Investing In BBAI: A Realistic Look At BigBear.ai's Stock Potential

Table of Contents

Understanding BigBear.ai's Business Model and Technology

BigBear.ai offers AI-powered solutions primarily to government and commercial clients. They tackle complex problems using advanced analytics and cutting-edge technology. Their expertise spans several crucial areas, including: data analytics for enhanced decision-making; robust cybersecurity solutions protecting critical infrastructure; and sophisticated geospatial intelligence for improved situational awareness.

BigBear.ai leverages a range of key technologies, including machine learning (ML), deep learning (DL), and natural language processing (NLP), to build powerful and adaptable solutions. Their approach focuses on providing customized solutions tailored to specific client needs.

- Successful Projects and Client Wins: BigBear.ai has secured several significant contracts with government agencies and large corporations, demonstrating their capabilities and market acceptance. Specific examples are often highlighted in their press releases and investor reports.

- Proprietary Technology and Intellectual Property: While details are often kept confidential for competitive reasons, BigBear.ai possesses several proprietary algorithms and technologies that form the core of their intellectual property portfolio, providing a competitive edge.

- Scalability and Future Growth: The company's technology possesses inherent scalability, meaning it can adapt to handle increasing data volumes and more complex problems. This scalability represents a significant growth opportunity as the demand for AI solutions expands.

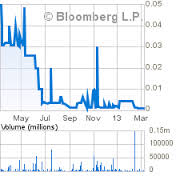

Analyzing BBAI Stock Performance and Valuation

BBAI's stock performance has been notably volatile, exhibiting significant price fluctuations. Investors need to be prepared for substantial ups and downs. A thorough analysis of BigBear.ai's financial statements, including revenue, earnings, and debt levels, is crucial before making any investment decisions. Comparing BBAI's valuation metrics to competitors within the AI sector provides essential context.

- Key Financial Ratios: Investors should closely monitor key financial ratios such as the Price-to-Earnings (P/E) ratio and revenue growth rates to gauge the company's financial health and growth trajectory.

- Recent Earnings Reports: Reviewing recent earnings reports and their impact on the stock price helps assess market sentiment and the company's performance against expectations.

- Market Capitalization: Understanding BigBear.ai's market capitalization provides a measure of the company's overall size and value relative to its peers in the AI market.

Assessing the Risks and Rewards of Investing in BBAI

Investing in BBAI, like any investment in the AI sector, involves considerable risk.

Potential Risks:

- Intense Competition: The AI market is highly competitive, with numerous established players and emerging startups vying for market share.

- Market Volatility: The AI sector is susceptible to significant market fluctuations driven by technological breakthroughs, regulatory changes, and investor sentiment.

- Technological Disruptions: Rapid technological advancements could render BigBear.ai's current technology obsolete, requiring significant investment in R&D to stay competitive.

- Financial Instability: As a relatively young company, BBAI’s financial stability could be vulnerable to economic downturns or unforeseen circumstances.

Potential Rewards:

- High Growth Potential: The AI sector is projected to experience substantial growth in the coming years, offering considerable potential for BBAI to capitalize on this expanding market.

- First-Mover Advantage: BigBear.ai holds a first-mover advantage in certain niche markets, giving them a head start over competitors.

- Government Contracts: Securing government contracts can provide a stable revenue stream and boost the company's financial standing.

The overall risk tolerance required for investing in BBAI is high. This is not an investment for risk-averse individuals.

- Competitive Threats: Identifying specific competitors and analyzing their strengths and weaknesses helps assess the competitive landscape.

- Regulatory Changes: Changes in government regulations concerning data privacy, cybersecurity, or AI development could significantly impact BBAI's operations.

- Management Team Expertise: Evaluating the experience and expertise of BigBear.ai's management team is crucial in assessing the company's ability to navigate the challenges and opportunities ahead.

Comparing BBAI to Other AI Stocks

Several other publicly traded AI companies compete with BigBear.ai, including notable players like C3.ai and Palantir. Comparing BBAI’s strengths and weaknesses against its competitors offers valuable insights into its relative position within the market. Analyzing their stock performance and valuation provides a broader context for assessing BBAI's investment potential.

- Similar Companies: A thorough comparison with companies like C3.ai and Palantir is essential for relative valuation and strategic assessment.

- Key Differentiating Factors: Identifying what sets BigBear.ai apart from its competitors—its unique technologies, target markets, or business model—is critical.

- Comparative Metrics: A summary table comparing key financial and operational metrics (revenue growth, market capitalization, profitability) can provide a concise overview for comparison.

Conclusion: Making Informed Decisions About Investing in BBAI

BigBear.ai presents a compelling investment opportunity in the rapidly expanding AI sector. However, the company's business model, stock performance, and significant risk profile must be carefully considered. While the potential rewards are substantial, so are the risks. Thorough due diligence is paramount before investing in BBAI or any other stock, particularly in a volatile market like AI.

Remember, conducting comprehensive research and understanding your own risk tolerance are essential before investing in BBAI stock. Consult with a qualified financial advisor to discuss your investment goals and determine if BBAI aligns with your risk profile. Investing in BBAI or any AI stock requires careful consideration and a long-term perspective.

Featured Posts

-

Louane Presente Sa Chanson Pour L Eurovision 2024 En France

May 20, 2025

Louane Presente Sa Chanson Pour L Eurovision 2024 En France

May 20, 2025 -

Restaurant Rooftop Galeries Lafayette Biarritz Avant Gout Pau Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025

Restaurant Rooftop Galeries Lafayette Biarritz Avant Gout Pau Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025 -

Hmrc Tax Letters Uk Households Earning Over 23 000 Targeted

May 20, 2025

Hmrc Tax Letters Uk Households Earning Over 23 000 Targeted

May 20, 2025 -

Biarritz Decouvrir Les Nouveaux Restaurants Et Chefs

May 20, 2025

Biarritz Decouvrir Les Nouveaux Restaurants Et Chefs

May 20, 2025 -

Big Bear Ai Holdings Inc Securities Lawsuit Filed

May 20, 2025

Big Bear Ai Holdings Inc Securities Lawsuit Filed

May 20, 2025

Latest Posts

-

Giakoymakis Kai Kroyz Azoyl I Prokrisi Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis Kai Kroyz Azoyl I Prokrisi Ston Teliko Toy Champions League

May 20, 2025 -

Protomagia Sto Oropedio Evdomos Odigos Gia Mia Aksexasti Empeiria

May 20, 2025

Protomagia Sto Oropedio Evdomos Odigos Gia Mia Aksexasti Empeiria

May 20, 2025 -

Kroyz Azoyl O Dromos Pros Ton Teliko Champions League Me Ton Giakoymaki

May 20, 2025

Kroyz Azoyl O Dromos Pros Ton Teliko Champions League Me Ton Giakoymaki

May 20, 2025 -

Prokrisi Kroyz Azoyl O Giakoymakis Odigei Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Odigei Ston Teliko Champions League

May 20, 2025 -

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025