Investing In The Future: A Guide To The Country's Newest Business Hotspots

Table of Contents

Identifying Promising Emerging Markets

Identifying promising emerging markets requires a thorough analysis of key economic indicators and industry trends. This involves understanding the investment potential and conducting comprehensive due diligence and risk assessment. Focusing on high-growth sectors is crucial for maximizing returns.

-

Analysis of GDP Growth Rates in Different Regions: Examining regional GDP growth rates helps pinpoint areas experiencing rapid economic expansion. For instance, the [Specific City/Region A] region has shown consistent GDP growth of X% over the last Y years, significantly outpacing the national average.

-

Identification of Sectors with High Potential for Growth: Several sectors are experiencing significant growth within the country. These include:

- Technology: The burgeoning tech sector, particularly in [Specific City/Region B], is attracting significant foreign investment and creating numerous high-paying jobs.

- Renewable Energy: Government initiatives promoting renewable energy sources have fueled substantial investment in solar, wind, and hydroelectric power projects.

- Tourism: [Specific City/Region C]'s thriving tourism sector benefits from its unique cultural attractions and growing infrastructure.

-

Government Initiatives and Policies Supporting Business Development: The government's commitment to business development is evident through various initiatives like tax incentives, streamlined regulations, and investment in infrastructure. These policies create a favorable environment for new businesses to flourish.

-

Examples of Successful Startups and Businesses: Several successful startups and businesses in these emerging markets demonstrate the potential for growth. For example, [Company A] in the tech sector has achieved remarkable success, attracting millions in funding and creating hundreds of jobs.

-

Market Research and Due Diligence: Thorough market research and due diligence are essential before investing in any emerging market. This involves analyzing market size, competition, regulatory landscape, and potential risks.

Understanding the Factors Driving Growth in New Business Hotspots

The success of these new business hotspots isn't accidental; several factors contribute to their growth. Understanding these drivers is crucial for identifying future investment opportunities.

-

Improved Infrastructure: Significant investments in infrastructure, including transportation networks, communication systems, and energy supply, are laying the foundation for economic growth. The development of [Specific Infrastructure Project] has significantly improved connectivity and logistics.

-

Availability of a Skilled Workforce: A skilled and educated workforce is a major asset. The country boasts a strong educational system and is producing a steady stream of graduates in fields like engineering, technology, and business.

-

Government Incentives and Tax Breaks: Government incentives and tax breaks for businesses create a favorable investment climate and encourage entrepreneurship. These incentives often target specific high-growth sectors.

-

A Culture of Innovation and Entrepreneurship: A supportive ecosystem for startups and entrepreneurs fosters innovation and drives economic growth. Incubators, accelerators, and angel investor networks are contributing to this vibrant environment.

-

Access to Funding and Investment Capital: Access to funding is critical for business growth. Venture capital firms and private equity investors are increasingly focusing on the country's emerging markets.

-

Favorable Regulatory Environment: A streamlined and transparent regulatory environment facilitates business operations and attracts investment. Recent reforms have simplified the process of registering and operating businesses.

Case Studies of Successful Businesses in Emerging Hotspots

Several successful businesses highlight the opportunities in these emerging hotspots. Analyzing their strategies reveals key factors for success.

-

[Company A]: [Company A], a technology startup based in [Specific City/Region B], disrupted the [Industry] sector with its innovative [Product/Service]. Its success can be attributed to its strong team, effective marketing, and strategic partnerships.

-

[Company B]: [Company B], a renewable energy company operating in [Specific City/Region A], capitalized on government incentives and growing demand for sustainable energy. Their focus on cost-effectiveness and efficiency has driven their rapid growth.

-

[Company C]: [Company C], a tourism-focused business in [Specific City/Region C], leveraged the region’s unique cultural heritage to attract a large number of tourists. Their investment in high-quality services and sustainable practices has contributed to their success.

Mitigating Risks and Making Informed Investment Decisions

Investing in emerging markets involves inherent risks. Understanding and mitigating these risks is crucial for successful investment.

-

Identifying Potential Risks: Potential risks include political instability, economic downturns, regulatory changes, and currency fluctuations. Careful analysis of these factors is crucial.

-

Strategies for Diversifying Investments: Diversifying investments across different sectors and regions reduces overall risk exposure. This approach mitigates the impact of potential setbacks in a single sector.

-

Importance of Thorough Due Diligence: Thorough due diligence is paramount before committing to any investment. This includes verifying information, assessing management capabilities, and analyzing market conditions.

-

Understanding Market Volatility: Emerging markets can experience significant volatility. Understanding these fluctuations and their potential impact on investments is essential.

-

Developing a Robust Investment Strategy: A well-defined investment strategy tailored to your risk tolerance and financial goals is critical. Professional advice can be invaluable in this process.

Conclusion

Investing in the country’s newest business hotspots offers significant potential for high returns, but careful consideration of emerging markets and risk factors is crucial. By understanding the drivers of growth and conducting thorough due diligence, investors can make informed decisions and capitalize on exciting investment opportunities. The key to success lies in identifying promising sectors, understanding the local landscape, and mitigating potential risks.

Ready to explore the future of business? Start your journey by researching the country's emerging business hotspots today and discover the investment opportunities that await. Begin your search for the best new business hotspots and secure your future investments now!

Featured Posts

-

Carolinas Storm Watch Understanding Active And Expired Weather Alerts

May 31, 2025

Carolinas Storm Watch Understanding Active And Expired Weather Alerts

May 31, 2025 -

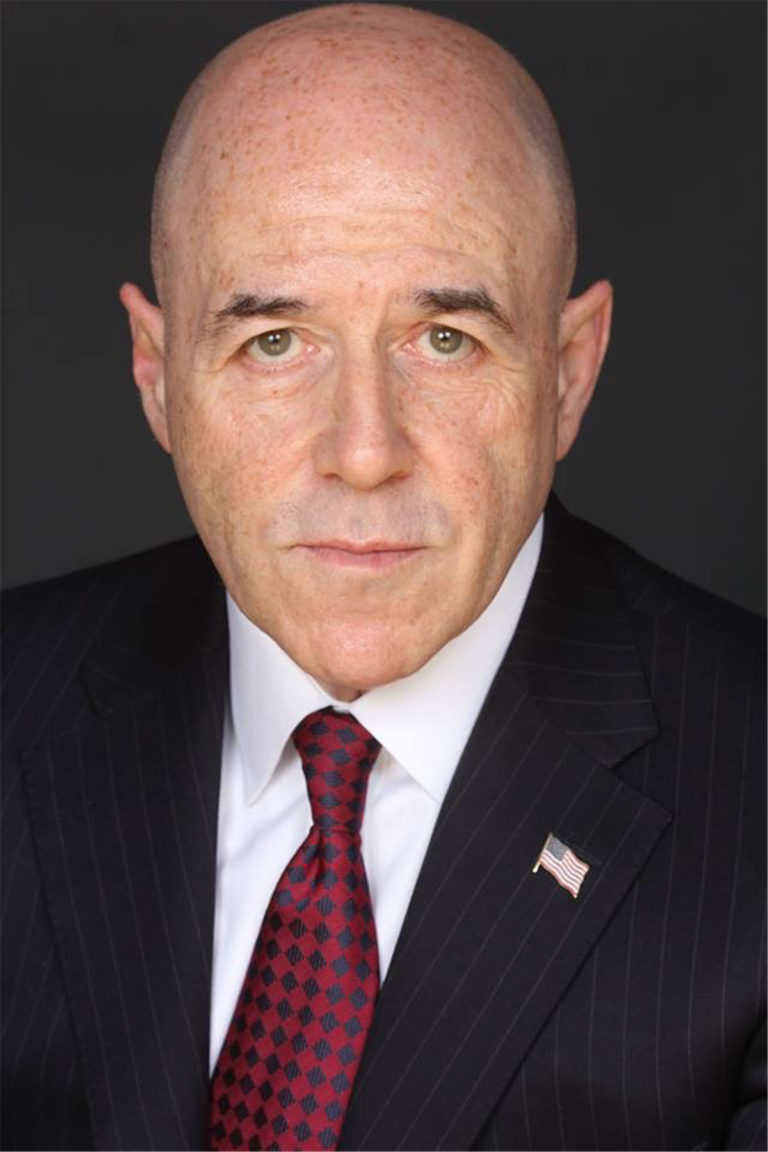

Hospitalization Of Former Nypd Commissioner Bernard Kerik Full Recovery Anticipated

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik Full Recovery Anticipated

May 31, 2025 -

Risultati In Tempo Reale E Live Streaming Del Giro D Italia

May 31, 2025

Risultati In Tempo Reale E Live Streaming Del Giro D Italia

May 31, 2025 -

The Life And Legacy Of Bernard Kerik A Retrospective

May 31, 2025

The Life And Legacy Of Bernard Kerik A Retrospective

May 31, 2025 -

Scoreless Inning For Chase Lee Successful Mlb Return On May 12 2025

May 31, 2025

Scoreless Inning For Chase Lee Successful Mlb Return On May 12 2025

May 31, 2025