Investing In The Future: A Map Of Emerging Business Centers

Table of Contents

Identifying Key Characteristics of Emerging Business Centers

Before diving into specific locations, it's vital to understand the characteristics that define thriving emerging business centers. Investors should carefully assess several key economic indicators and qualitative factors. These include:

- Strong Economic Indicators: Robust GDP growth, consistent FDI (Foreign Direct Investment) inflows, and a healthy business environment are essential signs of a developing economy. Look for sustained, not just sporadic, growth.

- Modern Infrastructure: Efficient transportation networks (roads, airports, ports), reliable communication infrastructure (internet access, mobile connectivity), and access to essential utilities (water, electricity) are critical for business operations.

- Access to a Skilled Workforce: A readily available pool of skilled labor, including professionals in technology, finance, and other specialized fields, is crucial for attracting businesses and fueling innovation. Investment in education and training programs is a positive indicator.

- Thriving Innovation Hubs and Startup Ecosystems: The presence of incubators, accelerators, and a supportive entrepreneurial culture fosters innovation and creates a fertile ground for new businesses to flourish. A strong startup ecosystem often attracts further investment.

- Supportive Government Policies and Tax Incentives: Government initiatives aimed at attracting foreign investment, simplifying regulations, and offering tax breaks can significantly boost economic activity and make a location more attractive.

- Affordable Cost of Living and High Quality of Life: A relatively low cost of living, coupled with a good quality of life (access to healthcare, education, and recreational facilities), attracts both talent and businesses.

- Strategic Geographic Location and Access to Markets: Proximity to major markets, transportation routes, and other key business centers can provide a significant competitive advantage.

Top Emerging Business Centers Around the Globe

Several regions are witnessing the emergence of dynamic business centers, offering compelling investment opportunities. While thorough due diligence is always required, the following examples illustrate the diverse landscape:

- Africa: Nairobi, Kenya, is experiencing rapid growth in its technology sector, fueled by a young, tech-savvy population and a burgeoning startup ecosystem. Its strategic location and improving infrastructure make it a compelling investment destination.

- Asia: Ho Chi Minh City, Vietnam, is attracting significant foreign investment, driven by its manufacturing capabilities, low labor costs, and strategic position within Southeast Asia. This city offers opportunities in manufacturing, technology, and real estate.

- Latin America: Medellín, Colombia, has undergone a remarkable transformation, becoming a hub for innovation and entrepreneurship. Its focus on technology, improved security, and attractive cost of living contribute to its appeal.

These are just a few examples; many other cities across Asia, Africa, and Latin America are emerging as significant business hubs, presenting diverse investment opportunities.

Investment Opportunities in Emerging Business Centers

Emerging business centers offer a variety of investment avenues, catering to different investor profiles and risk appetites:

- Real Estate Investment: Commercial and residential real estate often sees significant appreciation in rapidly developing areas. However, thorough market research and due diligence are essential.

- Venture Capital and Private Equity: Investing in high-growth startups in these centers offers the potential for substantial returns, although it's a higher-risk venture.

- Angel Investing: Providing seed funding to early-stage companies can yield high returns but involves significant risk.

- Infrastructure Development Projects: Investing in infrastructure projects, such as transportation or utilities, can provide steady returns, though these often require larger capital commitments.

Mitigating Risks in Emerging Markets

Investing in emerging markets carries inherent risks, including:

- Political Stability: Political instability and uncertainty can significantly impact investment returns.

- Regulatory Environment: Changes in regulations and policies can affect business operations.

- Currency Fluctuations: Exchange rate volatility can affect the value of investments.

- Economic Volatility: Emerging economies can be prone to economic fluctuations.

Thorough due diligence, careful risk assessment, diversification strategies, and seeking professional advice are crucial for mitigating these risks. Understanding local regulations, political landscape, and economic trends is critical.

Conclusion

Investing in emerging business centers presents a significant opportunity for substantial returns and participation in shaping the future of the global economy. By focusing on key characteristics like strong economic indicators, modern infrastructure, and a skilled workforce, investors can identify promising locations. The diversity of investment avenues available allows for tailoring strategies to individual risk profiles and financial goals. Remember, however, that thorough due diligence and professional advice are crucial to navigate the inherent risks associated with emerging markets. Start exploring the exciting world of investment opportunities in emerging business centers today. Discover the next big thing and secure your share of future growth by researching specific opportunities and consulting with financial professionals to develop a sound investment strategy. Don't miss out on shaping the future of business.

Featured Posts

-

Controles Antidrogue Chauffeurs Cars Scolaires Multiplication Des Tests Annoncee

May 30, 2025

Controles Antidrogue Chauffeurs Cars Scolaires Multiplication Des Tests Annoncee

May 30, 2025 -

Pella School Bus Accident Leaves Two With Injuries

May 30, 2025

Pella School Bus Accident Leaves Two With Injuries

May 30, 2025 -

Andre Agassi Una Nueva Cancha Una Nueva Competencia

May 30, 2025

Andre Agassi Una Nueva Cancha Una Nueva Competencia

May 30, 2025 -

Ira Khan Shares Unexpected Story After Andre Agassi Meeting

May 30, 2025

Ira Khan Shares Unexpected Story After Andre Agassi Meeting

May 30, 2025 -

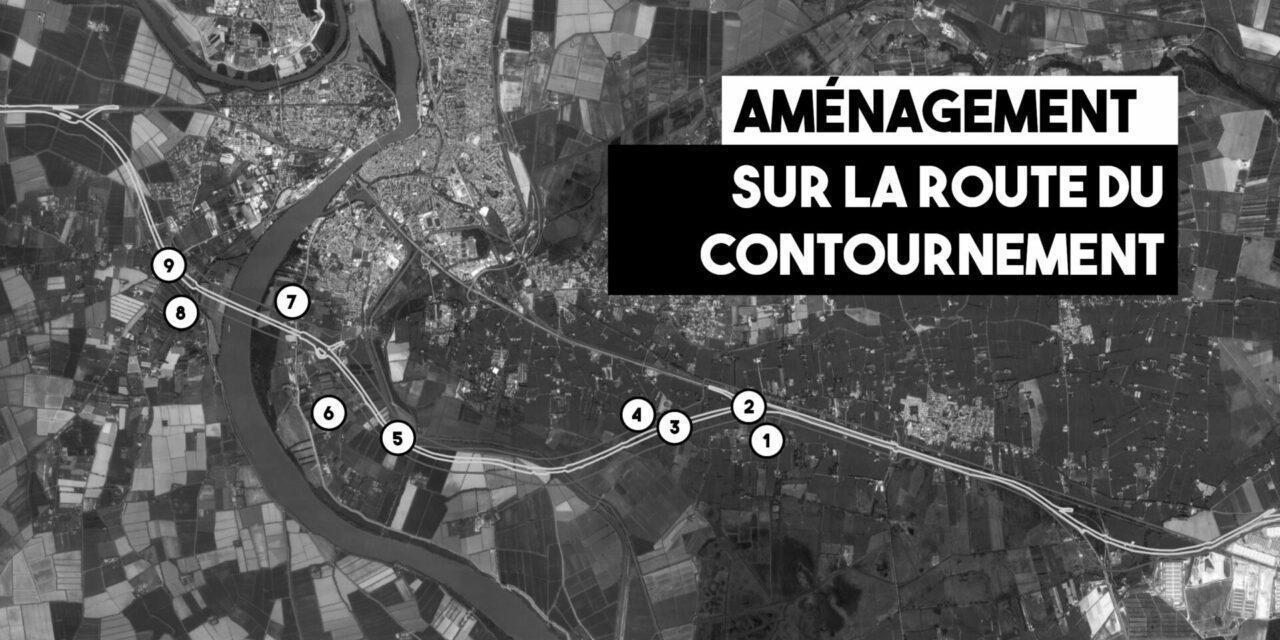

A69 Contournement De La Justice Et Relance Du Projet Autoroutier

May 30, 2025

A69 Contournement De La Justice Et Relance Du Projet Autoroutier

May 30, 2025

Latest Posts

-

2025 Pro Motocross Championship A Season Preview

May 31, 2025

2025 Pro Motocross Championship A Season Preview

May 31, 2025 -

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025 -

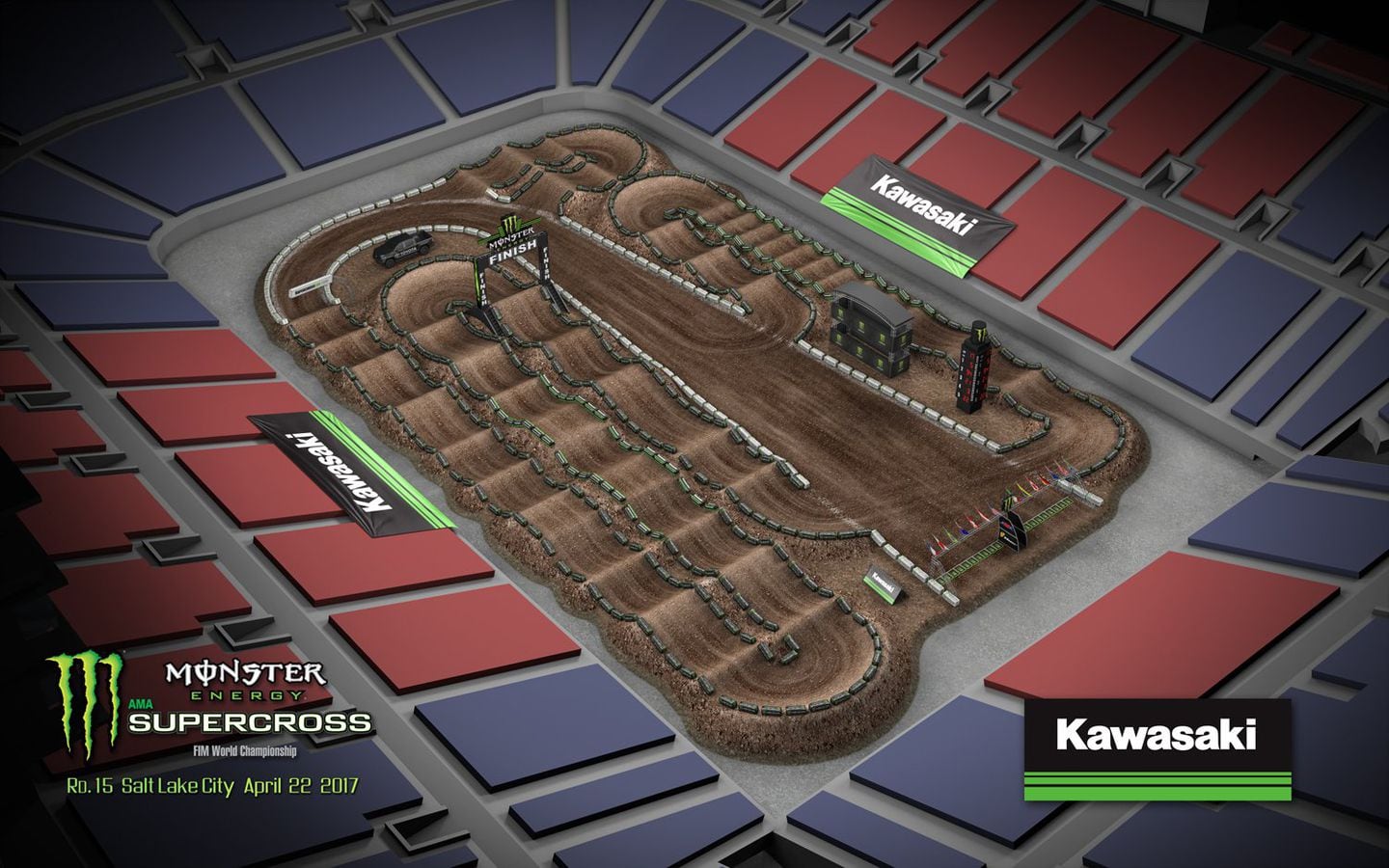

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025 -

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025 -

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025