Investing In Quantum Computing Stocks: Rigetti & IonQ In 2025

Table of Contents

Understanding the Quantum Computing Landscape in 2025

The quantum computing market is projected to experience explosive growth. MarketsandMarkets™ predicts the market will reach $64.98 billion by 2027, indicating substantial expansion by 2025. This growth is fueled by advancements in several approaches to quantum computing. Rigetti and IonQ represent two distinct approaches:

- Rigetti: Focuses on superconducting quantum computers, leveraging the properties of supercooled materials to achieve quantum superposition and entanglement.

- IonQ: Employs trapped ion technology, using precisely controlled individual ions as qubits. This approach offers potential advantages in terms of qubit coherence and scalability.

Key applications expected to benefit significantly by 2025 include:

- Drug Discovery & Development: Quantum computers can simulate molecular interactions with unprecedented accuracy, accelerating drug design and reducing development costs.

- Materials Science: Designing novel materials with superior properties (e.g., stronger, lighter, more efficient) is poised for a revolution thanks to quantum simulations.

- Financial Modeling: Quantum algorithms can optimize complex financial models, leading to improved risk management and investment strategies.

- Cryptography: Quantum computing has the potential to break current encryption methods, while also enabling the development of new, quantum-resistant cryptography.

Despite the potential, challenges remain. Current quantum computers are limited in the number of qubits (quantum bits) they can reliably control, and maintaining qubit coherence (stability) is a significant hurdle. Error correction and scaling remain crucial technological roadblocks that must be overcome for widespread adoption.

Analyzing Rigetti Computing (RGTI) Stock

Rigetti Computing is a leading player in the superconducting qubit space, known for its modular architecture and focus on building scalable quantum computers. Its business model involves both hardware sales and cloud access to its quantum computing resources. Rigetti's competitive advantage lies in its integrated hardware and software approach. However, predicting its 2025 financial performance is challenging given the nascent nature of the industry. Revenue projections and profitability remain uncertain.

Risks associated with investing in RGTI include:

- Technological hurdles: Overcoming the limitations of superconducting qubit technology and scaling to larger qubit numbers.

- Intense competition: The quantum computing industry is highly competitive, with several well-funded companies pursuing similar approaches.

- Market adoption: The time it takes for quantum computing to achieve widespread adoption across industries remains uncertain.

Mitigation strategies for these risks could include diversifying investments and holding RGTI for the long term, acknowledging that the quantum computing industry's development is a marathon, not a sprint. Analyst ratings and price targets for RGTI in 2025 are highly variable and should be viewed with caution.

Evaluating IonQ (IONQ) Stock

IonQ distinguishes itself through its trapped ion technology. The company boasts impressive partnerships and a strong focus on practical applications, making its technology potentially more accessible to a wider range of users. Similar to Rigetti, IonQ's 2025 financial performance is uncertain. However, its partnerships and technological advancements position it for potential growth.

Investment risks for IONQ include:

- Scalability challenges: Scaling up trapped ion systems to large numbers of qubits remains a technological challenge.

- Competitive landscape: IonQ faces competition from other companies developing trapped ion and other quantum computing technologies.

- Regulatory uncertainty: The regulatory environment for quantum computing is still evolving, which could impact growth.

Potential mitigations include a thorough understanding of the company's technology and its market position, combined with a long-term investment horizon. Analyst sentiment and price predictions vary substantially. It is crucial to critically evaluate all available information before making any investment decisions.

Comparing Rigetti and IonQ: Investment Strategies for 2025

Both Rigetti and IonQ offer distinct approaches to quantum computing, each with its advantages and disadvantages. Rigetti's focus on superconducting qubits might offer faster processing speeds in the future, while IonQ's trapped ion approach might prove more scalable in the long run.

Investment strategies depend on risk tolerance and investment goals:

- Diversified Portfolio: Investing in both RGTI and IONQ, and possibly other quantum computing companies, to reduce overall risk.

- Long-Term Hold: Investing in these companies with a long-term perspective (5+ years) acknowledging the potential for high risk and reward.

- Growth-Oriented: Investing predominantly in companies with high growth potential, accepting higher risk.

Diversification beyond Rigetti and IonQ could involve considering investments in other quantum computing companies or in companies developing quantum-related technologies, like quantum-resistant cryptography.

Navigating the Future of Quantum Computing Investments

Investing in quantum computing stocks like Rigetti and IonQ presents a high-risk, high-reward proposition. Both companies are at the forefront of a transformative technology, but substantial technological and commercial hurdles remain. Our analysis suggests that a long-term perspective is vital, with thorough due diligence crucial before committing capital.

While both companies show promise, we cannot offer a definitive recommendation to invest in either RGTI or IONQ, as this decision depends entirely on individual risk tolerance and financial goals. Investing in quantum computing stocks requires careful consideration of the inherent risks involved. Always consult with a qualified financial advisor before making any investment decisions.

The future of quantum computing is bright, and the companies leading this charge have the potential to revolutionize multiple industries. However, informed and cautious investment is paramount.

Featured Posts

-

Updated Trans Australia Run Record Attempt

May 21, 2025

Updated Trans Australia Run Record Attempt

May 21, 2025 -

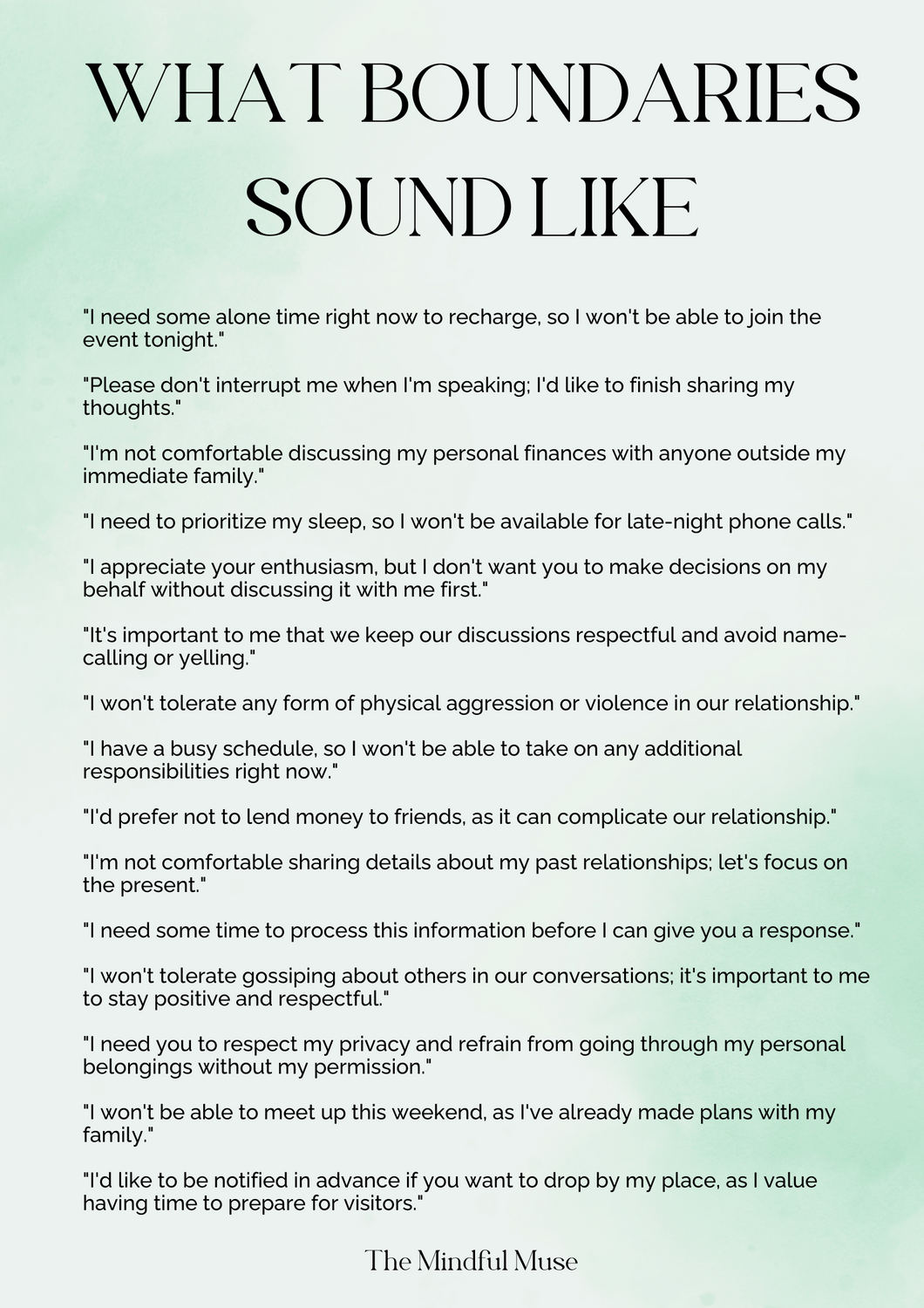

Coping With A Love Monster Strategies For Setting Boundaries And Protecting Yourself

May 21, 2025

Coping With A Love Monster Strategies For Setting Boundaries And Protecting Yourself

May 21, 2025 -

Rashfords Double Aston Villa Cruise Past Preston In Fa Cup

May 21, 2025

Rashfords Double Aston Villa Cruise Past Preston In Fa Cup

May 21, 2025 -

From Viral Reddit Post To Hollywood The Story Of A Faked Disappearance

May 21, 2025

From Viral Reddit Post To Hollywood The Story Of A Faked Disappearance

May 21, 2025 -

Manhattan Forgotten Foods Festival A Celebration Of Rare Ingredients

May 21, 2025

Manhattan Forgotten Foods Festival A Celebration Of Rare Ingredients

May 21, 2025

Latest Posts

-

Sound Perimeter How Music Connects Us

May 22, 2025

Sound Perimeter How Music Connects Us

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Thlathy Jdyd Fy Tshkylt Mntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Thlathy Jdyd Fy Tshkylt Mntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025 -

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025