Investing In Palantir: Analyzing The 40% Growth Projection For 2025

Table of Contents

Palantir's Current Market Position and Competitive Landscape

Palantir's current market position is a crucial factor when considering a Palantir investment. Understanding its revenue streams and competitive standing is paramount for any potential investor.

Palantir Government Contracts and Revenue Streams

Palantir's revenue historically relied heavily on government contracts, particularly with US intelligence agencies. This has provided a stable, albeit potentially cyclical, revenue stream. However, the company's strategy focuses on diversifying its revenue streams into the commercial sector.

- Stability of Government Contracts: Government contracts offer long-term stability but are subject to funding cycles and potential shifts in government priorities. This introduces inherent risk to Palantir stock.

- Commercial Market Growth: Palantir's success in the commercial market (financial services, healthcare, etc.) is crucial for achieving its growth projections. The commercial sector offers higher growth potential but also increased competition.

- Revenue Diversification: Successfully diversifying its revenue base, moving beyond its dependence on Palantir government contracts, is vital for mitigating risk and achieving sustainable Palantir growth.

Technological Innovation and Product Differentiation

Palantir's technological prowess is a significant factor in its competitive landscape. Its flagship platforms, Foundry and Gotham, offer unique data analytics and AI solutions.

- Palantir Foundry: This platform is designed for commercial clients, enabling data integration and analysis across various business functions. Its success hinges on ease of use and market adoption.

- Palantir Gotham: This platform caters to government and intelligence agencies, offering sophisticated data analysis capabilities for national security applications. Its continued success relies on maintaining its competitive edge in a highly specialized market.

- Competitive Landscape: Palantir faces competition from established tech giants and emerging data analytics firms. Maintaining its technological edge and innovating consistently are critical for sustained growth.

Factors Driving the 40% Growth Projection for 2025

The ambitious 40% growth projection for Palantir in 2025 rests on several key factors. Let's analyze these drivers to better understand their potential impact.

Expanding Commercial Market Penetration

Palantir's commercial market penetration is a significant growth driver. Success in this sector could greatly contribute to achieving the 2025 projection.

- Industry-Specific Growth: Focusing on high-growth industries like healthcare and finance offers significant potential for market share expansion. Tailoring solutions to specific industry needs will be crucial for adoption.

- Strategic Partnerships & Acquisitions: Collaborations and acquisitions can accelerate Palantir's market penetration and introduce new capabilities and customer bases.

- Palantir Market Share: Increasing Palantir market share in targeted industries will be a key indicator of success in achieving its growth ambitions.

Technological Advancements and New Product Launches

Continuous innovation is essential for Palantir's long-term success. New product launches and technological advancements can fuel significant growth.

- New Product Development: Introducing new products or significantly enhancing existing platforms can attract new customers and increase revenue streams. The success of these initiatives depends on market demand and competitive pressures.

- Palantir Innovation: Maintaining a culture of innovation and investing in R&D is critical for staying ahead of the curve in the rapidly evolving data analytics landscape.

- Technological Advancements: Leveraging advancements in AI, machine learning, and other technologies will allow Palantir to enhance its offerings and maintain a competitive advantage.

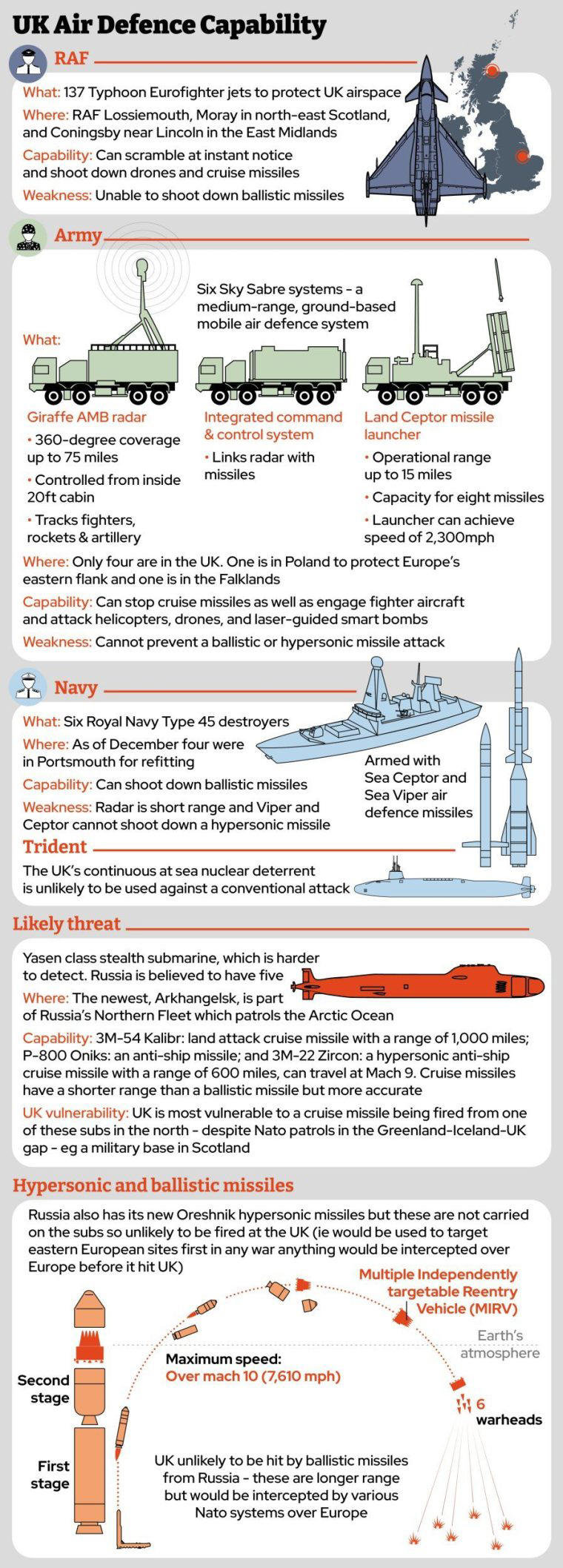

Global Geopolitical Landscape and its Impact

The global geopolitical landscape plays a significant role in Palantir's prospects. Increased government spending on national security can boost its government contracts.

- National Security Spending: Increased geopolitical instability often leads to increased government spending on national security and intelligence, benefiting Palantir's government contracts.

- Global Economy: A robust global economy generally benefits Palantir's commercial clients, boosting demand for its services. Conversely, an economic downturn can negatively impact its growth.

- Geopolitical Risk: While geopolitical instability may create opportunities, it also introduces uncertainty and risks that could negatively impact Palantir's growth.

Risks and Challenges to Achieving the 40% Growth Projection

While the growth potential for Palantir is significant, several challenges and risks could hinder the company from reaching its 40% growth projection.

Competition and Market Saturation

Intense competition in the data analytics market poses a significant challenge to Palantir's growth.

- Palantir Competitors: The company faces stiff competition from established tech giants and innovative startups offering similar data analytics solutions.

- Market Competition: The increasing number of players in the data analytics market could lead to price wars and reduced profit margins.

- Price Wars: Aggressive pricing strategies from competitors could squeeze Palantir's profitability and hinder its growth trajectory.

Economic Downturn and Reduced Government Spending

Economic downturns can significantly impact Palantir's revenue, particularly its reliance on government contracts.

- Economic Recession: A global economic recession could lead to reduced government spending on non-essential services, including data analytics contracts.

- Government Spending Cuts: Budgetary constraints may result in cuts to government contracts, directly impacting Palantir's revenue and profitability.

- Financial Risk: The company's revenue is vulnerable to macroeconomic factors, increasing the overall financial risk associated with a Palantir investment.

Conclusion

Investing in Palantir presents a compelling opportunity with considerable potential, yet substantial risk. While the 40% growth projection for 2025 is ambitious, it's not entirely unrealistic, given Palantir's technological strengths and expansion into the commercial market. However, the company’s reliance on government contracts, the competitive data analytics landscape, and the susceptibility to economic downturns all represent significant hurdles. Before investing in Palantir stock, carefully weigh the potential rewards against the inherent risks. Consider conducting thorough due diligence, exploring additional resources, and consulting with a financial advisor to make informed investment decisions concerning Investing in Palantir and its 2025 projection. Remember, past performance is not indicative of future results, and the stock market is inherently volatile.

Featured Posts

-

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 09, 2025

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 09, 2025 -

Briatores Authority Jack Doohans I Control You Netflix Confrontation

May 09, 2025

Briatores Authority Jack Doohans I Control You Netflix Confrontation

May 09, 2025 -

Europes Nuclear Shield A French Ministers Proposal

May 09, 2025

Europes Nuclear Shield A French Ministers Proposal

May 09, 2025 -

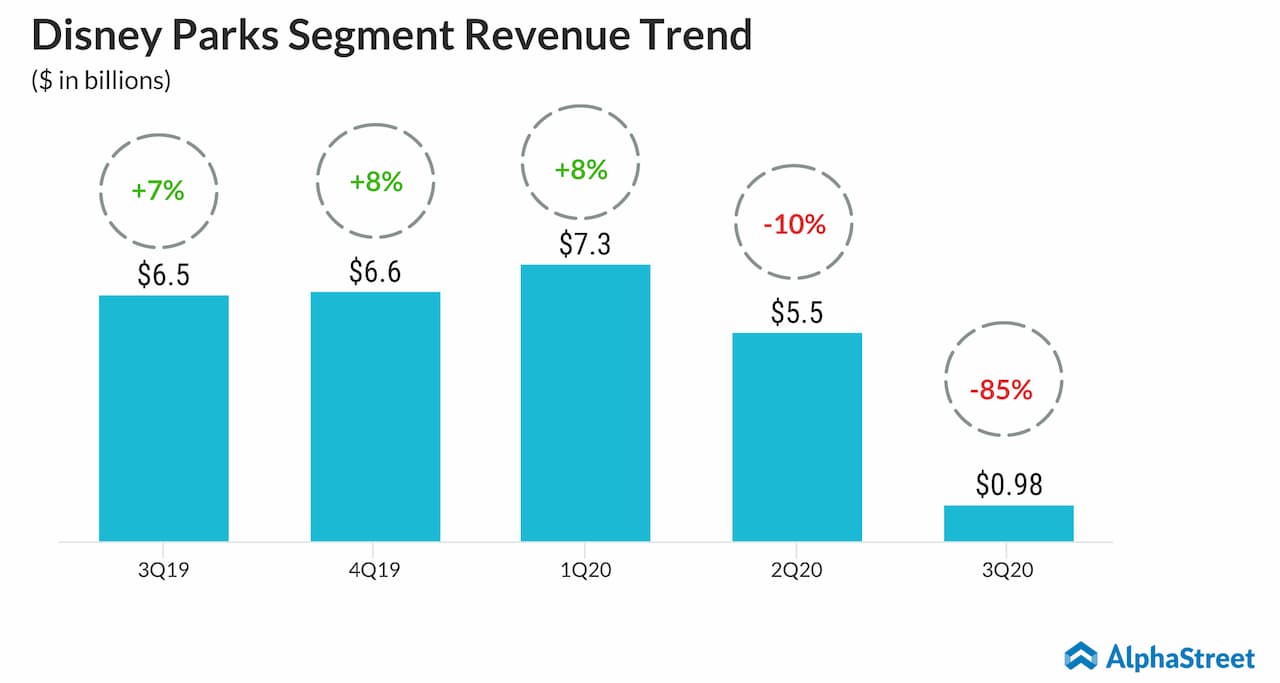

Disney Parks And Streaming Boost Profits Raising Company Outlook

May 09, 2025

Disney Parks And Streaming Boost Profits Raising Company Outlook

May 09, 2025 -

Nottingham Attack Survivors Speak Out A First Hand Account

May 09, 2025

Nottingham Attack Survivors Speak Out A First Hand Account

May 09, 2025