Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Explained

Table of Contents

What is Net Asset Value (NAV) in the Context of ETFs?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated daily by taking the total market value of all the holdings (the 30 constituent companies of the Dow Jones Industrial Average), subtracting any liabilities, and dividing by the total number of outstanding ETF shares. This figure reflects the intrinsic value of a single ETF share.

-

NAV and ETF Share Price: While the NAV is a crucial indicator, the ETF's market price can fluctuate throughout the trading day. The market price often closely tracks the NAV, but temporary discrepancies can occur due to supply and demand.

-

Factors Influencing NAV Fluctuations: Several factors influence daily NAV changes:

- Market Movements: The primary driver is the performance of the underlying Dow Jones Industrial Average. Increases or decreases in the prices of the constituent stocks directly affect the ETF's NAV.

- Dividends: When the companies within the index pay dividends, the ETF receives these dividends, which generally increase the NAV (after accounting for the ETF's expense ratio).

- Currency Fluctuations: For internationally traded ETFs, changes in exchange rates can impact the NAV.

-

NAV vs. Market Price: The difference between NAV and market price is often small, especially for actively traded ETFs. However, arbitrage opportunities can exist when significant discrepancies arise. These discrepancies usually correct themselves quickly as traders buy low and sell high to profit from the difference. Understanding this relationship is crucial for understanding ETF pricing dynamics.

How to Use NAV to Make Informed Investment Decisions

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for tracking its performance and making informed investment decisions.

-

Tracking ETF Performance: By comparing the NAV over time, you can assess the ETF's growth and performance against its benchmark (the Dow Jones Industrial Average).

-

Identifying Buying/Selling Opportunities: While not a perfect indicator, observing consistent NAV undervaluation (relative to the market price) might present a potential buying opportunity, whereas overvaluation could suggest a potential selling point. Remember to always consider your overall investment strategy and risk tolerance.

-

Determining Investment Returns: Your investment return is directly tied to the change in NAV, plus any dividend distributions received, minus any applicable fees. Regularly monitoring NAV helps you understand your investment's performance accurately.

Amundi Dow Jones Industrial Average UCITS ETF: A Closer Look at its NAV

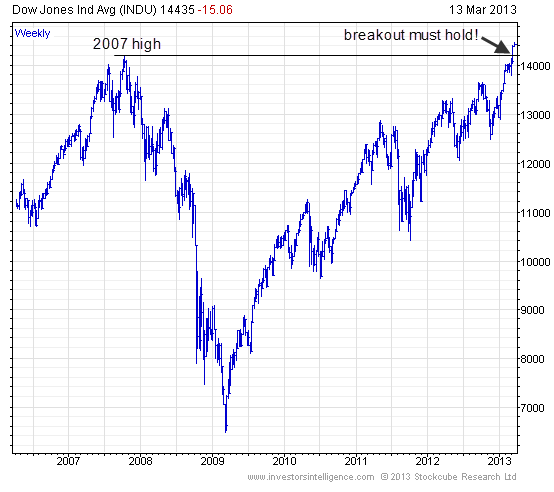

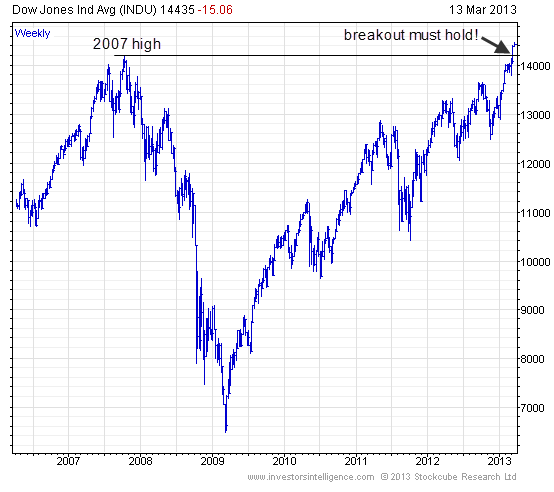

Analyzing the historical NAV of the Amundi Dow Jones Industrial Average UCITS ETF provides valuable insights. (Include a chart here showing historical NAV data if possible.) This data reveals the ETF's long-term growth potential and volatility.

-

ETF Composition and NAV: The ETF's composition (the weighting of each Dow Jones Industrial Average component) directly impacts its NAV. A strong performance by a heavily weighted stock will significantly influence the NAV.

-

Expense Ratio's Impact: The expense ratio, which covers the ETF's management fees, slightly reduces the NAV growth over time. A lower expense ratio is generally more favorable.

-

Dividend Distributions and NAV: Dividend payments from the underlying companies are typically reinvested, increasing the NAV. Understanding the dividend yield helps in estimating the potential for NAV growth through dividend reinvestment.

-

Benchmark Comparison: Comparing the Amundi Dow Jones Industrial Average UCITS ETF's NAV performance against similar ETFs tracking the Dow Jones Industrial Average or other broad market indexes helps gauge its relative performance and efficiency.

Investing in the Amundi Dow Jones Industrial Average UCITS ETF: Practical Considerations

This ETF offers several investment approaches:

-

Investment Strategies:

- Buy-and-Hold: A passive, long-term approach suitable for investors seeking exposure to the Dow Jones Industrial Average over the long term.

- Active Trading: A more involved strategy, suitable for experienced investors aiming to capitalize on short-term market fluctuations. This requires careful NAV monitoring and a deeper understanding of market dynamics.

-

Diversification: While the ETF itself provides diversification within the Dow Jones Industrial Average, combining it with other asset classes (bonds, real estate, etc.) further enhances your overall portfolio diversification.

-

Finding NAV Data: Reliable NAV data for the Amundi Dow Jones Industrial Average UCITS ETF can be found on the ETF provider's website, financial news websites, and brokerage platforms.

Conclusion: Mastering NAV for Successful Amundi Dow Jones Industrial Average UCITS ETF Investing

Understanding the Net Asset Value (NAV) is paramount for successful investing in the Amundi Dow Jones Industrial Average UCITS ETF. By regularly monitoring its NAV, comparing it to historical data, and considering its relationship to the market price and dividend distributions, you can make more informed investment decisions. Remember that factors like market movements, the expense ratio, and dividend payouts significantly influence NAV fluctuations. Research the Amundi Dow Jones Industrial Average UCITS ETF further, monitor its NAV closely, and consider incorporating this valuable tool into your investment strategy to gain exposure to the strength of the Dow Jones Industrial Average. Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV is key to unlocking its long-term investment potential.

Featured Posts

-

Dazi Stati Uniti Effetti Sui Prezzi Del Settore Moda

May 24, 2025

Dazi Stati Uniti Effetti Sui Prezzi Del Settore Moda

May 24, 2025 -

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 24, 2025

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025 -

M62 Manchester To Warrington Westbound Lane Closure For Resurfacing

May 24, 2025

M62 Manchester To Warrington Westbound Lane Closure For Resurfacing

May 24, 2025 -

Konchita Vurst Ot Evrovideniya 2014 K Mechte Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Ot Evrovideniya 2014 K Mechte Stat Devushkoy Bonda

May 24, 2025

Latest Posts

-

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 24, 2025

Strengthening Ties Bangladeshs Return To Collaborative Growth In Europe

May 24, 2025 -

Bangladesh And Europe A Partnership For Economic Growth

May 24, 2025

Bangladesh And Europe A Partnership For Economic Growth

May 24, 2025 -

Boosting Bangladeshs Presence In Europe A Collaborative Approach

May 24, 2025

Boosting Bangladeshs Presence In Europe A Collaborative Approach

May 24, 2025 -

Collaboration And Growth The Future Of Bangladesh Europe Relations

May 24, 2025

Collaboration And Growth The Future Of Bangladesh Europe Relations

May 24, 2025 -

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 24, 2025

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 24, 2025