Investing In Belgium's Energy Future: Financing A 270MWh BESS Project

Table of Contents

The Importance of BESS in Belgium's Energy Transition

Belgium's ambitious renewable energy targets necessitate significant changes to its energy infrastructure. The intermittent nature of solar and wind power presents a challenge: energy production fluctuates depending on weather conditions. This is where BESS technologies become invaluable. A 270MWh BESS project can significantly enhance grid stability and reliability, enabling better integration of renewable energy sources.

BESS provides several crucial benefits:

- Increased grid stability through frequency regulation: BESS can rapidly respond to changes in electricity supply and demand, preventing blackouts and ensuring grid stability. This is vital for a grid increasingly reliant on intermittent renewable sources.

- Peak demand shaving and reduction of reliance on fossil fuel peaker plants: BESS can store excess energy during periods of low demand and release it during peak times, reducing the need for polluting fossil fuel-based power plants.

- Improved integration of solar and wind power: BESS acts as a buffer, storing excess renewable energy generated during periods of high production and releasing it when production is low. This greatly improves the reliability and consistency of renewable energy supply.

- Enhanced grid resilience and security: BESS enhances grid resilience against unforeseen events, such as natural disasters or cyberattacks, by providing backup power and supporting grid operations during outages.

- Arbitrage opportunities in the energy market: BESS can capitalize on price fluctuations in the electricity market, buying energy at low prices and selling it at higher prices, generating additional revenue.

Financing Options for the 270MWh BESS Project

Securing funding for such a large-scale project requires exploring diverse financing options. Several avenues exist for financing the 270MWh BESS project:

Public Funding and Grants

The Belgian government offers various subsidies, grants, and tax incentives for renewable energy projects, including BESS installations. These incentives aim to accelerate the energy transition and support large-scale renewable energy deployment. Specific programs and their eligibility criteria should be reviewed with relevant governmental bodies.

Private Equity and Venture Capital

Private equity firms and venture capitalists are increasingly investing in large-scale renewable energy projects, recognizing the long-term growth potential and attractive return on investment. Their funding can provide significant capital for the BESS project.

Project Finance

Project finance structures, including non-recourse loans, are commonly used to finance large infrastructure projects like BESS. This minimizes lender risk by focusing on the project's cash flows rather than the sponsor's overall financial health.

Green Bonds and Sustainable Finance

The growing market for green bonds and other sustainable finance instruments offers another viable option. These bonds are specifically designed to finance environmentally friendly projects, attracting investors focused on ESG (Environmental, Social, and Governance) criteria.

Each financing option presents unique advantages and disadvantages. Public funding may involve stringent regulations and lengthy application processes, while private equity investment might entail relinquishing some control. Project finance requires meticulous due diligence and financial modeling, whereas green bonds might attract a premium interest rate. A balanced approach, potentially combining multiple funding sources, could optimize project financing.

Investment Opportunities and Returns

The 270MWh BESS project presents a compelling investment opportunity with significant potential returns. The ROI will depend on factors such as energy prices, government incentives, and operational costs. However, the long-term profitability is promising, driven by the increasing demand for grid stabilization services and the growing integration of renewable energy sources.

- Long-term profitability: Consistent revenue streams from grid services and potential arbitrage opportunities contribute to long-term profitability.

- Tax benefits and financial incentives: Government incentives further enhance the financial attractiveness of the project.

- ESG appeal: The project's environmental benefits, aligning with sustainability goals, attract investors prioritizing ESG factors.

Regulatory Landscape and Permitting Process in Belgium

Navigating the regulatory landscape is crucial for successful project implementation. Belgium has a framework for renewable energy projects, including BESS, but the permitting process can be complex. Key regulatory bodies like the CREG (Commission de Régulation de l'Électricité et du Gaz) play a significant role in the approval process. Understanding the required permits, approvals, and timelines is essential for efficient project execution. Consulting with legal and regulatory experts familiar with the Belgian energy sector is highly recommended.

Conclusion: Investing in Belgium's Energy Future: Securing a Sustainable Energy Supply

This article highlighted the critical role of BESS in Belgium's energy transition and the substantial investment opportunities presented by the 270MWh BESS project. Various financing options exist, each with its own advantages and disadvantages. The project offers significant long-term returns and aligns perfectly with ESG investment priorities. Invest in Belgium's green energy future by exploring the financing options for this crucial project. Become part of Belgium's sustainable energy revolution and explore BESS project financing opportunities. Don't miss this chance to contribute to a cleaner, more secure energy future for Belgium.

Featured Posts

-

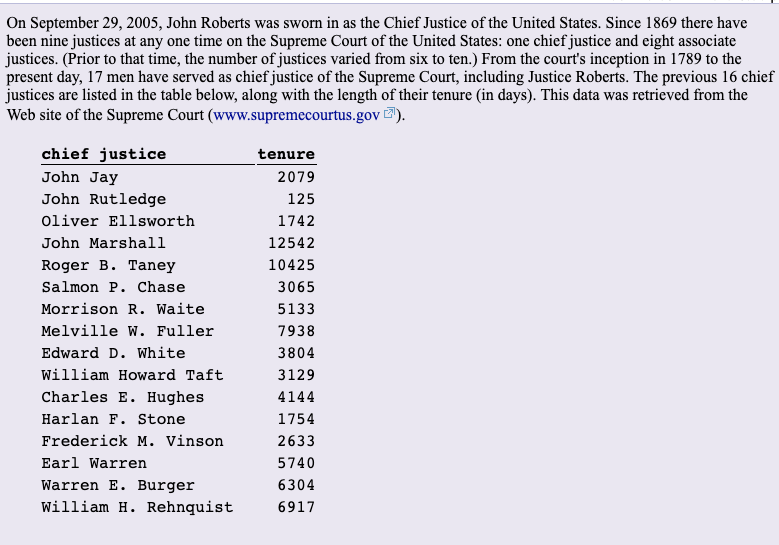

A Critical Analysis Of John Roberts Three Key Rulings On Church And State Separation

May 03, 2025

A Critical Analysis Of John Roberts Three Key Rulings On Church And State Separation

May 03, 2025 -

Fortnite Update 34 40 Causes Server Outage When Will It Be Back Online

May 03, 2025

Fortnite Update 34 40 Causes Server Outage When Will It Be Back Online

May 03, 2025 -

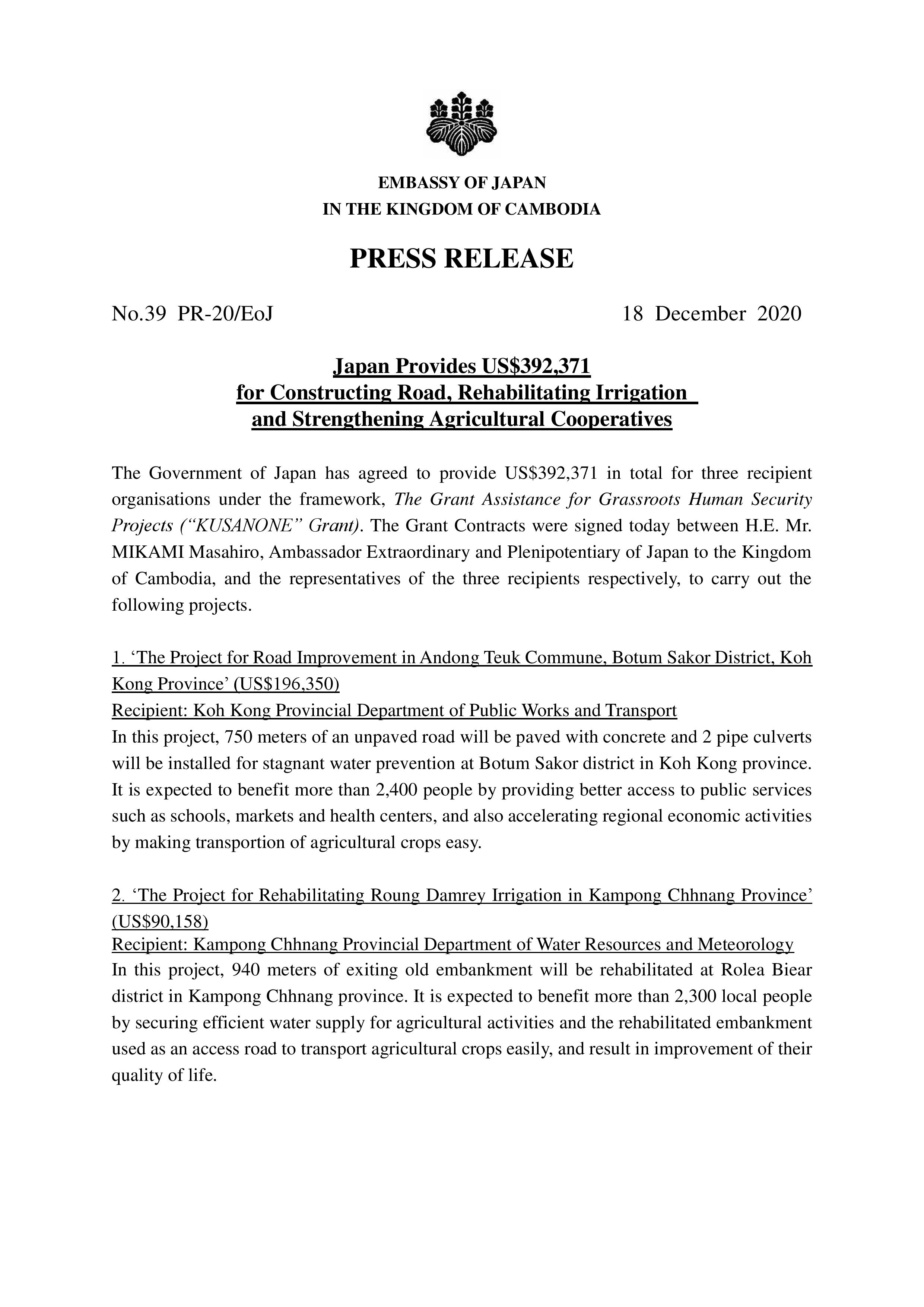

Signing And Exchange Of Notes Grant Assistance To Mauritius

May 03, 2025

Signing And Exchange Of Notes Grant Assistance To Mauritius

May 03, 2025 -

Indias Pm Modis Upcoming France Trip Ai Summit And Ceo Forum Participation

May 03, 2025

Indias Pm Modis Upcoming France Trip Ai Summit And Ceo Forum Participation

May 03, 2025 -

The Justice Department And School Desegregation The End Of An Order And The Beginning Of What

May 03, 2025

The Justice Department And School Desegregation The End Of An Order And The Beginning Of What

May 03, 2025

Latest Posts

-

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025 -

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025 -

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025 -

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025