturn, along with the absence of positive news, potentially negative analyst sentiment, and the possibility of increased short selling or institutional selling, all likely contributed to the drop.

It is crucial for investors to continue monitoring D-Wave Quantum and the quantum computing sector closely. Understanding the interplay between macroeconomic conditions and company-specific developments is essential for informed investment decisions. Monitor D-Wave Quantum's stock performance, analyze the future of QBTS, and understand the factors influencing D-Wave Quantum's stock price to make well-informed investment choices.

Featured Posts

-

Analysis Abc News Shows Survival After Significant Layoffs

May 20, 2025

Analysis Abc News Shows Survival After Significant Layoffs

May 20, 2025 -

Ou Manger A Biarritz Les Dernieres Ouvertures De Restaurants

May 20, 2025

Ou Manger A Biarritz Les Dernieres Ouvertures De Restaurants

May 20, 2025 -

Tweede Kindje Voor Jennifer Lawrence Officiele Bevestiging

May 20, 2025

Tweede Kindje Voor Jennifer Lawrence Officiele Bevestiging

May 20, 2025 -

Solo Travel Destinations Inspiring Ideas For Your Next Trip

May 20, 2025

Solo Travel Destinations Inspiring Ideas For Your Next Trip

May 20, 2025 -

Wayne Gretzky Fast Facts Key Moments And Milestones

May 20, 2025

Wayne Gretzky Fast Facts Key Moments And Milestones

May 20, 2025

Latest Posts

-

Tyler Bate Returns To Wwe Raw Reaction And Analysis

May 20, 2025

Tyler Bate Returns To Wwe Raw Reaction And Analysis

May 20, 2025 -

The Fallout Tony Hinchcliffes Unsuccessful Wwe Talent Report

May 20, 2025

The Fallout Tony Hinchcliffes Unsuccessful Wwe Talent Report

May 20, 2025 -

Tufft Men Effektivt Jacob Friis Vinner I Malta

May 20, 2025

Tufft Men Effektivt Jacob Friis Vinner I Malta

May 20, 2025 -

Wwe Raw Tyler Bates Triumphant Return And Future Plans

May 20, 2025

Wwe Raw Tyler Bates Triumphant Return And Future Plans

May 20, 2025 -

Wwes Hinchcliffe Segment A Critical Evaluation Of The Backstage Reaction

May 20, 2025

Wwes Hinchcliffe Segment A Critical Evaluation Of The Backstage Reaction

May 20, 2025