Investing In Palantir Technologies: A Look Ahead To May 5th And Beyond

Table of Contents

H2: Palantir's Upcoming Earnings Report (May 5th): What to Expect

Palantir's May 5th earnings report (PLTR earnings) will be a pivotal event for investors. Analysts are eagerly anticipating insights into the company's Q1 2024 performance. Several key metrics will be scrutinized:

-

Revenue Growth: Based on previous quarters and analyst predictions from sources like Seeking Alpha and Yahoo Finance, revenue growth is expected to be in the [insert range with percentage and source]. However, achieving this target will depend on the success of securing new government contracts and driving further commercial adoption of the Foundry platform.

-

Profit Margins: Investors will closely examine Palantir's profit margins, a key indicator of its operational efficiency. Improvements in profitability will be a positive signal, suggesting that the company is effectively managing costs and scaling its operations. Any significant deviations from expectations could impact the PLTR stock price.

-

Key Metrics: Beyond revenue and profit, several other metrics will be crucial. These include:

- Customer Acquisition: The number of new customers acquired, particularly in the commercial sector, will signal the effectiveness of Palantir's sales and marketing efforts.

- Contract Wins: The size and number of new government contracts secured will determine the future revenue stream and demonstrate the company’s competitive edge in the government contracting market.

- New Product Launches: Any announcements of new product features or offerings will be closely watched for their potential to expand Palantir's market reach and attract new clients.

-

Market Reaction: Historical performance suggests that positive surprises in Palantir's earnings reports often lead to a surge in the PLTR stock price, while negative surprises can result in considerable drops. The current market sentiment will also play a role in how investors react to the report.

-

Risks and Uncertainties: Potential risks include geopolitical instability (affecting government contracts), increased competition in the data analytics market, and the ongoing transition to a more commercially-focused business model.

H2: Palantir's Government and Commercial Business Segments: A Deep Dive

Palantir operates in two primary segments: government and commercial. Understanding the performance of each is vital for a complete Palantir investment analysis.

-

Government Contracts: Palantir Gotham, the platform specifically designed for government agencies, remains a significant revenue driver. The sustainability of government contracts is paramount; fluctuations in government spending and political shifts pose inherent risks.

-

Commercial Growth: Palantir's commercial business, fueled by its Foundry platform and Artificial Intelligence Platform (AIP), is crucial for long-term growth. Successful expansion into the commercial sector will be key to reducing dependence on government contracts. Key factors include successful partnerships, innovative product development to stay ahead of the competition, and the ability to demonstrate a clear return on investment for commercial clients.

-

Strategic Initiatives: Palantir is actively pursuing strategies to expand its commercial reach, including partnerships with leading technology companies and strategic investments in product development, focusing on areas like artificial intelligence and cloud computing.

-

Competitive Landscape: The competitive landscape in both government and commercial sectors is highly dynamic. Companies such as Databricks and Snowflake pose competition in various aspects of the data analytics and cloud computing space. Palantir's ability to differentiate itself through its unique platform capabilities and superior data analysis will determine its market success.

H2: Assessing the Long-Term Value and Risks of Investing in Palantir

A long-term Palantir investment requires a careful evaluation of its valuation, growth potential, and inherent risks.

-

Valuation: Palantir's current valuation needs to be compared to its peers and its historical performance. Factors like revenue growth, profit margins, and market capitalization should be considered against the prevailing market conditions and the overall performance of the data analytics sector.

-

Future Growth: The future growth potential hinges on Palantir's ability to successfully penetrate the commercial market, expand its product offerings, and leverage the increasing demand for advanced data analytics solutions. Market projections and the company's strategic execution will play a key role.

-

Key Risks: Investing in PLTR stock carries inherent risks:

- Competition: The data analytics market is fiercely competitive.

- Geopolitical Factors: Government contracts are subject to geopolitical uncertainties.

- Dependence on Large Contracts: Over-reliance on a few large government contracts presents a vulnerability.

- Technological Advancements: Rapid technological change requires continuous innovation to remain competitive.

H3: Key Factors Influencing Palantir's Stock Price

Beyond the company's performance, several external factors significantly impact the Palantir stock price:

- Overall Market Performance: Broader market trends and economic conditions heavily influence investor sentiment.

- Competitor Actions: Competitive actions, new product launches by rivals, and shifts in market share influence Palantir's valuation.

- Company News: Announcements of new contracts, product releases, or partnerships directly impact investor perception.

- Analyst Ratings: Changes in analyst ratings and price target adjustments significantly affect investor confidence.

- Investor Sentiment: Overall investor sentiment, including fear, uncertainty, and doubt (FUD), greatly impacts trading volume and stock price.

3. Conclusion:

Investing in Palantir Technologies requires a thorough understanding of its upcoming earnings report, its diverse business segments, and the associated risks and rewards. While Palantir’s future growth hinges on successful commercial expansion and navigating the competitive data analytics landscape, the potential for substantial returns remains. However, the dependence on government contracts and the competitive nature of the market present notable challenges. Conduct your own due diligence before making any investment decisions.

Call to Action: Considering the upcoming May 5th earnings report and the long-term potential of Palantir Technologies, now is a crucial time to conduct thorough research and develop a well-informed investment strategy for Palantir stock (PLTR). Continue your due diligence and make an informed decision about investing in Palantir Technologies. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

30 Drop In Palantir Stock Time To Invest

May 10, 2025

30 Drop In Palantir Stock Time To Invest

May 10, 2025 -

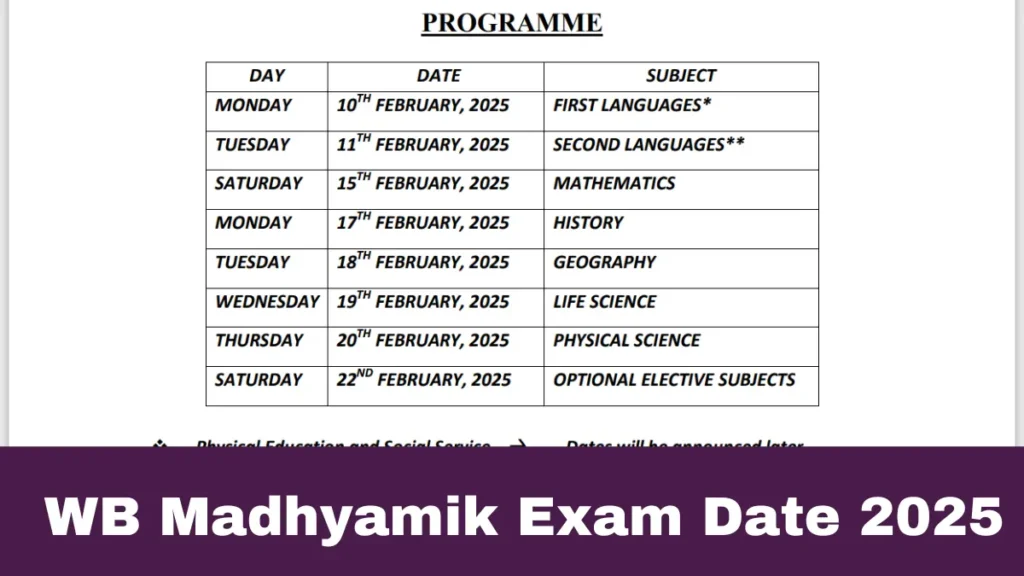

West Bengal Madhyamik Exam 2025 Merit List And District Wise Results

May 10, 2025

West Bengal Madhyamik Exam 2025 Merit List And District Wise Results

May 10, 2025 -

Attorney General Pam Bondi And The James Comer Epstein Investigation

May 10, 2025

Attorney General Pam Bondi And The James Comer Epstein Investigation

May 10, 2025 -

Has Chris Martins Influence Shaped Dakota Johnsons Acting Career

May 10, 2025

Has Chris Martins Influence Shaped Dakota Johnsons Acting Career

May 10, 2025 -

Draisaitls Absence Oilers Lineup Changes For Winnipeg Game

May 10, 2025

Draisaitls Absence Oilers Lineup Changes For Winnipeg Game

May 10, 2025