Investing In 2025: MicroStrategy Stock Or Bitcoin? A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy, a publicly traded company, is primarily known for its enterprise analytics software. Let's delve into its core business and its significant Bitcoin investment strategy.

MicroStrategy's Core Business

MicroStrategy's core business centers around providing enterprise analytics software and cloud-based solutions. Their offerings in business intelligence, mobile software, and cloud-based applications cater to a wide range of businesses seeking to improve data analysis and decision-making processes. They are a major player in the enterprise analytics software market, competing with other established players in the industry. This traditional business segment provides a relatively stable, albeit less exciting, revenue stream. Keywords: enterprise analytics software, business intelligence, cloud-based solutions, data analytics, enterprise software.

MicroStrategy's Bitcoin Investment Strategy

MicroStrategy's bold move into Bitcoin has significantly shaped its trajectory and attracted substantial attention. Under the leadership of Michael Saylor, the company has amassed a considerable amount of Bitcoin, transforming itself into a significant corporate holder of the cryptocurrency. This strategy reflects a belief in Bitcoin's long-term value as a store of value and a hedge against inflation. This heavy investment in Bitcoin, however, introduces significant volatility to MicroStrategy's stock price, directly tying its performance to the price fluctuations of Bitcoin. Keywords: Bitcoin investment, cryptocurrency holdings, corporate Bitcoin adoption, Michael Saylor, Bitcoin strategy.

-

Advantages of Investing in MicroStrategy Stock:

- Exposure to both a traditional software business and the potential upside of Bitcoin.

- Potential for high growth if Bitcoin's price appreciates.

- Relatively easy access through traditional stock markets.

-

Risks of Investing in MicroStrategy Stock:

- Significant volatility tied to Bitcoin's price.

- Dependence on the enterprise software market's performance.

- Regulatory changes affecting either the software industry or the cryptocurrency market could negatively impact the stock price.

Analyzing Bitcoin's Future Potential in 2025

Bitcoin, the leading cryptocurrency, has captured global attention due to its unique features and potential. Let's examine its technological underpinnings and future prospects.

Bitcoin's Technological Fundamentals

Bitcoin's foundation lies in blockchain technology, a decentralized and secure ledger that records all transactions. This inherent decentralization makes it resistant to censorship and single points of failure. Its limited supply (21 million coins) contributes to its perceived value as a deflationary asset and a potential store of value. As cryptocurrency market cap continues to grow, Bitcoin maintains a dominant position. Keywords: Bitcoin blockchain, decentralized currency, cryptocurrency market cap, store of value, Bitcoin mining.

Regulatory Landscape and Market Adoption

The regulatory landscape surrounding Bitcoin remains complex and evolving. Different jurisdictions are adopting varying approaches, influencing Bitcoin's price and accessibility. However, increased institutional investment in Bitcoin and growing mainstream adoption signify a shift in perception. More and more individuals and institutions are recognizing Bitcoin's potential as an asset class, leading to increased demand and price appreciation. Keywords: Bitcoin regulation, cryptocurrency adoption, institutional investment in Bitcoin, Bitcoin price prediction, crypto regulation.

-

Potential Upsides of Investing Directly in Bitcoin:

- High growth potential due to increasing adoption and scarcity.

- Potential inflation hedge.

- Decentralized and resistant to censorship.

-

Potential Downsides of Investing Directly in Bitcoin:

- Extreme price volatility.

- Regulatory uncertainty.

- Security risks associated with self-custody.

Direct Comparison: MicroStrategy Stock vs. Bitcoin in 2025

Choosing between MicroStrategy stock and Bitcoin necessitates a careful assessment of your risk tolerance and investment goals.

Risk Tolerance and Investment Goals

Investors with a higher risk tolerance and a longer-term investment horizon might find Bitcoin more appealing due to its potential for significant growth, despite its volatility. Those seeking a more balanced approach, with exposure to both established markets and the cryptocurrency space, might prefer MicroStrategy stock. Keywords: risk assessment, investment strategy, portfolio diversification, long-term investment.

Potential Returns and Volatility

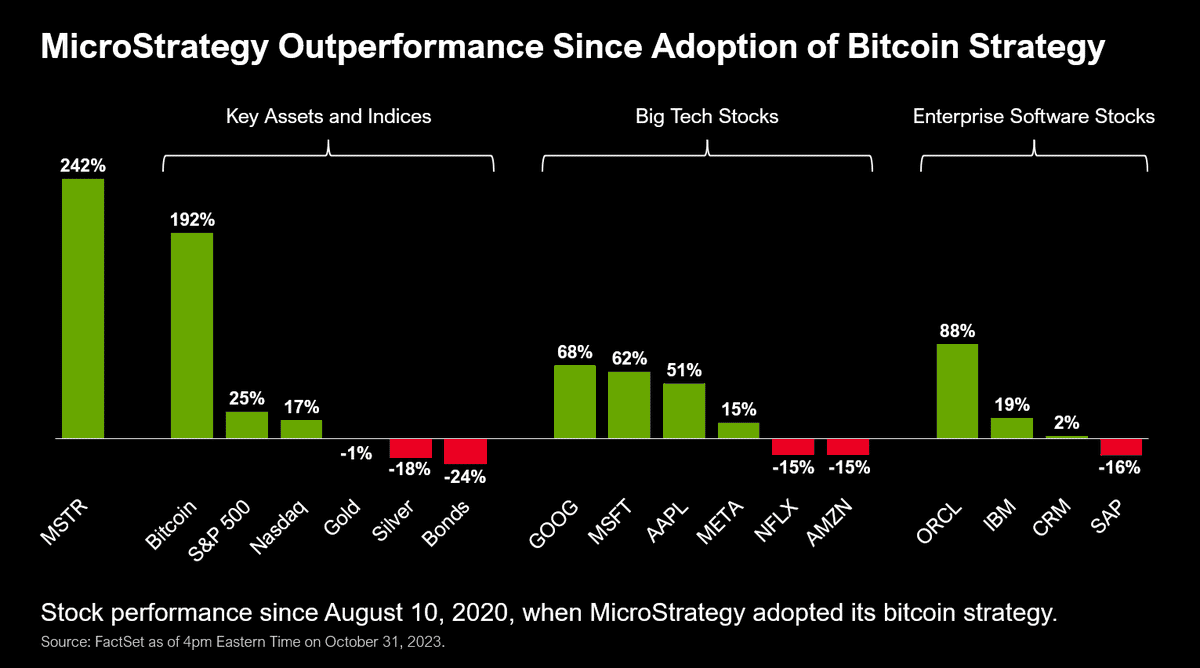

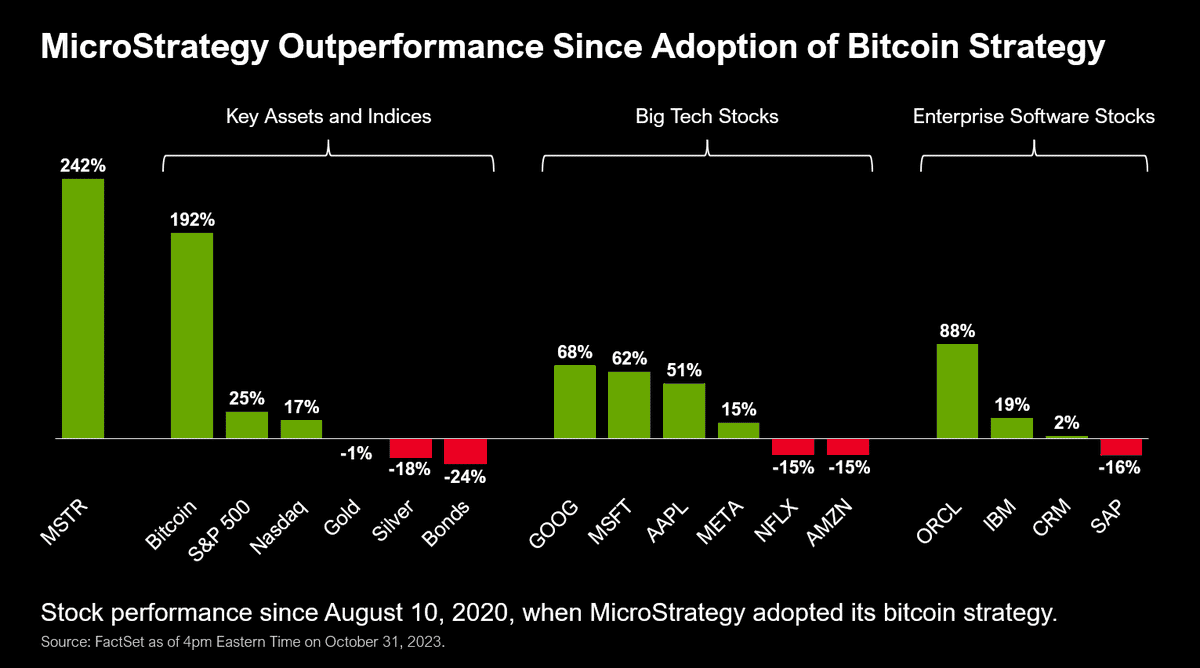

Comparing potential returns and volatility requires considering historical data and projections (with appropriate disclaimers). Bitcoin's historical volatility is significantly higher than MicroStrategy's stock, but its potential for growth is also considerably larger. MicroStrategy's performance is partially influenced by Bitcoin’s performance, making it less volatile than direct Bitcoin investment but still significantly riskier than traditional investments. Keywords: return on investment, volatility analysis, investment risk, risk management.

- Pros and Cons Summary:

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Risk | Moderate to High (tied to Bitcoin) | High |

| Volatility | Moderate to High (tied to Bitcoin) | Very High |

| Potential Return | Moderate to High (tied to Bitcoin) | Very High |

| Accessibility | Easy (through traditional stock markets) | Requires cryptocurrency exchange access |

| Liquidity | Generally high | Can vary depending on market conditions |

- Investment Strategy Examples:

- Conservative: Invest in established assets, potentially with a small allocation to MicroStrategy stock for limited Bitcoin exposure.

- Moderate: Diversify across MicroStrategy stock and Bitcoin, carefully managing risk based on personal tolerance.

- Aggressive: Primarily invest in Bitcoin, accepting higher risk for potentially higher returns.

Conclusion

Investing in 2025: MicroStrategy Stock or Bitcoin requires careful consideration of your individual risk profile and financial goals. MicroStrategy offers a blend of traditional business exposure and Bitcoin exposure, while direct Bitcoin investment offers higher potential returns but also substantially higher volatility. Remember, past performance is not indicative of future results. Both options present significant risks and rewards.

Final Thoughts: Thorough research and understanding your own risk tolerance are paramount before making any investment decision. Both MicroStrategy stock and Bitcoin are volatile assets. Diversification is crucial, and no single investment should make up the entirety of your portfolio.

Call to Action: Continue your research and make an informed decision about Investing in 2025: MicroStrategy Stock or Bitcoin, carefully considering your unique financial circumstances. Remember to consult with a qualified financial advisor before making any significant investment choices.

Featured Posts

-

Palantir Technologies Stock Buy Sell Or Hold

May 09, 2025

Palantir Technologies Stock Buy Sell Or Hold

May 09, 2025 -

Turkey X Blocks Access To Jailed Mayors Social Media Following Protests

May 09, 2025

Turkey X Blocks Access To Jailed Mayors Social Media Following Protests

May 09, 2025 -

Arctic Comic Con 2025 A Photo Recap Characters Ectomobile And More

May 09, 2025

Arctic Comic Con 2025 A Photo Recap Characters Ectomobile And More

May 09, 2025 -

From Underdogs To Champions Luis Enriques Resurgence Of Psg

May 09, 2025

From Underdogs To Champions Luis Enriques Resurgence Of Psg

May 09, 2025 -

Analysis Of Pam Bondis Comments Regarding The Killing Of American Citizens

May 09, 2025

Analysis Of Pam Bondis Comments Regarding The Killing Of American Citizens

May 09, 2025