Investing In BigBear.ai (BBAI): A Penny Stock Perspective Using Key Indicators

Table of Contents

Understanding BigBear.ai (BBAI) Fundamentals

Company Overview and Business Model

BigBear.ai (BBAI) is a technology company specializing in providing artificial intelligence (AI) and big data solutions to government and commercial clients. Their business model centers on delivering advanced analytics, machine learning, and AI-powered decision support systems. BBAI boasts a strong team of data scientists and engineers, giving them a competitive edge in the rapidly growing AI market. This AI stock offers specialized services within niche markets.

Financial Health

Assessing the financial health of BBAI is crucial for any potential investor. While revenue growth is essential, profitability and financial stability need careful consideration.

- Revenue Growth: Examine recent quarterly and annual reports to identify growth trends. Are revenues increasing steadily or experiencing fluctuations?

- Profitability: Is BBAI profitable, or is it operating at a loss? Analyzing profit margins helps understand the efficiency of the business model.

- Debt Levels and Liquidity: High debt levels can be a significant risk factor. Evaluate BBAI’s debt-to-equity ratio and its cash flow to ensure sufficient liquidity.

- Cash Flow: Positive cash flow is a critical indicator of a healthy business. Analyze BBAI's operating cash flow and free cash flow to assess its ability to generate funds.

Future Outlook

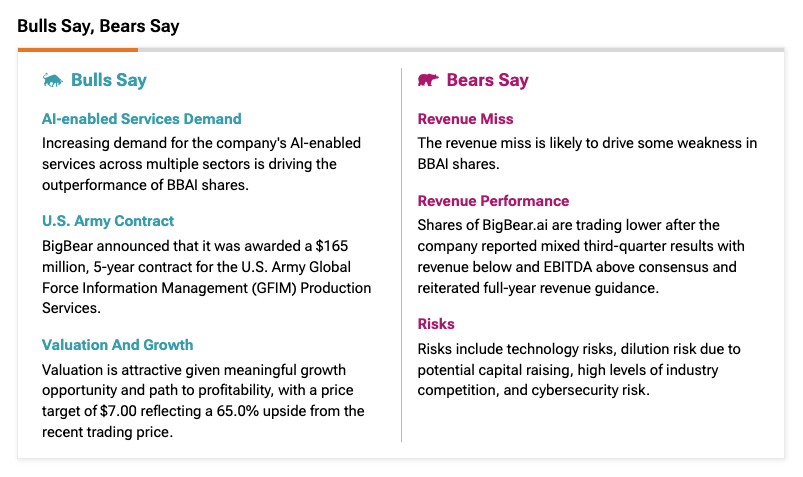

BigBear.ai's future outlook depends on several factors. Potential catalysts include:

- Securing new contracts: Government contracts represent a significant portion of BBAI’s revenue. Success in acquiring new contracts would positively impact its financial performance.

- Technological advancements: BBAI's ability to innovate and adapt to the ever-evolving AI landscape will determine its long-term competitiveness.

- Strategic partnerships: Collaborations with other companies could expand market reach and accelerate growth.

However, several risks exist:

- Intense competition: The AI market is highly competitive. BBAI needs to maintain its competitive advantage to succeed.

- Market saturation: The potential for market saturation could limit future growth opportunities.

- Regulatory changes: Government regulations can impact the AI industry, influencing BBAI's operations and profitability.

Technical Analysis of BBAI Stock

Technical analysis complements fundamental analysis in assessing BBAI's investment potential.

Chart Patterns

Analyzing BBAI's price charts can reveal important trends. Identifying support and resistance levels, as well as uptrends and downtrends, can help predict future price movements.

Trading Volume

High trading volume often accompanies significant price changes. Increased volume during an uptrend suggests strong buying pressure, while high volume during a downturn indicates selling pressure.

Moving Averages

Moving averages, like the 50-day and 200-day moving averages, smooth out price fluctuations and can help identify trends. Crossovers between these averages can generate buy or sell signals.

Relative Strength Index (RSI)

The RSI is a momentum indicator that helps determine whether a stock is overbought or oversold. RSI values above 70 often suggest an overbought condition, while values below 30 suggest an oversold condition.

Other Technical Indicators

Other technical indicators, such as the Moving Average Convergence Divergence (MACD) and Bollinger Bands, can provide additional insights into price trends and momentum.

Risk Assessment for BBAI Penny Stock Investment

Investing in BBAI, a penny stock, involves significant risks.

Volatility

Penny stocks are inherently volatile, meaning their prices can fluctuate dramatically in short periods. BBAI is no exception, and investors should be prepared for significant price swings.

Liquidity

Low trading volume in penny stocks like BBAI can make it difficult to buy or sell shares quickly, potentially leading to losses if you need to exit your position rapidly.

Financial Risk

BBAI's financial health, as discussed earlier, presents a significant risk. Losses, high debt levels, and inconsistent revenue streams all contribute to the uncertainty.

Market Risk

Broader market conditions and economic factors can significantly impact BBAI’s performance. Economic downturns or negative sentiment in the tech sector could lead to substantial price drops.

Comparing BBAI to Similar AI Penny Stocks

To gain perspective, let's compare BBAI to other AI-focused penny stocks (specific examples would need to be researched and updated regularly for accuracy and relevance). Consider comparing key metrics such as revenue growth, profitability, market capitalization, and debt levels. This comparative analysis helps determine BBAI’s relative strengths and weaknesses within its competitive landscape.

Conclusion: Making Informed Decisions on BigBear.ai (BBAI) Investment

Investing in BigBear.ai (BBAI) as a penny stock offers the potential for substantial returns, but it also carries significant risks. Our analysis using key indicators – including fundamental and technical analysis – reveals a complex picture. While BBAI operates in a promising sector with potential growth catalysts, the company's financial health and the inherent volatility of penny stocks cannot be overlooked. Before investing in BBAI or any penny stock, conduct your own thorough due diligence, understand the associated risks, and consider your risk tolerance. Further research into BigBear.ai (BBAI) and its key indicators is vital for making a well-informed investment decision. Remember, always invest responsibly and only with capital you can afford to lose.

Featured Posts

-

Retired 4 Star Admiral Convicted On Four Bribery Charges

May 21, 2025

Retired 4 Star Admiral Convicted On Four Bribery Charges

May 21, 2025 -

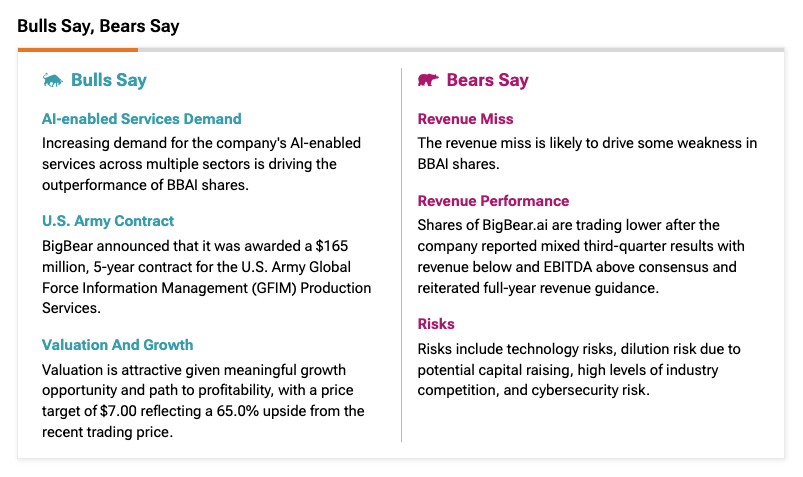

Strong Wind And Severe Storm Warning Take Action Now

May 21, 2025

Strong Wind And Severe Storm Warning Take Action Now

May 21, 2025 -

500 K Bribery Scandal Retired Navy Admiral Convicted Faces 30 Years

May 21, 2025

500 K Bribery Scandal Retired Navy Admiral Convicted Faces 30 Years

May 21, 2025 -

Us Navy Corruption Four Star Admiral Found Guilty

May 21, 2025

Us Navy Corruption Four Star Admiral Found Guilty

May 21, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its History And Impact

May 21, 2025

The Closure Of Anchor Brewing Company A Look Back At Its History And Impact

May 21, 2025

Latest Posts

-

Juventuss Numerical Disadvantage Fails To Secure Victory Against Lazio

May 22, 2025

Juventuss Numerical Disadvantage Fails To Secure Victory Against Lazio

May 22, 2025 -

96

May 22, 2025

96

May 22, 2025 -

Athena Calderone Celebrates A Significant Milestone In Rome

May 22, 2025

Athena Calderone Celebrates A Significant Milestone In Rome

May 22, 2025 -

Building Community Through Music The Sound Perimeter

May 22, 2025

Building Community Through Music The Sound Perimeter

May 22, 2025 -

1 1

May 22, 2025

1 1

May 22, 2025