Investigating The Factors Contributing To CoreWeave (CRWV)'s Thursday Stock Decrease

Table of Contents

Macroeconomic Factors Impacting CRWV Stock Performance

Several macroeconomic factors likely contributed to CoreWeave's (CRWV) stock performance on Thursday.

Broad Market Trends

The overall market sentiment on Thursday played a crucial role. The [mention specific market index, e.g., S&P 500] experienced a [mention percentage change, e.g., 1% decline], indicating a broader market downturn. This negative sentiment can impact even strong performers like CRWV.

- Interest rate hikes: Continued interest rate increases by central banks can dampen investor enthusiasm and lead to decreased investment in growth stocks like CRWV.

- Inflation concerns: Persistent inflation erodes purchasing power and can lead to decreased consumer and business spending, negatively impacting the cloud computing sector.

- Geopolitical instability: Ongoing geopolitical tensions can create uncertainty in the market, causing investors to seek safer investments.

Data Point: On Thursday, the S&P 500 closed down 1%, reflecting a general risk-off sentiment amongst investors. This broad market weakness likely exacerbated the decline in CRWV stock.

Sector-Specific Pressures

The cloud computing and AI infrastructure sector also faced pressure on Thursday. Several competitors, including [mention specific competitors, e.g., AWS, Azure, Google Cloud], experienced [mention percentage changes in competitor stocks].

- Increased competition: Intense competition within the cloud computing sector can put downward pressure on stock prices.

- Slowing cloud adoption: Concerns about a slowdown in the overall rate of cloud adoption could also contribute to sector-wide weakness.

- [Mention any relevant news specific to the sector that impacted trading on that day]

Data Point: A comparison chart showing CRWV's performance against its main competitors on Thursday would illustrate the sector-specific pressures. (Insert chart here).

Company-Specific News and Announcements Affecting CRWV Stock Price

In addition to macroeconomic headwinds, company-specific news might have influenced CRWV's stock price.

Earnings Reports and Financial Performance

[Mention if CRWV released any financial news on or around Thursday]. If so, analyze the key takeaways:

- Revenue growth: Was revenue growth in line with expectations? Any significant deviation could impact stock prices.

- Earnings per share (EPS): Did the EPS meet or exceed analyst estimates? A miss could trigger selling pressure.

- Future guidance: Was the company’s outlook for future growth positive or cautious? Negative guidance can lead to stock price declines.

Data Point: If an earnings report was released, include specific numbers from the report (e.g., revenue of X, EPS of Y, guidance of Z%).

Regulatory Developments and Legal Issues

[Mention any regulatory announcements or legal challenges impacting CoreWeave on or around Thursday].

- Potential fines or penalties: Any potential legal issues could create uncertainty and lead to a sell-off.

- New regulations: Changes in regulations could impact CoreWeave’s operations and profitability.

Data Point: Link to relevant news articles or official statements regarding any regulatory or legal developments.

Analyst Ratings and Price Target Changes

Any changes in analyst ratings or price targets for CRWV stock could significantly impact its price.

- Downgrades: Negative analyst reviews or lowered price targets generally exert downward pressure on stock prices.

- Reduced buy ratings: A decrease in the number of analysts recommending a "buy" rating signals decreasing confidence in the stock.

Data Point: Include quotes from analyst reports if available, highlighting their reasoning for any rating changes.

Technical Analysis of CRWV Stock Chart on Thursday

Analyzing the CRWV stock chart on Thursday provides further insights into the price drop.

Trading Volume and Volatility

High trading volume alongside significant price movement indicates strong selling pressure.

- High volume: Increased volume suggests a larger number of investors are selling their CRWV shares.

- Increased volatility: Significant price swings during the day demonstrate market uncertainty and heightened risk.

Data Point: Include a chart illustrating trading volume and price volatility for CRWV stock on Thursday.

Support and Resistance Levels

Technical analysts identify support and resistance levels to predict price movements.

- Support level breach: A break below a key support level often signals further price declines.

- Resistance level failure: Failure to break through a resistance level indicates a lack of buying pressure.

Data Point: Include a chart showing support and resistance levels on the CRWV stock chart for Thursday.

Chart Patterns

Certain chart patterns can indicate future price movements.

- Head and shoulders pattern: This pattern often suggests a price reversal to the downside.

- Double top pattern: This pattern also signals potential for further price decreases.

Data Point: Include charts illustrating any relevant chart patterns observed on Thursday.

Conclusion: Understanding and Monitoring CoreWeave (CRWV) Stock Fluctuations

CoreWeave’s (CRWV) Thursday stock decline resulted from a combination of macroeconomic headwinds, such as broader market weakness and sector-specific pressures, and potentially company-specific news impacting investor sentiment. The technical analysis further confirmed the downward pressure.

Key Takeaways: Investors should consider the interconnectedness of macroeconomic trends, company performance, and analyst sentiment when assessing stock price fluctuations. Careful analysis of financial reports, regulatory updates, and market conditions is crucial.

Call to Action: Stay informed about CRWV by monitoring its performance, upcoming earnings reports, and any significant news impacting the cloud computing and AI infrastructure sectors. Further investigate CRWV's future prospects and conduct thorough research before making any investment decisions. Remember to diversify your portfolio and manage risk appropriately.

Featured Posts

-

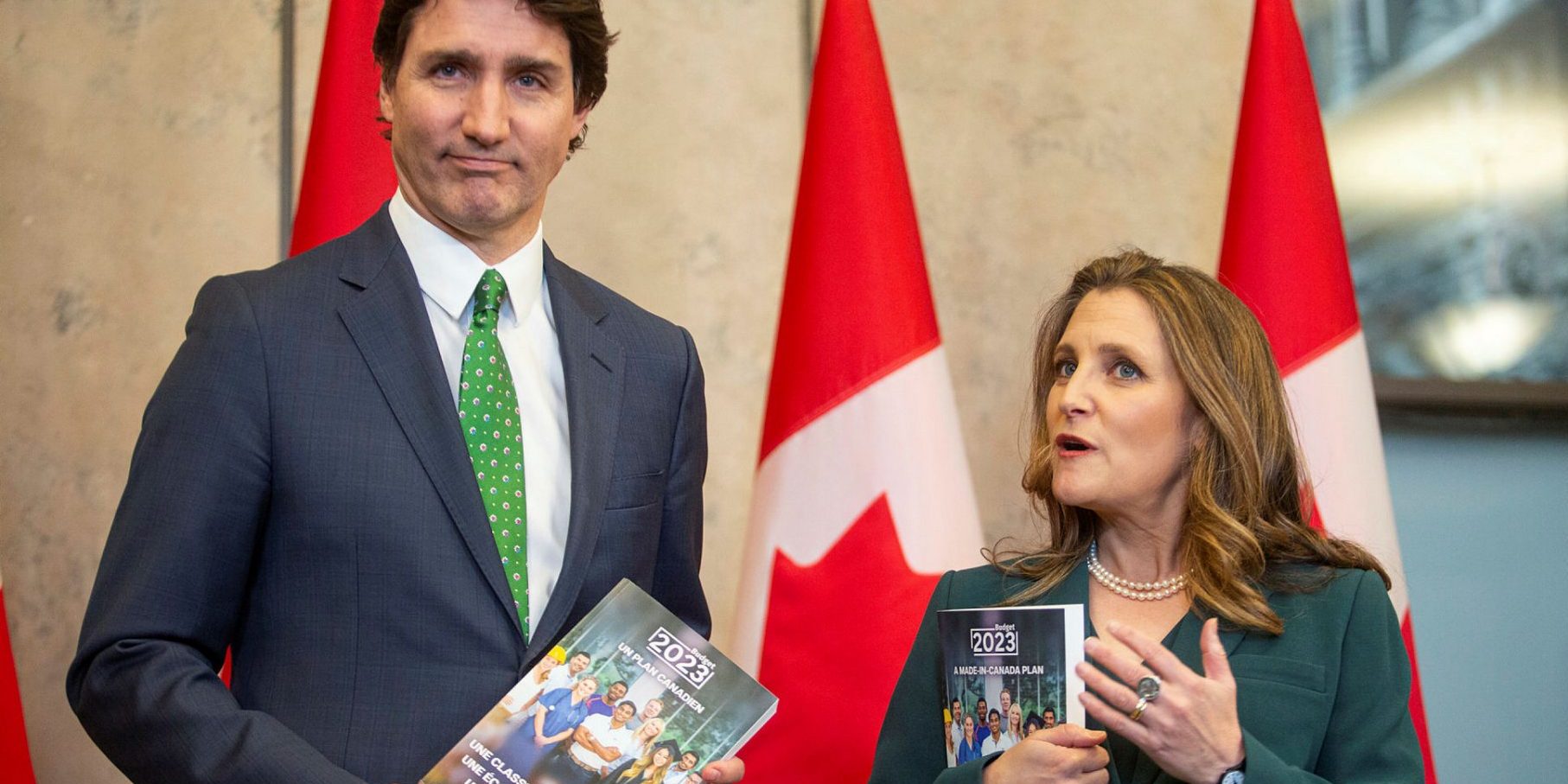

Federal Election Fallout Analyzing Its Effects On Saskatchewan Politics

May 22, 2025

Federal Election Fallout Analyzing Its Effects On Saskatchewan Politics

May 22, 2025 -

Streamers Are Making Money The Complex Reality For Viewers

May 22, 2025

Streamers Are Making Money The Complex Reality For Viewers

May 22, 2025 -

Is A Dexter Resurrection Trailer Coming Soon Release Date Rumors

May 22, 2025

Is A Dexter Resurrection Trailer Coming Soon Release Date Rumors

May 22, 2025 -

Discover The Unique Taste Of Cassis Blackcurrant

May 22, 2025

Discover The Unique Taste Of Cassis Blackcurrant

May 22, 2025 -

The Allure Of Cassis Blackcurrant Flavor Profile And Uses

May 22, 2025

The Allure Of Cassis Blackcurrant Flavor Profile And Uses

May 22, 2025

Latest Posts

-

Music World Mourns Death Of Adam Ramey Dropout Kings Singer

May 22, 2025

Music World Mourns Death Of Adam Ramey Dropout Kings Singer

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist 32 Dies

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist 32 Dies

May 22, 2025 -

Adam Ramey Of Dropout Kings Dead At Age

May 22, 2025

Adam Ramey Of Dropout Kings Dead At Age

May 22, 2025