Investing In Ripple (XRP): Risks And Rewards Of A 15,000% Growth Asset

Table of Contents

Understanding Ripple (XRP) and its Technology

What is Ripple?

Ripple is a real-time gross settlement system (RTGS), currency exchange, and remittance network created by Ripple Labs. Unlike many cryptocurrencies that operate independently, Ripple focuses on facilitating fast and efficient cross-border payments for banks and financial institutions. XRP, its native cryptocurrency, plays a vital role in this system. It differs from Bitcoin or Ethereum in its primary purpose; it's designed as a bridge currency to enable seamless transactions between different fiat currencies.

How XRP Works

XRP facilitates transactions within RippleNet, a global network connecting banks and payment providers. Its key features include:

- Speed and Efficiency: XRP transactions are significantly faster than traditional banking systems, often settling within seconds.

- Lower Transaction Fees: Compared to traditional international wire transfers, XRP transactions offer substantially lower fees.

- Scalability: The Ripple network is designed for scalability, capable of handling a high volume of transactions simultaneously.

These characteristics make XRP an attractive option for financial institutions seeking to improve their cross-border payment solutions.

RippleNet and its Adoption

RippleNet's adoption by banks and financial institutions is steadily increasing. Many major players utilize Ripple's technology to streamline their international payment processes. For example, [insert link to a credible source showing adoption rates, e.g., a Ripple press release or financial news article]. This growing adoption demonstrates the potential for XRP to become a significant player in the global financial landscape. The increasing integration of XRP transactions within established financial systems is a key factor to consider when assessing XRP investment.

The Potential Rewards of Investing in XRP

Past Performance and Future Projections

XRP's historical price performance has been exceptionally volatile. While it experienced a remarkable 15,000% growth at one point, it's crucial to remember that past performance is not indicative of future results. Predicting future XRP price movements is impossible. However, analyzing current market trends, institutional adoption rates, and technological advancements can help inform potential investment strategies.

Factors Contributing to Potential Growth

Several factors could contribute to future XRP growth:

- Increased Institutional Adoption: More banks and financial institutions adopting RippleNet could drive up demand for XRP.

- Strategic Partnerships: New collaborations and partnerships with major players in the financial industry could boost XRP's value.

- Regulatory Developments: Positive regulatory developments could lead to increased market confidence and investment. (Note: Negative regulatory developments could have the opposite effect.)

- Growing Demand for Faster, Cheaper Cross-Border Payments: The global need for efficient and affordable cross-border payments continues to grow, potentially benefiting XRP.

Diversification Benefits

Adding XRP to a well-diversified investment portfolio can potentially mitigate risk. However, it's important to only allocate a small percentage of your portfolio to higher-risk assets like XRP to manage overall exposure.

The Risks Associated with Investing in XRP

Volatility and Price Fluctuations

XRP's price is highly volatile, subject to significant swings. Past price drops demonstrate the potential for substantial losses. Investors should be prepared for unpredictable market movements.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is constantly evolving and often uncertain. Ongoing legal battles and potential regulatory changes could significantly impact XRP's price and future.

Competition and Technological Disruption

The cryptocurrency market is highly competitive. New technologies and alternative solutions could emerge, potentially diminishing XRP's relevance.

Security Risks

Like all cryptocurrencies, XRP investments are subject to security risks, including hacking and the loss of private keys. Secure storage and best practices are vital.

Conclusion: Investing in Ripple (XRP): A Balanced Perspective

Investing in Ripple (XRP) presents both significant potential rewards and substantial risks. The technology behind RippleNet is innovative and potentially disruptive, offering faster and cheaper cross-border payments. However, the inherent volatility, regulatory uncertainty, and competitive market require careful consideration. The 15,000% growth is a testament to its potential, but also serves as a reminder of its risk.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Consult with a qualified financial professional before making any investment decisions.

Make informed decisions about your investment in Ripple (XRP) by thoroughly researching the market and understanding the associated risks. Remember that XRP investment, like any cryptocurrency investment, requires due diligence and a tolerance for high risk.

Featured Posts

-

Exclusive Report U S Armys Plans For A Significant Increase In Drone Deployments

May 02, 2025

Exclusive Report U S Armys Plans For A Significant Increase In Drone Deployments

May 02, 2025 -

England Womens Squad Update Kelly Replaces Injured Players For Nations League

May 02, 2025

England Womens Squad Update Kelly Replaces Injured Players For Nations League

May 02, 2025 -

Kampen Start Kort Geding Tegen Enexis Stroom Voor Duurzaam Schoolgebouw In Gevaar

May 02, 2025

Kampen Start Kort Geding Tegen Enexis Stroom Voor Duurzaam Schoolgebouw In Gevaar

May 02, 2025 -

Play Station Network Te Guevenli Giris Ve Hesap Guevenligi

May 02, 2025

Play Station Network Te Guevenli Giris Ve Hesap Guevenligi

May 02, 2025 -

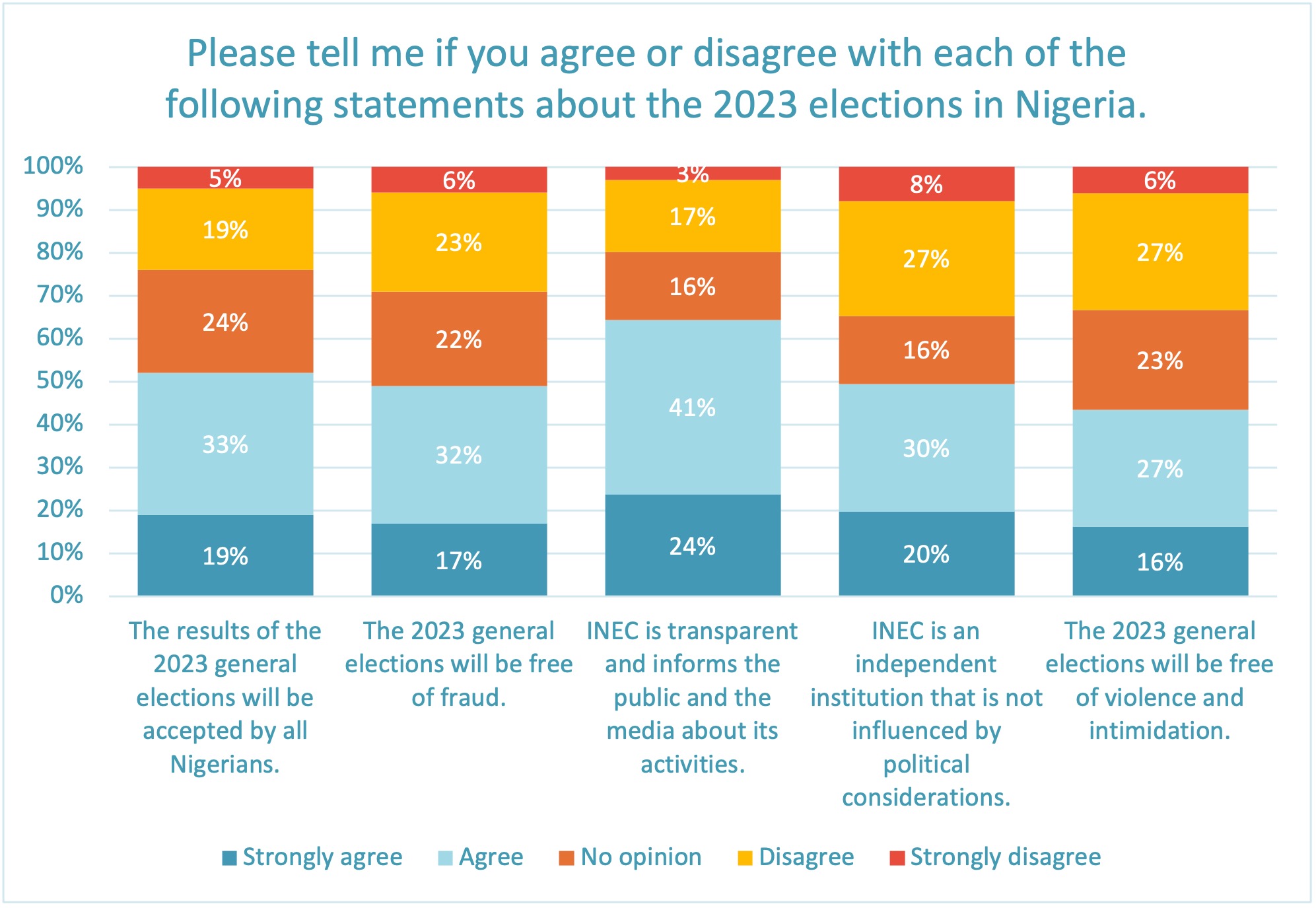

South Carolina Election Trust 93 Of Voters Say Yes

May 02, 2025

South Carolina Election Trust 93 Of Voters Say Yes

May 02, 2025

Latest Posts

-

Aid Ship Sailing To Gaza Reports Drone Attack Issues Sos Off Malta

May 03, 2025

Aid Ship Sailing To Gaza Reports Drone Attack Issues Sos Off Malta

May 03, 2025 -

Growing Number Of Chinese Ships Spotted Near Sydney Implications For Australias Security

May 03, 2025

Growing Number Of Chinese Ships Spotted Near Sydney Implications For Australias Security

May 03, 2025 -

Increased Chinese Ship Sightings Near Sydney Concerns And Implications

May 03, 2025

Increased Chinese Ship Sightings Near Sydney Concerns And Implications

May 03, 2025 -

Malta Coast Drone Attack Aid Ship To Gaza In Urgent Need Of Assistance

May 03, 2025

Malta Coast Drone Attack Aid Ship To Gaza In Urgent Need Of Assistance

May 03, 2025 -

Sydney Harbour Activity Understanding The Rise In Chinese Ship Spottings

May 03, 2025

Sydney Harbour Activity Understanding The Rise In Chinese Ship Spottings

May 03, 2025